Market update: April

- Bitcoin continues its upward trajectory

- Consumer Price Index remains the narrative

- Ethereum completes its Shanghai Upgrade

- The Role of Bitcoin Dominance

- US Regulators experience backlash

- Hodl News

- Hodl Research - Maple Finance

Bitcoin continues its upward trajectory

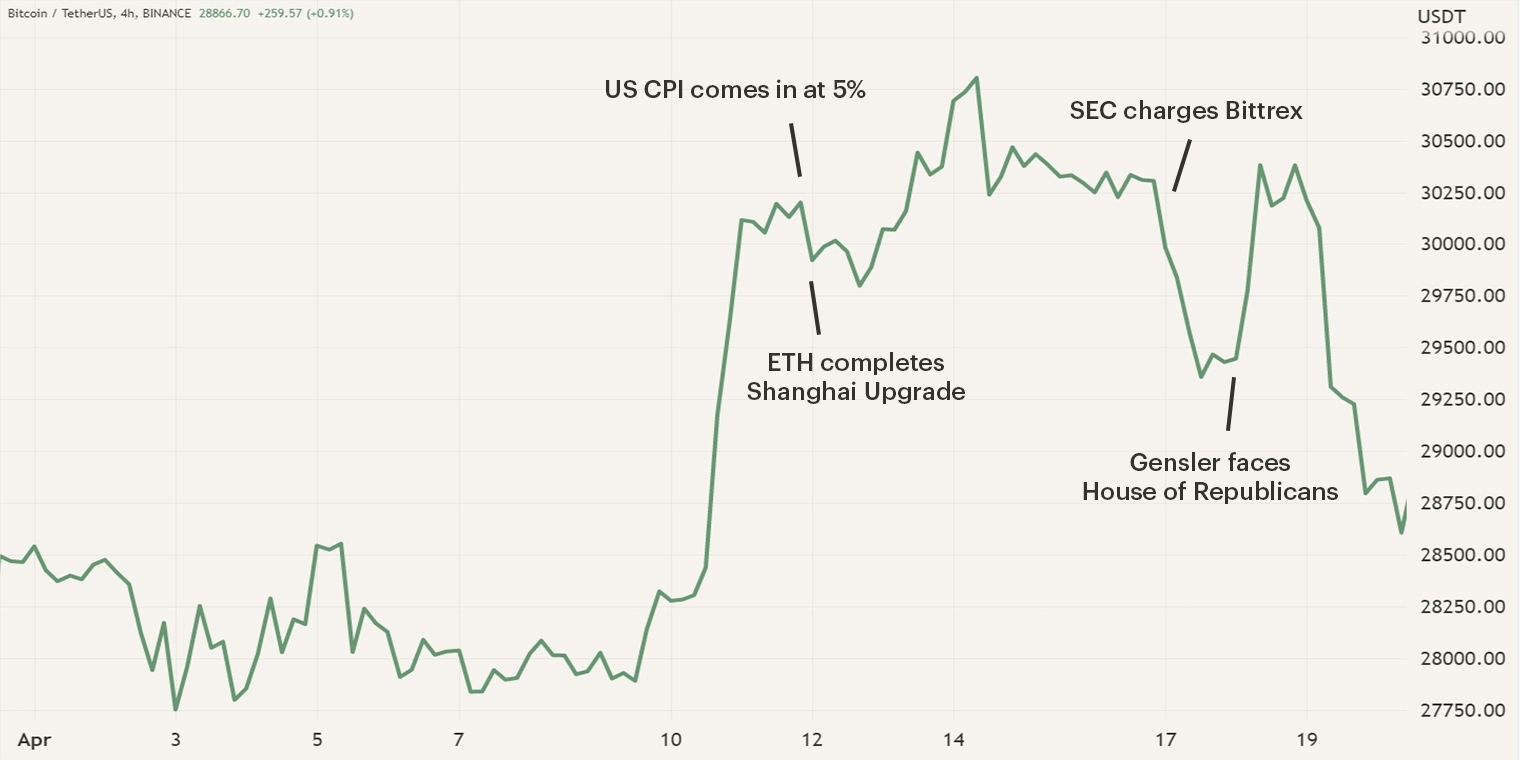

During the first two weeks of April, Bitcoin experienced a period of consolidation which was followed by a strong upwards movement, reaching a new yearly high of $31.000. After reaching this new high, Bitcoin experienced a correction to $28.000 where it’s currently consolidating.

As Bitcoin continues its upwards trajectory, positive sentiment is slowly returning to the market. Despite the strong positive movement of the sector, market participants are keeping the latest Consumer Price Index in mind as this will continue to play a crucial role in the upcoming months.

Consumer Price Index remains the narrative

On the 12th of April, the latest U.S. Consumer Price Index (CPI) data was published. The event again sparked high levels of volatility as market participants still view the CPI data as an important indicator of which direction financial markets will follow. As the recent data came in, financial markets experienced a rally as the month-over-month and year-over-year numbers were better than expected, 0.1% and 5%, respectively. This resulted in a rally in Bitcoin’s price as it rose over $31.000, reaching new highs this year.

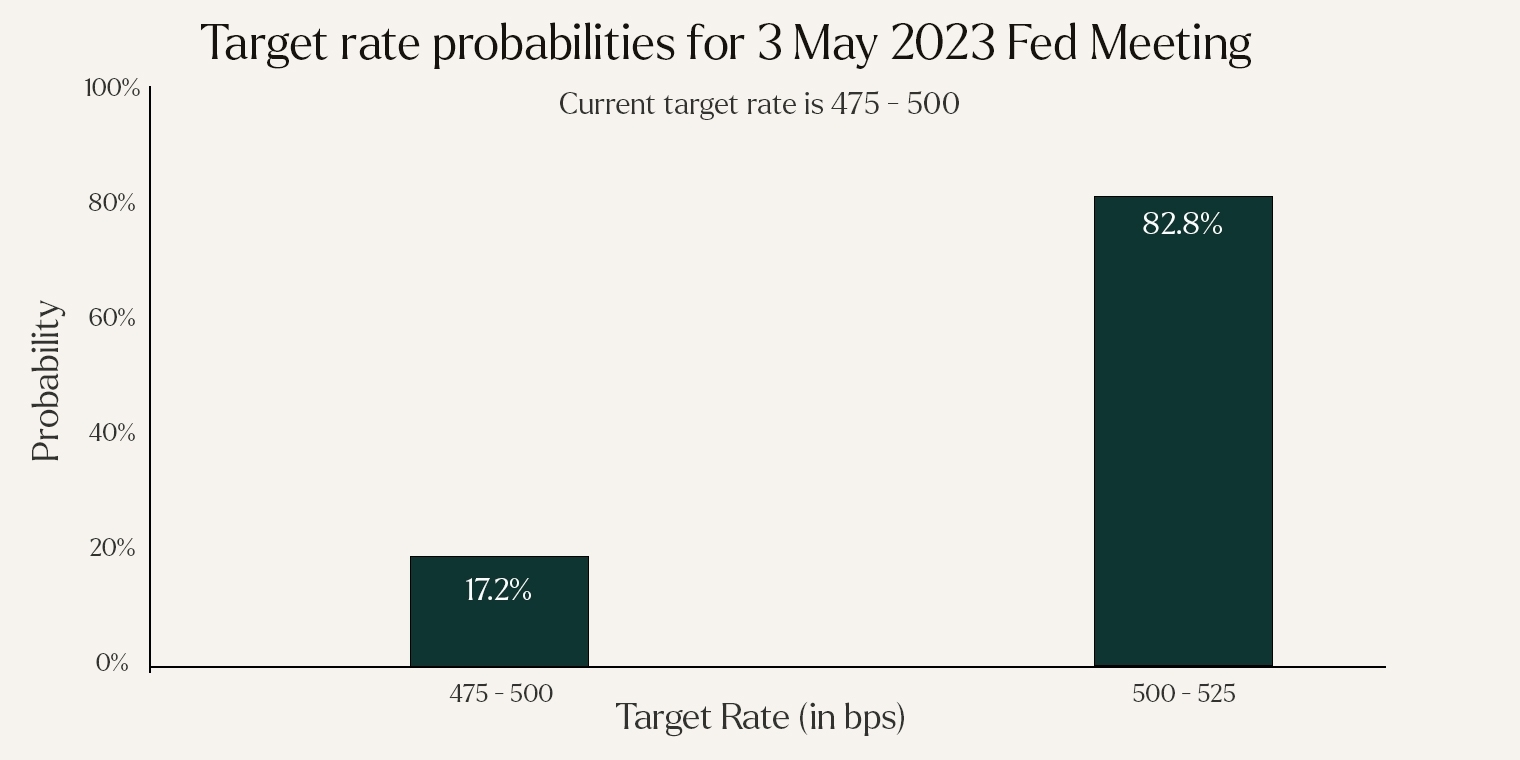

Despite some trouble in the financial sector, inflation seems to be declining and the interest rate hike campaign appears to have a positive effect. The upcoming two weeks will play a decisive role as the next Federal Open Market Committee meeting is scheduled for the third of May. Currently, market participants are expecting an increase of 0.25%, bringing the rate to 5.25%. Earlier this year, the expectations were that this was the final rate, thus we will shortly see if the expectations are met.

Ethereum completes its Shanghai Upgrade

As Ethereum continues to operate on Proof-of-Stake (PoS), the network has been preparing for the next major upgrade, the Shanghai Upgrade. This event was scheduled for the 12th of April and it will enable users to un-stake (withdraw) their staked Ether. As Ethereum prepared to switch to PoS, the network needed users to stake Ether in order to operate. Since 2020, millions of Ether have been staked. The drawback was that the assets couldn’t be un-staked as it may compromise the network when too many users withdraw at the same time.

As the upgrade closed in, some investors feared that the unlocking of staked Ether would negatively impact the price of Ethereum. However, after the upgrade, there will be a daily limit on withdrawals of 40,000 Ether. This may seem like a substantial number but the expectation is that the market will be able to absorb this selling pressure. Selling pressure is also countered by the staking rewards and the fact that many of the stakers are still underwater since they started staking.

Ethereum experienced quite some volatility toward the upgrade. But when the selling pressure indeed seemed less than expected, its price continued to surge from $1900 to well over $2100. Currently, the price of Ethereum has remained stable, consolidating between the price levels of $2000 and $2100.

The Role of Bitcoin Dominance

A commonly used indicator when defining the direction of the cryptocurrency market is the Bitcoin Dominance Chart. The chart illustrates the percentage of Bitcoin market capitalization against the entire cryptocurrency market and traders and investors extract valuable insights from the dominance. In the early days of cryptocurrency, Bitcoin’s dominance was quite high, during some periods roughly 80%. As the cryptocurrency market experienced adoption and more cryptocurrencies were introduced, Bitcoin’s dominance began to decline.

A high BTC dominance illustrates that cryptocurrency traders and investors have chosen for a more risk-off approach, as Bitcoin is considered the least riskiest asset, the BTC dominance tends to increase. When traders and investors engage in a more risk-on approach and seek for returns in other cryptocurrency assets, the dominance tends to decline as BTC is converted into other assets. Currently, Bitcoin’s dominance is at approximately 47% and illustrates signs of a possible downward trend.

The 47% - 49% level has developed as a strong resistance and BTC hasn’t been able to breach this level for almost two years. This might indicate that investors and traders are slowly converting their Bitcoin for other cryptocurrencies, starting an upward trend for the more low to medium market cap cryptocurrencies. However, the Bitcoin Dominance chart remains a tool and isn’t always accurate as a drop in Bitcoin Dominance can mean that investors and capital are departing the market.

US Regulators experience backlash

During the first four months of 2023, we have seen various regulatory actions against cryptocurrency organizations such as Binance and Coinbase. This month we have seen this pattern continue. On the 17th of April, the Securities and Exchange Commission (SEC) charged Bittrex for operating as an unregistered securities exchange, broker and clearing agency. Earlier this month, Bittrex announced that they would halt their U.S. operations as regulatory uncertainty made it impossible to stay competitive. The exchange was in the process of halting its activities as trading for U.S. customers stopped on the 14th of April and withdrawals would be accepted until the 29th. It slowly seems that U.S. regulators are choking out cryptocurrency organizations located in the U.S.

As US regulators try to choke cryptocurrency organizations out, Asian regulators seem to do the opposite by attracting cryptocurrency organizations. The city of Hongkong is aiming to bolster its status as a financial center and cryptocurrencies will play a role in achieving this goal. Hongkong has scheduled over 100 crypto-related conferences and meetings throughout April, illustrating their interest. Another Asia cryptocurrency hub is Singapore, the country has also laid its eyes on becoming a big financial hub. With the tightening of cryptocurrency regulations in the U.S., we expect that these Asia financial hubs will play a crucial role in the future and that more organizations will move to these jurisdictions.

This issue has also been noticed by the House of Republicans as Gary Gensler, Chairman of the SEC, was bombarded with criticism with regard to his cryptocurrency policy. Various Republicans stated that the current approach of the SEC is driving innovation overseas which will endanger America’s future competitiveness. In addition, the regulatory vagueness was cited as digital asset enterprises are penalized for allegedly breaking the law while they are unaware that existing law applies to them, or while there is even no written law on the subject yet. Despite the attack on Gansler’s policies during the hearing, it is no guarantee it will on short notice stop going after cryptocurrency organizations.

Hodl News

We are delighted to announce that we can introduce another addition to our ever growing Hodl team. This month, we present Martijn Bakker as he joins the accounting team of Hodl as Business Controller. Prior to joining Hodl, he started various companies and now he is eager to learn more about the world of cryptocurrencies.

Martijn: "I’m an experienced controller with a background in business administration and over 20 years of experience as an entrepreneur in the internet industry. My expertise in financial control and analysis allows me to quickly integrate into new organizations like Hodl. I’m confident that with my experience and expertise, I can contribute to the further growth and development of Hodl".

Hodl Research - Maple Finance

We are excited to introduce Hodl Research: a platform where we will share our insights and knowledge of the cryptocurrency market. In the upcoming months, we will work on a professional place where new and experienced market participants can learn more about the developments in the market. One of these key elements is our research into specific cryptocurrencies. This month we launched our first report that highlights the Maple Finance token (MPL).

Maple Finance aims to close the bridge between cryptocurrency lending and borrowing and traditional institutions. When a user wishes to borrow cryptocurrency, a large collateral is required which acts as a safety net if the borrower defaults on the loan. This large collateral forms an obstacle for traditional institutions as they borrow capital to improve their operational activities. This will generate more returns in the long run, thus providing a collateral for borrowing is quite inefficient. Maple Finance solves this problem by providing a capital market through which organizations can access un- and undercollateralized loans. Click on the link below to to read more about the Maple Finance platform and MPL token.

In the coming months, we will continue to work on the Hodl Research platform and start sharing reports, articles and much more. If you want to stay up-to-date on these insights, please follow the Hodl Research channels.

Sign up for our newsletter to stay on top of the crypto market.