Newsletter: Recap December

A calm December month

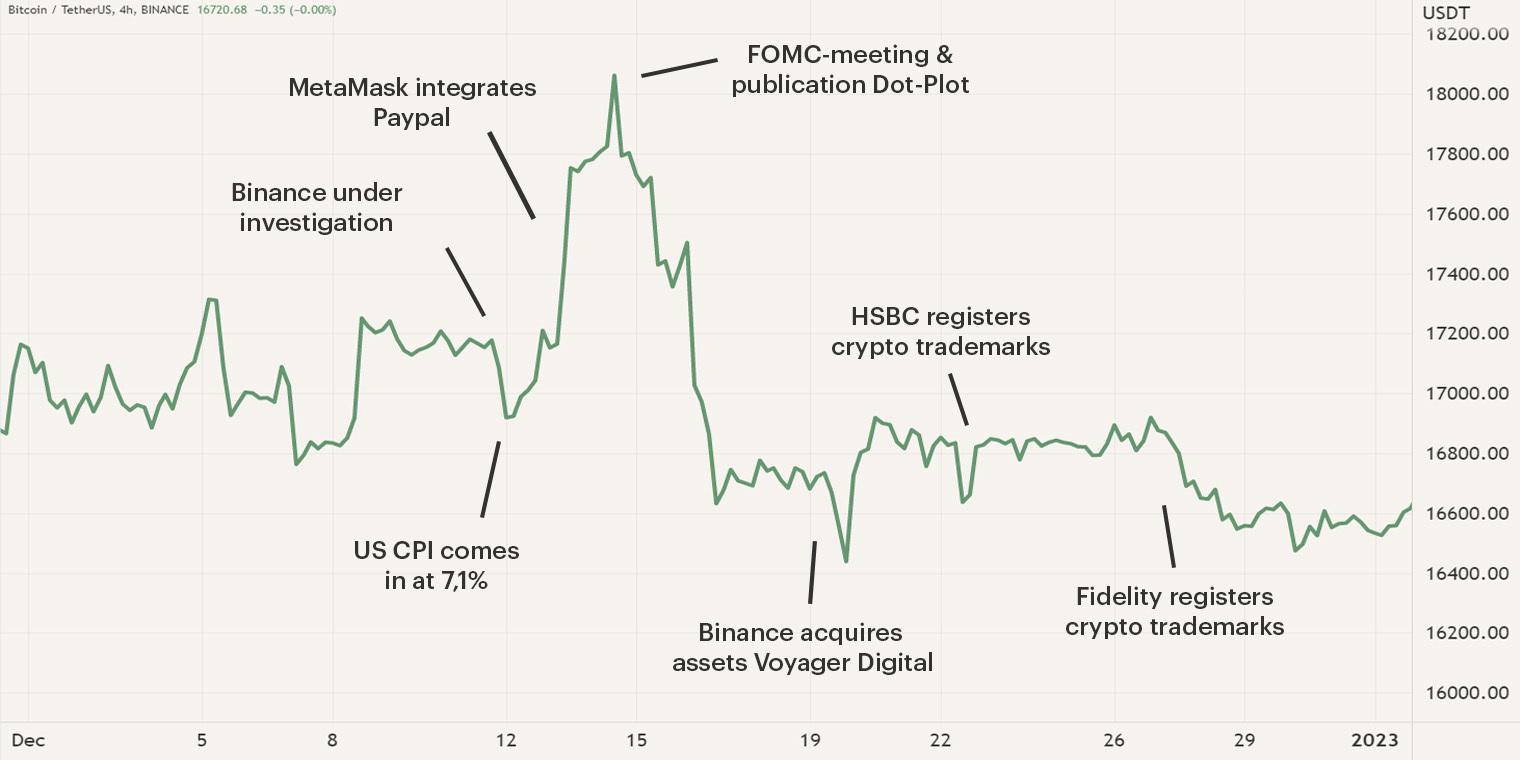

In the first two weeks of December, the market was mainly captivated by the publication of the new US Consumer Price Index and interest rates. For the second time this year, inflation has slowly cooled down but still remains rather high with 7.1% year-on-year inflation. The Federal Reserve (Fed) and the Federal Open Markets Committee (FOMC) are continuing their hawkish stance as the interest rate was hiked by 0.5%, reaching 4.5%. The newly published Dot-Plot of the Fed indicates that financial markets can expect further hikes in 2023, the mode of all voting members is currently at 5.125%. With the new DotPplot, none of the 19 voting members expects a decrease in 2024, however, the hikes won’t be as aggressive as in 2022. The publication of the new economic data had a negative impact on Bitcoin as the price declined from $18K to $16.5K during a couple of days. You can read more about the events of the first half of the month in our market update of December.

After the publication of the economic data, Bitcoin returned to its older price levels of $16.7K, the value prior to the release of interest rates and inflation. During the last two weeks of December Bitcoin continued its sideways movement as there were no big events in crypto and traditional markets. Investors maintained their hesitant stance for entering the market as the end of the year closed in. The end of the month December is a relatively quiet time for financial markets as institutions rarely enter new positions and usually close old positions as various banking holidays take place and aim to wrap up the year. A majority of the market has its eyes focused on the beginning of 2023, which may cause some volatility as investors take new positions or leave the market.

Bitvavo affected by fall FTX

The contagion of the FTX predicament has seemed to reach the Dutch cryptocurrency sector as well. On the 15th of December, news outlet Protos published an article that discusses that Bitvavo, the biggest cryptocurrency exchange in the Netherlands, is part of the creditors’ committee of Genesis trading. Genesis is facing bankruptcy as the collapse of FTX resulted in hundreds of millions worth of crypto assets being frozen on the platform, including the funds of other organizations. The three biggest creditors of Genesis and its parent company Digital Currency Group (DCG) are exchange Gemini, investment firm Eldridge and Bitvavo, which have formed a creditors’ committee to redeem their funds.

The initial article discussed that Bitvavo had an exposure of up to $500M, however, Bitvavo released a statement that the exposure is approximately $280M, depending on the price fluctuations of the assets. Bitvavo used Genesis for its staking program, committing cryptocurrencies to the blockchain for additional returns. Bitvavo has $1.6B assets under management, which means that the company had significant exposure to Genesis. When the news broke, Bitvavo announced that they are solvent and that all client funds are backed 1:1 and all withdrawals will be redeemed. Furthermore, Bitvavo reported that they would never lend out customer funds without permission from the customer. The exchange expects that the majority of the outstanding funds will be repaid. If Genesis fails to do so, the exchange announced they will refund all crypto assets which are currently frozen, albeit by their own reserves.

MetaMask integrates PayPal

On the 14th of December, wallet provider Metamask announced that they integrated their services with online payment provider PayPal. The integration will enable U.S. users to purchase Ethereum directly from the MetaMask app. The new feature will only be available in the MetaMask mobile app and only for U.S. users with the exception of Hawaii. The expectations are that in the next quarter the integration will also be available in the desktop browser extension. The aim of the integration is to make the purchase of cryptocurrency more accessible and efficient, but also to provide mobile users an easier chance to explore the crypto ecosystem.

During the last two years, PayPal has been becoming increasingly active in the crypto ecosystem. In 2020, the online payment provider announced that users can buy and sell various cryptocurrencies such as Bitcoin and Ethereum. However, users were unable to withdraw their digital assets to a personal wallet until this year. This new integration is a change of narrative as the purchased digital assets won’t be in the custody of the buying party. This may offer other online payment providers to explore the possibility of crypto exposure. The purchase of cryptocurrencies will offer these institutions revenue through trading fees while not being exposed to price fluctuations.

Binance US acquires Voyager assets

On the 19th of December, cryptocurrency exchange Binance US announced that they will acquire the assets of crypto lending firm Voyager. In July, Voyager filed for bankruptcy after it suffered enormous losses, $650M, due to its exposure to the failed crypto hedge fund Three Arrows Capital. Earlier this year, the bankrupted entity secured a bid of $1.4B by FTX US however, after the implosion of FTX, Voyager was forced to seek a new buyer. Voyager has determined that Binance US has the highest and best bid for the organization's assets at roughly $1.022B.

Currently, only the winning bid is official, the Bankruptcy Court still needs to approve Voyager’s request, which is scheduled on January 5th. If the court approves, the deal will be finalized on the 18th of April 2023. As an act of good faith and to show commitment towards the deal, Binance has made a $10M deposit. When the deal is complete, users of Voyager will be able to access their funds through the Binance US platform. This deal could also benefit Binance as it acquires over 100.000 new users for its platform who either can withdraw their funds, or decide to use the platform.

Institutions apply for trademarks

In December we also saw several institutional parties continue their interest in the cryptocurrency market. Fidelity Investments previously revealed plans to have pension plans invest in cryptocurrency; this time it followed with the registration of several crypto-related trademarks. The registration of these trademarks should benefit a wide range of crypto services, including offering their current services in the metaverse. These would also include registration for NFTs and NFT marketplaces, investment in digital real estate and cryptocurrency trading.

Banking giant HSBC came out with a similar announcement a few days earlier. HSBC registered two trademarks, securing both the name and the logo. The application included specifications regarding the use of NFTs, the provision of financial advisory services and the deployment of a digital environment in the form of a metaverse. As the registrations have not yet been followed by concrete announcements from the institutions themselves, this has led to speculation in the market for the time being.

The Hodl Funds

Due to the turmoil that still prevails in the cryptocurrency market, we saw several investors flee to safer havens such as Bitcoin and stablecoins. This had a negative impact on altcoins which led to a decline in the Hodl funds. The Hodl.nl Genesis Fund, the Hodl.nl Consensus Fund and the Hodl.nl Oracle Fund ended respectively at a Net Asset Value (NAV) of €2.15, €2.15 and €0.20.

Check your personal results here

Maurice Mureau at Salt iConnections Asia

Recently, our CEO Maurice Mureau had the pleasure of speaking at Salt iConnections in Singapore. Salt is a global networking forum that focuses on the thought leaders in finance and technology. Consequently, meetings are attended by leaders from SkyBridge, J.P. Morgan, BlackRock and more. The panel in which Maurice participated delved into the latest market developments, macroeconomic conditions and upcoming regulation. You can watch the recording of the panel below.

Sign up for our newsletter to stay on top of the cryptocurrency market.