What is the Bitcoin Halving and how does it impact investors?

- An introduction to the Bitcoin Network

- Why is the Bitcoin halving so important?

- What happened during the previous halvings?

- When is the next Bitcoin halving and what can investors expect?

- How can you prepare for the Bitcoin halving?

An introduction to the Bitcoin Network

On January 3, 2009, the Bitcoin network was launched and has since remained immune to hacks or shutdowns. Its successful implementation demonstrated the feasibility of a digital currency operating without reliance on a centralized entity like a bank. Bitcoin's ability to function in a decentralized environment is enabled by distributed ledger technology, with blockchain being the most widely recognized form.

A blockchain is essentially a chain of data blocks, akin to pages in a ledger. Every transaction that occurs on the blockchain is recorded in this ledger. But how does it all work? When a user initiates a transaction, a message is broadcasted to all connected participants within the Bitcoin network, including nodes and miners, both playing vital roles in maintaining the system.

Nodes hold either a complete or partial copy of the blockchain and serve to relay transactions across the network. On the other hand, miners assume the responsibility of verifying transactions and adding new blocks to the blockchain. These miners accumulate a bundle of transactions and then attempt to create a new block for addition to the chain. To create a new block, miners must solve a mathematical problem, a process known as mining.

Successfully creating and adding new blocks to the blockchain is a rewarding endeavor for miners. They are incentivized with Bitcoin for their efforts in securing the integrity of the ledger. Essentially, the blockchain operates as an incentive program to encourage more miners to participate and ensure the ledger remains incorruptible. This robust incentive mechanism forms the backbone of Bitcoin's resilience and security.

Why is the Bitcoin halving so important?

When the Bitcoin network was initially launched, the block reward for adding a new block successfully was 50 Bitcoin, which, in today's value, would amount to approximately $1.5 million. The brilliance of the Bitcoin blockchain lies in its programmed reduction of the block reward or issuance of Bitcoin every 210,000 blocks mined, about every four years. This process is known as "halving or halvening." The first halving took place on Nov 28, 2012, cutting the block reward in half to 25 Bitcoin.

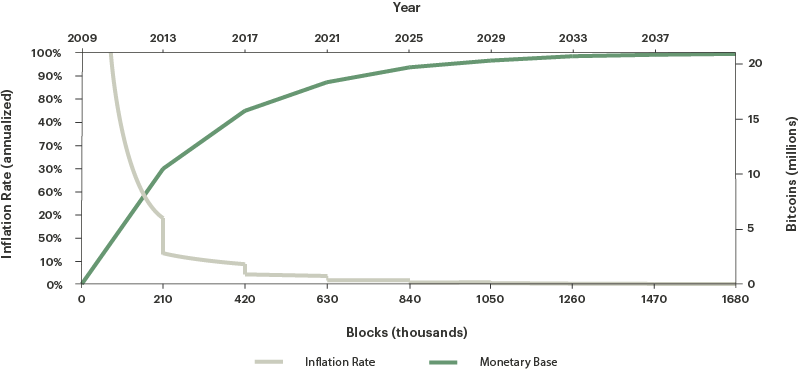

After this first halving event, 50% of the total supply of Bitcoin was in circulation, subsequent halvings continued to reduce the inflation rate of Bitcoin. In 2011, the Bitcoin inflation rate stood at 50%, which dropped to 12% after the 2012 halving, and further down to 4-5% after the 2016 halving. As Bitcoin has undergone three halvings, the block reward has dwindled to 6.25 Bitcoin, while approximately 19.4 million of the total 21 million supply are now in circulation. Currently, Bitcoin's inflation rate hovers around 1.74%, and it is expected to reach 0% in 2140, marking the point when the last Bitcoin will have been issued.

In theory, the decreasing issuance of Bitcoin combined with increasing demand should result in a higher value for the digital asset. Historical data indicates a correlation between the past halvings and Bitcoin's price surge, commonly known as a "bull run." However, this correlation is not always immediately evident, as these bull runs can sometimes be triggered days, weeks or even months after the halving event.

What happened during the previous halvings?

First Bitcoin halving, 28th of November, 2012:

When the first Bitcoin halving occurred, its price was approximately around $12. During this period, the digital asset was only known among a small niche of tech-savvy investors who understood the potential of blockchain technology and decentralized currencies. In mid-January, the price reached $14, and from there, Bitcoin embarked on an upward trajectory, eventually reaching a new all-time high of $266 on the 10th of April, 2013. Following this surge, the digital asset underwent a substantial correction, dropping to $63, before eventually stabilizing around $143.

Around a year after the halving, Bitcoin experienced a second rally, pushing its price to $1242. After this peak, the cryptocurrency entered a prolonged downward period, eventually hitting a low of $162.

Second Bitcoin halving, 9th of July, 2016:

During the second halving, a larger number of people became familiar with the digital asset. Initially, the price of Bitcoin showed fluctuations within the range of $620 to $660. However, following this event, the asset underwent a correction, dropping to $470. In 2016, Bitcoin became more publicly known to the general public and media outlets started to publish articles about this so-called new digital currency. This fuelled a new rally that lasted for over a year, surging to a new all-time high of $19,800 in December 2017.

In the prolonged period of downward movement after the rally, Bitcoin reached a low of $3,124 in December 2018. The market never returned to this low and started fluctuating between $6,000 and $11,000.

Third Bitcoin halving, 11th of May, 2020:

A notable thing to mention that happened leading up to the third halving is the Corona Crash. During this crash, Bitcoin sharply dropped to $3,880. After the drop, the market continued its upwards course with the Bitcoin price surging to $9,500 within a month after the crash. With the pandemic confining more people to their homes and increasing digital activity, coupled with the widespread use of quantitative easing, the interest in the cryptocurrency market soared.

The unique combination of liquidity, the halving event, and the reawakened interest of the general public set Bitcoin's price on a steady upward trajectory, ultimately peaking at approximately $69,000. This peak was followed by a bear market, causing Bitcoin's price to retreat to $16,000.

When is the next Bitcoin halving and what can investors expect?

The next Bitcoin halving is scheduled to take place at block 840,000, which is expected to happen around April 2024. During this halving event, the reward given to miners for each block they successfully mine will be reduced to 3.25 Bitcoins, and as a result, the inflation rate will decrease to 0.88%. When we compare different cycles of Bitcoin's history, interesting similarities and patterns emerge.

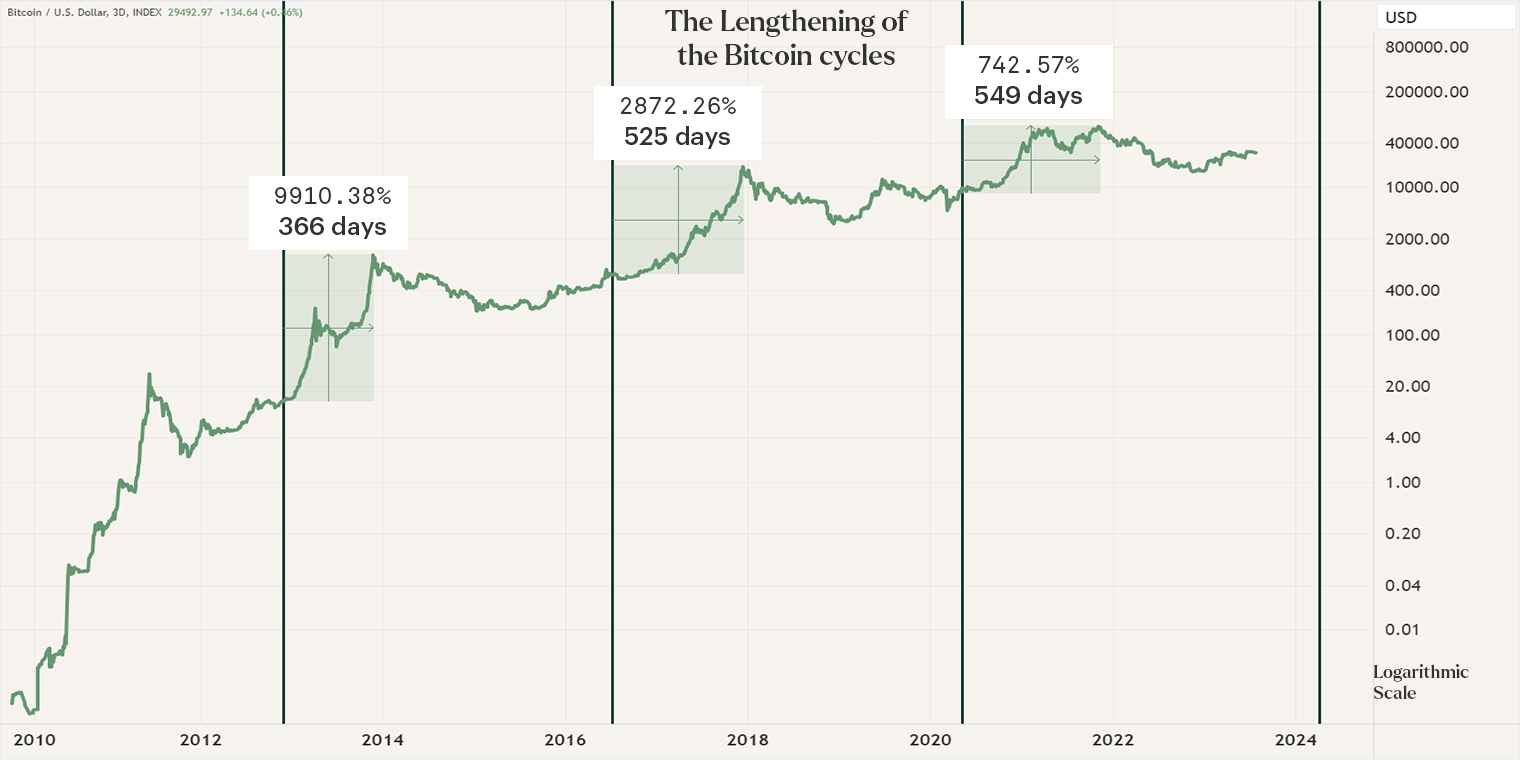

Looking back at past halvings, after the first one occurred, it took about 366 days for Bitcoin to reach its peak value during that particular cycle. The second and third halvings had longer durations to reach their cycle peaks, at 525 and 549 days, respectively. Additionally, the percentage increase in price from the halving to the cycle peak was 9910%, 2872%, and 742% for each halving, respectively. This observation reveals a clear pattern: the cycles seem to be getting longer and less explosive over time.

In the lead-up to the halving, the price of Bitcoin often shows an upward trend, which then accelerates significantly after the halving event. Apart from this surge, there are two other distinct periods in Bitcoin's price history: the bear market phase and the consolidation phase. After reaching a low point in the bear market, the price tends to fluctuate during a consolidation period that can extend for quite some time. Historically, once the price breaks out of this consolidation phase, it usually doesn't return to the previous price level.

Based on historical data, experts expect the next peak of Bitcoin to occur somewhere between October and November 2025. From June 2022 to March 2023, the price of Bitcoin remained consolidated within the range of $15,000 to $25,000 for about 280 days. While Bitcoin has hit its lowest point in historical terms, it doesn't necessarily mean that a correction back to $20,000 is impossible. If history is any indication, we are gradually heading towards a bull market, which is anticipated after the halving event in April 2024.

In line with previous cycles, it is anticipated that the explosive price movements will gradually decrease. Consequently, the overall returns may not be as significant, but on the flip side, the downside risk will also be reduced. While there are numerous other cryptocurrencies in the market that experience more explosive price surges due to their smaller market capitalizations, Bitcoin remains the predominant force driving broad market movements, whether upwards or downwards.

How can you prepare for the Bitcoin halving?

In our opinion, the most favorable approach to gain exposure to this event is by slowly Dollar-Cost-Averaging (DCA) into the market. Despite Bitcoin experiencing significant rallies, the liquidity eventually finds its way to other assets in the industry. By using the DCA method, investors can enter their positions gradually, which also presents the opportunity to take advantage of sudden corrections and reduce the average entry price. We strongly believe that preparation is superior to abruptly entering the market, making the upcoming period an opportune entry point.

Would you like to get personalized advice on the diversification of your portfolio? Contact one of our advisors through [email protected] or +31 85 060 7077

Sign up for our newsletter to stay on top of the crypto market.