Newsletter: Recap August

Newsletter: Recap August

Welcome to our newsletter of July 2022. Every month we create an overview of the performance of our Hodl funds, the developments within Hodl, and the latest cryptocurrency news.

Crypto-market remains driven by macroeconomic tension

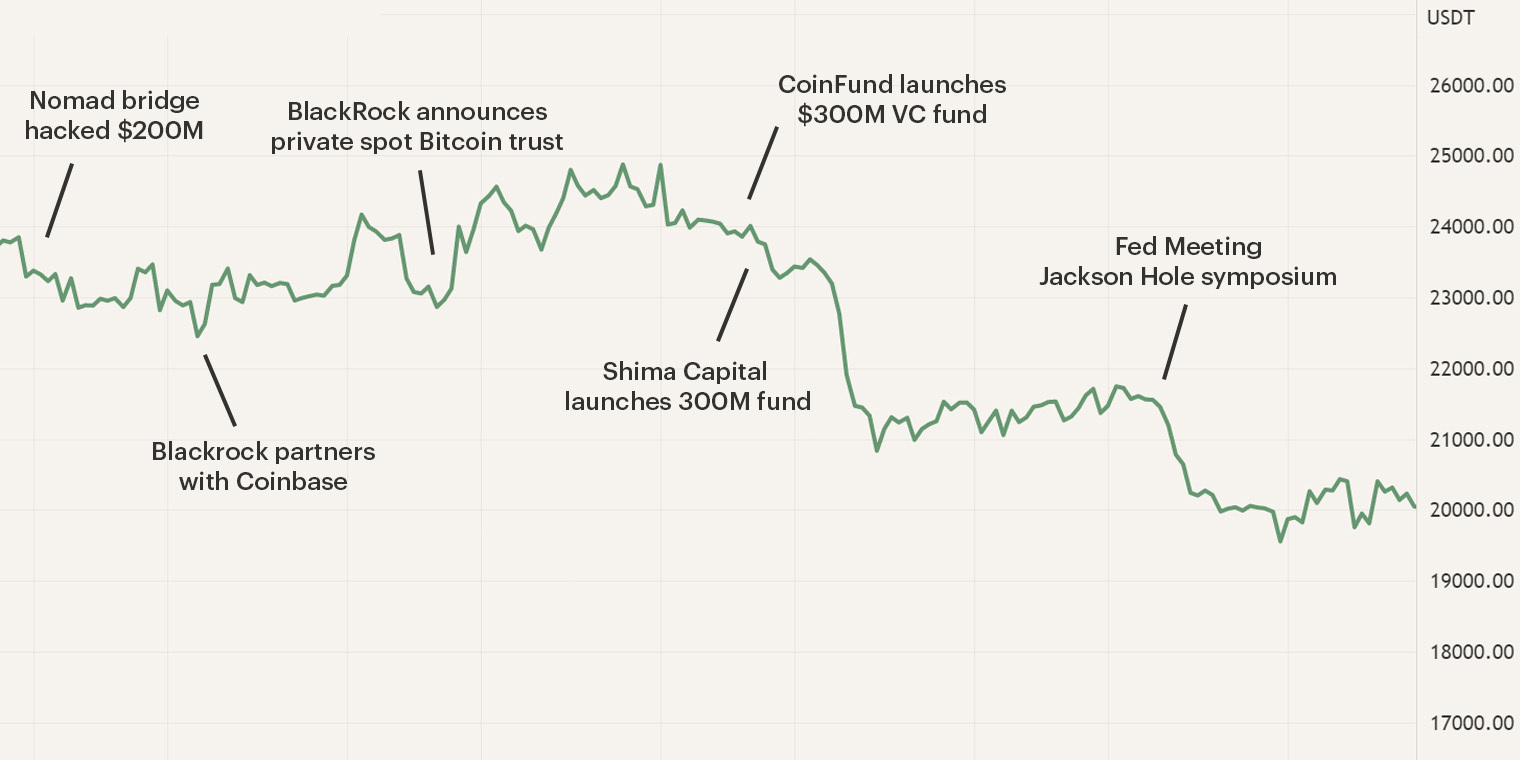

During the first two weeks of August, the market experienced a period of consolidation as Bitcoin oscillated between $22K - $24K, and briefly touched older levels of $25K. The period of consolidation was supported by the positive news of BlackRock entering the market with its Private Spot Bitcoin Trust. A few days before, the world's largest asset manager also announced a partnership with Coinbase creating a positive sentiment among investors. You can read more about the events of the first half of the month in our market update of August.

In the second half of the month, the market experienced several corrections as Bitcoins’ price dropped from $22K to $19K. The recovery of financial markets halted as the Federal Reserve indicated that it will continue its aggressive course of rate hikes if the economic data continues to fail expectations. This consequently led to the fall of major indexes such as The Dow and S&P 500, which fell by 3% and 3.4% respectively. The pessimistic outlook of the economic state also affected the cryptocurrency market as Bitcoin experienced a second correction. Bitcoin experienced a short rally from $20K to $21.8K, followed by a sharp drop to older levels of $19K. Despite the current economic conditions, the interest in the cryptocurrency market among investment firms continues to grow as more fundraisings take place. The market is also experiencing some turmoil as the Ethereum Merge closes in; the upcoming event affects a large ecosystem, causing investors to be cautious.

Venture Capitalists continue to display interest

In 2021, the interest in Web 3 exploded and the trend is continuing to grow in 2022. Despite the current downward trend, we see various institutional organizations exploring investment opportunities and attracting capital to the ecosystem. The current market provides a perfect opportunity for crypto projects to build, an opportunity that is also interesting for investors. Last year, Venture Capitalists (VC) raised $16B funding for the emerging ecosystem, we saw this trend continue as a total of $719M was raised in the first weeks of Q3.

Coinfund, a cryptocurrency investment firm, announced a $300M venture capital fund for early-stage projects, sectors of interest include layer 1 blockchains, gaming and NFTs. The fund is expected to support 30 to 40 startups as the firm's investments would range from $6 million to $10 million per company. A few days later, Shima Capital, a venture firm that invests in early-stage blockchain companies, received significant support from notable investors such as Dragonfly Capital, as it raises $200M. Shima Capital supports blockchain businesses in their early phases (pre-seed and seed) with investments ranging between $500,000 to $2M.

The raising of capital among VCs and investment firms illustrates that there is still high interest among investors, even if the market is experiencing a long period of downturn movement.

Ethereum Merge closes in

The most anticipated event, the Ethereum Merge, is closing in. With a market capitalization of $458B for the ecosystem, all eyes are focused on the outcome of the event. Opinions and expectations among the community are divided. In our newsletter of July, we briefly introduced the Ethereum Merge which is scheduled for the 15-16th of September.

This first update in a series of updates is focused on the move to the new consensus mechanism Proof-of-Stake (PoS) and will have the most impact on the issuance and mining of ETH. Currently, Ethereum disburses mining rewards, which will be replaced with staking rewards that distribute 90% less. With the already implemented burning mechanism, this can severely impact the amount of ETH in circulation. If the transaction fees surpass a certain threshold, the burning mechanism will burn more than the issuance, making Ethereum deflationary and creating scarcity over time.

After the implementation of PoS, all mining equipment will become obsolete. This drives miners to explore alternative income-generating services to make a return on their hardware investments. The first option is to use their miners on a different blockchain. The type of miners used in Ethereum support several smaller blockchains which makes Ethereum Classic (ETC), an earlier fork of Ethereum (ETH), the most interesting alternative. Over the past month, we have already seen an increase in hash rate on ETC which implies an increase in active miners.

The other alternative is a hard fork of ETH where users copy the old blockchain and continue on their own network without accepting the network changes. This way the protocol remains working on PoW. The hard fork is scheduled for September 8th and is referred to as ETHPoW. Cryptocurrency Poloniex and Bitmex and a couple of other exchanges have already announced that they will accept the forked Ethereum if the fork occurs.

It remains to be seen which side most Ethereum miners will choose. In order for a hard fork to succeed, it is relying on the adoption and acceptance of users, exchanges and liquidity providers. In order for an alternative chain, such as Ethereum Classic, to be beneficial for miners, it needs to drastically lure in new projects, investors and liquidity. Where the Ethereum miners generated $18B in revenue in 2021, ETC miners only generated $300M as a result of the low activity and usability of the chain.

The Hodl Funds

The stagnation of financial markets led to a decline of the Hodl funds. The Hodl.nl Genesis Fund, the Hodl.nl Consensus Fund and the Hodl.nl Oracle Fund ended respectively at a Net Asset Value (NAV) of €3.04, €3.03 and €0.35.

Check your personal results here

Developer Tornado cash arrested

On the 10th of August, the Dutch Fiscal Information and Investigation Service (FIOD) arrested 29-year-old “Alexy Pertsev” on suspicion of involvement in concealing criminal financial flows and money laundering through the well-known mixer “Tornado Cash”. A mixer gathers users’ incoming deposits and mixes them up with other incoming deposits. The longer the deposited funds are in the mixer, the more privacy is obtained. Users will then withdraw the funds to a new wallet, eliminating the connection between the original address and the new receiving address.

Two days before the arrest of Pertsev, the US government placed Tornado Cash on the OFAC sanctions list of America. Interacting with Tornado Cash is now forbidden for all U.S. persons and entities; willful violation can result in penalties of $50,000 to $10,000,000 and jail terms of 10 to 30 years.

The crypto community shared different opinions about the matter as Tornado Cash has always been a topic of debate, as it provides financial privacy for good and bad actors alike. The outcry of the community became louder as it came to light that the arrested suspect was a developer of the protocol and had only written open source code. Opinions among the cryptocurrency users are divided, some think it’s justified, while others think that he only wrote code and bad actors used his work for wrongful purposes. Which raises the question if developers are responsible for how others utilize their open source code? As technology isn’t necessarily good or bad, it’s neutral, the person using it will determine the implementation of the technology.

Sign up for our newsletter to stay on top of the crypto market.