The investor’s guide to cryptocurrency [part 4]

The benefits and use cases of cryptocurrencies

Welcome to our Investor’s guide to cryptocurrency. In this fourth part, we highlight the most popular purposes of cryptocurrency in different sectors, from videogames and data security schemes to ownership encryption. Continue reading to find your way into cryptocurrency investing.

Cryptocurrency as a payment solution

The origin of cryptocurrency lies in its use case as an alternative payment system. Bitcoin was the first, but many have followed. Individuals and organizations can use cryptocurrencies for the direct transfer of funds.

Cryptocurrency payments allow for instant (international) transfers, do not incur banking fees, are secure, and are not subject to the approval of a middleman. While seemingly not highly innovative, this use case requires drastic changes within the standards of our current society.

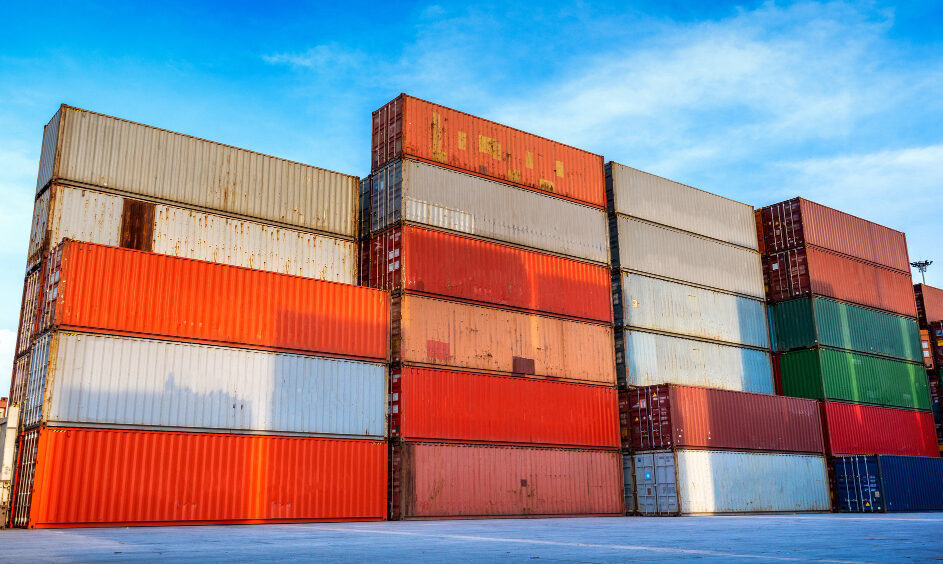

Cryptocurrency as a supply chain solution

Providing transparency and fighting counterfeit goods are top priorities for supply chain businesses In today’s markets, people want to know precisely where their product came from, the ingredients or raw materials, and if it fits their needs. Integrating blockchain technology into these operations can provide transparency as this technology can openly store all information on the blockchain.

For example, a supermarket product can be connected to a token on the blockchain through a referring RFID chip or QR code The openness of the blockchain provides complete insight into the token history or any additional data attached to the token. Scanning the code could tell you exactly what the ingredients are, which farmer produced it, when they harvested it and what pesticides they used.

Blockchain technology can also benefit the creators of brands that face many counterfeit goods. Besides missing out on revenue, it is also harmful to their brand perception. Storing all data on-chain and connecting this to a particular product can clarify which products are real and which are counterfeit.

Louis Vuitton is an example of a company introducing blockchain technology to its supply chain. By incorporating this technology, they can register the authenticity of a product while also being able to trace the origin of the product back to its raw materials. Making this data publicly available makes it harder to create counterfeit goods as users can exactly see the history and ownership of the item. Their latest collections no longer contain a date stamp but an RFID chip affiliated with a token on the blockchain.

Cryptocurrency as a digital ownership platform

In 2021 we saw tremendous growth for Non Fungible Tokens (NFT). NFTs are a new form of tokens that are used for registering ownership. NFTs can be used for a broad range of applications. From registering ownership of digital assets, such as images or game characters, to writing the ownership of the real estate and artwork.

One of the many examples where NFTs can be applied is the market for Arts and Collectibles. Especially the segment of digital collectibles has seen tremendous growth, resulting in a multi-billion dollar market capitalization for NFTs. This has also led to the development of online NFT marketplaces and the integration of NFT auctions in traditional auction houses such as Sotheby’s.

Cryptocurrency as a decentralized finance platform

Where Bitcoin once started as a peer-to-peer payment system, many more services adopted models from traditional finance and banking. The outcome: Decentralized Finance, also known as DeFi. DeFi provides financial services while also cutting out the middle man (bank).

Common services consist of lending, borrowing, insurance, investments, and saving plans. The benefits for its users come from decentralization. Decentralized Finance is more open and accessible to the general public through this structure The absence of a centralized controlling authority also drastically decreases its costs.

In short …

In this article, we covered the most important uses-cases and adoption by individuals and organizations. The proven versatility of cryptocurrencies has empowered transactions, thereby making the payment industry transparent, safe and reliable. However, its use-cases go beyond to include great benefits for the supply chain industry. The top-ranked businesses will also benefit from the security it brings when fighting counterfeit items. In the next article, The investor's guide to cryptocurrency [part 5], we will explore how DeFi (Decentralized Finance) can improve finance and banking.

Receive our newsletter to stay on top of the crypto market.