Newsletter: Recap February

- Binance at the center of attention

- China leading the market

- Bosch partners in Web3 development fund

- The Hodl Funds

- Mastercard enters Web3 Partnership

- Hodl - European Blockchain Convention

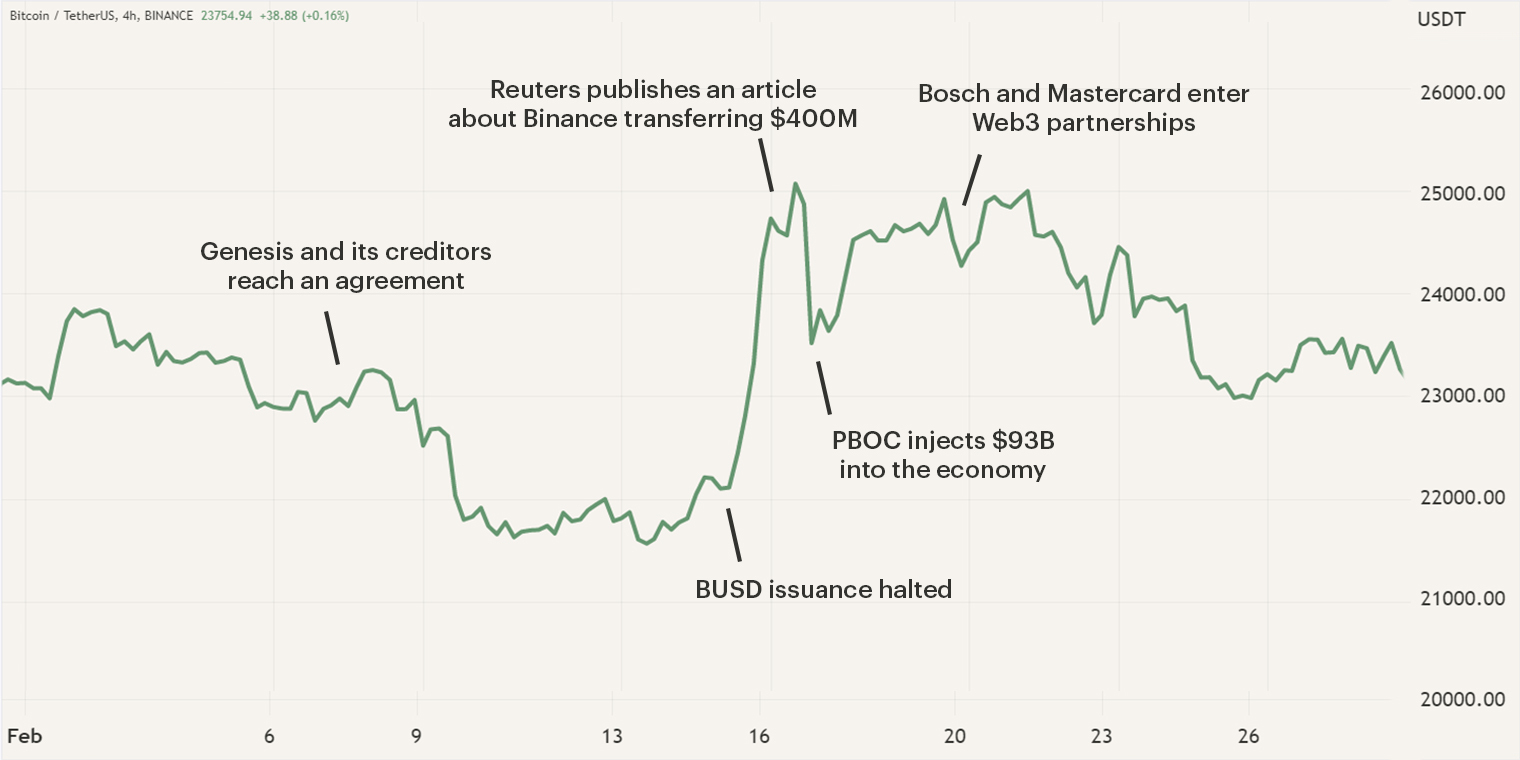

During the month of February, Bitcoin experienced a strong rally as its price soared toward $25K. A price level that is forming a major resistance as Bitcoin hasn’t been able to break through. The strong upwards trajectory of Bitcoin has created a wave of positive sentiment among traders and investors who are eyeing higher price levels. As the month continued, positive and negative news came to light.

Binance at the center of attention

Earlier this month, Binance was at the center of attention as their stablecoin issuer Paxos came under investigation by the New York State Department of Financial Services. Paxos is the issuer of the stablecoins Binance USD (BUSD) and Pax Dollar (USDP). Currently, Paxos has halted the issuance of both stablecoins, however, redeeming is still possible until at least February 2024. As the month of February continued, it came to light that the SEC intends to sue Paxos for violating investor protection laws. It is important to note that Binance is not the owner of the stablecoin BUSD, Paxos is.

Nevertheless, the investigation into BUSD causes issues for Binance as it uses the stablecoin extensively with its trading pairs. Ever since BUSD has become the third largest stablecoin with a total market capitalization of $16B. As the investigation transpires, Binance will need to explore new options for its BUSD-trading pairs and financial reserves. You can read more about the events of the first half of the month in our market update of February.

In addition to the investigation of their most used stablecoin, Binance.us, an independent partner of Binance, has come under investigation as $400M was transferred from the independent partner to a trading firm related to Changpeng Zhao (CZ), the CEO and founder of Binance.

On the 16th of February, an article was published by the news outlet Reuters which discussed that Binance transferred over $400M from Binance.us to trading firm Merit Peak. This raised some questions as documents of Merit Peak state that CZ is a manager at the firm. The article in Reuters discusses that Binance had secret access to a bank account that belonged to its independent U.S. partner and transferred large amounts of capital to the trading firm. The transfer of capital took place during the first three months of 2021, it remains unclear whether customer funds were transferred with these financial transactions. The investigation into Binance.us has to highlight whether the transactions include customer funds.

China leading the market

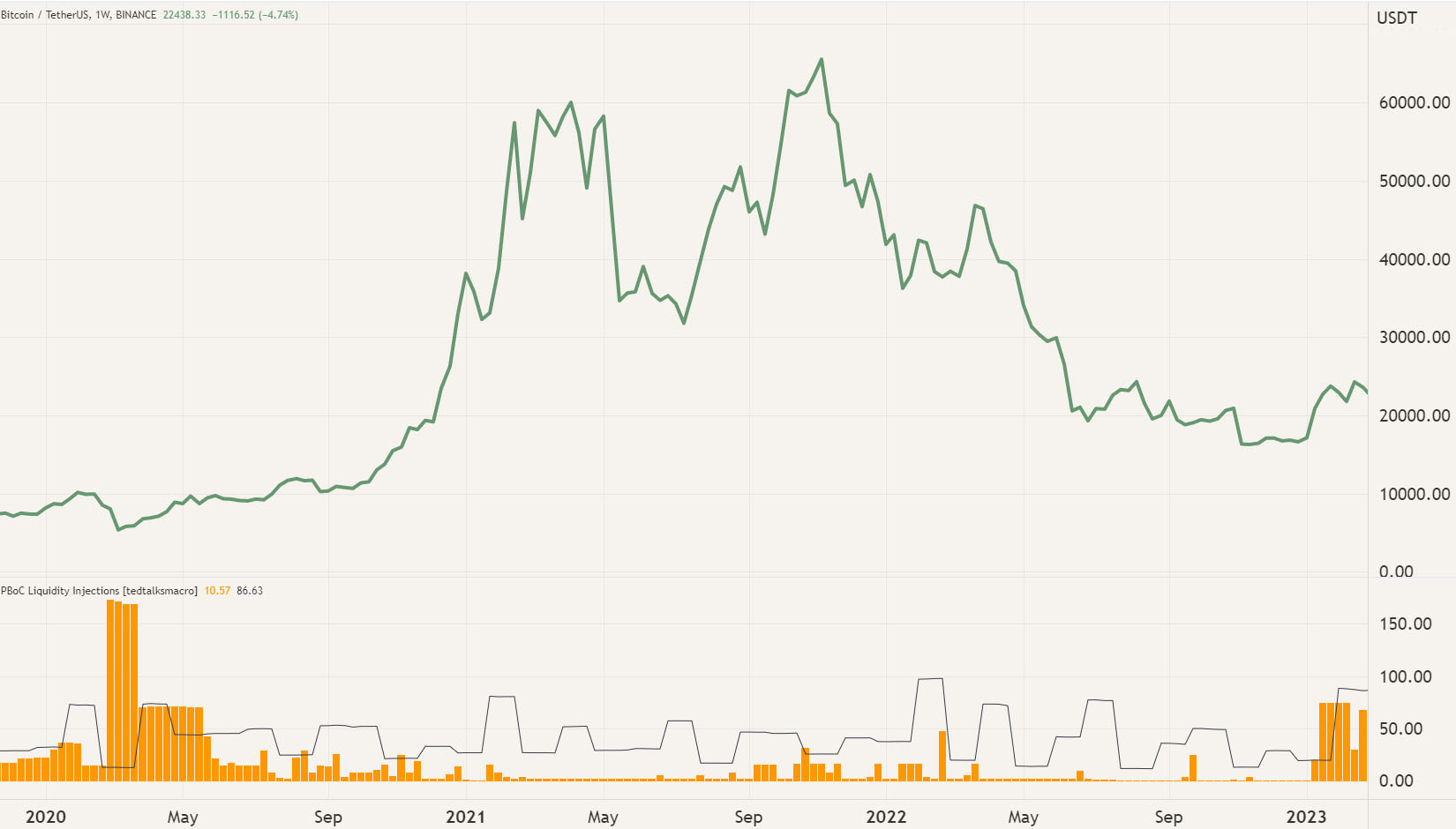

After three years of tedious lockdowns, China has opened its economy and is injecting billions worth of dollars into the economy. The economy of China has taken a toll over the past years as the property sector struggled and exports fell. With the country opening again, businesses and consumers started to seek new loans. The increase in loan demand created a liquidity shortage which resulted in the People’s Bank of China (PBOC), the central bank of China, injecting billions into the Chinese economy through quantitative easing (QE). QE is a form of monetary policy in which a central bank purchases securities to stimulate the economy. On Friday the 17th of February, the PBOC injected 632 billion yuan, the equivalent of $93 billion, into the economy with the use of reverse repos. In the chart below, the liquidity injections of the PBOC and Bitcoins' price are displayed, with the latest injections there is some correlation with Bitcoins' price.

On the 16th of February, other news from Asia came to light as Hong Kong proposed a new regulation that will legalize the trading of cryptocurrency starting from July, 2023. The cryptocurrency market responded positively to the news as it signals the potential for significant capital inflows during the coming months. The announcement of the legalization is part of a bigger plan for Hong Kong as it strives to become the Asian cryptocurrency hub.

In 1997, the 99-year lease of Hong Kong between the United Kingdom and China ended and since then China has been trying to influence Hong Kong politics. Over the past years, China’s influence has become increasingly clear but Hong Kong has still maintained autonomy concerning certain aspects such as immigration and tax. This autonomy also made it possible for Hong Kong to legalize the trading of cryptocurrency.

Currently, it seems that China is willing to allow the trading of cryptocurrency in Hong Kong as it can act as a sandbox. The legalization of trading cryptocurrencies will also make it possible for Chinese businesses to enter the cryptocurrency market through the Hong Kong jurisdiction. Currently, in China itself there is still a ban on trading cryptocurrencies and mining. We have seen China ban and unban cryptocurrency on multiple occasions. The latest ban on cryptocurrency in China came into force in September 2021.

As billions of worth of dollars are pouring into the economy and Hong Kong is exploring the option of legalizing cryptocurrency trading, many are believing that China and or the Asian market will initiate the next bull market. While the rest of the world is raising interest and trying to cool down its economy, China is injecting and trying to heat it. This may cause larger amounts of capital to enter the cryptocurrency sector as the money supply increases through Asian markets.

Bosch partners in Web3 development fund

International technology firm Bosch has entered a partnership with cryptocurrency protocol Fetch.ai to create the Fetch.ai Foundation. The Foundation will act as a grant program for the further development of Web3, artificial intelligence (AI) and decentralized technologies. A total of $100M has been earmarked for the grant program, throughout three years, the program will invest in selected enterprises and partners.

The Fetch.ai Foundation Board will feature members of both organizations and will mainly focus on the industrial AI sector. This isn’t the first time Fetch.ai and Bosch enter a partnership as in February 2021, they launched a multi-purpose blockchain network that focused on incorporating AI and the Internet of Things. As more traditional organizations explore the various sectors we believe that these organizations will enter the market through these partnerships. Cryptocurrency protocols are already battle-tested and offer a fast way to enter the market and profit from the emerging sector.

The Hodl Funds

The month of February led to a small increase of the Hodl funds. The Hodl.nl Genesis Fund, the Hodl.nl Consensus Fund and the Hodl.nl Oracle Fund ended respectively at a Net Asset Value (NAV) of € 3.18, € 3.15 and € 0.31. True Asset Fund II ended the month with a NAV of € 15,399.40. Clients of True Asset Fund can view their personal performance in the IQ-EQ portal.

Check your personal results here

Mastercard enters Web3 Partnership

On the 21st of February, payments provider Mastercard and Web3 payment protocol Immersve entered a partnership that will allow users to conduct crypto payments through the Mastercard network. Immersve is a New Zealand-based Web3 company that leverages smart contracts to bridge Web3 payments to other digital platforms. Users will be able to integrate their cryptocurrency wallet with Immersve and conduct transactions with merchants that accept Mastercard online payments. After the user's transaction is successful, USD Coin tokens — the US dollar-backed stablecoin USDC issued by Circle — are converted to fiat currency and used to settle transactions on Mastercard's network.

Over the past years, Mastercard has entered various partnerships to get a foothold in the cryptocurrency market. One of these partnerships was with leading cryptocurrency exchange Binance, which launched a prepaid credit card in Latin America. As time progresses, we continuously see payment providers such as Mastercard and Visa exploring their options in the emerging sector. We believe that this interest will continue to grow as cryptocurrencies, especially stablecoins, can offer beneficial transactions.

Hodl - European Blockchain Convention

During the 14 - 17th of February, several members of the Hodl team and our CEO Maurice Mureau joined the European Blockchain Convention (EBC) in Barcelona. The EBC is one of the biggest and most influential European conventions in digital assets and is welcome to cryptocurrency protocols and traditional institutions. After a successful edition in 2022, it's nice to be present again at the EBC. Despite the many challenges the sector faced in the last year, it is incredible to see the event almost double in size. Big names in the cryptocurrency sector which were present are Galaxy Digital and Coinbase, however, it remains an interesting thing to see institutions such as Capgemini, Deloitte and JP Morgan joining these conventions. Furthermore, we observed that more banks, such as ING, are interested in potentially cautiously entering the market.

On the opening day, our CEO Maurice Mureau participated in a panel discussion concerning the adoption of cryptocurrency among traditional institutions. The core message is that it is not a question of IF, but rather a question of when these institutions will fully embrace the cryptocurrency market. Last year we saw several international players such as BlackRock enter the market and the expectation is that this will increase as regulation will come into play. Above you will find the full recording of the panel.

Sign up for our newsletter to stay on top of the cryptocurrency market.