Institutions and Digital Assets: The current state of affairs

- The remarkable journey of digital assets

- Traditional Finance and Digital Assets are slowly becoming a melting pot

- The first steps toward institutional adoption

- Acceleration of adoption

- How will institutional adoption move forward?

The remarkable journey of digital assets

In recent years, we have seen a tremendous increase in the adoption of blockchain and digital assets among institutional players, this hasn't always been the case. Since the launch of Bitcoin, the relationship between digital assets and financial institutions has been a bumpy road. However, successful adoption is a critical step in the next cycle of the market. Let's take a deeper dive into the current state of adoption among institutions.

Traditional Finance and Digital Assets are slowly becoming a melting pot

Banks haven’t always been fond of digital assets as it is specifically designed to circumvent them. From that perspective, many (early) adopters of digital assets believe that banks and other financial institutions should not intervene with the industry as they should operate independently of each other. With the interest growing from both the retail and institutional sides, the two are slowly integrating.

The first time the market got widespread media coverage was during the bull run of 2016 - 2017. As Bitcoin set new all-time highs, the exponential growth of the industry attracted criticism from various influential individuals in financial markets. Lloyd Blankfein, the CEO of Goldman Sachs at that time, called Bitcoin a vehicle for fraudsters. Jamie Dimon, CEO of JP Morgan, called it a fraud that will blow up. Despite this criticism, the market displayed that it had properties to turn into an asset class and some institutions were faster figuring this out than others.

The first steps toward institutional adoption

One of the pioneers is asset manager Fidelity, the firm started to research digital assets and blockchain technology as early as 2014. In 2015, its charity arm Fidelity Charitable, accepted its first Bitcoin donation and started to engage increasingly more in the space. In 2018, the firm announced Fidelity Digital Assets, an institutional custody and trading platform for digital assets. In 2022, the institution also enabled Ethereum capabilities such as trading and storage and this was subsequently followed by Fidelity Crypto, a new service that offers cryptocurrency trading for individual investors.

After a while, we saw other institutions follow the first steps of Fidelity. In February 2019, Virginia's Fairfax County's Retirement Systems (FCRS) made history as the first U.S. pension fund to invest $21 million of its retirement holdings in cryptocurrency assets. We also witnessed Harvard University's investment arm, managing $38.3 billion in assets, making its initial foray into digital assets with a $12 million investment. Though relatively small, this move signified that institutional investors were still closely monitoring the space.

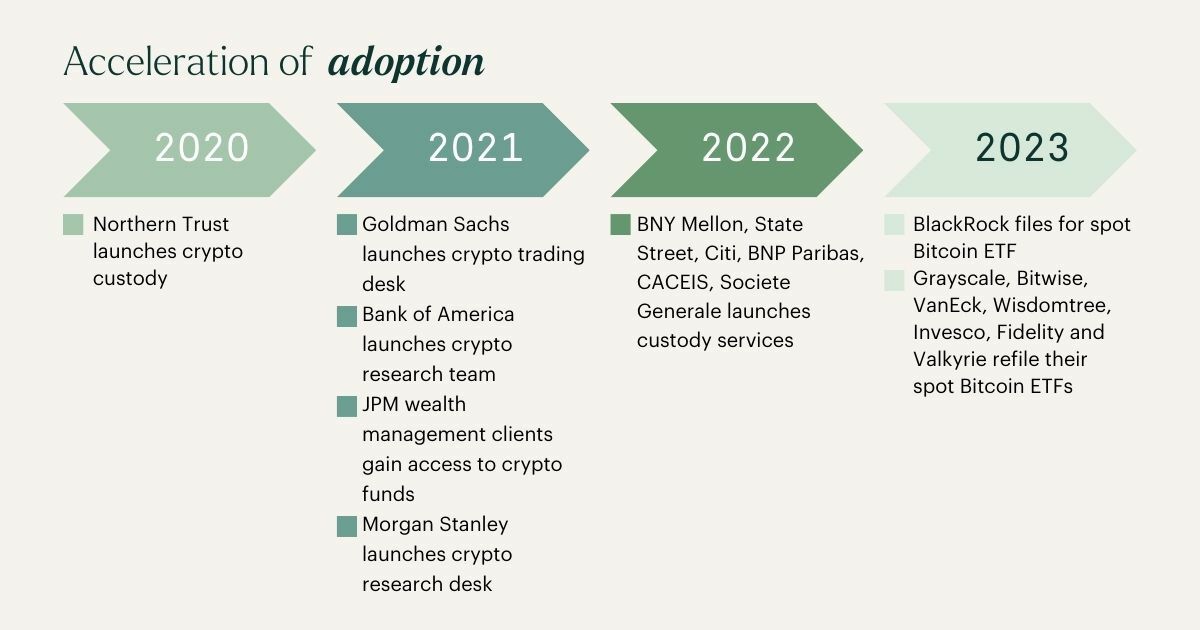

Acceleration of adoption

In recent years, we have seen the adoption rate accelerate as more traditional banks started to offer custodial services, showing their determination not to lag behind. In 2022, prominent banks such as State Street, Citigroup, BNP Paribas and Bank of New York Mellon (BNY Mellon) joined the trend by providing custodial services. BNY Mellon, world’s largest custodian bank and securities services company, disclosed in their survey that nearly all institutional investors (91%) are interested in investing in tokenized assets and 41% already incorporate cryptocurrency in their portfolio. Moreover, 15% have intentions to include digital assets in their portfolios over the next two to five years.

As the survey of BNY Mellon illustrated, there has been an increase in institutional investors holding cryptocurrency and more are looking into their options. Due to this increase, it's not a surprise that more financial institutions are developing investment vehicles for digital assets. Firstly, it allows them to tap into more capital and secondly, institutional investors are bound to stricter regulations which require them to invest through regulated channels, such as the stock exchange.

In 2023, BlackRock, the world’s largest asset manager and exchange-traded funds (ETF) provider, announced that they were filing an application for a Bitcoin spot ETF. Although they weren’t the first institution to seek the holy grail of investing, it does mark a significant milestone. Prior to BlackRocks application, various digital asset managers, such as Grayscale, and traditional asset managers, such as Fidelity, filed for application but these applications were declined.

The significance of BlackRock lies in the prestige of the firm but also in that it acts as a gatekeeper of capital. With almost ~$10 trillion in assets under management and widespread influence in financial markets, a Bitcoin spot ETF will lower the entry barrier massively for retail investors. Nevertheless, BlackRock Is not the only asset manager in the race for the spot ETF; Grayscale, Bitwise, VanEck, Wisdomtree, Invesco, Fidelity and Valkyrie, all have (re-)filed their applications.

How will institutional adoption move forward?

Where institutional players initially slowly started to embrace digital assets, we have seen this accelerate in recent history. For many, this started with offering custodial services to their clients. Slowly we are seeing this tide change into a broader range of products. We expect that during the upcoming years, institutions will offer more services and products to their customers, as it provides more indirect exposure to the industry. Through these products and services, firms will be able to generate additional fees such as management fees and possibly attract more investors.

However, we also believe that it will take some time for the industry to mature before these institutions will invest and\or acquire digital assets for direct exposure. This is also due to the current regulatory uncertainty regarding digital assets and the stricter regulations for assets on balance sheets for institutional investors.

Digital assets are still, in financial market terms, a young asset class and institutions will stay on the sidelines until, in their eyes, the industry has proven itself. But as more investors enter the market and more individuals ask their financial institutions if they offer digital assets services, they will be forced into action to retain their clients. Although Jamie Dimon is still a critic of the market, the two US investments are exploring the industry as Goldman Sachs and JP Morgan are experimenting with custodian services.

Traditional financial institutions and digital assets experienced their first glimpse of a possible integration as the first deadlines of Bitcoin spot ETFs closed in. On the 13th, the Securities and Exchange Commission requested an extension for their decision regarding the application of Ark Invest, which pushes the final deadline to as late as March 2024. Currently all applications are awaiting approval of the SEC. Till then we will need to patiently wait for traditional institutions to enter the market on their own accord.

Sign up for our newsletter to stay on top of the crypto market.