Sustainable developments within the Digital Assets Industry

- Developments within the Bitcoin Ecosystem

- The Proof-of-Stake Development

- The Emergence of Sustainability Organizations

- The Future of Digital Assets

In the last two decades, sustainable development has gained significant importance, with individuals and organizations across industries striving to meet their sustainability objectives. However, as the digital assets industry emerged, it faced scrutiny due to its energy-intensive operations. Bitcoin, in particular, has drawn criticism for its consensus mechanism that demands increasing computing power, leading to a corresponding rise in energy consumption.

It's widely acknowledged that Bitcoin, and consequently a significant portion of the industry, consumes substantial amounts of electricity that leads to CO2 pollution. It is important to note that when Bitcoin was introduced, prioritizing the asset's sustainability wasn't a primary concern. The primary goal was to introduce a decentralized digital currency, and achieving this milestone required some compromises. In recent years, we have seen a change. We would like to emphasize the changes that are occurring from the standpoint of the market participants and the efforts that are being made toward the sustainability of the industry.

Developments within the Bitcoin Ecosystem

To truly understand the problem, we need to recap why Bitcoin is energy-intensive. The Proof-of-Work PoW protocol requires miners to solve a mathematical problem to add a new block to the blockchain. The miner who solves the problem first is rewarded with new Bitcoin. To maximize profits, miners use hundreds of computers, which operate 24/7, to solve this problem.

The design of this system requires a continuous increase of computational power, which currently is energy intensive. As this computational power requires larger amounts of capital, it safeguards the system's security and genuine decentralization. By rewarding miners based on their invested computational power, Bitcoin leverages a vast resource pool, safeguarding the network's integrity from manipulation by any single entity.

Currently, it is estimated that Bitcoin accounts for 60-77% of global crypto-asset electricity usage and therefore most of the CO2 emissions. However, this carbon footprint is very regio dependent. Bitcoin miners are located all around the world but mostly concentrate in regions where energy is cheap to reduce their main operational costs.

As a result, in regions where fossil fuels are cheap and easily accessible, such as in Kazakhstan, CO2 emissions are higher than in regions with sustainable and more costly energy sources as Norway and Sweden where hydropower is being used. However, as we see sustainable and renewable energy become more and more accessible, the use of energy becomes more mixed.

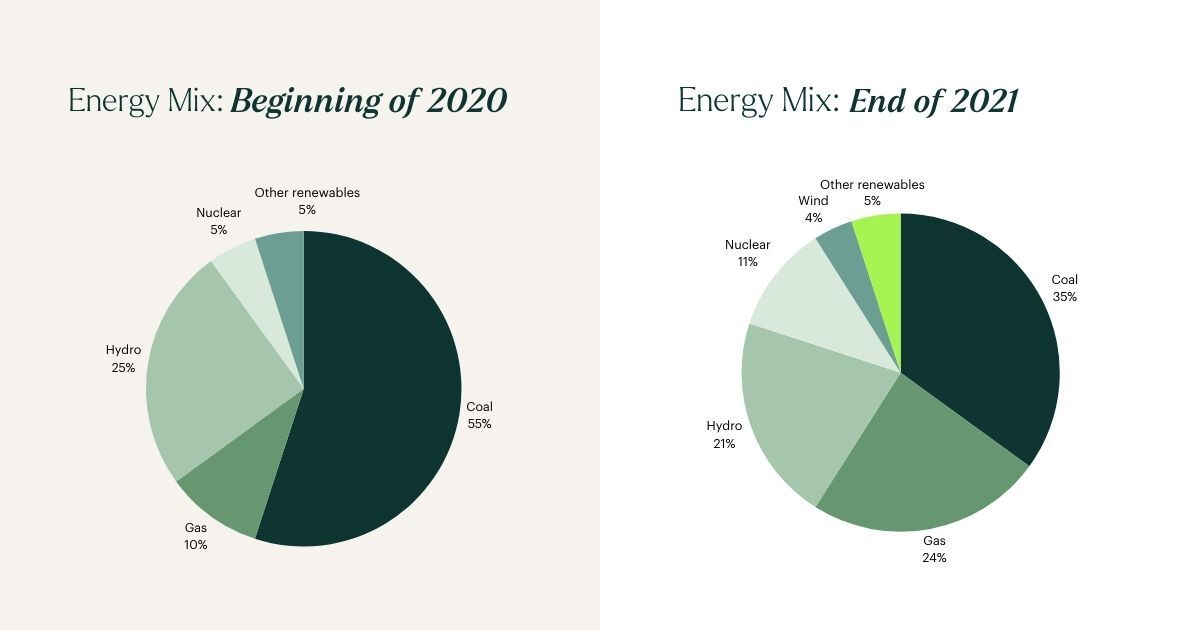

When we look at the energy mix at the beginning of 2020, according to CoinShares Research, coal was 55% of the network, gas (10%), hydro (25%), Nuclear (5%), and other renewables (5%). At the end of 2021, the energy mix consisted of coal (35%), gas (24%), hydro (21%), nuclear (11%), wind (4%) and other renewables (5%). So, there has been and still is moving towards more sustainable energy sources.

These developments are best illustrated at an individual level in for example Iris Energy, a pioneering company that has centered its entire operation on the sustainable mining of Bitcoin. Their sites are exclusively powered by 100% renewable energy, with approximately 97% derived from clean and renewable sources, as confirmed by BC Hydro, primarily sourced from hydroelectricity. The remaining 3% is obtained through the acquisition of Renewable Energy Certificates (RECs). The market has observed a growing number of miners exploring sustainable and renewable energy solutions, a trend we anticipate will continue as these energy sources become more accessible and cost-effective.

In addition to this, Bitcoin miners have been exploring alternative approaches. The hardware utilized by Bitcoin miners generates considerable heat. Instead of dissipating this heat, there has been a shift towards repurposing it. For instance, the Canada-based company MintGreen has collaborated with the local energy utility company, Londsdale Energy Corp. Together, they have introduced their "Digital Boilers'' designed to convert heat from Bitcoin Miners into a sustainable heat source.

Another notable advancement involves the reduction of Methane emissions. Methane, a potent greenhouse gas, is emitted by various sources, including coal mines, landfills, and industrial processes like oil and gas extraction. Presently, methane contributes to 30% of global warming. Bitcoin mining has emerged as a potential solution to this issue. Companies are actively working to capture vented methane from landfills, subsequently converting it into electricity for use in the mining process. This innovative approach not only helps curb emissions but also facilitates the production of valuable cryptocurrency.

The Proof-of-Stake Development

As more digital assets were introduced into the market, developers also started developing other consensus mechanisms. One of these new mechanisms was Proof-of-Stake (PoS), which isn’t energy intensive as validators don’t have to compete with each other to finalize a block. Valditors need to stake some digital assets, this can be seen as a security measure, and the network will randomly choose which validator may finish the next block, the more tokens you have staked, the likelier you will be chosen to finish a block.

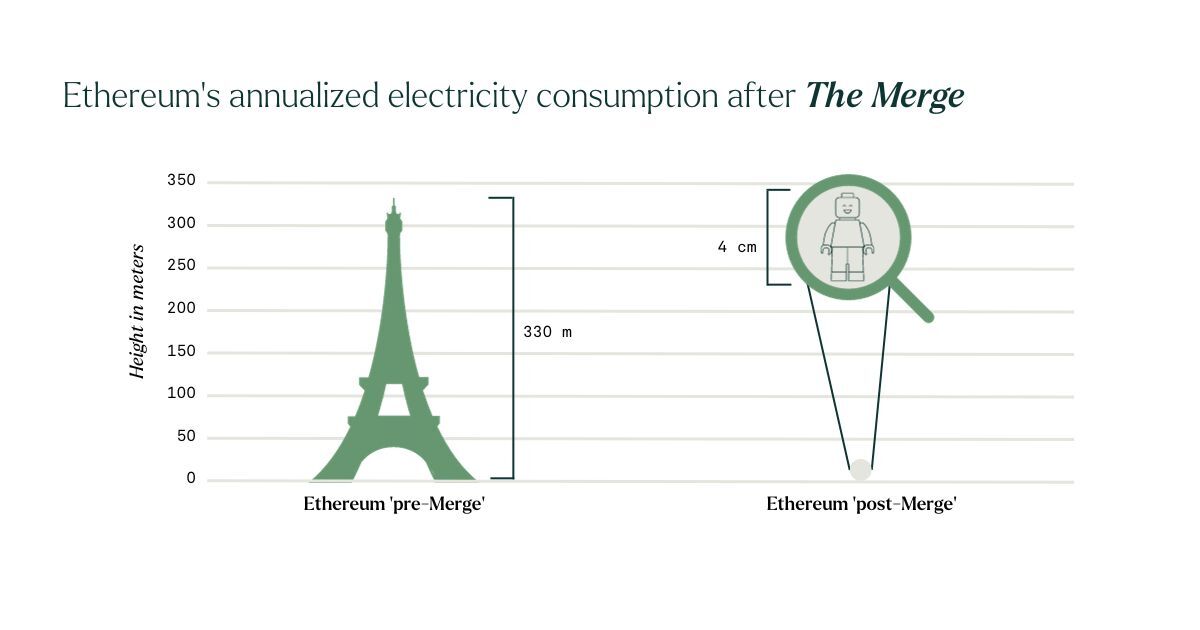

Due to its unique features, more and more emerging blockchains chose the more sustainable PoS mechanism instead of PoW. The breakthrough of PoS and sustainability in the digital assets industry was in September 2022 with Ethereum switching from consensus mechanism PoW to PoS. Before the Merge, Ethereum used 78 TWh per year, which could power approximately 5 million households for a year, and since it switched to PoS, the network only uses a mere 0.0026 TWh per year, using 173 households worth of energy. This switch caused Ethereum’s annualized electricity consumption to decrease by approximately 99.988% and its carbon footprint by approximately 99.992%. As most of Decentralized Finance (DeFi) applications and other projects are built on Ethereum, the entire digital assets industry took a giant leap in the right direction.

As aforementioned, newer main networks such as Avalanche (AVAX), Fantom (FTM), Cardano (ADA) and other main networks implemented PoS as it requires less energy and hardware. Lowering some entry barriers for new validators and increasing the adoption of sustainable networks.

Networks such as AVAX only consume the same amount of energy as 46 U.S. households, the average U.S. household uses 10,600 kWh, which is negligible for a network that holds $1,6B of assets. Polkadot uses as much as 6.6 U.S. households and Fantom only uses 8,200 kWh, which is even less than the average U.S. household and the network currently holds ~$380M worth of assets.

The Emergence of Sustainability Organizations

During the past three years, we witnessed an increase in organizations that are aiming to create a more sustainable blockchain-based economy. One of these organizations is the Crypto Climate Accord, an organization inspired by the Paris Climate Agreement, launched in April 2021, which focuses on the decarbonizing of the cryptocurrency and blockchain industry. Over the past two years, more than 200 companies and individuals have joined the accord, they originate from all sectors; crypto, finance, technology, NGO and climate sectors.

An interesting development emerged through the collaboration between prominent cryptocurrency-related projects including Avalanche, Ripple, Solana, Circle, and the World Economic Forum (WEF). One of the primary areas of focus revolves around the current and future environmental impact of these technologies.

Initially, the group will conduct a thorough analysis of the existing effects, subsequently zeroing in on devising strategies to leverage Web3 technology to decarbonize everyday tasks. Both decentralization and mining processes consume a substantial amount of energy. This study aims to guide Web 3.0 enterprises toward the creation of initiatives aimed at reducing energy consumption, consequently diminishing their overall carbon footprint.

In tandem, the WEF is dedicated to the standardization and integration of carbon credits onto the blockchain, envisioning it as a tool for holding individuals accountable for their carbon emissions. By harnessing the transparency of blockchain technology, reliable communication within the blockchain can be established for the issuance and management of carbon credits. This not only ensures sustainability but also serves as an inspiration for more individuals to engage in the community's efforts to advance Web 3.0 technologies.

The Future of Digital Assets

In the digital assets industry, innovation has been abundant, from faster transactions to integrating real-world assets onto the blockchain. Yet, the focus on sustainability seems overlooked by many observers outside the industry. While it's perceived as energy-intensive, there's a readiness within the industry for transformation.

One notable shift involves Bitcoin miners increasingly adopting sustainable energy sources like hydro and nuclear power. This movement, while potentially increasing Bitcoin's energy consumption, is being driven by growing institutional and investor demands for sustainability, compelling miners to pivot.

Moreover, protocols themselves are evolving. Ethereum's transition to Proof of Stake (PoS) caused numerous projects to operate sustainably. Others are launching with energy-efficient technologies in place. While acknowledging the industry's journey ahead, it's crucial to recognize its youthfulness and eagerness to adapt.

Sustainability isn't an immediate shift for any industry. Despite the time it'll take, we're confident that sustainable or renewable energy will emerge as the new norm among market participants, reflecting the industry's commitment to change.

Sign up for our newsletter to stay informed about the developments in Hodl and the team.