Newsletter: Recap February

Newsletter: Recap February

Welcome to our monthly newsletter. Every month we create an overview of the performance of our Hodl funds, the developments within Hodl, and the latest cryptocurrency news.

Cautious market due to geopolitical landscape

The month of February started with positive sentiment as Bitcoin broke out of its three-month-long descending trend. Unfortunately, this recovery was interrupted by tensions in the geopolitical landscape and the speculation on extra rate hikes by the FOMC. An escalation in the conflict between Russia and Ukraine made investors back off from high-risk investments to secure their funds. This so-called risk-off movement led to a fall in the prices of stocks and cryptocurrency, while the price of safe havens such as commodities rose.

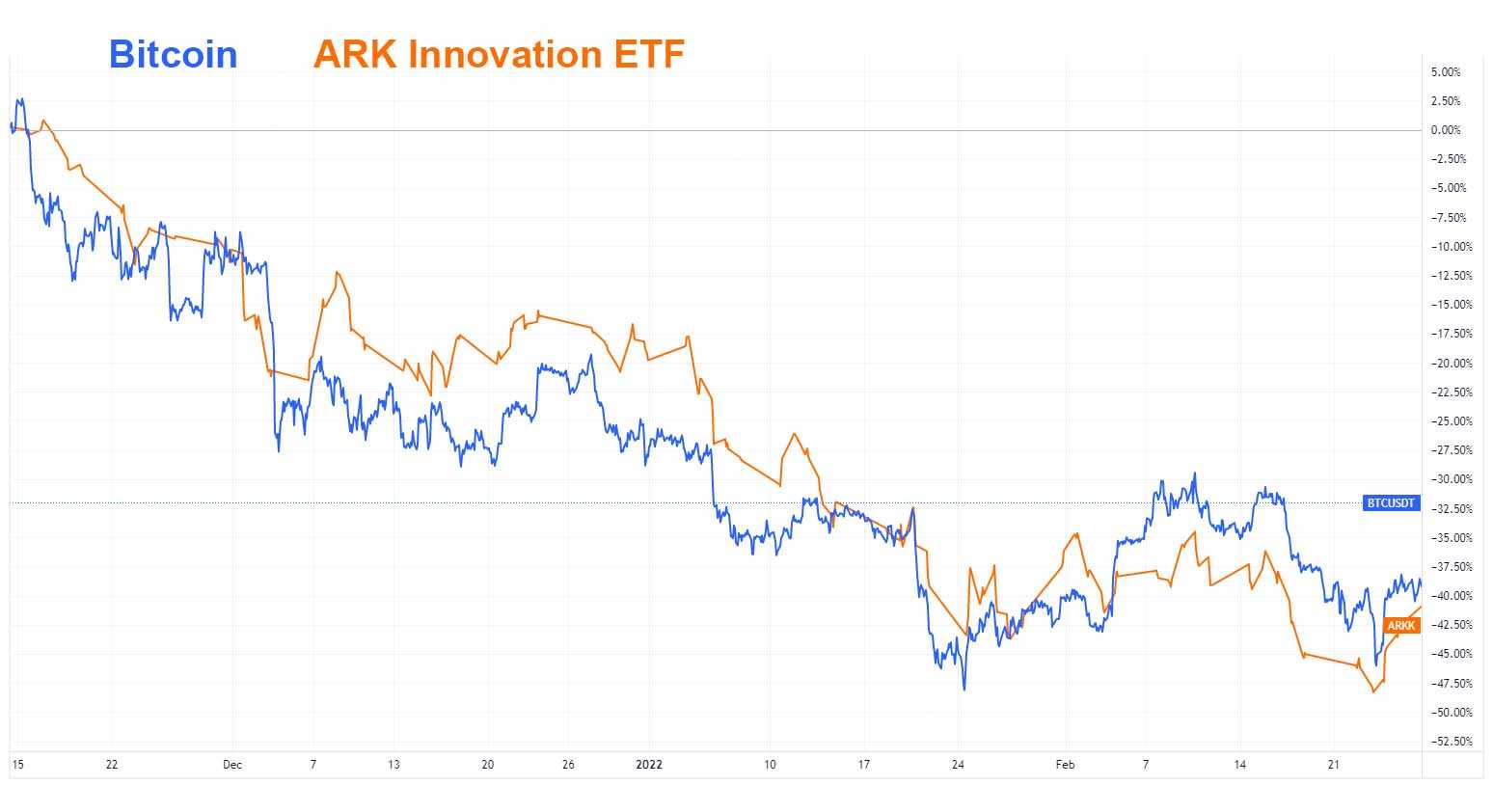

The escalation drastically slowed down financial markets across the board. Where macro-economic trends and geopolitical issues previously had less impact on Bitcoin’s price action, we now see a parallel between stocks and cryptocurrencies. Due to institutional adoption, cryptocurrency is now subjected to similar macro trends. The biggest correlation can be found with tech stocks.

Institutional investors are active in all markets and treat crypto as a risk asset in their portfolios. The correlation was shown when both markets responded with similar price movements and corresponding volume fluctuations after the escalation between Russia and Ukraine.

The cautious sentiment was also visible on the blockchain as data shows a decline in the number of short-term Bitcoin holders. On-chain analysis confirms this risk-off move. Low network activity and a declining number of active entities also indicate investors are on the fence.

The wait-and-see approach from investors led to an all-time high of stablecoins on exchanges. The fact that investors are increasing their stablecoin positions instead of withdrawing their funds, indicates that investors still foresee growth for the cryptocurrency market and are waiting to (re-)enter the market once macro-economic situations improve.

The case for cryptocurrency

Corona vaccination policies around the world have led to massive protests. One of these protests, “The Freedom Convoy of Canadian Truckers” protested against the Canadian government’s vaccine mandate that required all cross-border truckers to be vaccinated. The truckers expressed their dissatisfaction by occupying several streets in the capital Ottawa. The protest got national as well as international support and soon several fundraisers were started to cover the protesters’ expenses and expected fines.

One of the fundraisers collected more than $500.000 in Bitcoin. In a desperate attempt to stop the protests the Canadian government ordered financial institutions and crypto exchanges to halt all transactions associated with the protests. Canadians started massively withdrawing money from their bank accounts out of fear that their assets would be frozen. Several banks experienced outages as a consequence of this so-called bank run.

Independent of your opinion on these protests, the direct intervention of the government and financial institutions once again highlights the importance of cryptocurrency. The ability of the government to halt transactions, freeze accounts, and interfere with payments can have dire consequences. This further strengthens the case for a decentralized alternative to our current monetary system.

The Hodl funds

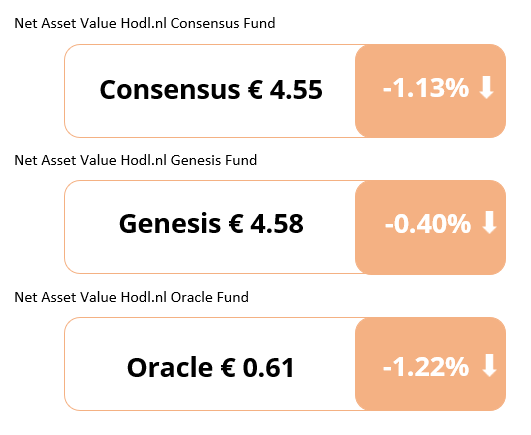

February started with a positive recovery for the cryptocurrency market. The recovery, however, was corrected very quickly due to the further escalation of the conflict between Russia and Ukraine. This led the Hodl funds to a neutral performance over the month of February. The Hodl.nl Consensus Fund, Hodl.nl Genesis Fund, and the Hodl.nl Oracle Fund achieved a performance of respectively -1.1%, -0.4%, and -1.2%.

Results February 2022:

Team expansion

This month, we welcome four new additions to the Hodl team. We have two new traders/analysts and two interns who will be helping the marketing/sales department.

On the trading side, two new names have joined the team: Nick van der Heiden and Vladimir Mikirtumov. Nick has been trading cryptocurrency full time since 2017 and at Hodl he will be researching early-stage investment opportunities. After working at ASML, Vladimir decided to get pivot into the cryptocurrency industry and will be helping Hodl on the data side of trading.

Nick: “When trading and investing for myself full-time, I missed being part of a team. It energizes me to be in an environment that lives and breathes crypto, that is why I am very excited to get started at Hodl”

Vladimir: “I’m glad that Hold offers me the chance to be at the forefront of new developments within the cryptocurrency space. Given the fast-paced and iterating environment of crypto as an analyst, I’m presented with the ultimate challenge of separating the signal from the noise.”

This month, we can also officially welcome two new interns namely: Celin Birol and Gerard de Jager.

Celin: “I will be joining Hodl from February-July to do my graduation internship, I will be carrying out several experiments regarding sales/marketing using the Lean method. I’m looking forward to joining Hodl and expanding my knowledge in regard to cryptocurrency as well as marketing!.

Gerard: “For my graduation internship, I will be doing an analysis of the business processes at Hodl. I have always liked cryptocurrency and have done research into the topic as a retail investor. Due to my interest in crypto, I started looking for professional cryptocurrency companies and found Hodl. During my time here I want to learn all about the professional side of cryptocurrency and investment funds.”

We warmly welcome all our new team members!

News overview February

Grayscale enters stock market with first ETF

On February 2, Grayscale Investments, the world’s leading cryptocurrency asset manager, started trading on the New York Stock Exchange with its first ETF called “Grayscale Future of Finance” with the ticker GFOF. To date, Grayscale already has 16 crypto-related investment products resulting in a total of $34.6 billion in assets under management.

The organization aims to use the recently introduced investment product to invest in companies and technologies that will shape the Future of Finance. The ETF has a total of 22 holdings including several organizations that contribute to the advancement of the cryptocurrency market. The biggest holdings of the ETF include Coinbase, Hut 8 Mining, and Block Inc.

Grayscale has been trying for some time to convert its “Bitcoin Trust” mutual fund into a listed spot ETF, but this has been rejected time and again. Our prognosis is that the release of the Grayscale ETF will bring experience in going through the regulatory processes. The experience gained will therefore help to improve the collaboration with regulators such as the SEC and increase the likelihood of approval of their intended spot ETF.

Alleged Bitfinex hackers brought into custody

On Feb. 8, the American Department of Justice (DoJ) announced that they had arrested two people who were allegedly involved with the hack of cryptocurrency exchange “Bitfinex”. In 2016, the hacker(s) were able to breach and withdraw 120.000 Bitcoins, which had a value of $72 million. For years, little progress was made in recovering the stolen Bitcoins and many thought the Bitcoins would never be recovered.

On Feb. 1, multiple wallets addresses connected to the hack showed activity and sent out thousands of transactions, with one wallet address consolidating 90.000 bitcoin, worth $3.6 billion. A week later, the DoJ announced they had seized a total 94.000 Bitcoins ($3.55 billion) and brought two individuals into custody.

The Doj stated they were able to apprehend the suspect after they exercised their ability to “follow the money through the blockchain. Which is a good example of how transparency of the blockchain works. And when this technology is implemented throughout the various sectors, it can create great advantages for everyone.

BlackRock plans to offer crypto trading

According to internal sources, BlackRock, world’s biggest asset manager, is planning to offer cryptocurrencies to its clients. The asset manager has a clientele of more than 1.500 institutional investors, which has resulted in $10 trillion Asset under Management. Earlier this year, BlackRock hinted some positive signals towards cryptocurrencies when Larry Fink, current CEO, said that the company is studying the potential of cryptocurrencies to serve as long-term investments.

Furthermore, the asset manager also intends to launch its “iShares Blockchain and Tech ETF” into the market. The ETF is a bundle of several US companies that are closely involved in the development of crypto technology. We prognosticate that there will be an increased influx of financial institutions who will intend to enter the cryptocurrency market. Especially, if the largest asset manager in the world is introducing crypto-trading services to its institutional clients.

BlockFi settles with the SEC for $100 million

BlockFi, a cryptocurrency lending platform, has agreed to pay the Securities and Exchange Commission $100M in penalties for failing to register its cryptocurrency lending service. There is still much uncertainty regarding the legal status of several cryptocurrency services, including the lending of crypto against a given interest. Regulations are lagging behind due to the accelerating pace of new innovations within the cryptocurrency market, leaving crypto organizations in a legal grey area.

Since March 2019, BlockFi has been offering customers the opportunity to lend cryptocurrency, these clients earned interest on the given loans. Customers even earned an annual compounded return of over 9% on specific crypto currencies. Regulators, such as the SEC, found the service offered to be too similar to an investment contract.

It appeared from the SEC’s conducted investigation that BlockFi had registered its services insufficiently and was fined accordingly. This has given the regulator more judicial impact and it is probable that other organizations will also be investigated. The BlockFi settlement does provide other cryptocurrency organizations more clarity concerning the requirements and vision of the regulator which might indicate a further step towards regulation.

Receive our newsletter to stay on top of the crypto market.