What is Curve Finance (CRV)?

- Introduction to Curve Finance (CRV)

- Curve Finance Technology

- Curve Finance Use Case

- Curve Finance Ecosystem

- Curve Finance News

- Curve Finance Price

Introduction to Curve Finance (CRV)

In the early days of cryptocurrency, centralized exchanges (CEXs) were able to lower the entry barrier for starting investors. They provided user-friendly solutions that made buying, selling and storing cryptocurrencies accessible. However, this does create a dilemma as cryptocurrencies were meant to get users back in control of their own funds through self-custody. These centralized exchanges, however, function in the same way as a bank, removing self-custody and re-introducing a single point of failure.

In their search for an alternative to a CEX, users created the first “Decentralized Exchange” (DEX) with smart contracts. This enables users to maintain self-custody over their funds while buying and selling cryptocurrency. The downside of these exchanges are the high slippage costs, the difference between the expected and the eventual price, caused by the underlying smart contract mechanism.

Curve Finance aims to solve this problem with its decentralized exchange that is optimized for low slippage trades against pegged assets such as dollar-pegged stablecoins. Curve achieves this via its unique Automated Market Maker (AMM), a protocol that uses a special formula to price assets. This AMM provides users with low slippage trades and liquidity providers a steady income coming from conversion fees.

Curve Finance Technology

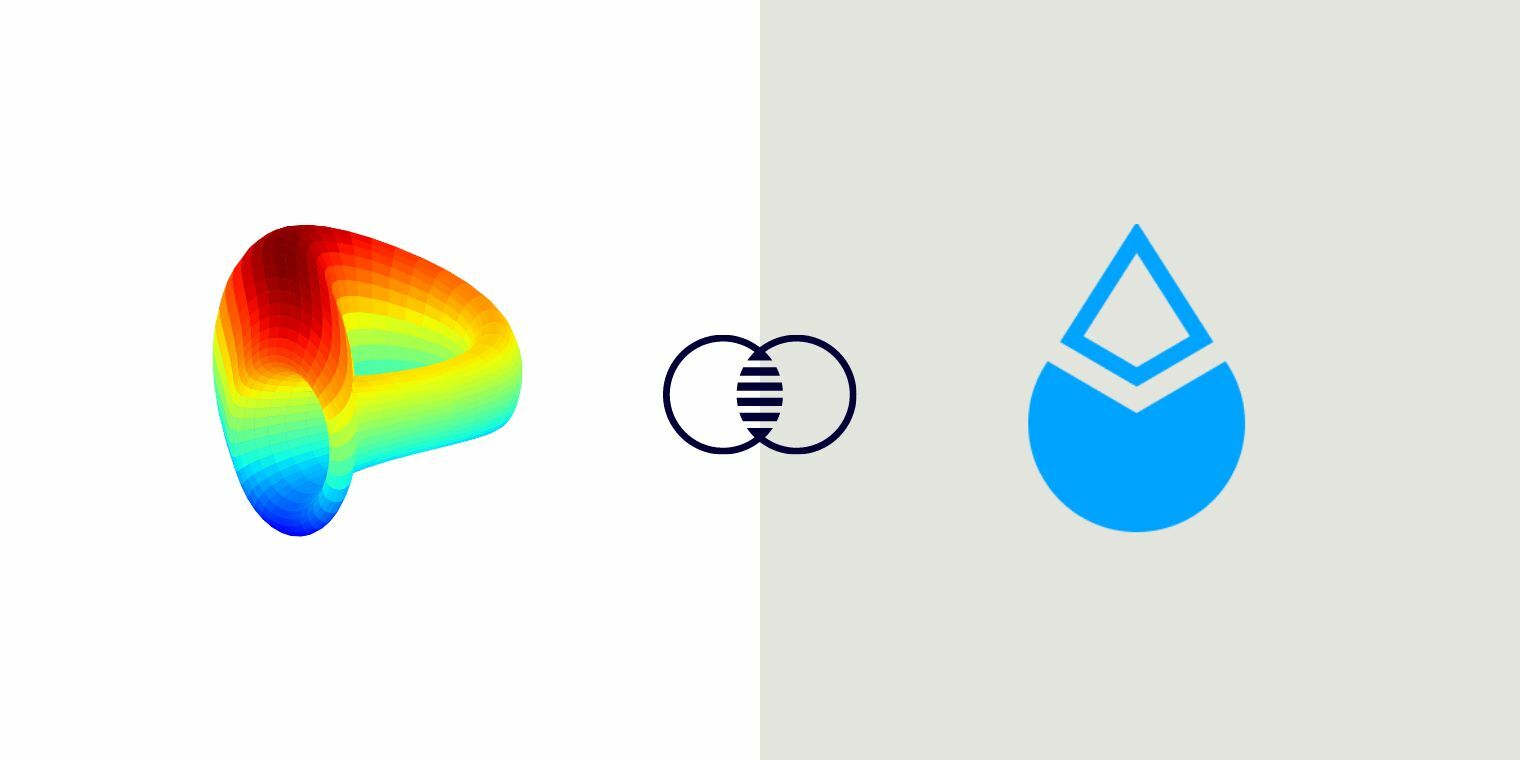

The technology implemented in Curve Finance is best illustrated in the inner workings of the AMM. The AMM provides low slippage trades against pegged assets such as dollar-pegged stablecoins for its users; this is achieved through a uniquely designed formula. The formula is a combination of two known AMMs: Constant Price (X + Y = K) and Constant Product X * Y = K).

These formulas represent ways on how to group two assets in a liquidity pool. In both formulas, X and Y represent the pooled assets present inside of the liquidity pool. The K represents the element that is meant to stay constant as people trade in-and-out of a liquidity pool.

The downside of the Constant Price formula is that it would allow, from its design, for the liquidity pool to be fully drained as the price of an asset will always remain the same regardless of the existing balance in the pools. The Constant Product has gained a lot of popularity as the algorithm auto-adjusts the price, ensuring that there is always liquidity at any price. The disadvantage of this model is that it requires enormous liquidity for slippage not to get unnoticed – the price goes up exponentially as we travel away from equilibrium.

Curve's AMM

By combining both concepts, Curve Finance merges both: the Constant Price formula allows users to have no slippage, but it is not ideal because the liquidity pool can run out of tokens. The Constant Product is self-regulating; however, the user gets a lot of slippage. The combination of the two formulas creates a self-regulating AMM with little to no slippage on the Curve Finance platform.

Curve Finance Use Case

Due to the specifically designed AMM, the use-cases are limited. The main use-case of the protocol is providing traders with low slippage trades and steady income for liquidity providers. Curve can offer these low slippage trades by accommodating liquidity pools of similarly behaving assets. One of these liquidity pools is the 3pool, the pool consists of three stablecoins, cryptocurrencies pegged to be 1 dollar. Because the pool is composed of stablecoins which experience a similar volatility, the slippage is lowered to a minimum. There is a combined $300M worth of assets in the pool and a daily volume of $65M.

Liquidity Providing

A liquidity pool cannot exist without the corresponding liquidity. To encourage liquidity providers, the protocol integrates with other DeFi platforms to reward and incentivize liquidity providers to join the Curve platform. These additional income streams compensate for the earnings from the low slippage trades, allowing the liquidity provider to earn a yield of 3-7% on their dollar denominated stablecoins. This provides a compelling argument to get some exposure as a liquidity provider on Curve.

Curve Finance Ecosystem

Since the launch of the protocol in 2020, Curve has gained much popularity among cryptocurrency traders and organizations. Various cryptocurrency protocols such as decentralized exchanges, yield aggregators and decentralized autonomous organizations have integrated with Curve Finance due to its low slippage costs and steady earnings. The protocol continues to attract more users as they maintain their current pace of innovation such as trying to solve impermanent loss.

Curve has grown into one of the biggest and most popular DEXs in the market. The exchange has gained a massive following on various communication channels, with 290K followers on Twitter. Investors are also intrigued by Curve as it functions as a DAO, which enables users to vote on the protocols future.

Curve Finance News

Liquid Staking

As liquid staking platforms started to attract more and more users, cryptocurrency exchanges such as Curve Finance started to explore the possibility of leveraging this narrative. Since January 2021, the Curve Finance exchange offers users a pool through which they can swap their Ether to staked Ether and vice versa. Additionally, users can provide Ether and staked Ether to the pool to generate additional tokens. The pool consists of $737M worth of tokens and experiences a daily volume of approximately $20M.

Curve Finance Price

The CRV token experienced a sharp decline after a breakout attempt failed around February 20th. This led to a continuous downward trend, with the price breaking out of its previous range and undergoing a steep -50% correction. Now, as the price is currently positioned above the 21-day EMA after bottoming out around June 13, there's potential for $CRV to rebound back into its prior trading range. However, traders should keep an eye on the marked divergence spotted on the Stochastic Oscillator. It's a signal that the price could be rejected.

Would you like to read the full report? Our report provides an in-depth analysis of team, tokenomics, technology and more.