Market update: January

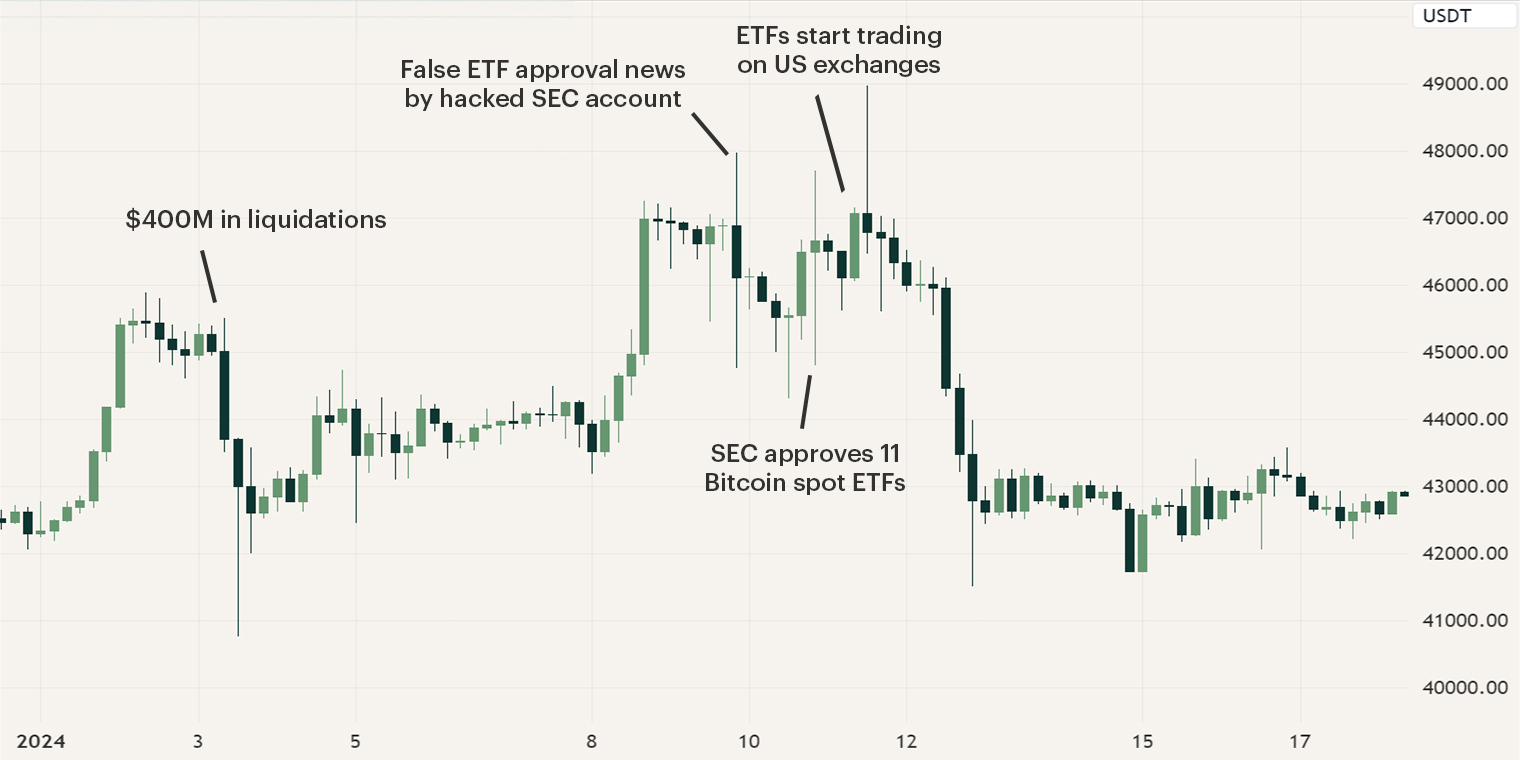

During the first two weeks of January, Bitcoin experienced a hectic period as various developments unfolded. The month started with a sharp correction as $400M of capital was liquidated in a few hours, causing Bitcoin to drop from $45,500 to $40,750. However, Bitcoin swiftly recovered as the final deadline for the Bitcoin spot exchange-traded funds (ETFs) closed in.

On the 9th of January, the SEC X account published a statement that all Bitcoin spot ETFs were approved, which was later refuted as the account was compromised. This again increased volatility. However, the day after, Bitcoin experienced its moment in the sun as eleven spot ETFs were approved, causing Bitcoin to surge toward $49,000, before dropping to $42,000 as the hype around the ETF weakened.

Stamp of approval

On the 1st of July 2013, founders of the Gemini exchange Cameron and Tyler Winklevoss filed for the first Bitcoin spot ETF but it would take ten years before this instrument would become reality. During those ten years, various asset managers such as Skybridge, Fidelity, Bitwise and Grayscale applied for the ETF but the Sec rejected all applications until now. Ark Investments would be the first asset manager in 2023 to try it again, but many market observers gave a low chance of success. However, this narrative changed when BlackRock, the world’s largest asset manager, entered the race, which generated interest among several asset managers, causing an influx of ETF applications.

Still, many remained skeptical about approval as the SEC countered these applications by stating that the market is prone to price manipulation. Then in August, digital asset manager Grayscale won its legal dispute against the SEC, the US court stated that the agency denied Grayscale applications on the wrong grounds, increasing the chance of approval.

Throughout the year, the SEC pushed its verdict to the next possible deadline, ultimately pushing it to the final deadline of January 10th, 2024. As the date closed in, market observers gave the applications a fair chance of approval and Bloomberg ETF analysts gave a 90% chance of approval.

As the market entered 2024, all eyes were focused on the SEC. On the 9th of January, the X account of the SEC published a statement that all applications were approved. This caused Bitcoin’s price to increase to $47,900. However, shortly after the tweet, Gary Gensler, Chairman of the SEC, stated on X that the SEC account was compromised and that no ETFs had been approved. This caused Bitcoin’s price to correct just below $45,000 before consolidating once again.

Then the decisive day came at last, on Wednesday, January 10th the SEC published the statement that eleven Bitcoin spot ETFs have been approved and will be allowed trading on January 11th. Ten years after its first filing, Bitcoin will be traded on traditional exchanges allowing retail and institutional investors to access the digital asset through mainstream methods.

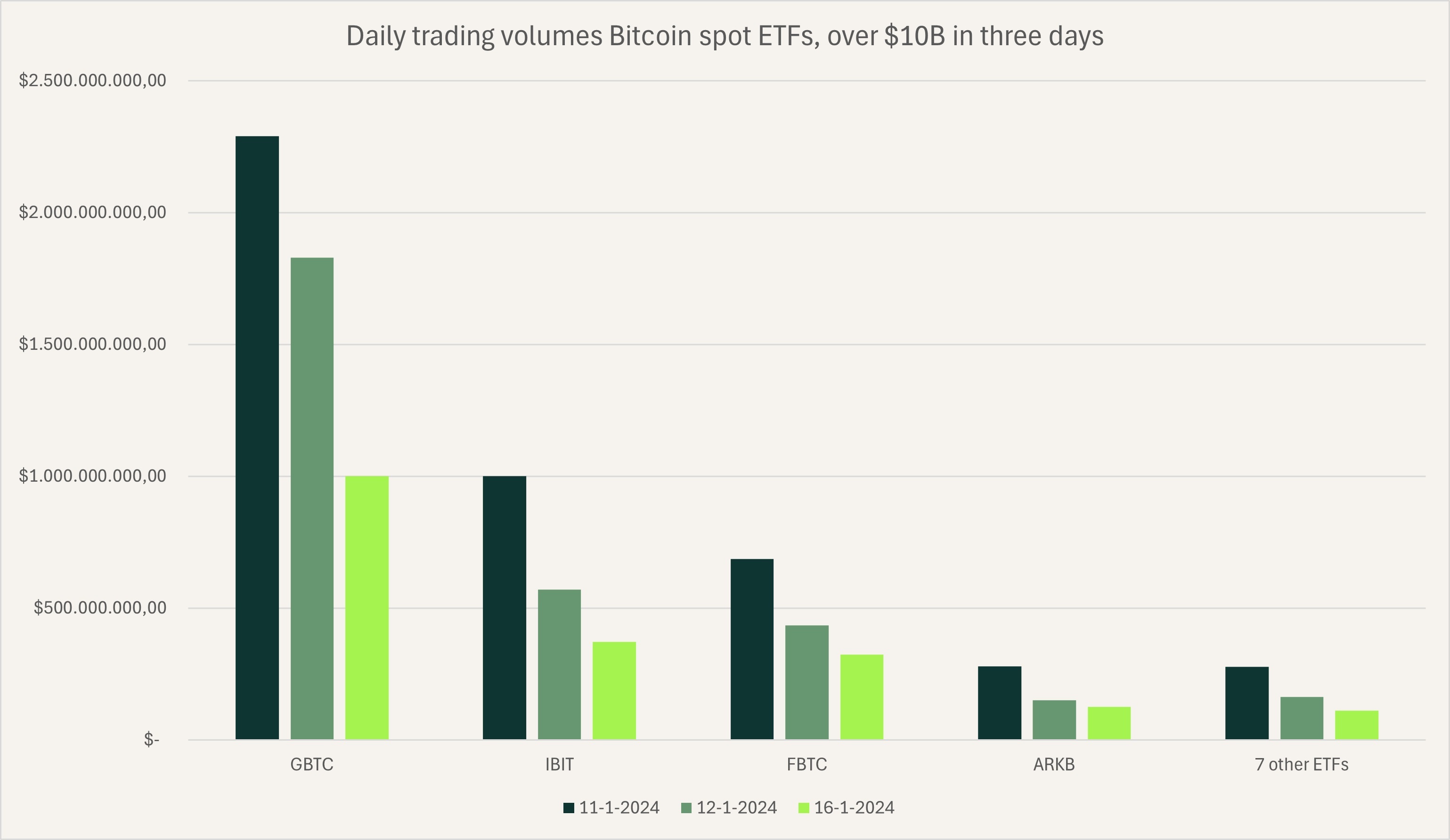

Investors and traders closely watched the ETFs as they started trading and as the trading day ended many deemed it a great success. The ETFs amassed a total trading volume of over $4.5B with over 700,000 trades. Grayscale’s ETF (GBTC) led the pack with over $2.3B volume, the largest ever first-day turnover for an ETF, followed by BlackRock (IBIT) with over $1B volume. Its success was also not only destined for the first day as it ended its second day with a total trading volume of $3.15B.

This is arguably the biggest moment in Bitcoin history and we expect that the long-term impact of these investment vehicles will be immense. Although the current assets under management in these ETFs aren’t significant yet, we expect that during the year we will see larger inflows into the industry. Furthermore, this approval paves the way for other potential digital assets ETFs such as Ethereum, whose first final deadline is set for May.

Liquidation wave hits the market

On the 3rd of January, the market experienced a sharp correction as $400M was liquidated, pushing Bitcoin’s price towards $40,750. Although it's difficult to pinpoint the exact reason behind the liquidation cascade, many think the cause was an article published by Matrixport, one of the world's largest digital assets platforms. In the report, a Matrixport analyst stated that he expects that all Bitcoin spot ETF applications will be denied and will start trading only in the second half of 2024.

This negative article was published when the market was relatively tense due to the potential ETF approval. As the report began to circulate, some traders and investors started to panic sell which caused a snowball effect of liquidations. Altcoins were hit the hardest as some assets such as Arbitrum dropped by 30% in a few hours.

However, after the initial liquidation wave, traders and investors acquired these assets at lower price levels as the majority of market participants still believed in a potential approval. However, most altcoins haven’t fully recovered to their pre-crash values.

Sign up for our newsletter to stay on top of the crypto market.