Market update: December

- Federal Reserve forecast interest cuts in 2024

- New euro-pegged stablecoins entering the market

- Industry experiences widespread hack

- Hodl Ventures - European Blockchain Convention

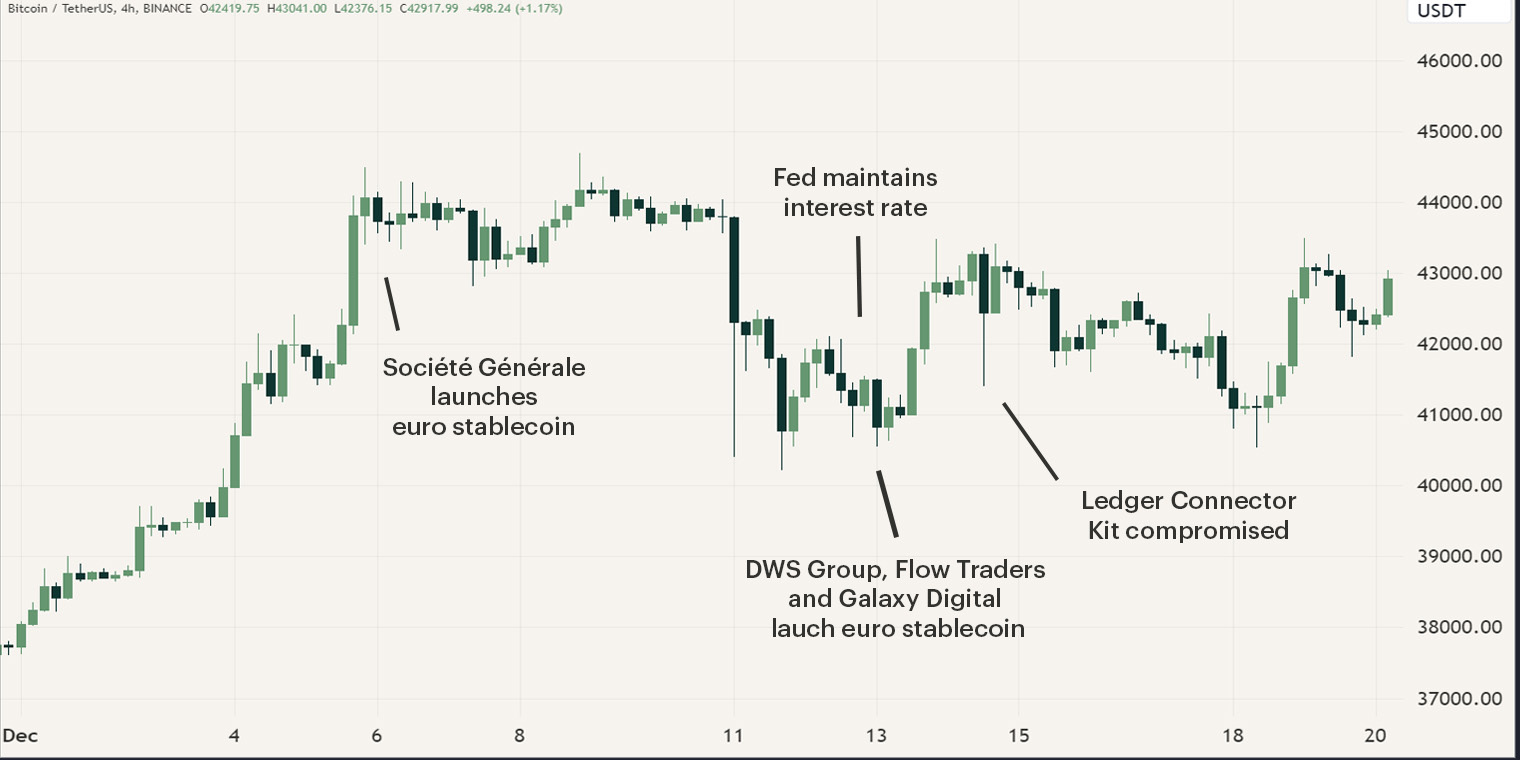

During the first two weeks of December, although Bitcoin experienced high levels of volatility, fluctuating between $37,600 and $44,700, the industry was quite uneventful. The most noteworthy news was the latest Federal Open Markets Committee (FOMC) in which the Federal Reserve (FED) decided to maintain the current and publish their latest dot plot for 2024 and the years to come.

Furthermore, the digital assets industry witnessed the French bank Société Générale launch its euro-pegged stablecoin and its first green bond on Ethereum. This news was later followed by the announcement of another euro-pegged stablecoin by a collaboration of DWS Group, Flowtraders and Galaxy Digital. Additionally, the industry experienced a widescale hack which caused multiple frontends of projects to be compromised.

Federal Reserve forecast interest cuts in 2024

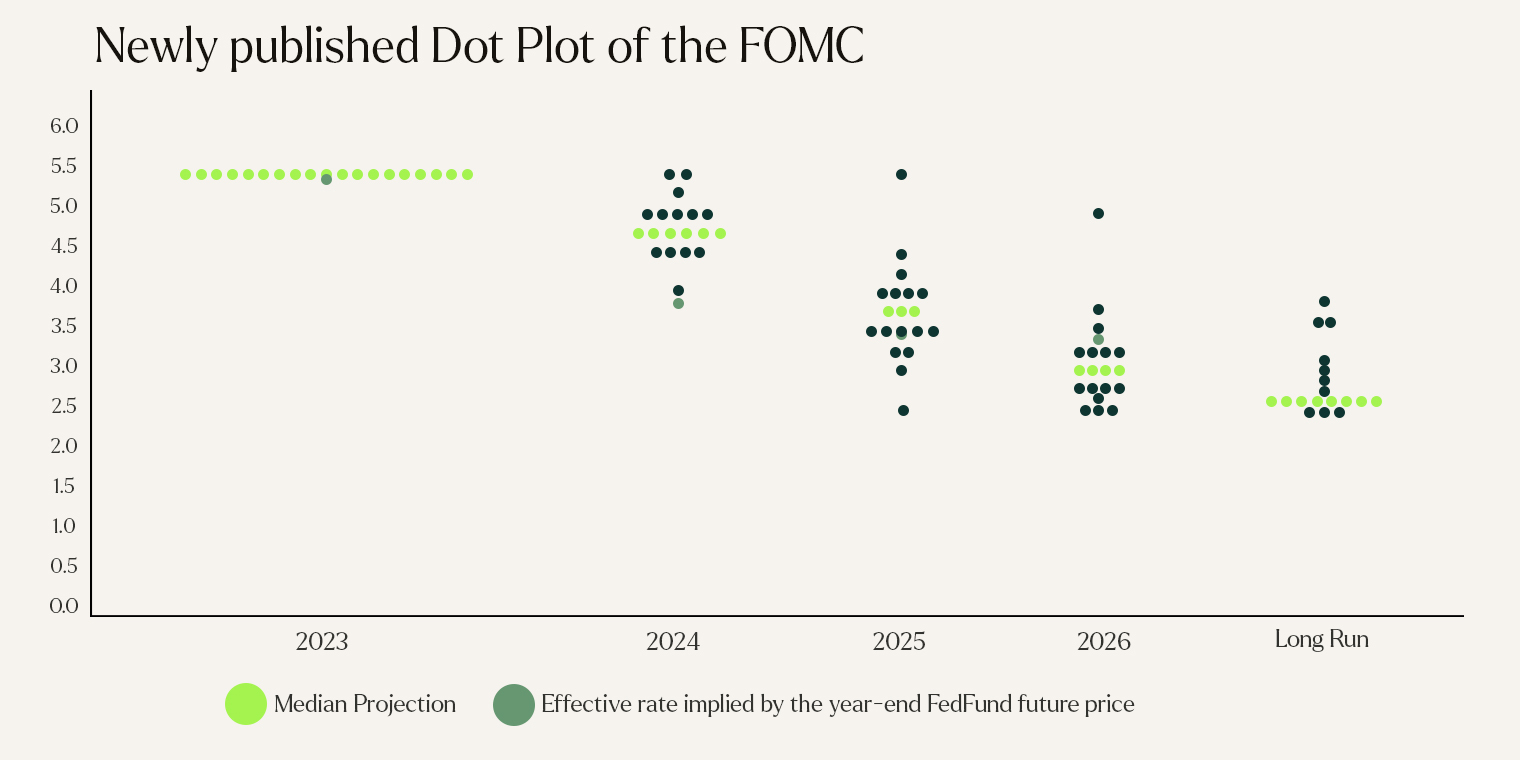

On the 13th of December, the FED decided to maintain the current interest rate at 5.50%, marking over six months of stability. But there is light at the end of the tunnel as the latest dot plot states FOMC participants anticipate rate cuts in 2024. The median projection suggests multiple cuts to 4.75%, decreasing the rate by 75 basis points. Financial markets positively received this news as the S&P 500 and Nasdaq jumped by 1.37% and 1.23%, respectively. Conversely, the US dollar index experienced a 1.47% decline, losing appeal as a currency to hold onto.

Interest rate traders currently anticipate a 25 basis point cut on March 20th, signaling the end of one of the most aggressive hiking campaigns. As a result, borrowing costs decrease and money becomes more affordable. This will likely allow investors to reposition themselves in financial markets, adopting a more risk-on strategy. Consequently, these cuts will shift more capital and investors into the digital assets market. This effect was immediately observed as Bitcoin surged by 4.26% upon the Fed’s statement.

New euro-pegged stablecoins entering the market

On the 6th of December, news broke that Société Générale, France's third-largest bank, debuted trading of its stablecoin, EUR CoinVertible on Luxembourg exchange Bitstamp. The French bank is making significant strides in the industry as the firm launched its first digital green bond on Ethereum in December. Furthermore, the investment firm that acquired the bond, Axa Investment Managers, used the new euro-stablecoin, marking its first institutional transaction.

On the 13th of December, asset manager DWS Group followed the news when it announced the intended formation of a new company called AllUnity, together with Flowtraders, a Dutch market maker, and Galaxy Digital, a digital asset investment firm, to issue a euro-pegged stablecoin. In the upcoming months, AllUnity will initiate the process of applying for an E-money license with BaFin, Germany’s financial supervisory authority. According to the parties involved, the goal is to launch the stablecoin in 12 - 18 months.

Currently, around 90% of all stablecoins are tied to the dollar and are predominantly issued by two major players, Tether (USDT) and Circle (USDC). The emergence of new competitors could bring about healthy competition, fostering progress in the industry and mitigating the risks associated with single-point-of-failure scenarios.

Industry experiences widespread hack

On December 14th, the industry was rattled by breaking news revealing that a commonly used decentralized application (Dapp) connector known as the Ledger Connector Kit had been infected with malicious code. The hacker achieved this by phishing scamming a former employee of Ledger, who unfortunately still had access to the Ledger system. The exploit allowed a bad actor to drain wallets if a user interacted with a Dapp utilizing this connector.

Although the issue was resolved within a couple of hours, several well-known Dapps, including Sushiswap, were compromised. The hacker stole ~$500K worth of digital assets, although this is unfortunate, this attack was incredibly widespread, so, the damage is relatively speaking incredibly low.

It's worth noting that the Hodl Funds remained unaffected by this malicious code. As we have stated various times, our Hodl Funds rely on the Ledger Vault for security. The Ledger connector kit and Ledger Vault aren’t products that are inherently linked, so our security remains intact. Furthermore, our team of research analysts monitor these kinds of unfolding events and are quickly aware of these situations. While we occasionally utilize these Dapps, we conduct thorough checks to ensure the absence of ongoing issues before engaging with them.

Hodl Ventures - European Blockchain Convention

In November, various team members of Hodl attended and spoke in panels at the leading digital assets event in Europe, the European Blockchain Convention. One of the panel speakers was our Head of Ventures, Anton Shakur, who delved into the latest developments in the cryptocurrency Venture Capital sector and most importantly, when will VC capital return to the industry. You can watch the recording of the panel below.

Sign up for our newsletter to stay on top of the crypto market.