Market update: March

- Market displays strong recovery after correction

- Traditional Finance contagion reaches the cryptocurrency sector

- Cryptocurrency banks experience closure

- Core CPI remains high

- European Central Bank tightens further

Market displays strong recovery after correction

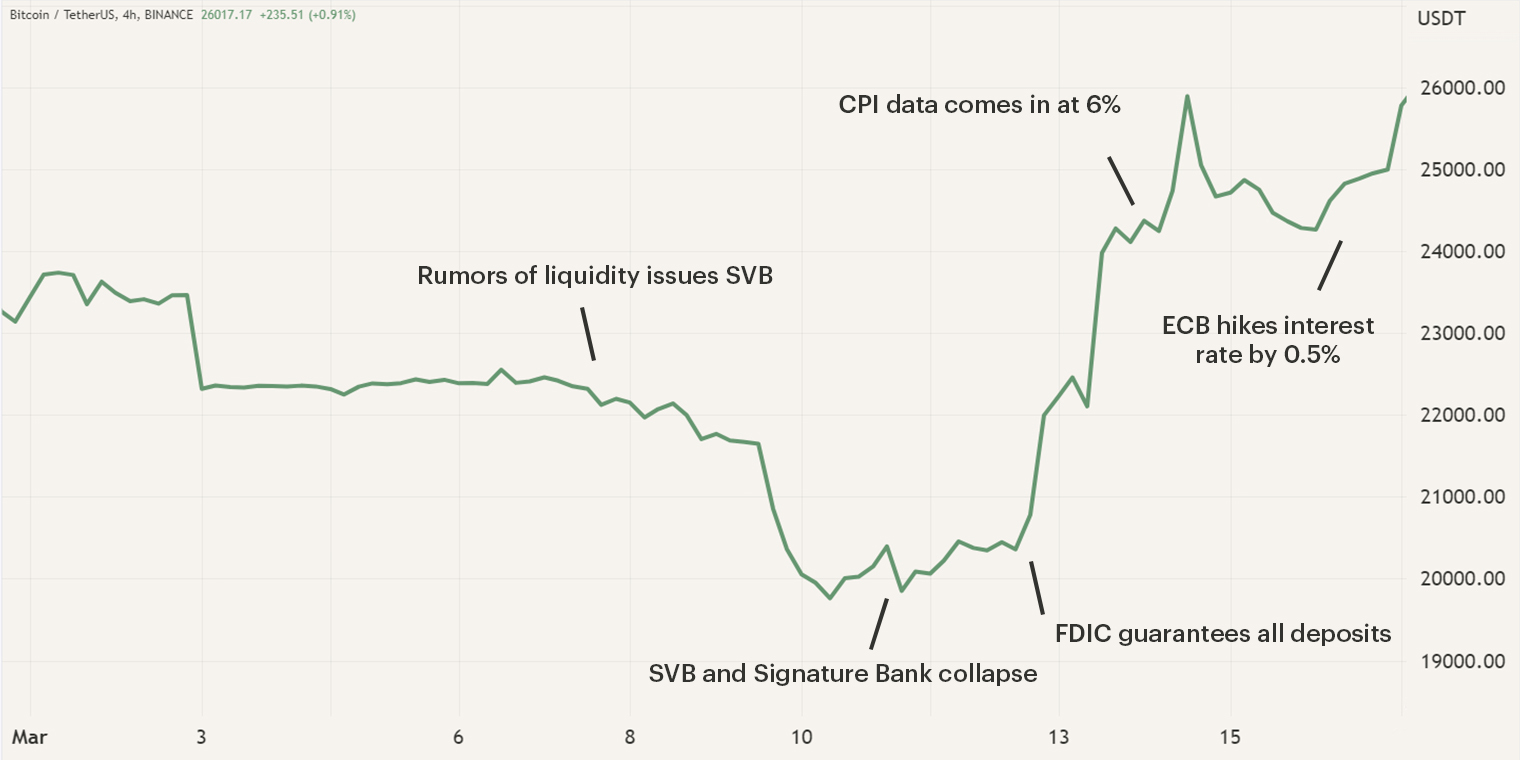

The beginning of March was characterized by a series of strong corrections that pushed Bitcoins’ price back to $19,500. Reaching this low was followed by a significant recovery rally with the price of Bitcoin surging from $19,500 to well over $26,000. The initial corrections were caused by turmoil within the US banking sector and its effects were also felt in the cryptocurrency market. The biggest cause-effect of this turmoil was the depegging of the second-largest dollar stablecoin, USD Coin (USDC), which had some ramifications.

The depeg was caused by Silicon Valley Bank (SVB) experiencing liquidity problems and eventually collapsing, causing $3B worth of USDC’s reserves to not be accessible. The collapsed Silicon Valley Bank put fear in financial markets as banking stocks across the US markets tumbled down with many regional banks suspended from trading. This fear was eventually soothed as the Financial Deposit Insurance Corporation (FDIC) and the Biden administration intervened.

Traditional Finance contagion reaches the cryptocurrency sector

During the second week of March, the first rumors began to circulate that SVB was experiencing liquidity problems. SVB was the 16th largest bank in the US and had over $200B worth of assets, its business was heavily focused on the US tech sector, mostly startups. During the covid pandemic of 2020-2021, these tech startups and organizations experienced a surge in business as most consumers were confined to their homes, which resulted in an influx of deposits at SVB. Incoming deposits cost money for banks and to cover the costs, they seek positive returns through loans or investments. SVB decided to invest these deposits into US government bonds, traditionally a safe investment. However, as the US Federal Reserve started one of its most aggressive rate hike campaigns, SVB started to face problems with the returns on their bonds.

The continuous increases in interest rates caused the value of the bonds to decrease and as economic conditions worsened in the tech sector, organizations started to deplete their accounts in order to stay afloat. As most of these deposits were invested, SVB was forced to sell these bonds at major losses which caused concerns over the financial health of the bank. These rumors eventually caused so much panic among depositors that the bank experienced a bank run, causing the collapse.

The collapse of SVB was also felt in the cryptocurrency market as stablecoin USDC depegged. USDC is controlled and issued by Circle, a US technology-financial payment company, and one of its main tasks is the control and maintenance of USDC reserves. USDC is a fiat-pegged stablecoin that is pegged to the US dollar. In order for a stablecoin to remain stable, the reserves are required to match the issued supply. These reserves need to be deposited at financial institutions for investing or saving and like most US tech companies, Circle had some of their reserves, approximately $3B, located at SVB. This was somewhere around 10% of the entire market capitalization at the time of the collapse.

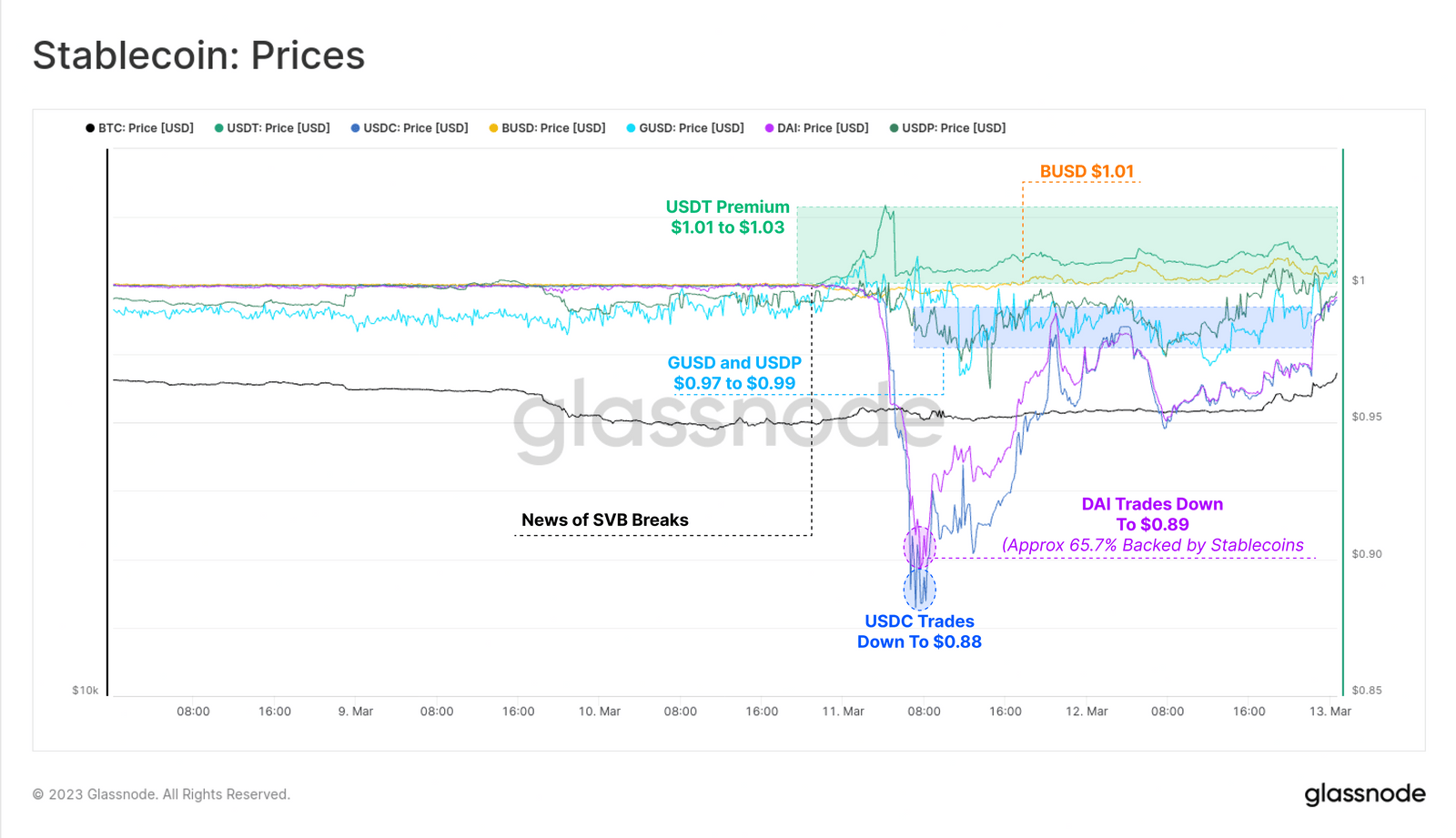

The initial news about the poor condition of SVB came out on Friday, March 10th. This created a problem because there can be no exchange with closed banks on weekends. As a result, Circle was unable to intervene to restore the peg. Panic and selling pressure caused a rapid decline of the stablecoin to 88 cents. Many traders exchanged their USDC for Bitcoin (BTC), Ethereum (ETH), and other stablecoins such as Tether (USDT). Due to the large influx of capital, these assets experienced buying pressure, with USDT even rising to $1.03 for a certain period of time.

Initially, it was uncertain if the FDIC and the US government would intervene but on the 10th March the California Department of Protection and Innovation closed SVB and placed the FDIC as curator. At first, account holders were guaranteed a deposit insurance of $250,000, which caused difficulties as most account holders were startups and organizations, which have much larger accounts. This caused the price of USDC to drop over the weekend and only to recover on Sunday, 12th March, after the Biden Administration announced that all deposits were going to be insured and accessible starting Monday the 13th. This guarantee restored confidence in the sector and as the markets opened on Monday, USDC completely recovered its peg of $1.

As other stablecoins utilized USDC for their own financial reserves, they also experienced a depeg, such as DAI which fell to $0.89. As trust recovered in USDC, these other stablecoins also recovered their peg, however, it does illustrate the interconnectedness of the ecosystem and the possible implications.

Cryptocurrency banks experience closure

In addition to the collapse of SVB, Signature Bank, $114B of assets, and Silvergate Bank, $11B of assets, also announced the closure of their banks. Both banks were predominantly active in the cryptocurrency sector and acted as a bridge between traditional financial institutions and the emerging cryptocurrency market. In the case of Signature Bank, the closure of the institution was in part caused by the collapse of SVB and deteriorating market conditions. In 2018, Signature Bank started to focus on the crypto sector and over the years their number of clients grew and the importance of crypto within the institution increased, in February 2023, 30% of the bank's deposits came from the cryptocurrency sector. As the markets reversed, cryptocurrency organizations started to deplete their balances, similar to SVB. AS SVB collapsed, depositors at Signature bank panicked due to its close link to cryptocurrency, causing another bank run.

A similar thing happened to Silvergate Bank. The bank had become primarily cryptocurrency focused and its income dropped significantly after the downturn of the market. In 2022, Silvergate also lost several high-profile clients such as cryptocurrency exchange FTX and lender Genesis. As these events unraveled, depositors started massively withdrawing their bank funds. In January 2023, the bank published its earning report which stated that $8.1B was withdrawn. On the 8th of March, Silvergate announced its intent to wind down operations and voluntarily liquidate the bank. The closure and voluntary liquidation of cryptocurrency-friendly banks may become an issue in the future. Cryptocurrency organizations still need access to liquidity, bank accounts and on- and off-ramps in order to operate. Although the aforementioned banks have a close relationship with the market, the failure in this case was due to poor risk management and mismanagement of user funds.

Core CPI remains high

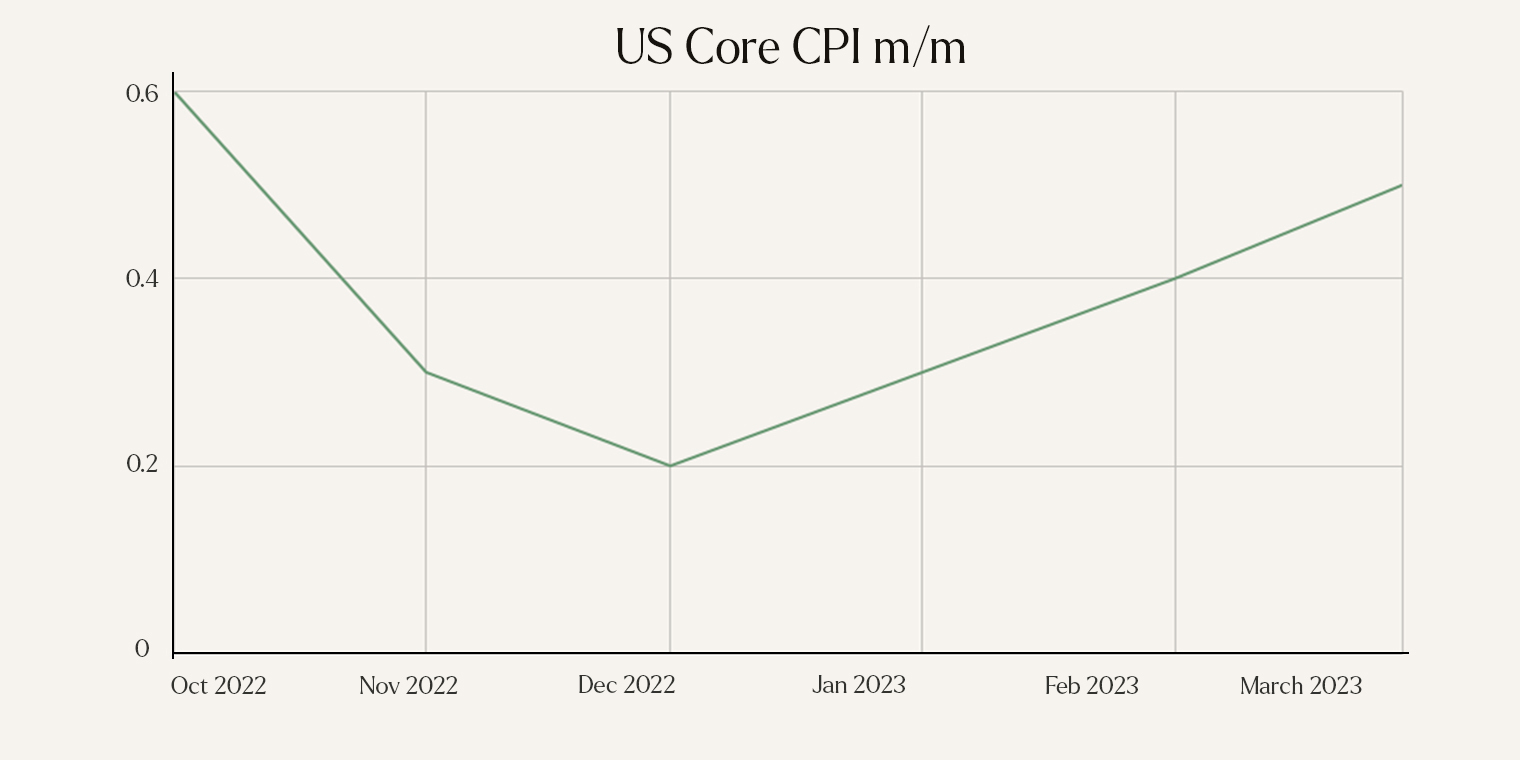

On the 14th of March, the latest US Consumer Price Index (CPI) was published and prior to the meeting, the Bitcoin price increased from $24K to $25K. The CPI numbers of last month were disappointing as the numbers were higher than expected, however, still continuing their downward trend. The latest CPI numbers were well in line with expectations and came in at 0.4% m/m and at 6.0% y/y .Conversely, the Core CPI m/m, the change in the price of goods and services excluding energy and food, was higher than forecasted.

Currently, the US market is still experiencing high inflation. Although the overall figure is decreasing, the Core CPI seems more persistent. Energy prices are an important component of the overall inflation rate, but they are slowly decreasing as the winter comes to an end. However, we still see rising prices persisting in other aspects that make up the Core inflation rate. It is still unclear whether the FOMC will continue with its aggressive campaign. Nevertheless, the market still expects a 0.25% increase on March 22nd, which would bring the interest rate to 5%. In the past week, we have seen a drastic change in sentiment, which has been fluctuating from day to day. With the collapse of the first American banks, some even expected the FOMC to begin lowering interest rates. In the coming week, we will learn more about the impact of the downfall of SVB and the decision that the FOMC will make.

European Central Bank tightens further

On the 16th of March, the European Central Bank announced that the interest rate will be increased by another 0.5%, bringing the rate to 3.5%. During the first quarter of 2023, inflation across the eurozone surged again reaching levels of 8% and 9.3% in the Netherlands and Germany, respectively. Currently, inflation is still remaining quite high and with periods it swings back up throughout the eurozone. The expectations are that the ECB will continue its hike campaign as the Core CPI continues to increase. In 2022, the ECB discussed that inflation was mainly caused by energy and food prices, the Core CPI illustrates that it might not be the case.

After the publication of the interest rate, the ECB released a statement concerning monetary policy. Overall, the ECB has confidence that European Banks are able to withstand this interest hike and that they are more financially healthy and shockproof in comparison to 2008. However, the ECB did mention in their statement that they are ready to respond when necessary, which undermines the previously mentioned confidence.

Sign up for our newsletter to stay on top of the crypto market.