Newsletter: Recap March

- Trouble in banking sectors grows

- Central banks start coordinated action

- Change of Plan

- U.S. regulators clamp down

- Hodl News

- The Hodl Funds

- Hodl - European Blockchain Convention

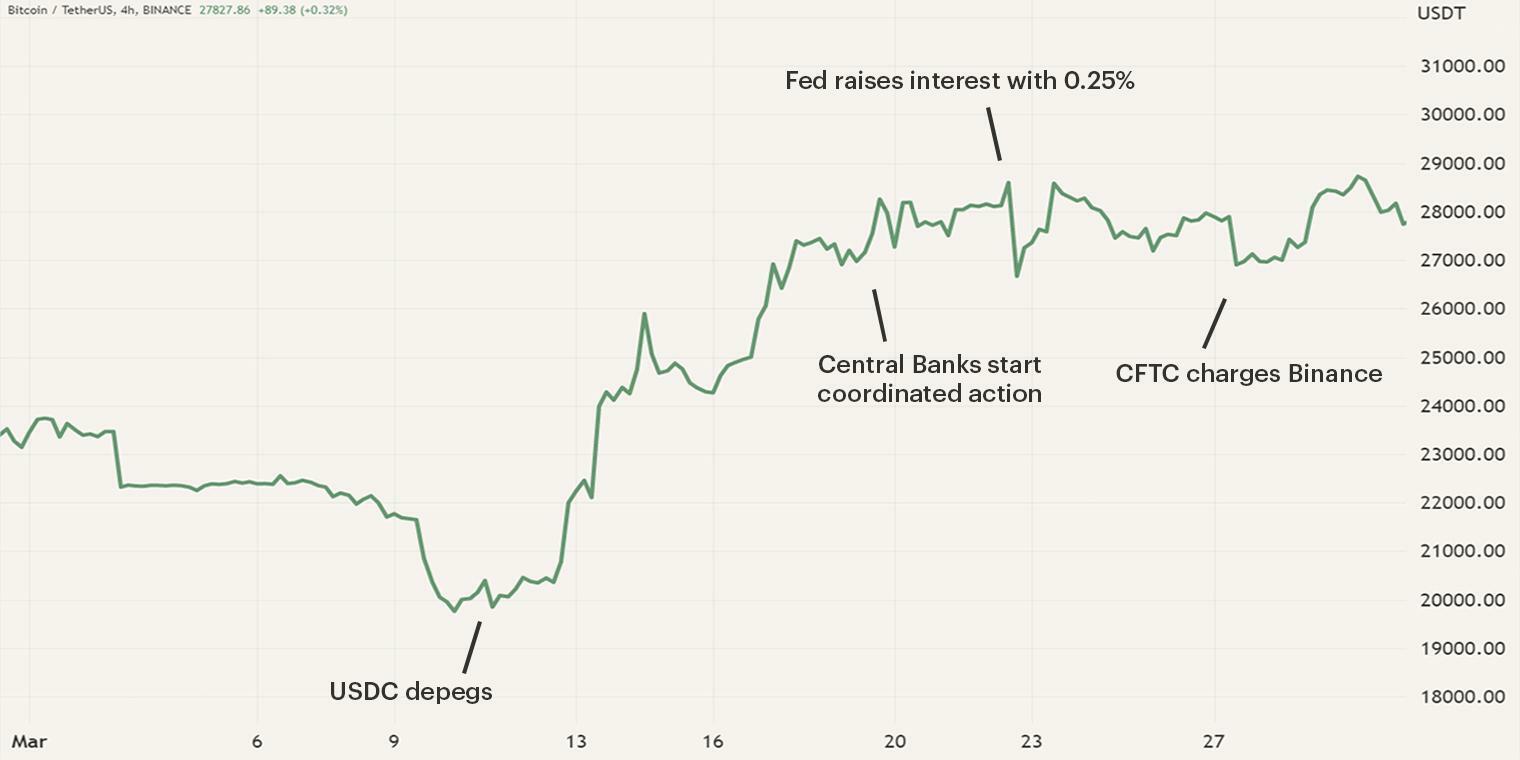

During the month of March, the cryptocurrency market experienced quite some volatility as panic in the banking sector deepend. In the beginning of the month, the market experienced a big shock as the second biggest stablecoin, USD Coin (USDC), depegged from its $1 value. The depegging of USDC was caused as the market was afraid that approximately 10% of the reserves were lost by the collapse of Silicon Valley Bank. This caused panic in the market and resulted in a heavy correction in the price of Bitcoin as it fell towards $19,500.

As other stablecoins used USDC for their own financial reserves, various big stablecoins such as DAI also depegged from their $1 value. Eventually the news broke that the Biden Administration and the Financial Deposit Insurance Corporation (FDIC) would cover all deposits of the collapsed bank, causing positive sentiment to return. You can read more about the events of the first half of the month in our market update of March.

Trouble in banking sectors grows

Despite the ongoing fear in the banking sector, Bitcoin experienced a strong rally towards $28K. After the collapse of Silicon Valley Bank, many started to fear that other banks might fail as well. A few days later this fear became a reality as the stock of Credit Suisse plummeted. Eventually, Credit Suisse was acquired by its competitor UBS for approximately $2B. The forced takeover has caused financial losses for stockholders of the bank as the stocks are sold for a discounted price and bondholders of the bank have been completely wiped out, with an approximate loss of $16B.

As one of the biggest and oldest banks in the world failed, the signs of a crisis were becoming more alarming. The aggressive interest hike campaign of the Federal Reserve (Fed) is slowly hurting these financial institutions as the value of bonds depreciates. The depreciation isn’t the biggest problem as it’s an unrealized loss, an underwater position can still appreciate in value. It does become an issue when the bank is forced to sell the bonds, realizing the losses and causing liquidity problems, which is what we saw at Silicon Valley Bank.

The current financial status of banks remains largely unknown but on both sides of the Atlantic the financial watchdogs, the Fed and European Central Bank (ECB), state that the banks and other financial institutions are healthy. These assurances weren’t realized as banking stocks continued to fall.

Central banks start coordinated action

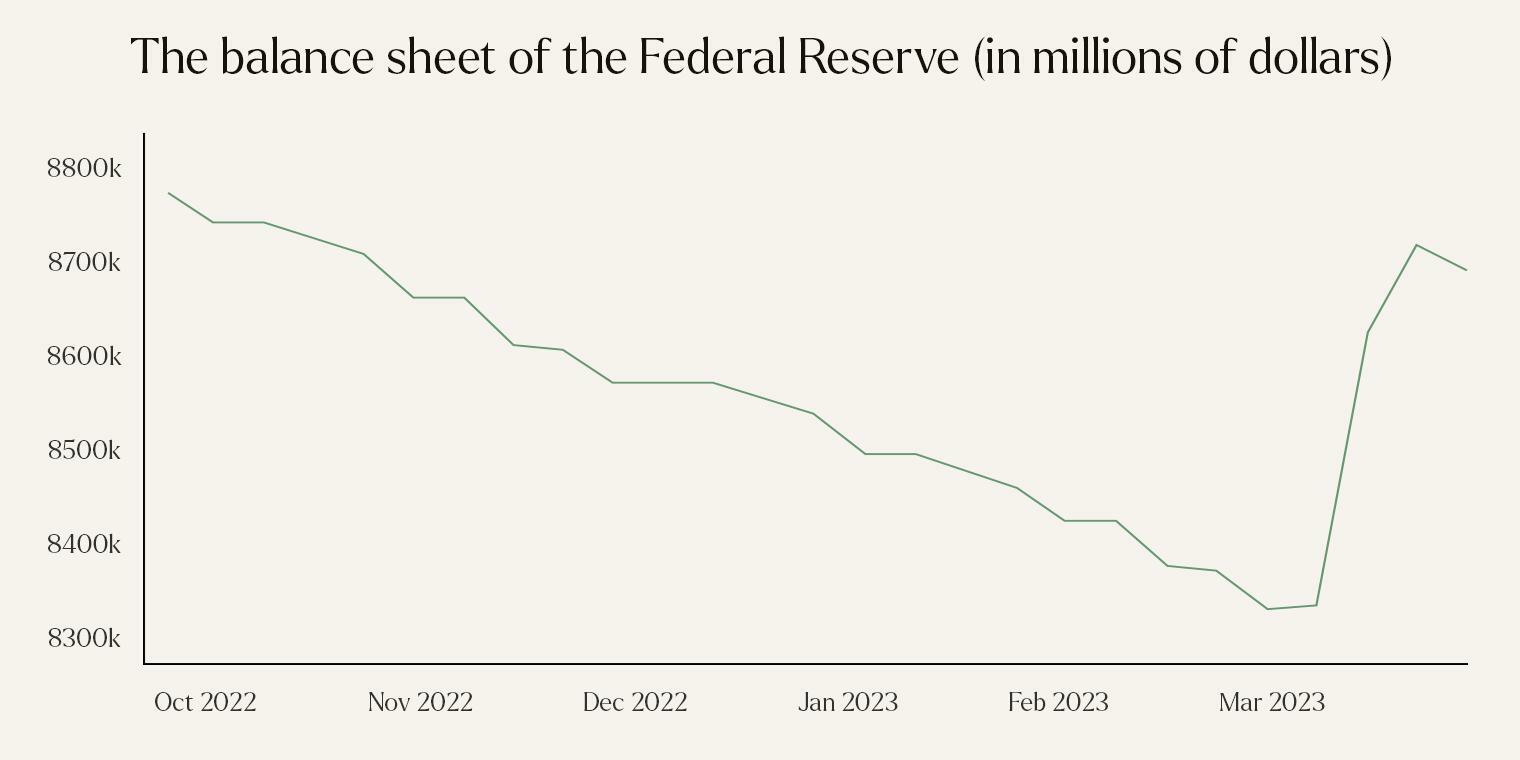

During the past year, the Fed has aimed to combat runaway inflation with increasing interest hikes. In addition to raising interest, the Fed has been lowering its balance sheet by selling the securities it acquired, tightening the US economy. On the 16th of March, news broke that US banks had sought a record amount of emergency liquidity, $152.9B, from the Fed. In addition, $140B was provided to the bridge banks, an organization that operates failed banks until a buyer is found, in this case for Silicon Valley Bank and Signature Bank. In total, nearly $400B worth of liquidity was provided to financial institutions, effectively wiping out 5 months of quantitative tightening. As aforementioned, the Fed stated that the financial sector and banks are healthy and strong, however, the sudden supply of liquidity may indicate that these “healthy” banks experience some liquidity issues.

On the 19th of March, seven central banks around the world, including the Fed and ECB, announced that they are planning a coordinated action to enhance the provision of US dollar liquidity. The central banks are aiming to lighten the fear in the financial market as investors are more uncertain after the collapse of three US banks and the acquisition of Credit Suisse. They aim to achieve this via the standing US dollar liquidity swap line arrangements.

Central banks are allowed to access and borrow dollars once per month, this limit has been put to once a day. This daily provision of dollars increases the available liquidity for central banks and in turn financial institutions. As we read between the lines, central banks around the world are possibly preparing for a quantitative easing strategy, with the dollar as the main instrument as it’s still the world’s reserve currency. As of today, no information is available if these seven central banks have acted on these daily swap line arrangements, this daily limit will be available through the end of April.

Change of Plan

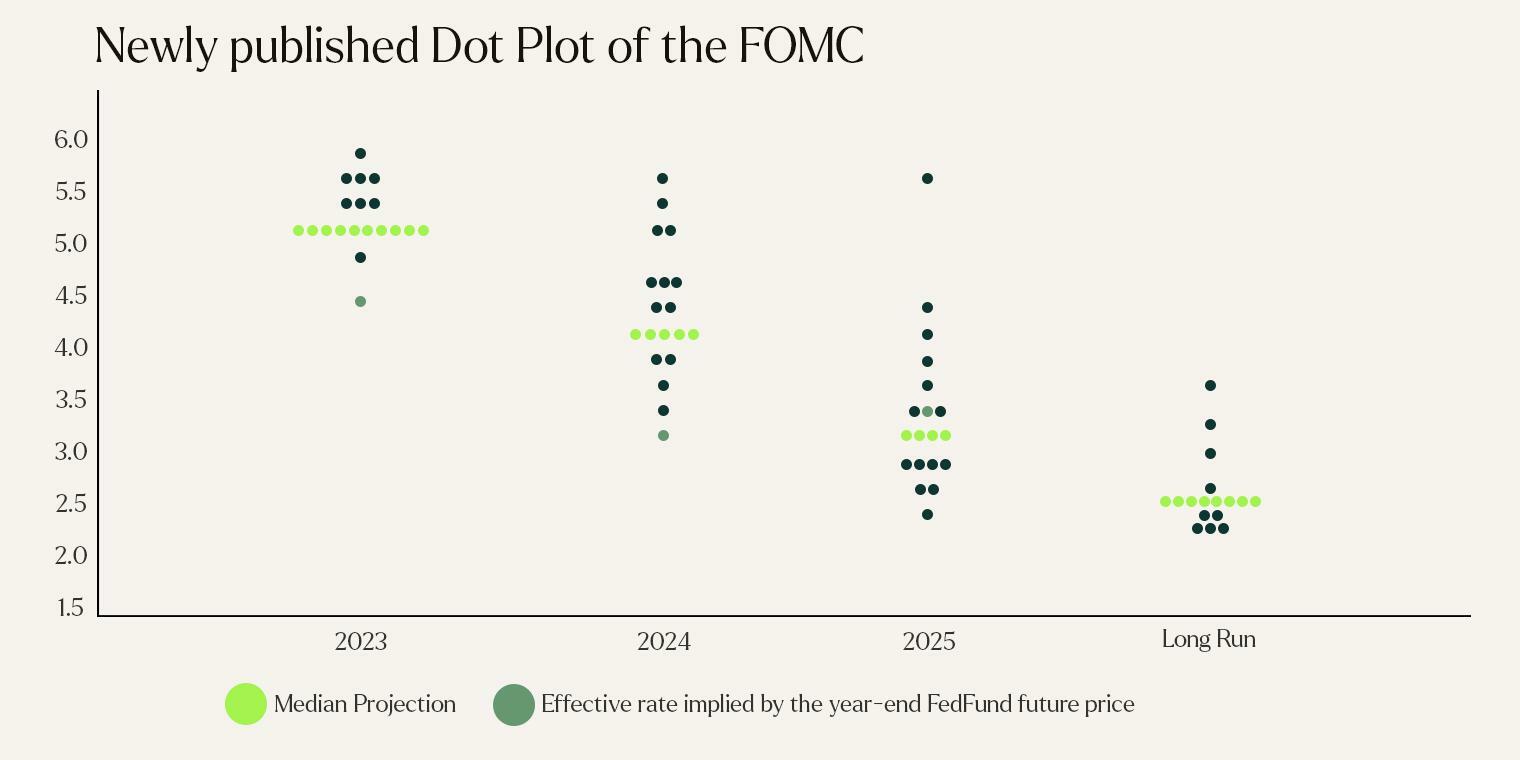

On the 22nd of March, the Fed and the Federal Open Markets Committee (FOMC) announced that they will increase the interest rate by 0.25%, bringing the final rate to 5%. Prior to the meeting, Bitcoin slowly moved to $29.000. As the meeting commenced, Bitcoin experienced a drop as it fell to $26.600. After this, it started to slowly recover the price levels it initially lost. As the month progressed, the expectations of the market about the interest rate hikes fluctuated a lot. The core inflation rate came in higher than expected, increasing the odds of a continued hawkish stance of the Fed. Several days later, the cracks in the foundation of several big banks created room for a more dovish stance. As aforementioned, the Fed increased its balance sheet by $400B to aid financial institutions such as banks. As a result, the bond market is currently pricing in interest rate cuts by the end of 2023.

During the meeting, the FOMC also published its newly updated Dot Plot which provides more information about future interest rates. According to the Dot plot, the FOMC still expects to increase the rate of interest once more, bringing to the final rate of 5.25%. The next FOMC meeting will be held on the third of May, thus the upcoming months will be an interesting period for the market.

U.S. regulators clamp down

Throughout the past two months, the cryptocurrency market has experienced various regulatory actions towards big industry players, all located in the U.S. In February, cryptocurrency exchange Kraken was charged by the Security and Exchange Committee as they “failed to register the offer and sale of their crypto-asset staking-as-a-service program”. This charge left other market participants perplexed as most cryptocurrency exchanges offer staking services and didn’t experience any issues. The same month, Paxos was sued by the New York regulator and had to stop the issuance of their stablecoins Pax Dollar (USDP) and Binance USD (BUSD).

During March, Signature and Silvergate bank both collapsed due to made losses and an unexpected bank run. These banks had been active in the crypto industry for some years and had been termed “Crypto banks”. However, after their collapse due to bad risk management, these banks were urged to close their crypto divisions. Additionally, two of the biggest cryptocurrency exchanges received regulatory enforcement as Coinbase received a Wells notice from the SEC and Binance and its CEO Changpeng Zhao were both charged by the Commodity Futures Trading Commision. U.S. regulators seem to be setting their sights on cryptocurrency organizations and institutions. Coinbase VP Daniel Seifert stated that cryptocurrency organizations are fleeing the United States as US regulators choose hard action instead of dialogue and clarity

At Hodl we believe that regulation in certain aspects is necessary, especially if the space wants to continue to grow and attract institutional investors. However, this regulation needs to be created through coordination with industry players to ensure innovation within the space. The current approach of U.S regulators will only push market participants away to jurisdictions which are more friendly towards cryptocurrency.

Hodl News

As Hodl continues to grow, we welcome a new addition to the Hodl team. The sales team is getting extra manpower as Jaël Rauter joins the organization as a Sales & Account executive.

Jaël: After saying farewell to my previous job in the "traditional" investment world, I’m excited to dive deeper into the world of cryptocurrencies. My main focus will be on the rollout of new strategies to promote our growth and the provision of information about our (new) products to customers. Furthermore, I will also guide new participants on their journey toward a professional investment in cryptocurrencies. Overall, I’m excited to start my journey with Hodl.

The Hodl Funds

The month of March has led to a small increase and decrease in the Hodl funds. The Hodl.nl Genesis Fund, the Hodl.nl Consensus Fund and the Hodl.nl Oracle Fund ended respectively at a Net Asset Value (NAV) of € 3.22, € 3.14 and € 0.35. True Asset Fund II ended the month with a NAV of € 16,283.95. Clients of True Asset Fund can view their personal performance in the IQ-EQ portal.

Check your personal results here

Hodl - European Blockchain Convention

During the 14 - 17th of February, several members of the Hodl team and our CEO Maurice Mureau joined the European Blockchain Convention (EBC) in Barcelona. The EBC is one of the biggest and most influential European conventions in digital assets and is welcome to cryptocurrency protocols and traditional institutions. After a successful edition in 2022, it's nice to be present again at the EBC. Despite the many challenges the sector faced in the last year, it is incredible to see the event almost double in size. Big names in the crypto-sector which were present are Galaxy Digital and Coinbase, however, it remains an interesting thing to see institutions such as Capgemini, Deloitte and JP Morgan joining these conventions. Furthermore, we observed that more banks, such as ING, are interested in potentially entering the market in a cautious manner.

On the opening day, our CEO Maurice Mureau participated in a panel discussion concerning the adoption of cryptocurrency among traditional institutions. The core message is that it is not a question of IF, but rather a question of when these institutions will fully embrace the cryptocurrency market. Last year we saw several international players such as BlackRock enter the market and the expectation is that this will increase as regulation will come into play. Above you will find the full recording of the panel.

Sign up for our newsletter to stay on top of the cryptocurrency market.