Newsletter: Recap May

- Bitcoin experiences a minor correction

- Tether announces Bitcoin investment

- Cryptocurrency organizations still experience troubled times

- Ledger's feature causes backlash

- Germany enters recession

- The Hodl Funds

- Hodl - Dutch Blockchain Days

Bitcoin experiences a minor correction

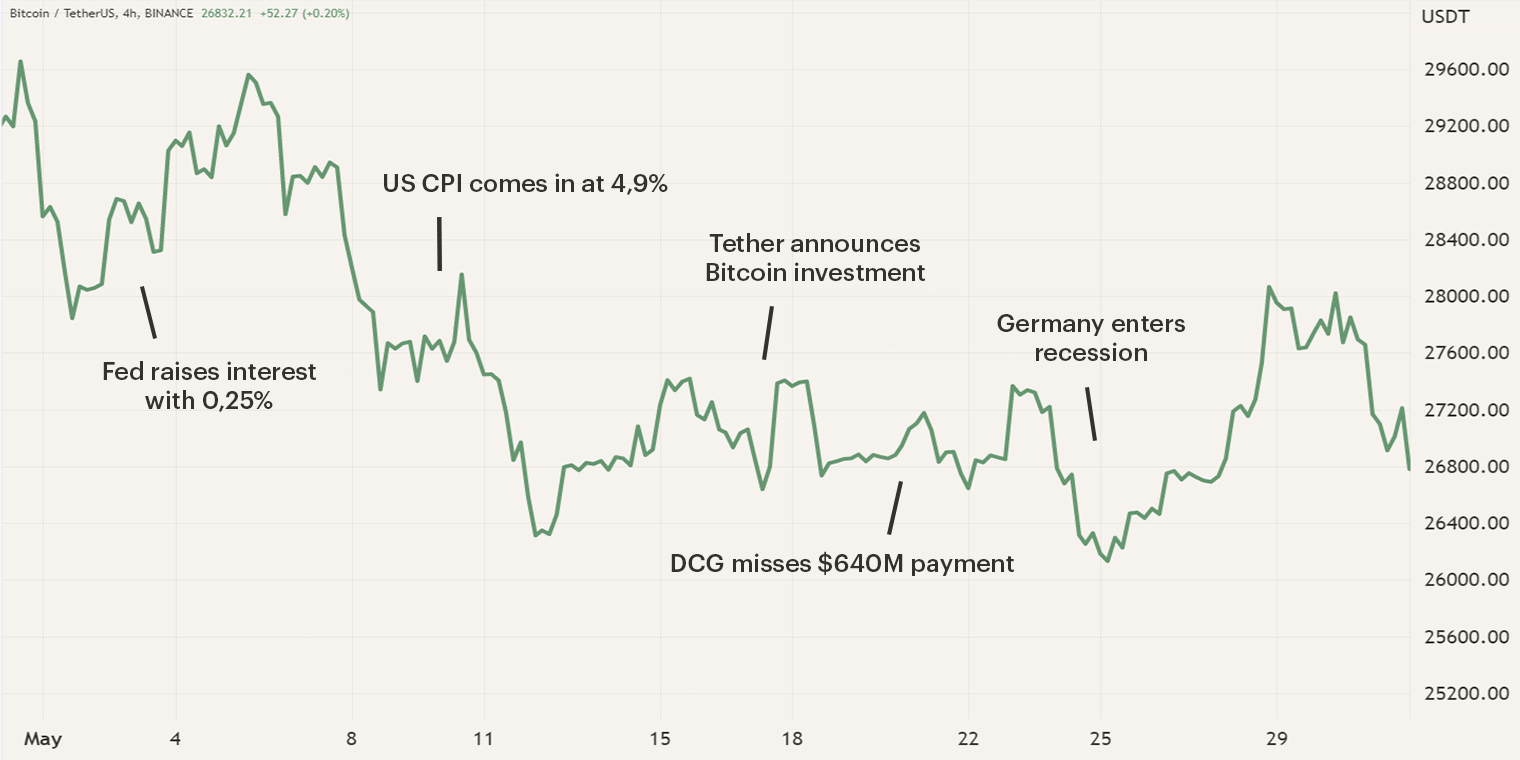

The month of May unraveled with a market in decline as Bitcoin underwent a minor correction, reaching its lowest point since half March. During the first two weeks of May, the market saw the Federal Reserve (Fed) and the European Central Bank raising the interest rates by 0,25%. This brought the interest rate in the US to the expected highest rate of 2023. If inflation cools down enough, the Fed may start to look at a more dovish approach. This resulted in a short rally in Bitcoins’ price as it climbed over $29.500. This move was however short-lived as Bitcoin wasn’t able to break through its $30.000 resistance.

Furthermore, the latest US Consumer Price Index (CPI) figures were released which sent mixed signals as the overall CPI maintains its downward trend, however, the Core CPI remains rather high at 0.4%. To read more about the events during the first half of the month, please visit the Market Update of May.

In the second half of the month, the issuer and organization behind the stablecoin Tether (USDT) announced that they will start to acquire Bitcoin with their realized profits. Additionally, the legal battle between Gemini and Digital Currency Group (DCG) continues as DCG missed a payment. Other noteworthy news in the industry was the controversy caused by the private key recovery feature introduced by Ledger.

Tether announces Bitcoin investment

On the 17th of May, stablecoin issuer Tether announced that they are planning to acquire Bitcoin with a portion of their monthly earnings. The organization stated that it will allocate up to 15% of its earnings to buying the digital asset. This statement was shortly released after the quarterly earnings report, the organization booked a profit of $1.5B during the first quarter of 2023.

A crucial operational activity of a stablecoin issuer is the maintenance and preservation of the stablecoin’s reserves as it needs to remain fully backed. Tether's reserves mainly consist of cash, cash equivalents and other short-term deposits (approximately 85%), and 2% in Bitcoin. The newly acquired Bitcoin won’t serve as a reserve for USDT, it will act as an asset on its balance sheet for future returns.

Tether has been a topic of discussion within the cryptocurrency industry as it hasn’t always been fully transparent about its reserves. However, Tether has survived various market corrections, hasn’t deppeged and is slowly increasing the transparency of its reserves. For Tether to commit to buying Bitcoin with monthly earnings does provide the organization with the opportunity to put itself in a better light. For market participants, it means that a larger flow of capital will affect the industry, providing extra buying pressure.

Cryptocurrency organizations still experience troubled times

In recent weeks we have seen two more organizations experience problems as a result of the bear market. The past two years was a harsh period for established and new parties alike and sadly, Dutch cryptocurrency broker LiteBit and Hong Kong based exchange Hotbit, announced they are shutting down operations. LiteBit stated that due to market developments such as increasing compliance costs and competition, the organization decided to halt all operations. Similar reasons were also seen by Hotbit but the exchange further stated that the implosion of FTX pushed more users to decentralized alternatives such as decentralized exchanges.

The bankruptcy of FTX had widespread effects in the industry which hit various leading industry players such as Gemini, DCG and Genesis. These organizations have now been in a legal dispute for months as Gemini lost client funds on the Genesis platform, and DCG is the parent company of Genesis.

On the 20th of January 2023, Genesis was forced to declare bankruptcy, which affected the $1,1B of client funds Gemini had allocated on the Genesis platform. As Genesis declared bankruptcy, Gemini started to look at DCG to repay the outstanding loans, also as DCG had large outstanding loans with Genesis.

This started months of a legal dispute with DCG committing to pay the outstanding loans to Genesis. On the 21st of May, Gemini claimed that DCG had failed to pay a $640M loan to Genesis, which in turn would be paid to Gemini. It seems that this legal issue is far from over and that it’s going to take significant time to fully sort out the issues. The matter only looked bleaker as another lawsuit showed that Genesis owes more than $3.5B to its top 50 creditors.

Ledger's feature causes backlash

Ledger, the industry leading security solutions providers, was flooded with criticism as news broke that Ledger’s new recovery feature can retrieve private keys when lost. The new feature will cost $9,99 per month and the private keys are then divided into three different shards which are distributed among three servers of three different companies. This was followed by a massive backlash, many participants were not fond that Ledger can push potentially damaging updates such as the recovery feature.

Additionally, the crypto community stressed the fact that if two of the three servers get subpoenaed, a government organization will have access to your wallet. Despite that Ledger is still the leading security provider, the organization has postponed the release of the feature and has stated to publish more information about the code.

Germany enters recession

During May, the latest figures were released about the German economy and for the second quarter in a row, the German economy has declined in terms of Gross Domestic Product (GDP) growth. During the last quarter of 2022, the GDP of Germany declined by 0.5% and during the first quarter of 2023, this was followed by a drop of 0.3%. From an economic stance, Germany has entered a recession which may indicate negative times for Europe. The German economy can be seen as a benchmark for the European economy as it’s the strongest and largest economy. Over the past year, consumer confidence has been declining in Germany and the effects are now seen.

The consumer confidence in the Netherlands has also been declining, however, it remains above average. Nevertheless, the Dutch economy has experienced a decline. According to macroeconomists, consumers are slowly feeling the pain of inflation and are starting to cut costs. The probability that the Netherlands will feel the recession of a German recession is quite high as a quarter of Dutch exports go to Germany.

The Hodl Funds

The month of May has led to a decrease in the Hodl funds. The Hodl.nl Genesis Fund, the Hodl.nl Consensus Fund and the Hodl.nl Oracle Fund ended respectively at a Net Asset Value (NAV) of € 3.07, € 2,98 and € 0.34. True Asset Fund II ended the month with a NAV of € 15,684.10. Clients of True Asset Fund can view their personal performance in the IQ-EQ portal.

Check your personal results here

Hodl - Dutch Blockchain Days

On the 14th of June, we will be attending the Dutch Blockchain Days (DBD) in The Meervaart in Amsterdam. The DBD is the leading Dutch event in terms of blockchain, cryptocurrency and the Web3 ecosystem, organized by the Blockchain Netherlands Foundation (BCNL). Together with a wide variety of organizations, such as Bitget, Loyens & Loeff and Ernst & Young (EY), Hodl is one of the main sponsors of the venue. The event has a variety of speakers such as executives of JP Morgan and Deloitte and our Head of Ventures, Anton Shakur, is also one of the main speakers at the event.

As almost everything in the crypto ecosystem takes place in a digital environment, it may be difficult at times to visualize the industry. These events are an open and welcoming place in order to learn more about the sector but also what the future holds. If you wish to attend one of these events, Hodl can provide you with a discount on your tickets with the promotion code: HODL20.

Tickets can be purchased through the button below. We are looking forward to see you on the 14th of June!

Sign up for our newsletter to stay on top of the cryptocurrency market.