Newsletter: Recap January

Newsletter: Recap January

Welcome to our monthly newsletter. Every month we create an overview of the performance of our Hodl funds, the developments within Hodl, and the latest cryptocurrency news.

Turbulent market

Whereas December was characterized by a slight corrective movement, this was certainly not the case for January. Halfway through the month, the market was shaken by a sharp correction from which the market is still recovering. The correction was driven by the speculation leading up to the FOMC meeting of the FED in which they announced the new interest rate policy. This negative news resulted in a chain reaction of liquidated positions and eventually a free fall of Bitcoin’s value.

The sharp correction was even stronger in the so-called altcoins, where prices fell by as much as 30-50%. At the FOMC meeting, the FED announced that it would not be raising interest rates immediately, which provided some relief and leeway for the crypto and stock markets. The next FOMC meeting is scheduled for March.

Adoption of crypto infrastructure

Aside from the speculation on Bitcoin’s value, January was a month in which the adoption of cryptocurrency infrastructure often passed the news. The adoption rate of cryptocurrency infrastructure is seen as a better benchmark for the long term than price.

This month, Visa announced that they had processed $2.5 billion in transactions during the previous quarter for these so-called crypto cards. Crypto cards are prepaid credit cards on which cryptocurrency can be deposited to replenish the balance of the card. Because of this partnership, it is possible to pay with crypto at various outlets which support Visa. Visa announced that they are already working with 65 crypto platforms to develop these cards.

Twitter is also working on further implementing cryptocurrency infrastructure in its services. This month, the organization implemented a feature to set NFTs as profile pictures. Other social media platforms such as Reddit, Facebook, and YouTube followed soon with their announcements about implementing NFTs within their platforms. As previously explained in our forecast for 2022, we expect the infrastructure surrounding NFTs to play a crucial role in this coming year.

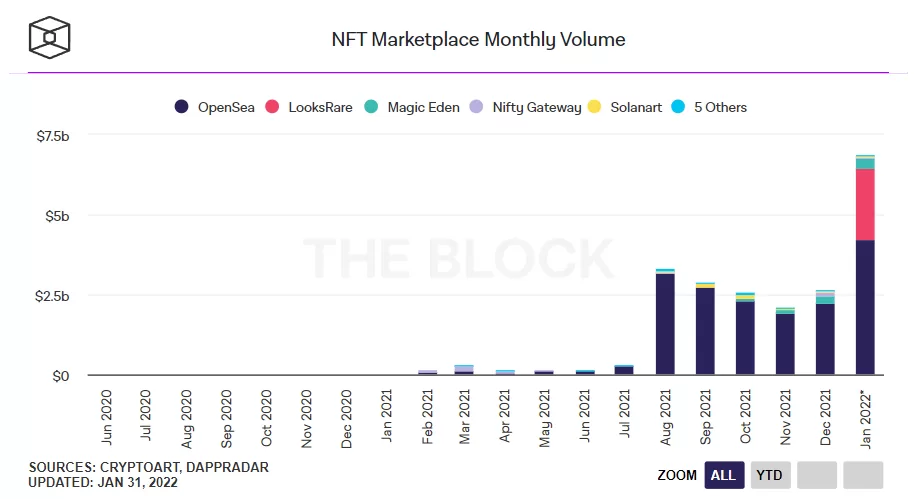

In the month of January, the performance of NFTs was for the first time not directly linked to that of cryptocurrencies. While we saw the total trading volume of cryptocurrencies decline in January, the NFT trading volume reached new heights with a total volume of over $6 billion.

The Hodl funds

The huge drop in the crypto markets that started during the month of January is also reflected in the results of the funds. During the month of January, Bitcoin saw a drop of 21% which was followed by a drop of 32% for Ethereum. Other cryptocurrencies such as Polkadot and Avalanche declined by around 40%. The Hodl.nl Genesis Fund, Hodl.nl Consensus Fund, and the Hodl.nl Oracle Fund showed a decline corresponding to this price drop.

Results January 2022:

Team expansion

This month, we welcome two new additions to the Hodl team. Casper is going to work as an IT manager and Tobias joins the marketing team.

Casper Karreman has been working as a software engineer for over 20 years. With his vast experience in developing complete software systems and product development, he is now responsible for Hodl’s IT strategy. With the growth we are experiencing, it is time to take the automation of our systems into our own hands.

“After 16 years at the same company, where I experienced a lot of personal growth, it is now time for a new challenge. At Hodl, I get the chance to be at the forefront of new developments, which challenges me enormously. With my knowledge and experience, I will support the current team in automating tasks so they can work more effectively.”

This month, we can also officially welcome Tobias to Hodl. After a successful internship, he will be working with us part-time next to his study.

“After an educational internship, I hope to really get involved with Hodl and learn more about this interesting and ever-changing sector. During my internship, I researched some interesting marketing opportunities. Staying with Hodl also gives me the opportunity to develop these ideas further and ultimately implement them.”

We warmly welcome Tobias and Casper and look forward to working together!

News overview January

Inflation decreases Dutch and Belgian savings

The comparison site for insurance and financial products called “Geld.nl” has calculated that Dutch saving accounts lost around 9 billion euros in purchasing power. This is the result of the historically low-interest rates and rising inflation. For calculation purposes, the site used the total value of the withdrawable savings based on data obtained from the Dutch Central Bank.

In the Netherlands during 2021, there was an average savings rate of 0.05%, which yielded 170 million in interest. At an average inflation rate of 2.7% during 2021, total savings have decreased in value by 9.18 billion. In Belgium, the real interest rate (interest minus inflation) was -5.7%, which reduced the purchasing power of Belgian saving accounts by 16.5 billion euros.

BitMEX plans acquisition of German bank “Bankhaus von der Heydt”

On 18 January, cryptocurrency trading platform “BitMEX” announced its plans to acquire the 267-year-old German bank “Bankhaus von der Heydt”. BitMEX and Dietrich von Boetticher, the current owner of the bank, have already signed the bank’s purchase agreement. However, the terms of the acquisition have not been disclosed yet. The acquisition is part of BitMEX’s strategic plan to launch a one-stop-shop for regulated crypto products in Germany, Switzerland, and Austria. However, the acquisition still needs to be approved by BaFin, the German banking and financial services regulator.

Share of criminal activities in crypto decreases

The recently published report from Chainalysis, an organization that collects and reports blockchain data, shows that the number of transactions linked to illicit activity has decreased in percentage. In 2020, 0.62% of all crypto activities were linked to illicit activity such as cybercrime, money laundering, and terrorist financing, and the percentage dropped to 0.15% in 2021. However, the absolute value of criminal transactions has never been so high within the crypto ecosystem.

Both the total transaction volume and the transaction volume linked to illicit activities has increased every year. However, the growth of legal activities outpaces the growth of Illicit activities, decreasing the percentage of transactions volume linked to illicit activities.

NFT Marketplace OpenSea faces issues

OpenSea, the leading NFT-marketplace, has experienced a tumultuous month with some concerning issues. For the past year, OpenSea has been “the place” to sell and buy your NFTs. Due to the great success of OpenSea, many users hoped that the organization would bring out a token to reward the users of the platform. Instead, OpenSea has signaled plans for an IPO, angering many users.

A recently founded NFT platform called ‘LooksRare ” took advantage of the situation, the platform tried to attract OpenSea users by handing out their native token “LOOKS”, which is currently trading around $4. The number of users on LooksRare surged after the announcement that users could claim the free token.

The decrease of users on OpenSea continued when hackers leveraged a flaw in their systems. In short, the hackers were able to bypass the price set by the owners of the NFTs and were able to buy the assets at cheaper prices. This created a massive backlash towards OpenSea and pushed the users towards other platforms. OpenSea has announced that they will reimburse the users who have become a victim of the flaw, but it is most likely that the original NFTs can not be returned.

Receive our newsletter to stay on top of the crypto market.