Hodl joins the Ledger Enterprise Tradelink Network

We are proud to announce that the Hodl Group has joined the revolutionary new Ledger Enterprise Tradelink network as launching partner. This new network is the latest digital asset security solution developed by Ledger, which enables secure custodial trading and exchange connectivity while maintaining self-custody over our investors' funds.

One of the primary concerns for institutional investors revolves around the secure trading of digital assets. The majority of these trades take place on centralized exchanges, which, regrettably, do not always function as expected. To mitigate the counterparty risk for institutional investors, Ledger designed a network that enables institutions to maintain self-custody over their funds, while trading digital assets on these exchanges.

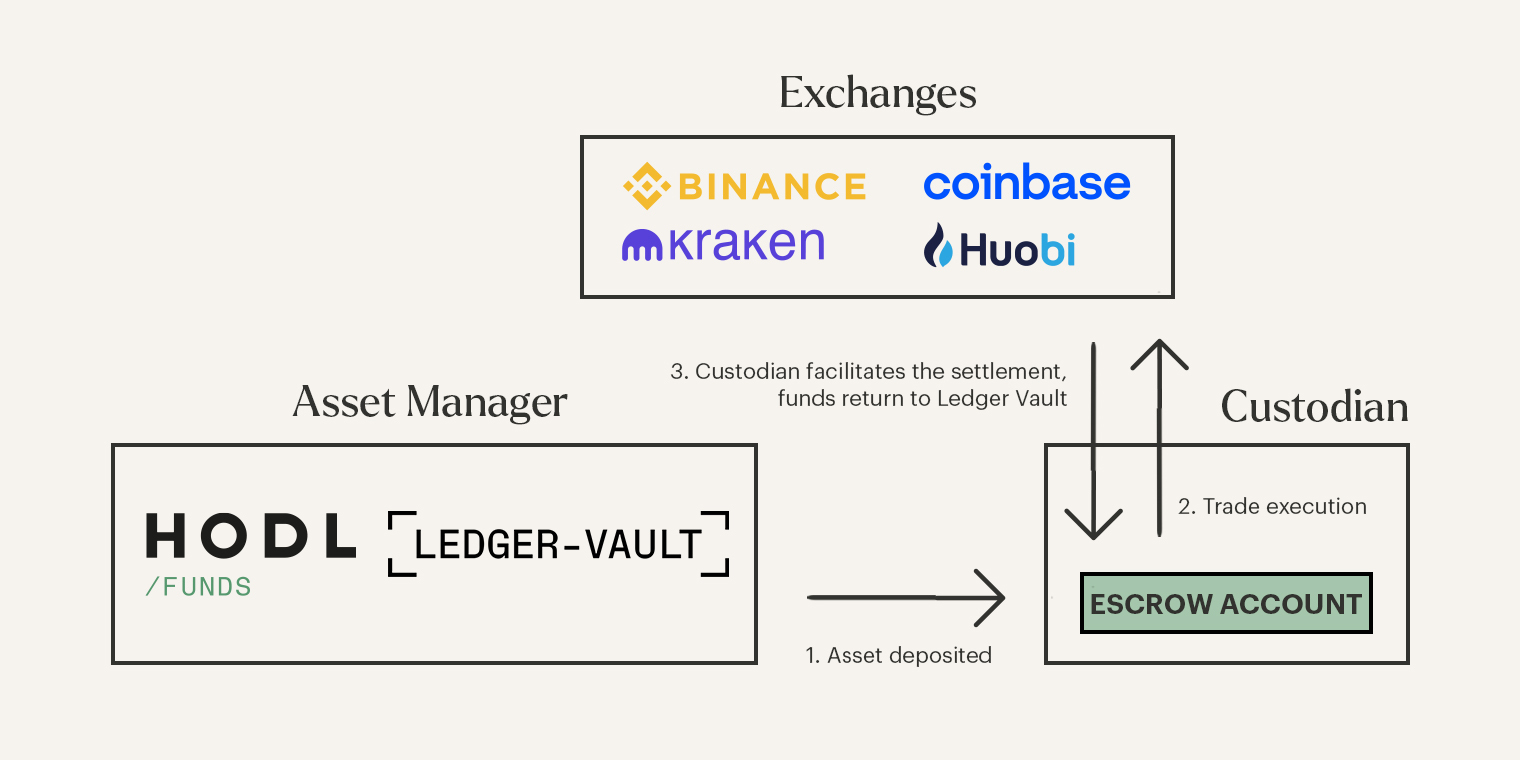

The network operates in the following manner: The Hodl Funds' holdings are securely stored in the Ledger Vault, a multi-signature cold storage solution, until the research analysts decide to trade a digital asset. With the Tradelink network, the research analyst can send the desired digital assets to an escrow account within the Ledger Vault instead of sending it to the exchange. This diminishes the risk of counterparty failures.

Once the assets are held in the escrow account, the research analyst can proceed to create a buy/sell order for the asset, ensuring a smooth flow of transactions. By utilizing an API, the exchange gains visibility into the escrow account, confirming the availability of sufficient assets for executing the transaction. Once the transaction is triggered, it requires approval from multiple pre-designated signers within Hodl. This approval serves as a necessary step to authorize the transfer.

Upon receiving confirmation, a qualified custodian facilitates the settlement process between Hodl and the exchange. It's important to note that the custodian does not have direct access to the assets; their role is solely to transfer the assets between the two entities involved. Once the transfer is successfully completed, the assets are promptly returned to the Ledger Vault, ensuring their secure storage. Ledger has already partnered with several regulated custodians.

“This step allows the Hodl Funds to engage in trading on a centralized exchange while retaining full control over our assets and minimizing counterparty risk,” said Nick Friedrich, Co-founder and COO of Hodl Group. “Security has been our utmost concern from the inception of the Funds. In 2020, Hodl became the first financial institution in the Netherlands to utilize Ledger Vault, and now as Hodl expands internationally, we continue to be a true forerunner in the security of our Investors’ digital assets.”

We would like to thank Ledger Enterprise for its continuous pursuit of enhancing the security of digital assets and we look forward to what the future holds. In addition, we would also like to express our gratitude for the opportunity to join the Tradelink Network alongside other parties such as Crypto.com, Huobi, Bitstamp and Wintermute.

Sign up for our newsletter to stay on top of the crypto market.