Market update: February

- ETF demand surpasses miner capacity

- Staking may come to ETFs

- New York Attorney General files $3B in charges against digital assets firms

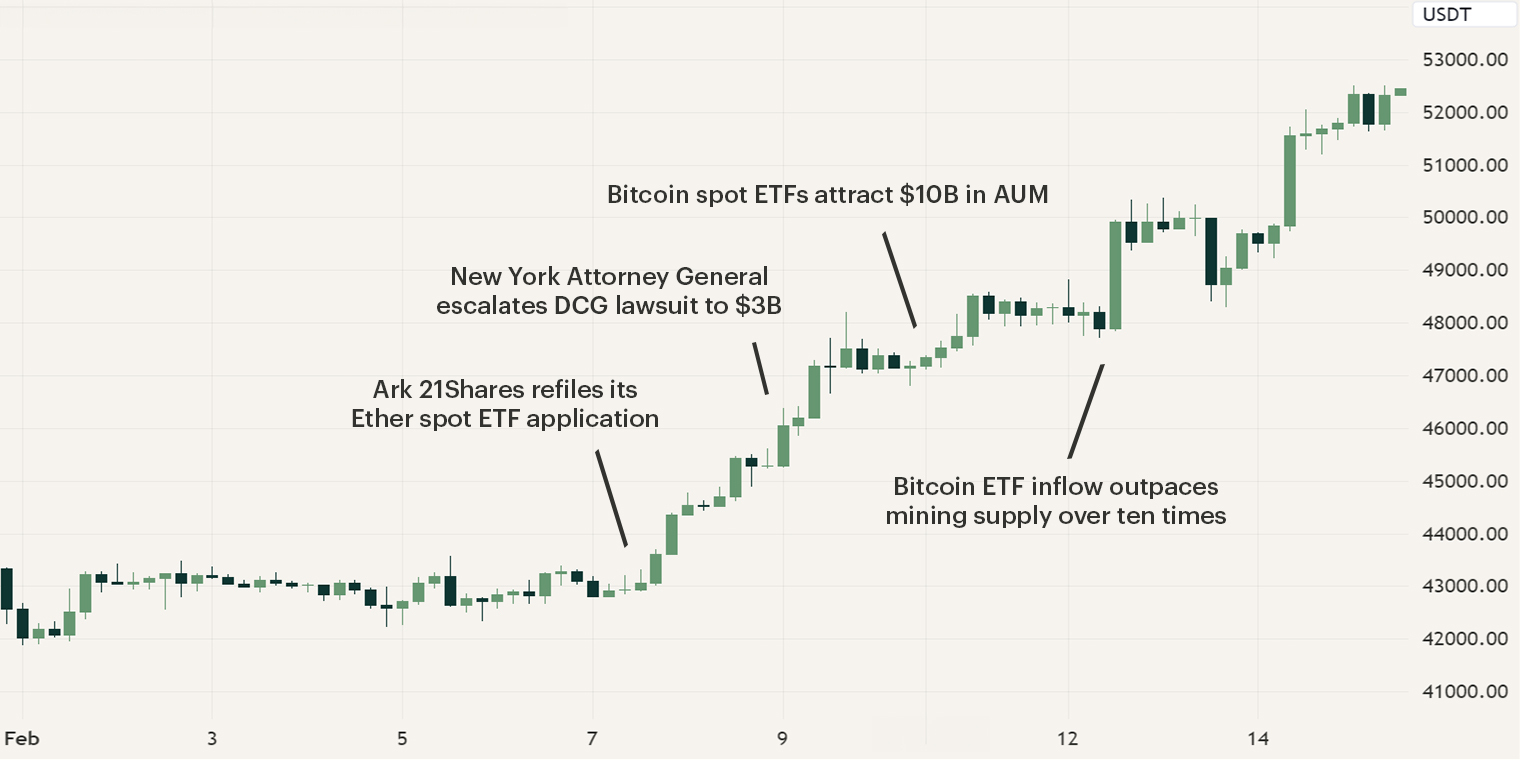

During the first two weeks of February, Bitcoin saw a significant rise, surpassing the $52,000 mark, a price point last seen in December 2021. As the market nears the Bitcoin Halving event, which cuts the supply of new Bitcoin in half and enhances its scarcity, along with strong institutional demand through approved exchange-traded funds (ETFs), traders and investors are aiming for even higher price levels.

Although Bitcoin experienced a strong upswing, the newsflow in the beginning of February was relatively quiet. The most significant developments were that asset managers Ark Invest and 21Shares refiled their joint application for an Ether ETF, and Franklin Templeton joined the race as well. Furthermore, the New York Attorney General expanded their lawsuit against Digital Currency Group (DCG), Gemini, and the bankrupt Genesis to $3 billion.

ETF demand surpasses miner capacity

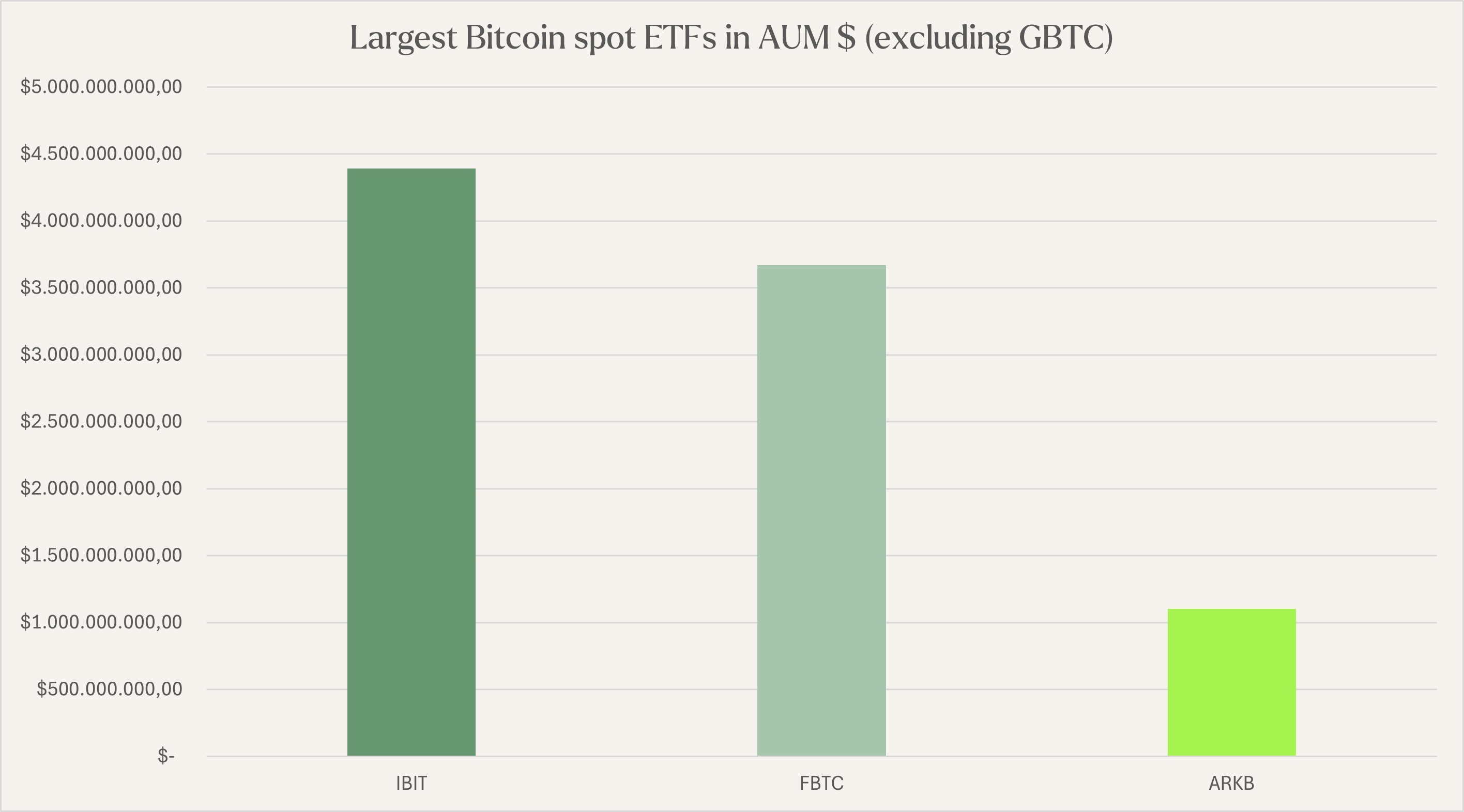

In January, the eleven approved Bitcoin spot ETFs all saw a positive start, although there were a couple of days with negative overall net flows, contributing to significant outflows from Grayscale ETF (GBTC). However, in recent weeks, the outflows from GBTC have weakened, while inflows into other ETFs, particularly BlackRock’s ETF (IBIT), have increased.

In February, the overall Bitcoin spot ETFs did not experience any days with negative outflows. On February 10th, excluding GBTC, these ETFs surpassed $10 billion in assets under management, with IBIT alone amassing over $4 billion, underscoring the growing interest in Bitcoin among professional investors. Additionally, on February 12th, Bitcoin ETFs acquired ten times more Bitcoin than miners produced, with approximately 10,280 Bitcoin flowing into ETFs while only 1,059 were issued. This trend was also observed on February 9th when around 12,700 Bitcoin flowed into Bitcoin ETFs. Furthermore, the miner’s Bitcoin reserves have decreased to ~1.8m BTC, its lowest point since June 2021, further displaying the flows of Bitcoin towards the traditional system.

These circumstances are setting the stage for a favorable scenario for Bitcoin's price movement. In April, the Bitcoin Halving is expected to reduce the issuance of Bitcoin to 3.125 Bitcoin per block, which averages about 450 Bitcoin per day. Consequently, if the current trend continues, the supply of Bitcoin may struggle to meet institutional demand, potentially resulting in long-term price increases. There are already signs of this, as Bitcoin recently exceeded the $52,000 milestone.

Staking may come to ETFs

Although Ether's price action lagged in 2023 and 2024 so far, US asset managers remain focused on obtaining the Ether spot ETF. On February 7th, Ark Invest and 21Shares refiled their joint application, incorporating a cash creation and redemption model for investors to acquire and redeem shares solely through fiat. This mirrors Bitcoin spot ETFs. A notable aspect is the proposed staking element, allowing the ETF to periodically stake assets through a trusted third party.

Additionally, on February 12th, Franklin Templeton filed its application for an Ether ETF, including staking. This marks a significant development, integrating DeFi yield with traditional finance. However, staking remains under discussion among US regulators, notably the SEC, which has fined firms like Coinbase for allegedly selling unregistered securities via staking services.

New York Attorney General files $3B in charges against digital assets firms

On the 9th of February, New York Attorney General (NYAG) Letitia James announced the pursuit of $3 billion in restitution from Gemini, DCG, and its subsidiary Genesis for alleged fraud related to the Gemini Earn product. Gemini Earn allowed users to earn interest by lending out assets to trusted borrowers. Initially, the NYAG sued the involved parties in October, alleging they defrauded 230,000 investors of $1,1 billion, but the claim has since increased to $3 billion.

The complaint alleges that Gemini misrepresented Earn as "a highly liquid investment" and implied Genesis Capital's creditworthiness through Gemini's continuous risk management. DCG's challenges are mounting as it has been embroiled in legal battles with the parties involved over the past year. It appears that the NYAG is increasingly focusing on the firm.

Sign up for our newsletter to stay on top of the crypto market.