Newsletter: Recap May

Newsletter: Recap May

Welcome to our monthly newsletter. Every month we create an overview of the performance of our Hodl funds, the developments within Hodl, and the latest cryptocurrency news.

Market consolidates after collapse UST and Luna

After the market corrected as a response to the hawkish position of the Fed and the collapse of UST and Luna, we saw it consolidate for the remainder of the month.

At the beginning of the month, we saw the entire financial market await the outcome of the Fed’s FOMC meeting. During this meeting, the Fed will state its position on its current interest rate policy, inflation and the near future of the economy. Although the market initially reacted positively during the meeting, the hawkish stance of the Fed was reason enough to trigger a sharp correction in the market.

For cryptocurrencies, this fall was further fueled by the collapse of UST and Luna. When the algorithmic stablecoin UST lost its peg with the US Dollar, it led to panic among investors holding the currency. In its attempt to restore the peg, the underlying algorithm caused tremendous inflation of Luna, the cryptocurrency used as collateral. This led to a downwards spiral and a true bank run. In our market update, we explain in detail what happened.

Markets restore but crypto lags behind

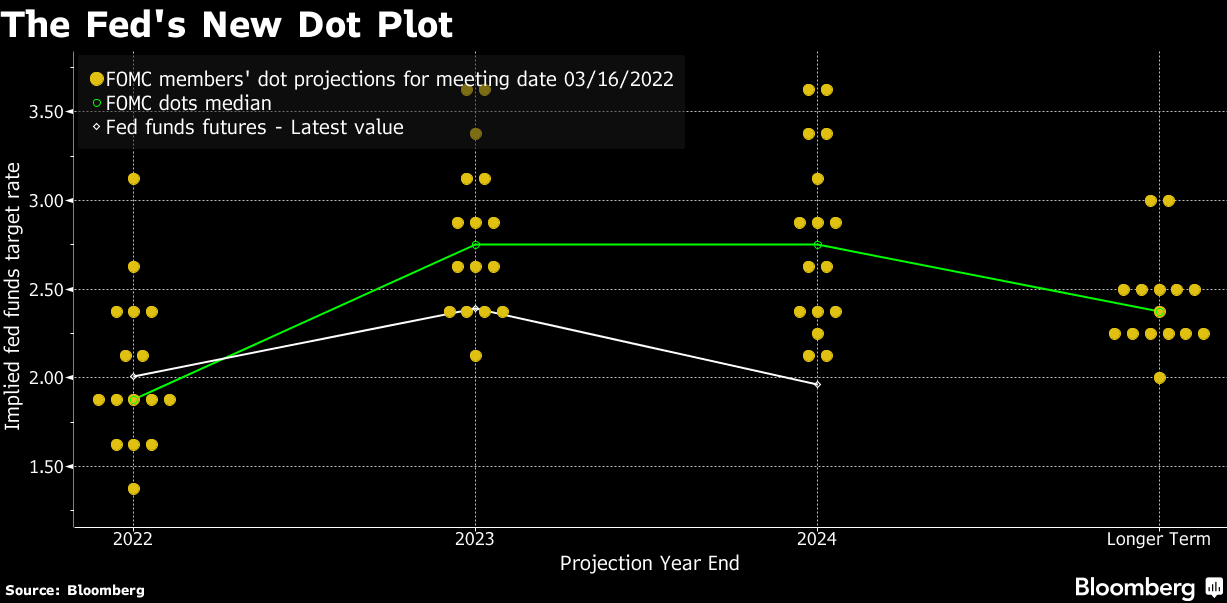

In the second part of the month, we saw a strong recovery of the Dow Jones, AEX and S&P 500. In reality, we often see that rate hikes are priced into the markets. This was clearly visible this time as well with the hawkish position of the fed. One of the models that provide insights into expected rate hikes is The Fed’s New Dot Plot. The U.S. Central Bank applies this to visualize the interest rate that the Fed’s members expect at the end of the year.

The latest release of the Dot Plot shows that Fed members expect interest rates to rise in the short term, but to flatten and fall again in the long term (green line). Meanwhile, we are seeing the first effects of the rate hikes on the economy taking place. Should these effects continue in the coming period, the expectation is that fewer increases or less aggressive increases will prove necessary, which is a positive signal for financial markets. This is also evident from the Fed funds futures (white line) where the market clearly already expects interest rates to level off and fall at an earlier stage.

Unlike the equity markets, the cryptocurrency market did not have a strong recovery. The second half of the month was characterized by a consolidating market. It wasn’t until the last few days of the month that we saw the first signs of a recovery. The lack of a strong recovery was mainly caused by turmoil due to the collapse of Luna and UST. Many investors were afraid other that stablecoins such as USDT and USDC might also fail.

The consolidation phase was also driven by the current monetary policy and current the status of the financial market. We have seen bear markets in cryptocurrency before but never in conjunction with a possible recession. Additionally, the Fed has also started with its monetary tightening on June 1st. As this is the first time that tightening is taking place in such an aggressive manner since the arrival of cryptocurrency, it remains to be seen what impact this will exactly have on the crypto market.

Silence on the blockchain

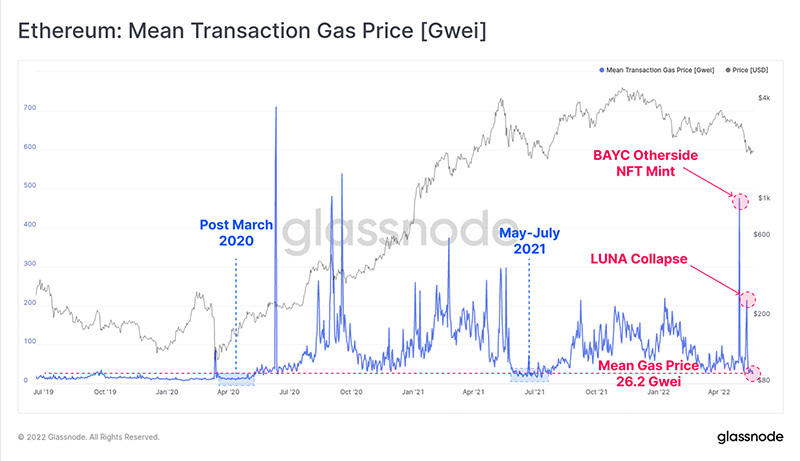

On-chain we also see the inactivity of the market. One of the indicators of activity on the blockchain is transaction costs, which are strongly influenced by the number of transactions. If there are many transactions, the transaction costs of networks such as Bitcoin and Ethereum rise sharply along with them. Apart from a few occasional transaction peaks, the average cost of an Ethereum transaction has been declining structurally since December.

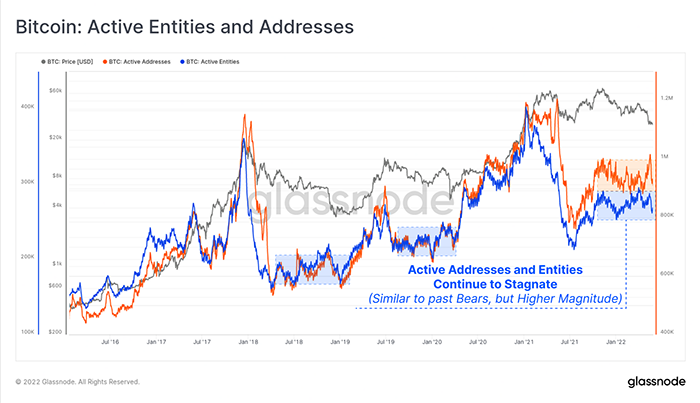

If we look at the bitcoin network, we see that the number of active users has now been stagnant for well over 6 months. This stagnated growth is similar to previous bear markets. On the other hand, we do see that the trend of the number of users is still increasing structurally, which confirms the positive development of the market and the adoption of cryptocurrency.

The Hodl funds

The downward move of May has also led to a decline of the Hodl funds. The Hodl.nl Consensus Fund, the Hodl.nl Genesis Fund and the Hodl.nl Oracle Fund ended respectively at a NAV of €3.26, €3.38 and €0.41.

Results May 2022:

Highlighted: Aleph Zero

Every month we highlight a cryptocurrency. This month it is one of our holdings, namely: Aleph Zero (AZERO).

The arrival of blockchain technology created a new decentralized economy. Within this economy, all transactions, balances and interactions are publicly available on the blockchain. While this creates more transparency, it is desirable for several applications to have more privacy. Valid examples are government institutions and hospitals that process sensitive (patient) data.

Aleph Zero aims to create a scalable, fast and secure network ready for (enterprise) operations with the highest privacy-preserving standards.

Team expansion

This month we welcome two new members to our team. Daniël den Boer started as Manager New ventures & projects and Javier Arancibia will support our Development team.

Daniël: “After years as an innovator in the Blockchain industry it was time to switch to the investor’s side. Hodl is a very innovative investment fund, which therefore created the perfect match. I am very enthusiastic to start my adventure at Hodl.”

Javier: ”I am excited to start my journey with the Hodl Development Team. Due to my background in Architectural Design and Full stack development, I am looking forward to building apps and digital products for our team and investors.”

Our new brand

Since Hodl was founded in 2017 the company has been expanding rapidly, leading to a growing team and evolving identity. It is time for our brand to grow along. In the upcoming weeks, we will introduce the new Hodl brand. This new style expresses the development of our organization and will also improve the user experience of our investors. We are looking forward to sharing our new brand identity with you.

The investor’s guide to cryptocurrency

In this blog series on investing in cryptocurrency, we dive deeper into topics such as the evolution of our money, the origins of cryptocurrencies, the various applications of this new technology and the underlying differences.

After going through the rise cryptocurrencies in the third chapter, it is now time to dive deeper into the most used applications of cryptocurrencies. From applications in video games to data security and registration of ownership. What are the possible applications? And how are cryptocurrencies used herein? We will walk you through this in the fourth chapter of our cryptocurrency investor’s guide.

Receive our newsletter to stay on top of the crypto market.