2024 Bitcoin Market Trend: Our Perspective

As 2023 draws to a close, Bitcoin seems poised to conclude the year on a positive note, potentially doubling in value since the year began. With this strong upward trend, traders and investors are curious about the trajectory of Bitcoin's price in 2024.

Throughout the past year, the market has been abuzz with investors and analysts predicting various price levels for Bitcoin—some shouting out figures like $100k+, $500k+, or even $1M+. While we all hope for Bitcoin to hit $1M, it's crucial to approach this with an unbiased perspective toward potential outcomes. In this blog, we want to outline two scenarios, one positive and one negative, we will use historical data to support both.

Diminishing Bitcoin Returns

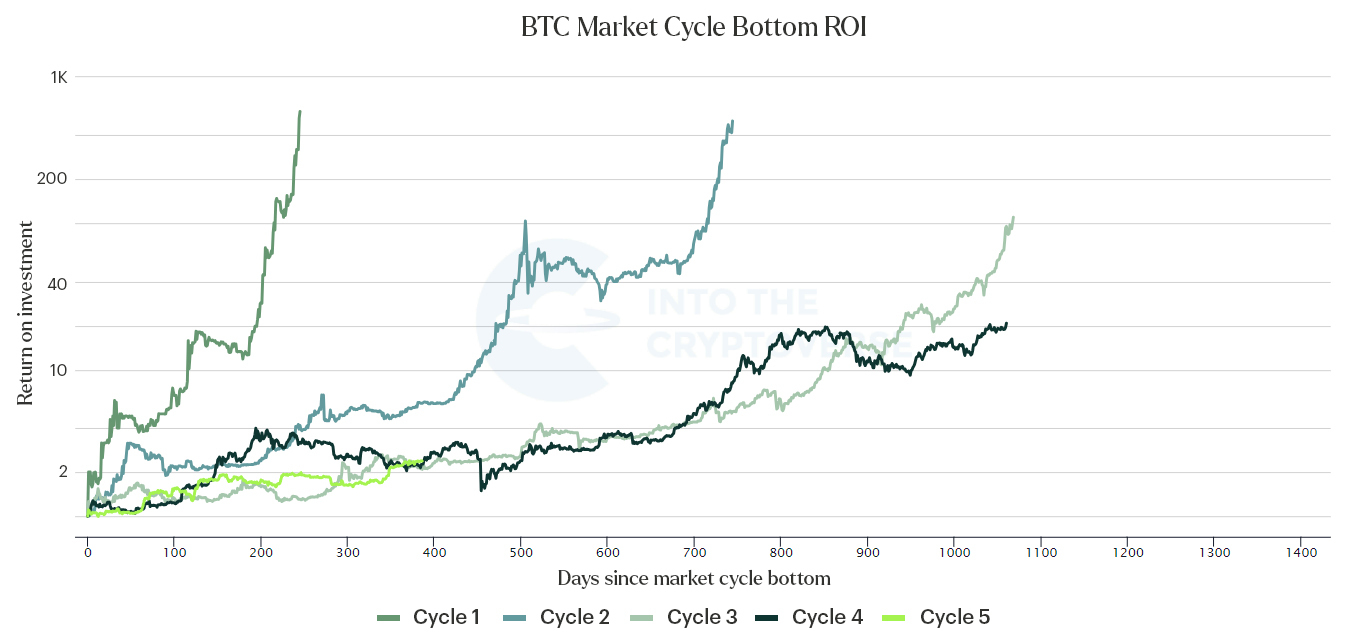

Since the inception of Bitcoin, the primary digital asset has undergone four market cycles, and the fifth cycle is presently underway. Analyzing these past cycles reveals two key observations: the lengthening of the Bitcoin cycle and a reduction in volatility, leading to lower percentage returns. This evolution is not surprising, considering Bitcoin's transition from a speculative asset to a real-world investment, indicating market maturation. As Bitcoin continues to increase its market capitalization and capital invested, the sudden department of investors and capital is having increasingly less impact on its price. Furthermore, the influx of investors who remain active in the market for longer periods of time contributes to the diminishing volatility.

Looking back at Bitcoin's initial cycle, primarily characterized by speculation, the market completed its cycle in 248 days, calculating from market cycle bottom to market peak, delivering a remarkable return on investment (ROI) of 583 times the initial investment. This phase stood out as the most volatile and briefest cycle.

However, as we transitioned into the second cycle, a notable trend emerged with a clear lengthening of the market cycle. It expanded from 248 days to 754 days, accompanied by a decrease in ROI to 503x. This pattern of elongation persisted in the subsequent cycle. The cycle extended further to 1070 days, accompanied by a diminishing ROI of 110x.

The fourth cycle saw a stabilization in cycle length at 1060 days, but the ROI experienced a significant decline to 20x, indicating a consistent extension in cycle duration and a substantial reduction in ROI.

The previous cycle yielded an ROI of 20x from the market's lowest point, so, with our current market bottom hovering around $15,500, Bitcoin's potential peak this cycle shouldn't surpass $310,000. However, considering the diminishing returns, the actual figure might be lower.

Between cycle 3 and cycle 4, there was a significant drop of 78% in ROI. Applying a similar decrease to cycle 5 would bring the ROI down to 4.4x. To establish a realistic range, let's use a range between 4 and 5, indicating a potential peak between $62,000 and $77,500. While this projection might disappoint many, it's a reflection of the current data.

To shift away from this trend, the market would require a significant and unexpected event, a positive black swan, such as substantial institutional or governmental adoption, to alter the trajectory and potentially push the figures beyond these projected boundaries. A potential positive black swan event looms in January 2024 with the Bitcoin spot ETF deadline. If approved, it could catch many off guard, though some may later view it as foreseeable. The decision will have a swift and widespread impact, possibly pushing the current boundaries of the digital asset.

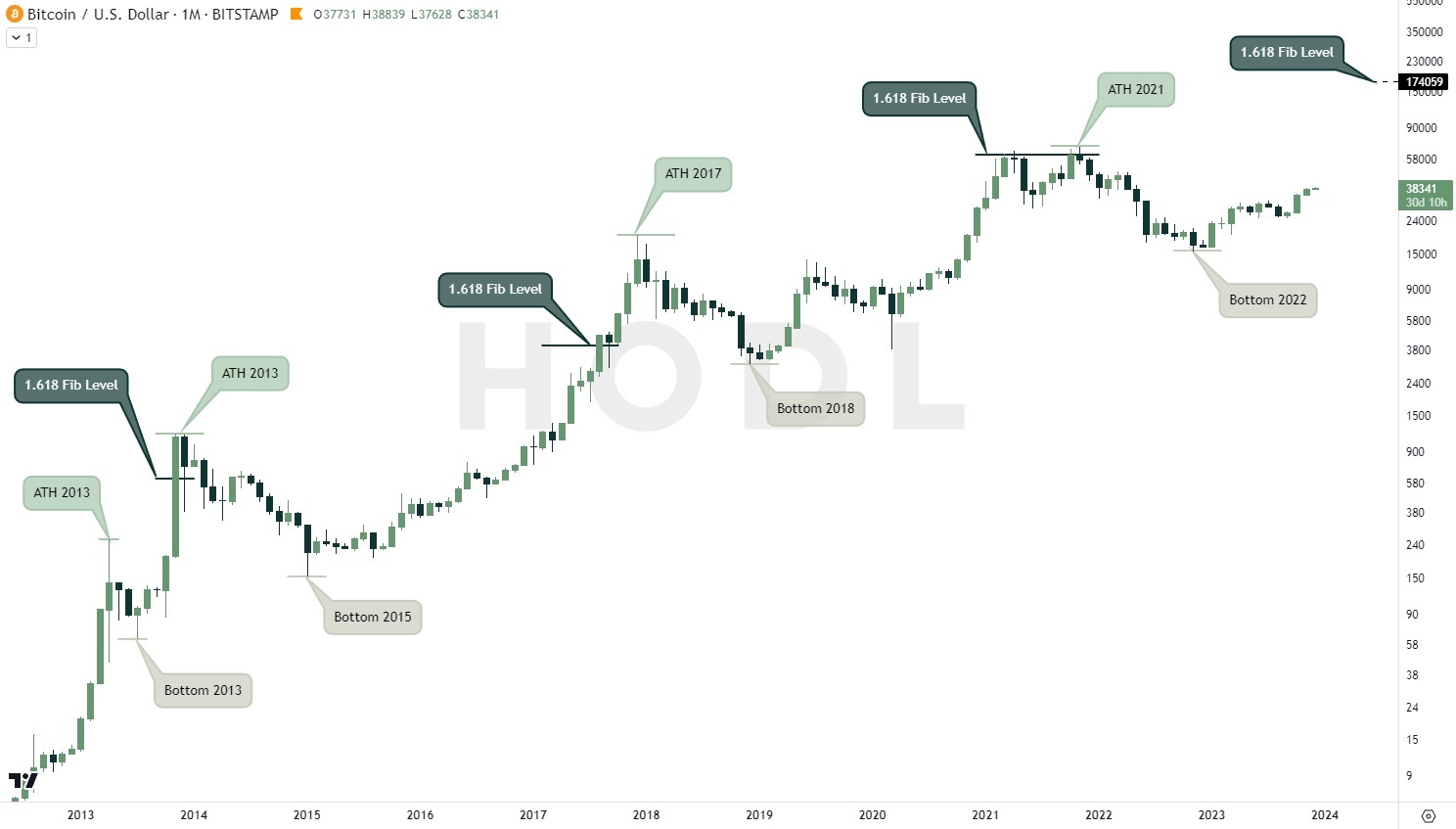

Fibonacci targets reached

The other scenario we wish to highlight is by implementation of the Fibonacci Sequence. Fibonacci Sequences are a series of numbers where each number is the sum of the two before it, to identify possible support or resistance levels in the market. These levels, like 23.6%, 38.2%, and 61.8%, help predict where prices may change direction. Bitcoin has consistently reached the 1.618 level in each cycle.

In the first cycle, Bitcoin's price went from $2.02 to $32.33, and using Fibonacci, the projected target was $177.88. Bitcoin surpassed this, reaching $1,175. In the second cycle, the price went from $165 to $1,175, and the Fibonacci target was $3,951. Bitcoin exceeded this, reaching $19,894. In the third cycle, with a low of $3,172 and a peak of $19,894.53, the Fibonacci target was $61,396. Bitcoin reached $69,000.

In the ongoing cycle, with a low of $15,800 and a high of $69,000, the Fibonacci 1.618 level suggests a potential range between $170,000 and $180,000. If historical patterns repeat, breaking the all-time high would likely lead to additional positive momentum, aiming for the 1.618 Fibonacci level.

Our takeaways

In conclusion, Bitcoin's maturing market, characterized by lengthening cycles and diminishing returns, prompts a nuanced approach for investors. Historical data suggests a potential peak between $62,000 and $77,500 in the ongoing fifth cycle, with the acknowledgment that unforeseen positive events could reshape this trajectory. At Hodl Funds, we take diminishing returns seriously, preparing for challenges while aiming for the best returns.

Looking at Fibonacci analysis, Bitcoin often surpasses expectations, suggesting it might reach $170,000 to $180,000 this cycle. Other forecasts from Hal Finney suggest a $10 million Bitcoin if it becomes a global legal tender. ARK Invest, known for early tech investments, says Bitcoin could exceed $1 million by 2030. Plan B's model expects $200,000 by 2025.

While these are interesting, we stay cautious about them happening in this cycle. At Hodl Funds, we actively manage portfolios to handle uncertainties and do better than just following Bitcoin's performance. This strategic approach aims to navigate market fluctuations and capitalize on opportunities, offering investors a diversified and resilient investment strategy.

Sign up for our newsletter to stay on top of the crypto market.