What is Yearn Finance (YFI)?

- Introduction Yearn Finance (YFI)

- Yearn Finance Technology

- Yearn Finance Use Case

- Yearn Finance Ecosystem

- Yearn Finance News

- Yearn Finance Price

Introduction Yearn Finance (YFI)

Since the establishment of financial institutions, these organizations have had the exclusive right to provide all financial services. For example, banks who are one of the few that can offer savings accounts against a certain interest, people can utilize these financial services but certain rights have to be surrendered. These rights include that the financial institution is in complete control of the funds and can freeze the account at one’s convenience.

The emergence of cryptocurrencies made it possible to create a decentralized financial system with the corresponding financial services (DeFi). Users created investment strategies combining these services, such as borrowing and lending, in order to generate passive income on their deposits. One of these strategies is called “Yield Farming”, this strategy can include services such as borrowing and lending, liquidity providing, or staking.

Yield Farmers use multiple DeFi platforms in order to generate the highest yield possible on their deposits. However, interest rates on these platforms can differ per day due to changing circumstances in the sector, making it difficult to fully optimize the yield farming strategy.

Yearn Finance offers a DeFi platform that offers a variety of Yield Farming options to maximize the yield on the deposits of the investors. These options are referred to as “Vaults” and consist of 1-2 cryptocurrencies, which follow a predetermined investment strategy in order to achieve the highest yield. Individuals who deposit their funds in these vaults maintain self-custody on their funds as they can withdraw at one’s convenience. A portion of the generated yield is deposited into the treasury of the Yearn Finance Decentralized Autonomous Organization (DAO).

Yearn Finance Technology

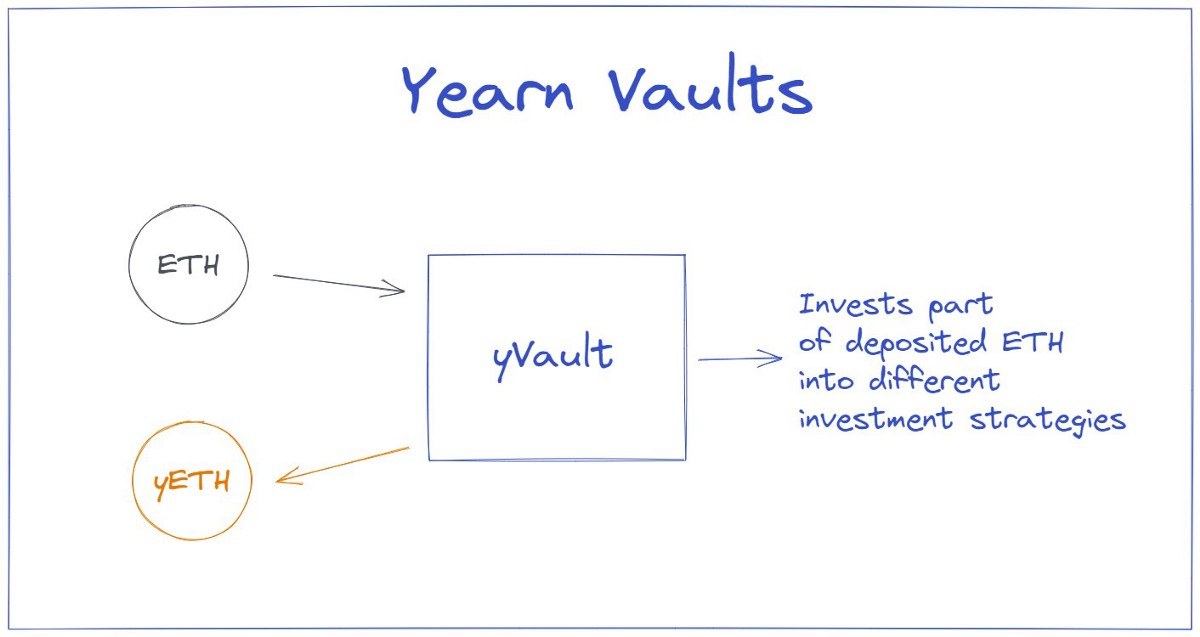

The technology implemented in Yearn Finance is best illustrated in the inner workings of the vaults. The vaults are smart contracts that accept incoming deposits of the investors and execute the pre-programmed investment strategy. The strategy can include any kind of combination of several financial services such as liquidity providing.

Yearn Vault

The vaults are usually programmed to maximize yield on one specific cryptocurrency, when the asset is deposited into the vault, the depositor still remains in control of their cryptocurrency. Investors of the vaults are able to effortlessly withdraw their deposit at one’s convenience; the protocol doesn’t charge any fees for withdrawals or deposits.

In order to ensure the continuity of the protocol, Yearn charges a 20% fee on the profits from each successful strategy. Creators of the strategy are rewarded for their efforts and receive 10% fee, the remaining 10% will be deposited into the DAO’s treasury to further develop the ecosystem.

Yearn Finance Use Case

In order to maximize the yield on the deposits, Yearn Finance offers a variety of yield farming vaults to its investors. These vaults can be found on the DeFi platform with a description of their investment strategy, making it possible for investors to choose a strategy which suits them best. Yearn technology helps maximize the yield through shifting capital, auto-compounding, and rebalancing the funds in the vaults.

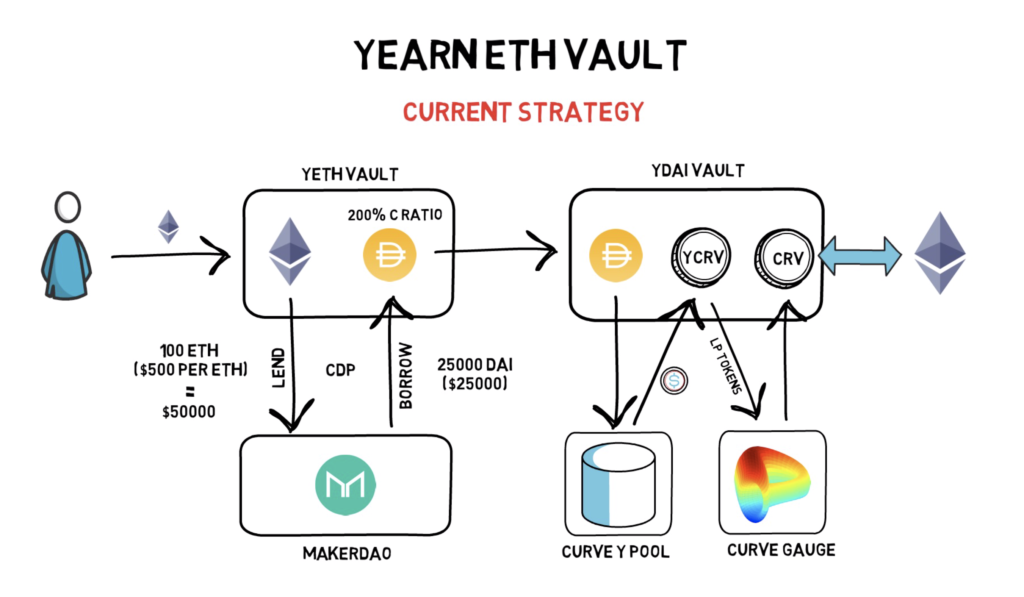

Ethereum Vault

One of the biggest vaults of Yearn Finance is the Ethereum (ETH) Pool. In order to join the vault, investors need to deposit ETH. The participants of the pool maintain their exposure in ETH, due to the vault’s mechanisms always holding the underlying asset. Investors can inform themselves about the Pool’s investment strategy, which currently consists of multiple strategies including staking. It currently holds approximately $400M worth of ETH. The current strategy has resulted in a APY of 1.49%; total earnings of $5M in less than a year.

Yearn Finance Ecosystem

Yearn Finance has grown in a short period into one of the biggest yield aggregators in DeFi. During this time, the protocol has attracted many organizations who they established collaborations with, most of its partners are well-known names in the cryptomarket space. These partnerships include protocols such as Akropolis, a Yield Aggregator that helps with institutional support. Another notable partner is C.R.E.A.M. Finance which is focused towards Lending.

One of the services which was previously provided by Yearn was Iron Bank. Iron Banks are borrowing and lending vehicles, which enables borrowers to earn yield on their borrowed cryptocurrency. As of recent, this has become a separate entity which remains a part of Yearn Finance’s ecosystem.

Yearn Finance News

Founder announces his departure

Andre Cronje, founder of Yearn Finance, has recently announced that he is leaving the DeFi space, including Yearn Finance. Cronje is one of the most prolific developers in DeFi and his departure left the market and his ventures in shock. The departure of Cronje is a shame but there are still approximately 150 people maintaining and developing the protocol of Yearn Finance.

Collaboration Shapeshift

Yearn Finance recently announced a partnership with ShapeShift, which is a crypto management platform that recently transformed into a DAO. The platform supports 750+ cryptocurrencies across 11 blockchains, which can be safely sent, received, bought, traded, and stored. The partnership with Yearn will allow users of ShapeShift to earn yield on their digital assets with no added fees.

Yearn Finance Price

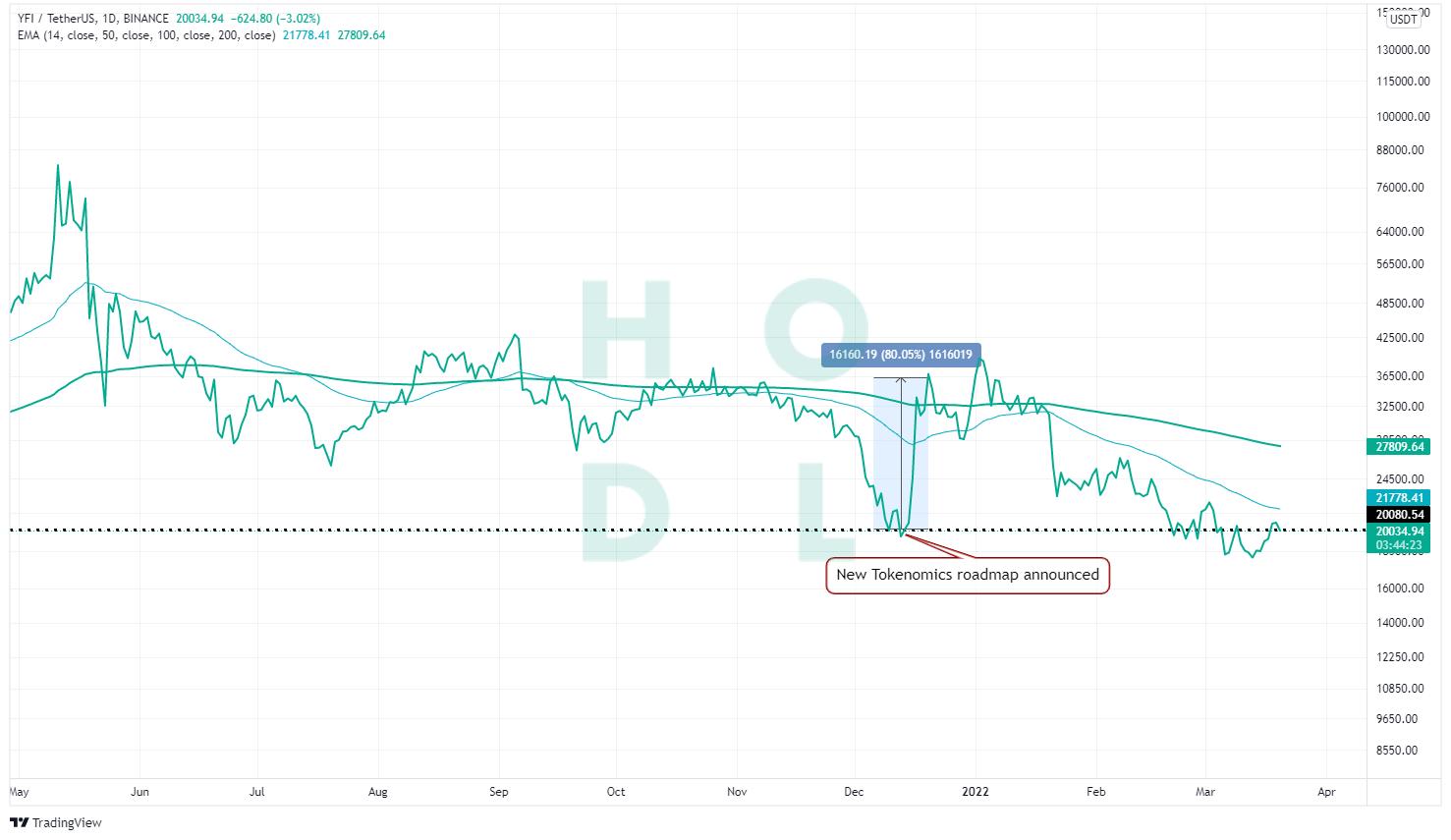

The YFI token’s price chart has been in an extremely long phase of consolidation for over a year. After the excitement of what DeFi represents for the new financial system and the services a user can get in crypto as a whole, the initial euphoria slowly dissipated. After reaching its historical all-time high in May 2021, the price has been slowly declining. The most recent price spike made the price of YFI increase by over +80%, however, it was not sustained due to the overall uncertain market conditions.

YFI token

Currently, the psychologically critical $20k level is being disputed by bulls and bears and the winner remains to be seen. It is likely that the bulls will act in case the Yearn Finance team displays significant progress on the future roadmap implementation announced at the end of last year. The announcement of Yearn’s founder Andre Cronje leaving Yearn resulted in a price drop of 14.5% from which the market appears to have recovered already.

As future inflation in the token is unlikely, it is a matter of increasing the use cases of the YFI token to witness the effectiveness of the Yearn Finance business, into a positive outlook for the YFI token’s price.

Would you like to read the full report? Our report provides an in-depth analysis of team, tokenomics, technology and more. Do you want to gain access to all our research reports? Create an account in our portal.