The Research Process of Hodl (1/2)

- The Research Process

- Due Diligence Stage

- Quickscan Stage

- Research Stage

- Discussion Stage

- Common Pitfalls during Research

- The Next Step

The cryptocurrency market consists of thousands of cryptocurrencies, each with its strengths and weaknesses. Researching and filtering through all these investment opportunities is a crucial activity within Hodl funds and requires a critical and analytical eye.

Our research analysts are always on the lookout for new investment opportunities to further optimize the fund's returns. But what does this process look like exactly? We would like to take you through the research process at Hodl.

The Research Process

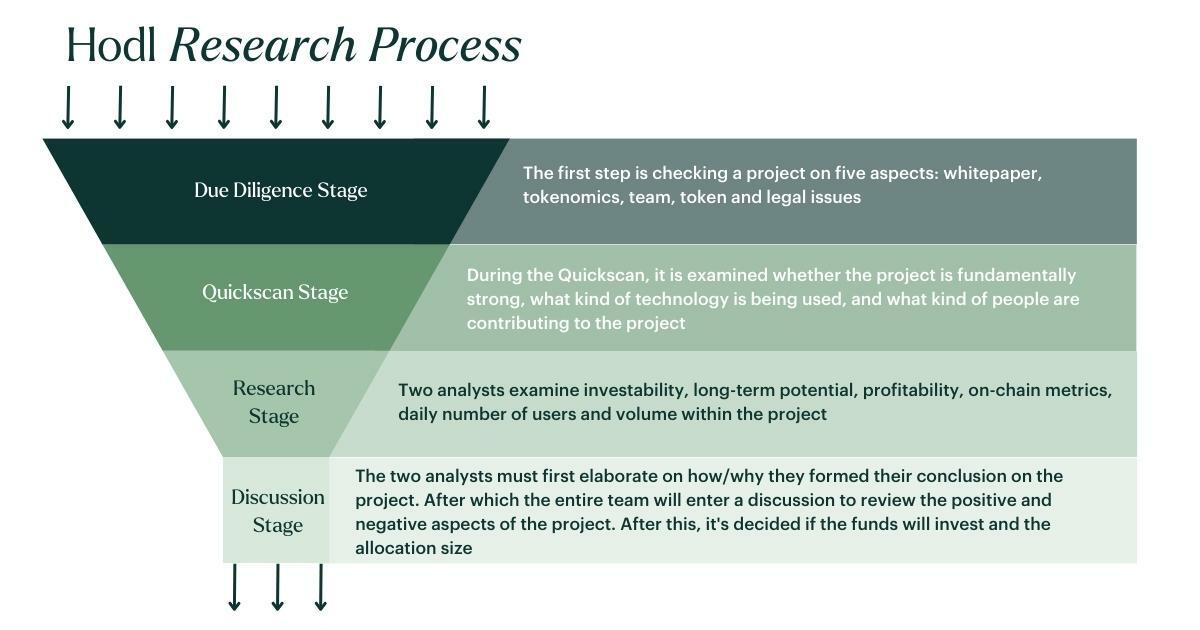

First, the research analysts choose a sector or topic within the cryptocurrency market where potential opportunities exist, such as the derivatives sector. Within the derivatives sector, the analysts will jointly investigate various projects that will all undergo the same analysis. This analysis can be divided into four different stages: the due diligence stage, the quickscan stage, the research stage, and the final discussion stage.

Due Diligence Stage

The first step is the due diligence stage. To separate the wheat from the chaff, the analysts have developed a due diligence check. The check consists of five different aspects on which the project is assessed. The five aspects are:

Is there a whitepaper for the project?

Are the tokenomics publicly available?

Are the identities of the team members publicly known?

Is there a token that can be invested in?

Are there any legal issues to consider?

These are the minimum requirements that the project must meet. Even if one aspect is missing, the project will not be further researched. It may happen that a project does not pass the due diligence check because there is no token available on the market yet. Projects like this are referred to our venture department, where it is researched if we can invest in the private round.

After the due diligence stage, the team has been able to determine that the basic requirements have been met and that the project is worth investigating. According to our Head of Trading, Jess Muntenaar, one of the most important aspects is the team behind the project. Cryptocurrencies are new digital assets, and their development requires specific expertise. By looking at the qualities and experience of the team, one can gain insight into the internal workings of the project.

Quickscan Stage

The second step in the research process is the quickscan stage. During this stage, the focus is on evaluating the fundamental strength of the project, the type of technology it implements, and the people involved in the project. Additionally, other crucial aspects such as the tokenomics and community are examined, including whether the project is trending on social media channels. If the quickscan yields a positive result, the project will proceed to the next step.

Research Stage

Next, the research stage begins. The project research is carried out independently by two analysts. They examine various aspects such as the long-term potential, profitability, on-chain metrics, daily active users and transaction volume of the project. The exact aspects which are being studied differ per project since the problem statement can vary significantly. After both analysts have completed their research, they form a conclusion. The conclusion reveals whether the project is interesting enough to invest in, after which it is presented to the entire team of analysts.

Discussion Stage

In the final stage, the discussion stage, the analysts who conducted the research must convince the entire team of their conclusion about the project. The team of analysts always engages in discussion, regardless of the conclusion of the research. During this time, the other analysts have also conducted research within the same sector and gained sufficient knowledge to hold a discussion. If the conclusion is positive, the team will delve deeper and the analysts must be able to refute any negative aspects. Even if the conclusion is negative, they still discuss why the project is not investment-worthy. Based on the outcome of the discussion, a decision is made on whether to invest funds in the project and with what allocation.

Common Pitfalls during Research

Researching investment opportunities is a time-consuming and meticulous process. It can be difficult to remain unbiased at times. An important aspect of investing is that decisions must be based on facts, and emotions should not influence the decision in any way. When a research analyst researches a project, there is a chance that a positive bias may develop. This is because time and energy have been invested in the research process, and if a few good aspects are found, the analyst may become enthusiastic about the project while there may also be many negative aspects. If the project is deemed uninvestable, it can feel like a waste of time and energy.

This is why the discussion stage is so important, as other analysts can look at the project without bias. Remaining critical and keeping emotions under control are essential during research and when taking positions.

The Next Step

The research of projects knows several methods and the investment style can therefore vary greatly. Last year we published a whitepaper on the different ways of investing. Herein, we also delve deeper into independent investing and the research necessary for it. The previously mentioned method of research works best in Hodl's position, but this does not necessarily mean it will work for individual investors. Mastering this research process is complicated and mistakes will be made. You can download our whitepaper via the link below to learn more about this process and gain valuable insights.

After the research process comes the other important phase: taking positions based on technical analysis (TA). With TA, research analysts study the chart of the researched token, looking at price action, support & resistance, transaction volume and other indicators. For many, this is a difficult topic, which is why we would like to share more about it with you. In the next blog, we will delve deeper into TA and how our analysts scale in and out to optimize the return of the funds.