Newsletter: Recap November

The aftermath of the bankruptcy of FTX

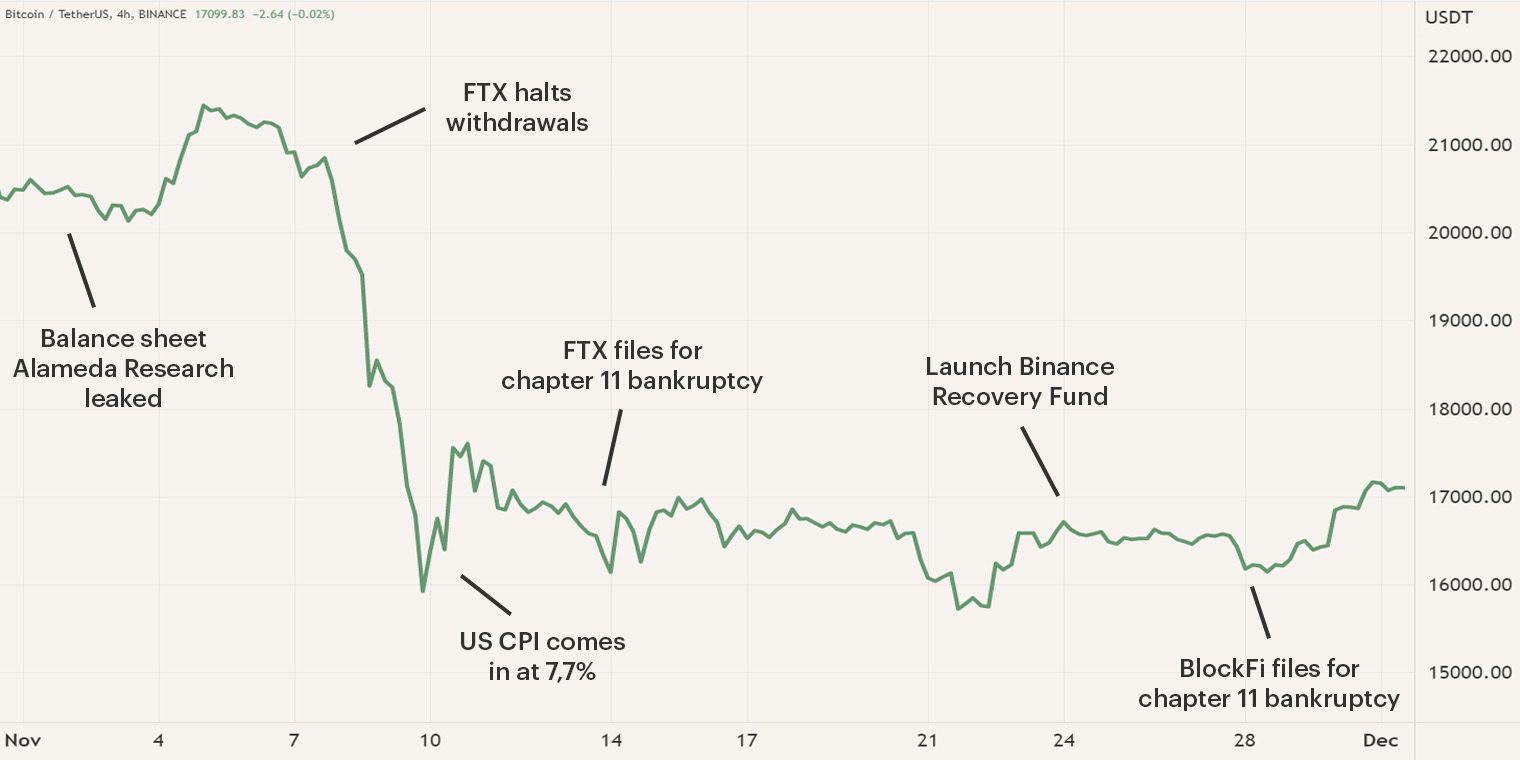

In the first two weeks of November, FTX, one of the biggest cryptocurrency exchanges, and Alameda Research, a cryptocurrency trading firm, declared bankruptcy after mishandling customer funds. As the debacle unfolded, Bitcoins’ price dropped from $21K to new cycle-lows of $15.5k, eventually stabilizing between $16.2K and $17K. As the predicament of FTX lingers on, the effect of the implosion on the market seems to become more clear.

One of the affected parties is crypto-services firm Genesis which mainly focused on providing institutions access to digital assets by providing services such as lending, hedging, trading and derivatives. On the 16th of November, Genesis announced that they are halting all customer withdrawals, indicating that there are more issues than meets the eye. Rumors are that Genesis is currently seeking $1B in new funding, if this isn’t raised it may file for bankruptcy.

Similar to Genesis, we have also seen crypto lending firm BlockFi facing problems as a result of the fall of FTX. BlockFi was closely linked with FTX of which it also received $400M in credit after losing assets during the Terra/Luna collapse. On November 11th, BlockFi halted customer withdrawals as they had significant exposure to FTX. Cryptocurrency exchange Binance has held talks with BlockFi, however, nothing substantial has been announced. Later in November, on the 28th, the lending firm officially filed for Chapter 11 bankruptcy.

Regaining trust

Due to the recent events, we see a clear trend of users avoiding or minimizing their exposure to centralized entities such as Centralized Exchanges. Customers have been withdrawing their assets by the millions and exchanges are trying to win back the confidence of the clients. One of the used methods is by issuing “Proof-of-Reserves”, proof that the exchange has sufficient funds to operate and back all deposits. Binance was one of the first to do so, the exchange shared all the public wallet addresses which totaled approximately $65B. Shortly after, various exchanges published their Proof-of-Reserves such as Bitfinex, OKX, Bybit and Huobi. For now, it’s only a handful of exchanges that published their reserves, however, it still has a significant impact as more financial transparency and trust are obtained.

Even though the Proof-of-Reserves is a first step in the right direction, it will take some time to see the trust in centralized entities return, if it ever does so. The fall of FTX was driven by malicious actions caused by powerful individuals within the organization and this risk will always remain present in a centralized entity. Recent events highlight the need for the right regulation of centralized entities, especially towards the adoption of cryptocurrency by institutional investors. Additionally, it will probably also result in a stronger move towards decentralization. Decentralization has always been the main driver of blockchain technology and cryptocurrency and this once again shows the need for truly decentralized solutions.

Binance launches “Industry Recovery Fund”

As the month unfolded, we have seen multiple cryptocurrency projects and providers get in trouble financially. To help these companies in troubled waters, Binance announced the launch of its $1B recovery fund on the 24th of November. The idea of a recovery fund was introduced on the 14th of November, shortly after the FTX debacle which left many firms with liquidity problems. The main goal of the fund is to aid protocols and firms which are facing difficulties due to the initial blowout. It won’t operate as an investment fund. Binance has allocated $1B of BUSD, the stablecoin of the BNB network, in a public address, making it possible for everyone to track incoming and outgoing funds. Binance isn’t the only organization that allocates funds in the fund, Jump Crypto, Polygon Ventures, Aptos Labs, Animoca Brands, GSR, Kronos and Brooker Group also participate in the recovery fund, committing a total of $50M.

Currently, 150 organizations have applied for the recovery funds and all investors of the fund will have the opportunity to review the applications and decide for themselves whether they aid with the recovery fund. Binance already announced if the $1B fund isn’t enough, they will allocate more, possibly towards $2B. In addition to recovering the industry, Changpeng Zhoa, the CEO of Binance, already hinted that Binance is also looking at acquiring FTX’s assets.

J.P. Morgan trademarks Bitcoin wallet

In our previous newsletters, we discussed that more traditional financial institutions are exploring the opportunities of gaining cryptocurrency exposure. A popular method of gaining exposure is by providing custodial services, institutions such as BlackRock and BNY Mellon already offer this service. Now it seems that J.P. Morgan will enter the custodial wallet sector as they registered a trademarked Bitcoin wallet on November 15th. In 2017, the CEO of the U.S. investment bank criticized Bitcoin openly, referring to it as a fraud and that it eventually will blow up. It’s good to see that even the larger investment banks slowly see the possibilities of cryptocurrencies, even if it’s the storage of the assets. It’s even more interesting now that the need for trustworthy centralized entities has increased. Banks such as J.P. Morgan have proven to have a longstanding track record and good reputation among other financial institutions.

Slowly but surely, more traditional institutions will enter the market, for now, they will continue to be in storage as real exposure will be deemed too risky. We believe that custodial services are one of the first steps for institutional adoption, eventually, these institutions will want to have real exposure. This can be obtained through assets on a balance sheet, becoming shareholders in crypto organizations or establishing their own cryptocurrency services. However, the market still needs some maturing for real institutional adoption to become a reality.

The Hodl Funds

The downwards move of the month of November has led to a decline of the Hodl funds. The Hodl.nl Genesis Fund, the Hodl.nl Consensus Fund and the Hodl.nl Oracle Fund ended respectively at a Net Asset Value (NAV) of €2.43, €2.43 and €0.25.

Check your personal results here

Digital Euro

On the 23rd of November, the Dutch House of Representatives conducted a debate concerning the digital euro. Currently, the European Central Bank (ECB) aims to implement a digital version of the euro in 2026, which will cause some significant changes. The change to a digital version of the euro isn’t that unnatural, more and more elements of our lives are moving to a digital environment. Even though the idea of a Central Bank Digital Currency (CBDC) has been around for well over a decade, we have seen the awareness increase drastically over the past few years. The main issues among critics are its privacy and the programmability of the digital euro. As privacy is becoming a hot topic in today's digitally driven world, we saw hundreds of Dutch civilians try to attend the latest debate.

The digital euro will cause a shift in power among commercial banks and the central bank. Currently, only commercial banks can provide checking accounts to clients, with a digital euro, the European Central Bank can also offer this service. Important to note, the digital euro will be an addition to scriptural and cash money, not a replacement (currently). The digital euro will try to compete with scriptural money as both are located in the digital environment. The difference between the two is that the current scriptural currencies are managed and issued by commercial banks. With the digital euro, the ECB will have a monopoly on the issuance of the euro.

Critics are afraid that the ECB will use this monopoly to tighten its grip on how consumers spend their money and to combat money laundering, resulting in less financial privacy. As the money is digital, it becomes programmable, which gives the ECB significant power. They could, for example, limit your personal spending to fight inflation. ECB’s current tools are limited to increasing the interest rates and shrinking the balance sheet in order to stimulate less spending. Tools that help but take time to do so. This can be seen in the current inflation rates. The inflation rate in the Netherlands dropped to 11.2% in November from its highs of 16.8% in October. Despite the fact that this provides perspective, it has been well above the pursued inflation rate of 2% by a year.

We believe that there will be a time where we move towards the use of a digital currency, however, the privacy and the choice of consumers must come first. As long as this isn’t the case, we believe that the future lies in decentralized digital currencies.

Sign up for our newsletter to stay on top of the cryptocurrency market.