Market update: August

Market update: August

Market stabilizes and BlackRock enters

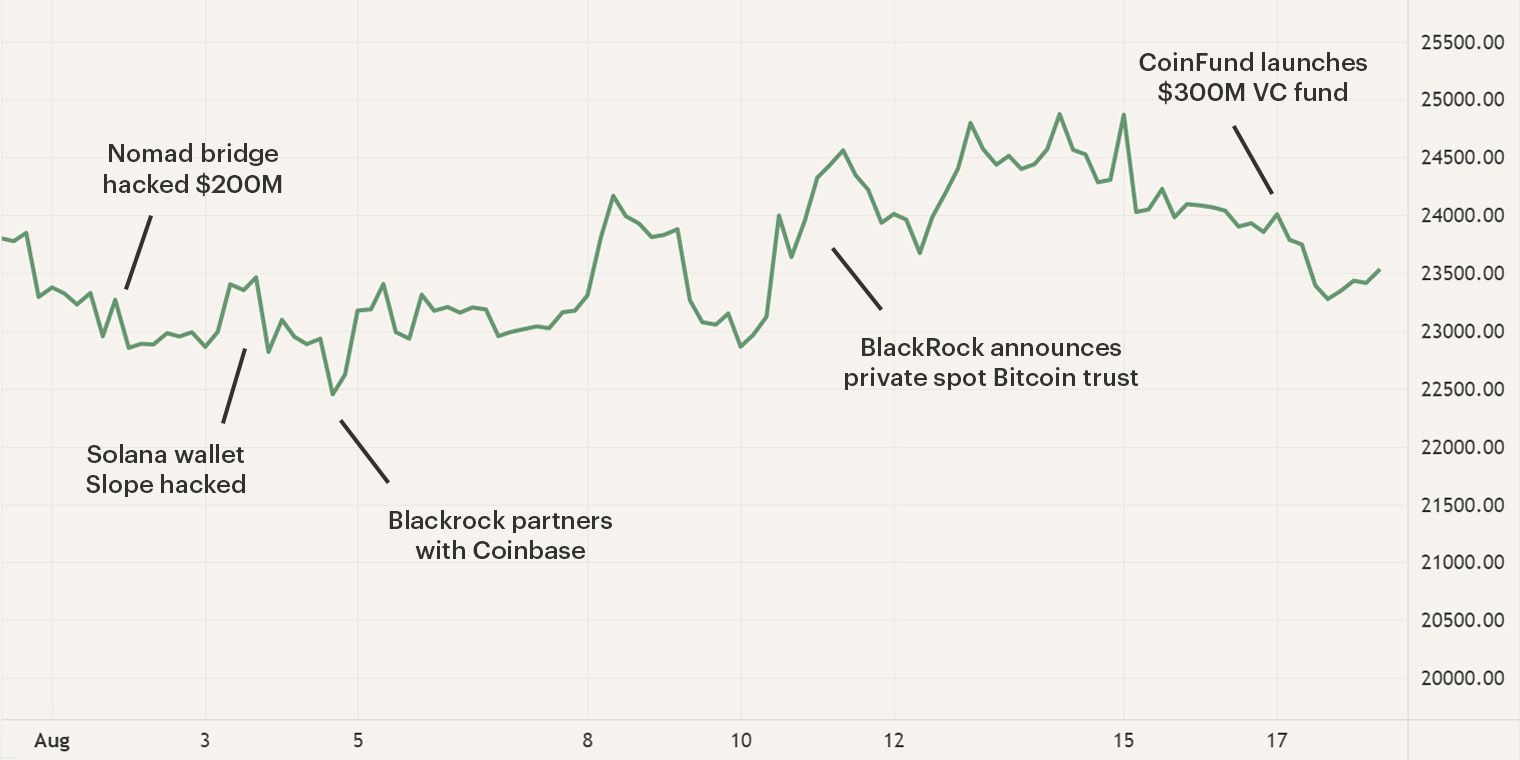

After the recovery in July, we saw the market stabilize in August. This month, much attention was drawn to BlackRock's entry into the cryptocurrency market. While we have witnessed speculations about its entry before, BlackRock, the world's largest asset manager with assets under management of around USD 10 trillion, has now finally made the move.

On August 4, BlackRock announced that it will begin offering Bitcoin to its institutional clients in partnership with the crypto exchange Coinbase. BlackRock will do this through its digital investment platform Alladin, which specifically targets institutional investors. The integration of Aladdin with Coinbase Prime will allow crypto to be traded, stored and reported on. Initially, this will involve trading Bitcoin, but later it aims to offer other cryptocurrencies as well.

A few days later, the U.S. investment giant launched its Bitcoin Private Trust. The trust is to track the performance of the Bitcoin exchange rate, minus the cost of its management. Because it is a trust exclusively available to BlackRock's clients, it does not have to register it with U.S. regulators. However, the fund will be limited to U.S. residents.

The entry of an asset manager of such proportion offers many opportunities and an interesting perspective for the future. Launching these products after the downward trend of the past few months shows that the interest in cryptocurrency investment products is still present among institutional players. Therefore, with an estimated 1,500 institutional clients, the offering by BlackRock opens many doors.

Damages 'Bridge hacks' reach $2 billion

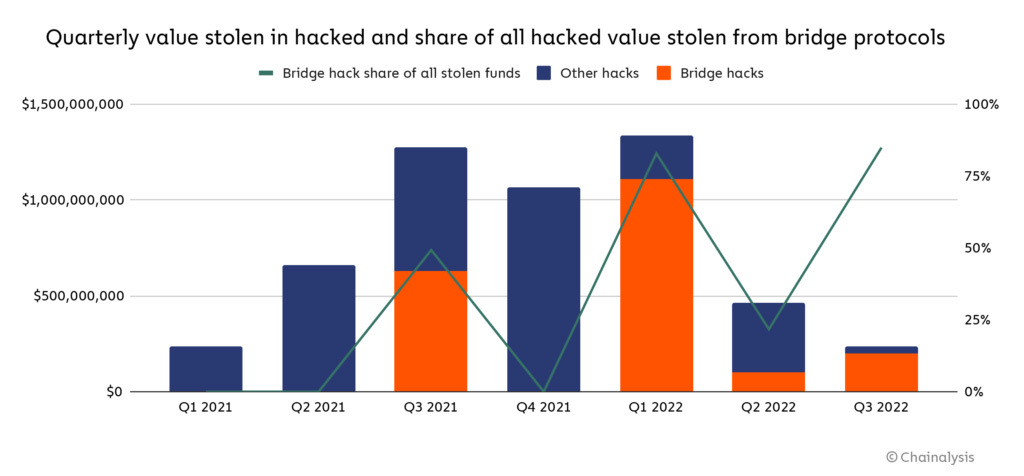

Although there was a lot of attention on the positive news from BlackRock, the month began with the negative news of a new hack. This hack allegedly took place on Nomad's cross-chain bridge. Approximately $190 million was captured in the hack. Cross-chain bridges allow different tokens to be moved from one blockchain to another, also known as swapping.

Recently, these bridges seem to be increasingly targeted by hackers, for example, blockchain data platform Chainalysis estimates that the total damages after 13 different hacks have now reached about $2 billion. By 2022, these bridge hacks would account for 69% of all stolen cryptocurrency. A cross-chain bridge is an interesting target for hackers because its technology is still in development. This is reinforced by the fact that a cross-chain bridge can quickly run high volumes and there is often a central point of storage or exchange in the process.

A few days after the Nomad bridge hack, there also followed hack on the Solana wallet called "Slope Wallet". Although this one was "only" $5 million in size, it did affect over 8,000 cryptocurrency wallets. Very often the term "hack" is used but on most occasions the malicious event occurs after an error or weakness in the programmed code.

The (recent) hacks also continue to affect the reputation of the cryptocurrency market, which in some cases discourages beginner investors. Therefore, it is very important that you do thorough research prior to making an investment, using a bridge for example or trusting a party to take these concerns off your hands. For example, Hodl funds only trade on trading platforms with a proven reputation and good security protocols.

Hodl's algorithmic trading bots

To optimize the performance of our Hodl funds, we use self-developed algorithmic trading bots. These algorithmic trading bots take full advantage of the volatility of the cryptocurrency market. The bots follow a predefined strategy and when a certain condition is met, a trade is automatically opened or closed. This condition can be, for example, a fluctuation in the price, but also a trading indicator going off.

Because we have developed the bots in-house and manage them ourselves, we have full control over the trading strategies. Based on daily analysis by our analysts, the bots are optimized and adjusted to the current market situation. Due to the slight turbulence still present in the market, our bots are currently adjusted to increase our position in Bitcoin. This means that the bots are using the higher volatility and growth of altcoins to ultimately gain more bitcoins.

Since all trading pairs consist of an altcoin versus Bitcoin position, the value of the altcoins is expressed in Bitcoin. In the past month, we saw the altcoins' value (expressed in bitcoin) in our trading bots drop by 10.8%. Normally, this would be offset by a 10.8% increase in the position of Bitcoin, as the altcoin is traded against Bitcoin in the trading pair. However, due to the efficiency of our bots, we saw our position in Bitcoin increase by over 16.7%, a great performance in this dynamic market! If we expect a period of strong growth in altcoins, we can adjust our strategy accordingly and use the increased position in Bitcoin to collect more altcoins.

Want to learn more about our trading bots? You can find it on our new Algorithmic Trading Bots page.

Sign up for our newsletter to stay on top of the crypto market.