Investment Thesis: Lending & Borrowing

- What is Lending & Borrowing?

- Why is Lending & Borrowing important?

- Why should Lending & Borrowing be a part of a portfolio?

- Interesting Lending & Borrowing Projects

- Hodl's Takeaways

The digital assets industry encompasses diverse sectors, each presenting unique strengths and investment potential. The strategic allocation of capital across these sectors can define the difference between a well-diversified portfolio generating positive returns and a concentrated one overly reliant on specific sectors. In this series, we aim to highlight interesting sectors within the industry and delve into why the Hodl Funds chose to invest in them. Among these sectors lies a significant sub-sector of Decentralized Finance (DeFi): Lending & Borrowing.

What is Lending & Borrowing?

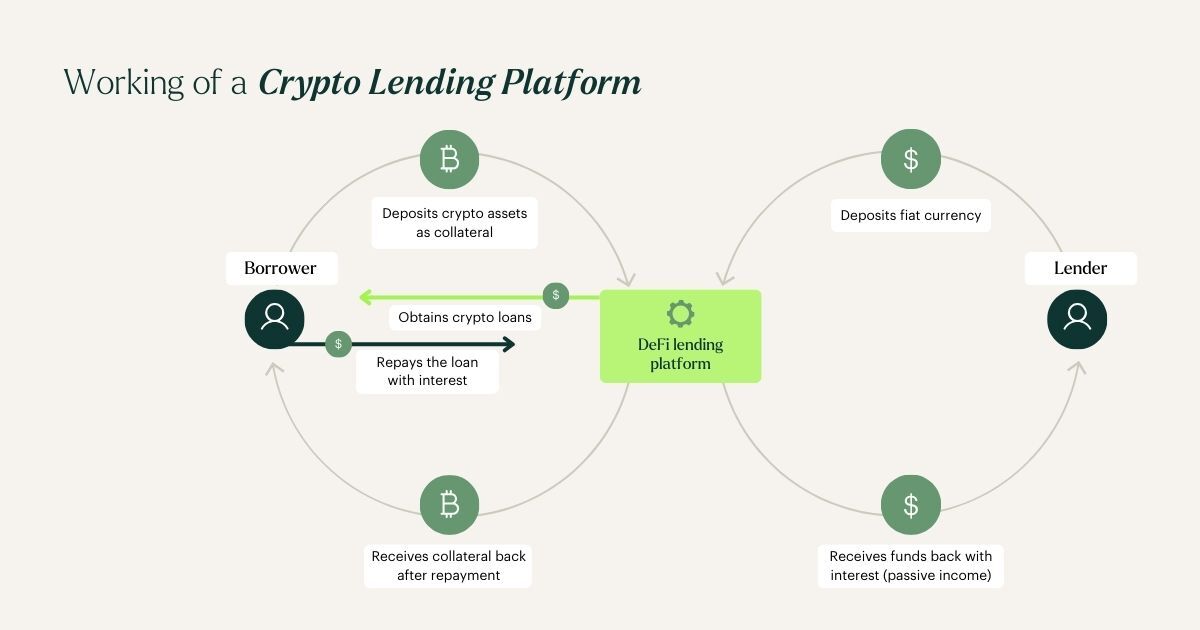

With the emergence of DeFi, one of the first instruments developed was Lending & Borrowing. Initially, this instrument was relatively straightforward, enabling users solely to borrow from one another. Given the decentralized nature of the industry, obtaining a loan requires users to provide collateral, typically fully or over-collateralized. Over time, these instruments grew in complexity, enabling borrowing against a broader range of tokens across DeFi platforms, even with lower rates of collateralization. This further evolved into a sector that facilitates traditional organizations' access to liquidity within the digital assets industry. Currently, it stands as one of DeFi's most important sectors and serves as a crucial barometer of the market's overall health.

Why is Lending & Borrowing important?

Lending & Borrowing is an important sector as it acts as a capital market for traders, investors and projects, allowing them to tap into liquidity or generate yield. Furthermore, over the past four years, the sector has transformed from focusing solely on the digital assets industry to bringing “real-world assets” to the market. These real-world assets include investing in US Treasury bills, essentially lending money to the US Government. Other protocols are exploring other options such as lending capital to organizations that operate outside the digital assets industry. As a result, these projects are generating revenue streams that operate outside the digital assets industry, creating sustainable returns for themselves and their users. To read more about real-world asset narratives, click the button below.

Furthermore, as the digital assets industry continues to grow in users and more institutions explore the space, the expectations are that more capital will shift to the market. Users and institutions will search for opportunities to put their capital effectively to work and we expect that the lending industry will prove interesting for many.

Why should Lending & Borrowing be a part of a portfolio?

A well-diversified portfolio is crucial for sustained returns, and within digital assets, DeFi stands as a vital component. However, DeFi is incredibly diverse, making it challenging to categorize as a single sector. Nevertheless, at its core, the Lending & Borrowing sector acts as the beating heart of DeFi. This sector is evolving, influenced by the narrative around real-world assets, ushering in a new era for generating yield in the digital assets industry. Given its crucial role in DeFi, ongoing evolution, and the potential influx of new capital, we strongly believe that a digital assets portfolio should have an allocation in the Lending & Borrowing sector.

As depicted in the illustration, the lending sector underwent substantial growth from 2021 to mid-2022, surging from a total value locked (TVL) of approximately $4 billion to over $50 billion. However, the crypto winter took a toll on the lending sector, causing liquidity to exit the market, and its TVL plummeted to around $10 billion. At the beginning of 2024, the TVL has rebounded to approximately $23 billion, signaling a resurgence of liquidity in the industry. As the crypto industry continues its recovery, potentially entering a new bull market, the lending sector is poised to reassume a pivotal role. Users, in search of additional capital and higher returns, are likely to turn to the lending sector once again. As of March 2024, TVL has surpassed $35 billion.

Interesting Lending & Borrowing Projects

The sector consists of hundreds of different projects each have its business models and focus points. One interesting project that has a specific niche is Maple Finance, a capital market that focuses on exclusively serving institutional and individual accredited investors. As aforementioned, the market is expected to grow in users and institutions, these institutions will need a capital market with high-level standards. Maple Finance aims to close this bridge by providing a platform through which these institutions can access the liquidity of the digital assets industry. To read more about Maple Finance, read our extensive report which dives deeper into the platform and its $MPL token.

Another interesting project is GoldFinch, which focuses on providing capital to real businesses globally. The platform introduced several lending pools, such as the Africa Innovation Pool, designed to support leading fintech firms in Africa. This represents a significant advancement, enabling emerging markets to access global liquidity beyond the traditional financial markets. Currently, GoldFinch manages a total of $83.33 million in active loans, with $48.92 million already repaid.

Hodl's Takeaways

Despite being one of DeFi's oldest sectors, Lending & Borrowing remains a fundamental cornerstone of the industry. Over the past four years, this sector has undergone significant evolution, now facilitating the integration of real-world assets and sustainable yield within the digital asset landscape. Moreover, it is a gateway for traditional financial institutions to access liquidity within the digital assets industry, bridging the gap between traditional finance and DeFi. This symbiotic relationship augments the sector's relevance and potential for exponential growth. For these compelling reasons, we believe that Lending & Borrowing will continue to hold a crucial role in digital assets portfolios.

The main lesson here underscores the importance of diversifying digital asset holdings to harness the industry's overall growth, steering clear of overexposure that may lead to substantial fluctuations in portfolio value. However, creating a well-diversified portfolio requires research and deep knowledge of the industry. At Hodl, we believe that every modern portfolio should have an allocation to digital assets and through regulated investment funds, we aim to aid professional investors in achieving this. Curious about what digital assets can bring to your portfolio? Book an appointment to discuss the possibilities.

Sign up for our newsletter to stay on top of the crypto market.