Market update: December

Market moves sideways after fall FTX

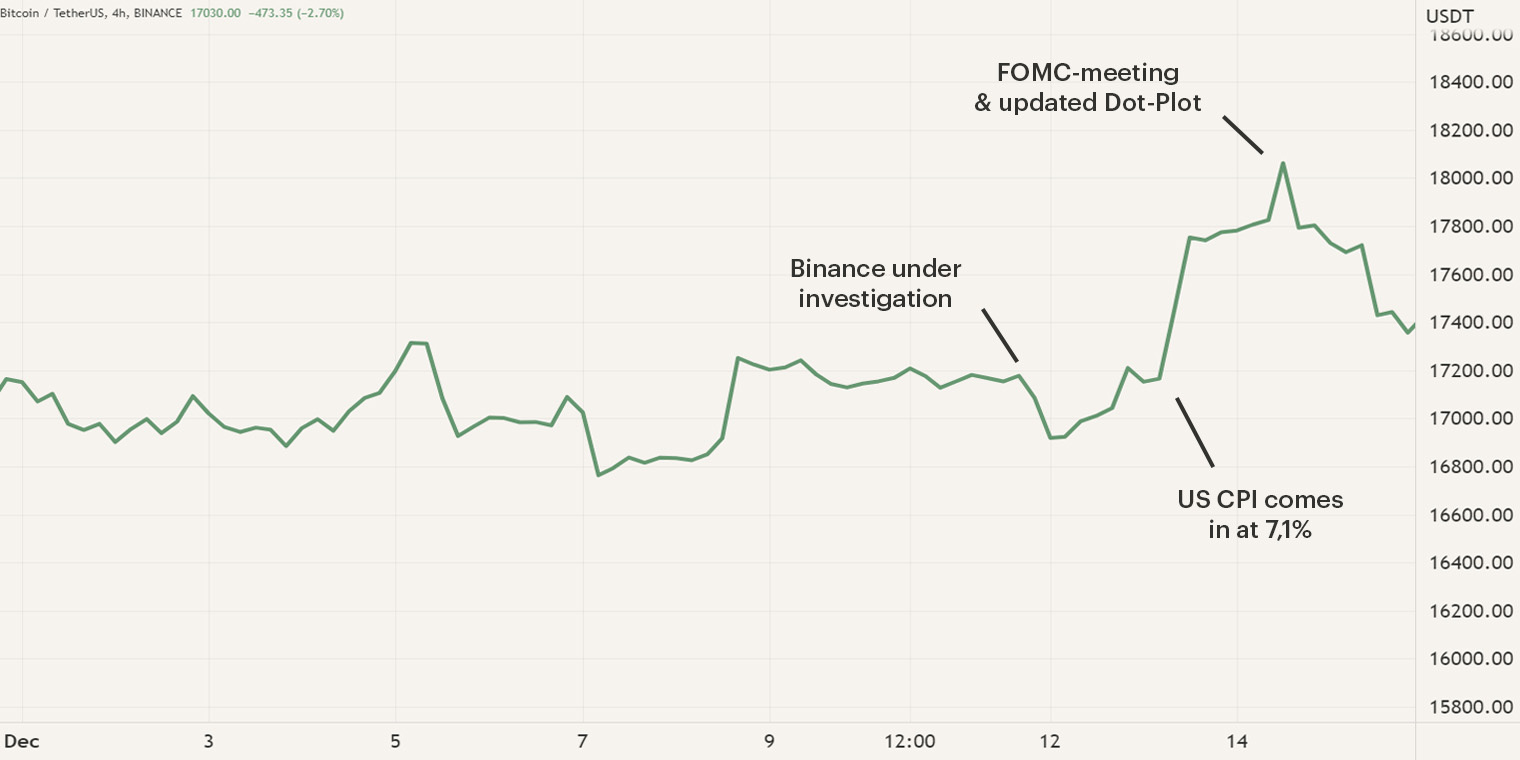

The month of December started with a period of consolidation as Bitcoins’ price fluctuated between the price levels of $16.5K and $18K. After the eventful month of November, the market is experiencing a recovery phase as most of the FTX contagion has had its effect. Investors and traders were still cautious and preparing for the release of the latest inflation numbers and the corresponding monetary policy of the Federal Reserve.

On the 13th of December, the Consumer Price Index (CPI) of the United States was published. Surprisingly, the number that measures inflation came in at 7.1%, 0.2% lower than the expectations of the market. The current CPI data suggests that inflation is cooling down. As this might imply that the current monetary policy by the FOMC is having its effect, it leads investors to believe that the FOMC might ease its policy. This led to a risk-on movement as investors re-entered the market resulting in the Bitcoin price rising from $17K to $18K. This later stabilized in the anticipation of the FOMC meeting the day after.

Continued tight monetary policy

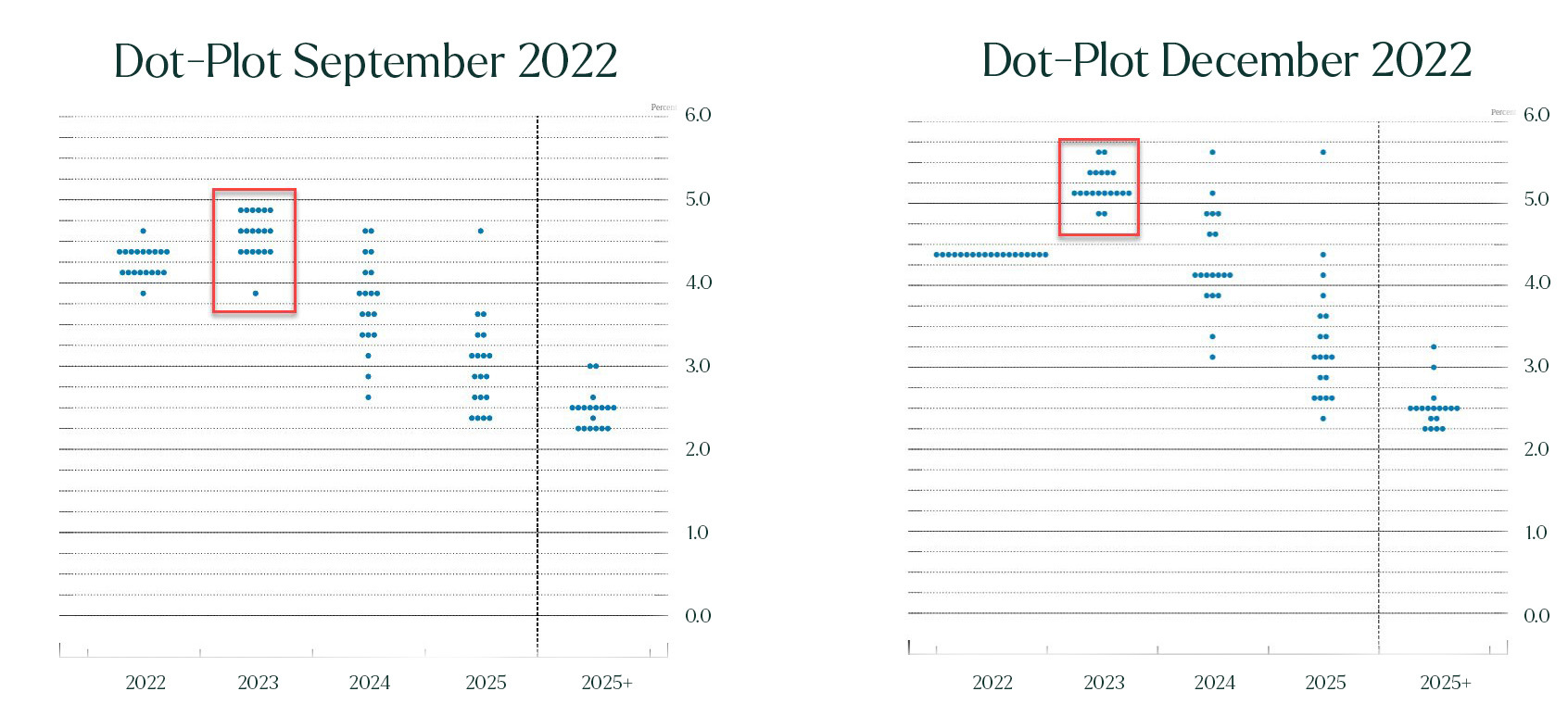

On December 14th, the FOMC published its economic projections and the new Federal Funds Rate. Prior to the meeting, the market expected a hike of 0.5% and these expectations were met. The FOMC increased the interest rate to 4.5%, reaching levels we haven’t seen since 2005-06. It seems that the FOMC is slowing down their hawkish approach as this is the first 0.5% increase this year, the first decrease in hike rates since July. The market experienced some volatility as the meeting loomed, Bitcoins´ price rose to $18.4K. However, after the publication of the updated Dot-Plot the Fed showed a more hawkish stance that indicates more rate hikes in the upcoming year. This deviates from the Dot-Plot published in September. This resulted in Bitcoins’ price dropping to $17.6K. Bitcoin began to consolidate between the price levels of $17.5K and $17.8K. The expectation is that Bitcoin will continue to move sideways as many agree that most of the market capitulation has already occurred, however, investors' faith in the market needs to be restored for an upward trajectory.

On the 15th of December, the European Central Bank (ECB) also published their monetary policy. The ECB announced that the interest rate will be increased to 2%, a hike of 0.5%. This is the fourth interest hike the ECB implements and now investors are waiting in anticipation for the Final CPI which is released on 16 December. Further expectations are that the ECB will slowly unload their $5T balance sheet which they have built during the past years. The news of Europe's monetary policy hardly had an impact on Bitcoins’ price as investors prioritize the US economy and dollar above Europe’s economic conditions.

Binance under investigation

On the 12th of December, news outlet Reuters published an article that discussed that some Department of Justice (DoJ) prosecutors believe that there is substantial evidence to file charges against Binance executives including CEO Changpeng Zhoa. The DoJ hasn’t announced any official charges yet but Binance is under investigation for money laundering and criminal sanction violations.

The investigation of Binance started in 2018 and spans prosecutors of three different offices such as the Money Laundering and Asset Recovery Section. Currently, the individuals working on the case are experiencing a split as some think they can start filing charges while others want more time to review the evidence. These allegations come at an inconvenient time as Binance is being openly criticized as there are doubts about the financial health of the exchange.

As discussed earlier, the market is experiencing high levels of fear and uncertainty and many investors are becoming extra skeptical. For now, the doubts are based on rumors and an investigation that hasn’t started any legal issues. We closely monitor the news and developments as Binance is a key player in the market.

Forced adoption of Central Bank Digital Currencies

Central Bank Digital Currencies (CBDC) are digital currencies that are issued and managed by the central bank of the given economic zone. One of the countries that is trying to push the adoption of its CBDC is Nigeria. On the 6th of December, the central bank of Nigeria issued a limit on cash withdrawals at ATMs and banks. Individuals and businesses are now limited to an equivalent of $45 per day and $225 per week at ATMs. Withdrawals at banks are also limited to $225 and $1,125 respectively, if these thresholds are exceeded, individuals and businesses are met with a 5% and 10%, respectively. This new directive has been implemented to push the “cash-less Nigeria” policy and to increase the use of the eNaira, the CBDC. An increase in the use of the eNaira will provide the central bank with more financial oversight and control over the financial flows of the country.

Since its launch on October 25th, 2021, the eNaira experienced a slow pace of adoption as only 0.5% of the population has used the CBDC. These kinds of financial directives are dystopian methods that will probably be seen more frequently in the future. Currently, eleven countries have launched their CBDC and fifteen are conducting a pilot. When these CBDCs are launched and adoption is low, the central banks will and can implement directives to push their digital currency. Other countries experimenting with the idea of CBDCs are Spain and England, Spain is understanding the use and flows of a CBDC in wholesale transactions and the Bank of England is seeking a “proof of concept” for a wallet that can hold a CBDC. In total, a hundred countries have launched, are doing a pilot, or are researching and developing a CBDC, it's only a question of when these new digital currencies will be implemented. As discussed in earlier newsletters, CBDCs can provide some financial advantages when correctly implemented but adoption shouldn’t be forced. These directives are against financial freedom and they may indicate how these central banks will act when they have a monopoly on money.

Sign up for our newsletter to stay on top of the crypto market.