A Deep Dive into the Stablecoin Market

- The stablecoin market is reviving

- Tether dominates the market

- Network dominance by stablecoins

- The future of stablecoins

The stablecoin market has experienced a rollercoaster ride in recent years, going from rapid expansion to a severe downturn. However, the tides are turning, and trust in the market is slowly being restored. In this research we will explore the latest developments in the stablecoin market, focusing on the dominance of major players and the networks hosting these digital assets.

The stablecoin market is reviving

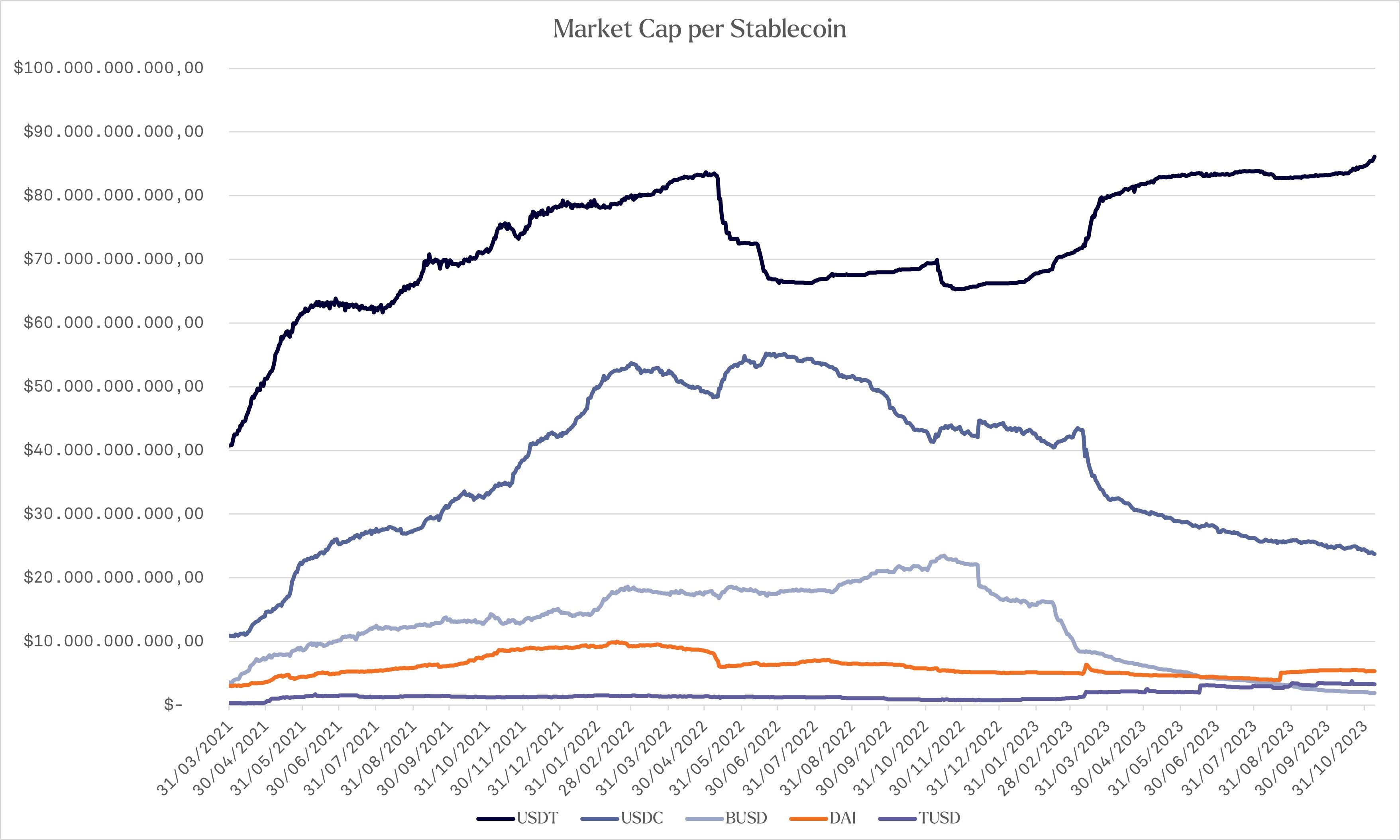

From October 2020, the stablecoin market witnessed a period of expansion, reaching a record high of approximately ~$188B before experiencing a downturn that started in April 2022. Since April 2022, the stablecoin market experienced mass redemptions, and the fall of Terra-based stablecoin UST, wiping out $18B, accelerated the pace of redemption due to loss of trust. The fall of UST and the overall declining cryptocurrency market caused many traders and investors to redeem their stablecoins for fiat money, effectively leaving the market. This exodus caused the market capitalization to reach a two-year low of ~$120B in October 2023, however, it is currently increasing. In the chart below, we observe that stablecoin redemptions are experiencing a weakening trend and for the first time since Q4 2022, the market witnessed a prolonged period of expansion of the stablecoin supply.

As the stablecoin market witnesses an expansion, there is a plausibility that market participants are converting their fiat money back into stablecoins to participate in the market. If the current trend continues, it may indicate that trust in the market is restored and that traders and investors have faith that digital assets will experience an upward trend.

Tether dominates the market

In the stablecoin market, a notable oligopoly is formed by a few major players. At its peak, USDT, USDC, and BUSD held the top spots. However, significant shifts have occurred within the past year and a half. The most significant change was witnessed with BUSD. In Q1 of 2023, Paxos, the issuer of BUSD, suspended the issuance of new BUSD and announced that redemption would only be possible until 2024. This move was prompted by an SEC investigation into Paxos, leading the organization to halt BUSD operations to alleviate pressure.

At that juncture, BUSD stood as the third-largest stablecoin with a market capitalization of approximately $22 billion. As 2023 progressed, its market capitalization plummeted to around $1.9 billion. With the approaching end of the redemption period, BUSD will ultimately cease its operations.

USDC faced its own set of challenges in March 2023 when the stablecoin depegged from its value of $1. To maintain its stability, USDC is required to hold equivalent capital reserves to match the issued supply. However, the United States banking crisis in March 2023 led to the collapse of three small and mid-sized banks, including Silicon Valley Bank (SVB). Circle, the issuer of USDC, had roughly 10% of USDC's reserves at the failed bank. SVB failed when it experienced a bank run and was taken over by U.S. regulators on Friday 10th of March, so, during the weekend, 10% of the reserves were unavailable, causing USDC to devalue to approximately $0.88 as the redemptions couldn’t be matched.

The peg was restored on Monday, March 13 when the U.S. government announced that all depositors would have access to all their money. Nevertheless, the depegging incident eroded confidence in USDC, resulting in a drop in market capitalization from around $43 billion to about $24 billion. At the time of writing, its market capitalization is still on a downward trajectory.

The dominant force in the stablecoin market remains USDT, which has reclaimed its all-time high in circulating supply. At its zenith, USDT boasted a circulating supply of roughly $83 billion. Like other stablecoins, it underwent an exodus, decreasing the market capitalization to $65 billion. However, with USDC's depegging and BUSD's issuance halt, traders and investors sought refuge in USDT, driving up its supply. Currently, USDT boasts a circulating supply of approximately $85 billion and commands a market dominance of around 68%, solidifying its position as the market leader. USDC holds the second position with a market capitalization of about $23 billion, followed by DAI in third place with around $5 billion.

Network dominance by stablecoins

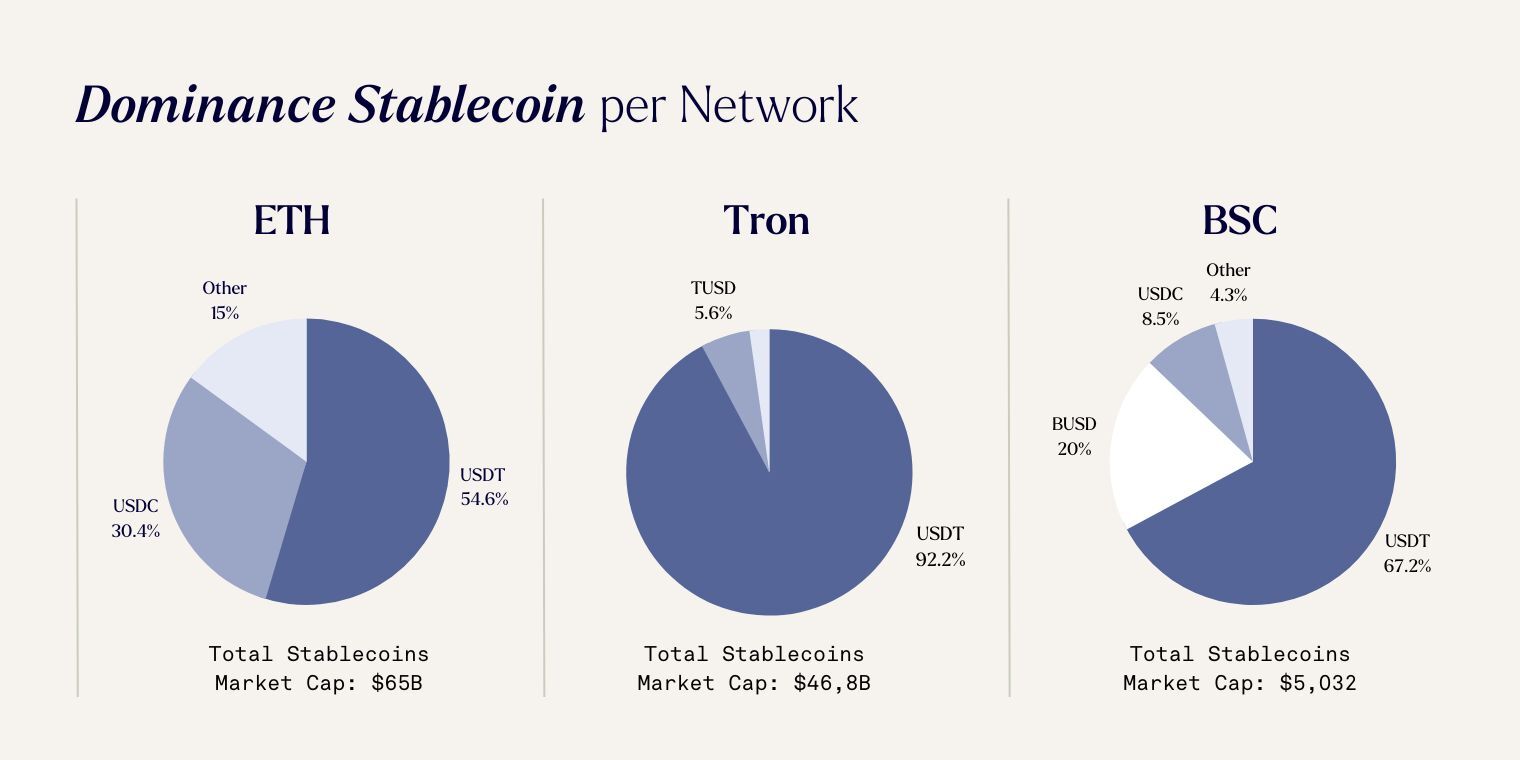

As mentioned earlier, a small number of major players dominate the market. A similar trend emerges when we examine the dominance of the networks hosting these assets. The majority of stablecoins are based on three main networks: Ethereum, Tron, and Binance Smart Chain.

Ethereum stands out as a pivotal network in the broader cryptocurrency landscape, particularly in the realm of Decentralized Finance (DeFi) protocols. Approximately $65 billion worth of stablecoins are situated on the Ethereum network, constituting 52% of the total circulating supply. Within the Ethereum network, USDT takes the lead once again, with around $35 billion USDT being located on the network, giving it a substantial 54% market share of the stablecoin market on Ethereum. The second-largest stablecoin, USDC, boasts an impressive $20 billion, accounting for approximately 70% of the total USDC circulation.

Moving to the Tron network, it emerges as the second-largest network in terms of stablecoin market capitalization, with around $46 billion in stablecoins. Similar to the pattern on Ethereum, USDT dominates here as well, with approximately $42 billion linked to Tron, translating to a staggering 92% market share. The second-largest stablecoin issuer on this network is TrueUSD, an up-and-coming player, with a market capitalization of roughly $2.6 billion.

In contrast, the Binance Smart Chain constitutes the third-largest market for stablecoins, but with a notable drop in market capitalization, hosting only around $5 billion in stablecoins. Again, USDT asserts its dominance, with approximately $3.3 billion USDT on the network, securing a market share of approximately 67%. Across all three networks, USDT not only maintains its position as the overall market leader but also dominates the three most significant networks.

An essential takeaway is that a staggering 93% of all stablecoins operate exclusively on these three networks, underscoring the pronounced imbalance within the digital assets ecosystem.

The future of stablecoins

Over the past two years, the stablecoin market went through a phase of decreasing supply, reflecting a decline in trust. However, there's now a resurgence of trust, leading to an uptick in the aggregated stablecoin supply. This shift has disrupted the established order significantly. BUSD, once the third-largest stablecoin, has almost completely lost its market capitalization and is nearing zero as we approach the redemption date. Similarly, USDC has experienced a roughly 50% decrease in market capitalization due to challenging market conditions and a depeg, while USDT is making a comeback to its former strength.

While we anticipate that USDC will regain some lost ground, USDT is poised to maintain its position as the market leader and primary issuer. Additionally, we are keeping an eye on promising newcomers like TrueUSD (TUSD), which has seen a substantial surge in supply from $800M at the start of 2023 to approximately $3.3B in November. While its chances of becoming a major industry player are slim, offering users a range of stablecoin options is crucial. Presently, the market is heavily influenced by two issuers, posing potential single points of failure. To uphold the decentralized spirit of digital assets, it's imperative that the dominance of these players diminishes.

In essence, stablecoins have evolved into a pivotal component of the broader digital assets ecosystem, with signs of expansion becoming evident. However, the current landscape is predominantly controlled by two centralized entities. To preserve the decentralized ethos of the market, there's a pressing need for more decentralized solutions. As the market regains lost ground, we anticipate that decentralized stablecoins will gain even greater prominence.

Sign up for our newsletter to stay informed about the developments in Hodl and the team.