Market update: June

- Market volatility amidst turbulent developments

- Atomic Wallet hacked for $100 million

- SEC targets leading exchanges

- Market focus shifts to CPI figures and interest rates

- Introduction to the Hodl Team

Market volatility amidst turbulent developments

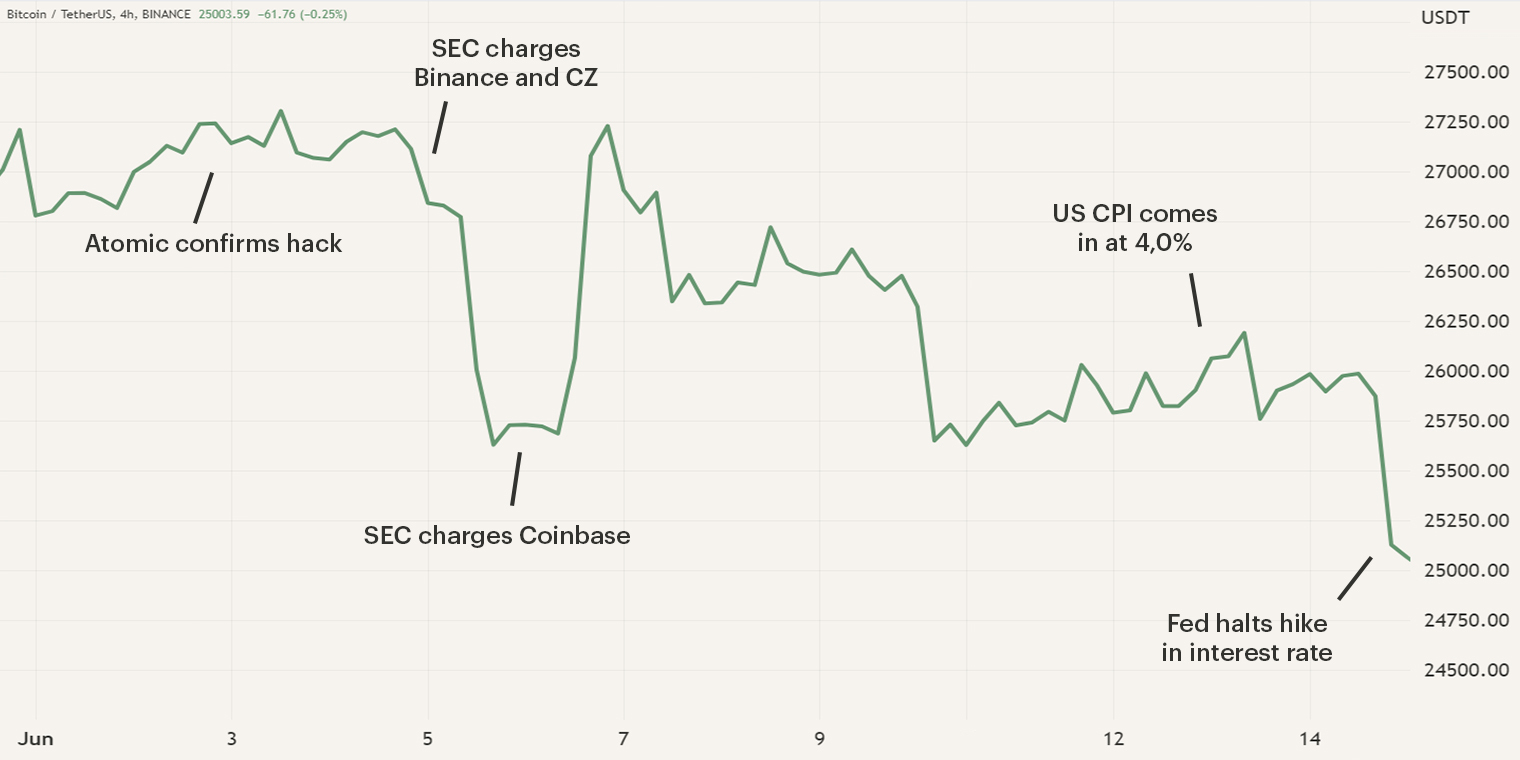

The first two weeks of June witnessed several noteworthy events, with a particular focus on regulatory developments in the U.S. market. The Securities and Exchange Commission (SEC) filed charges against the two largest cryptocurrency exchanges Binance and Coinbase. This caught significant attention to the market and led to a sharp market correction. At the beginning of the month, Bitcoin was trading slightly above $27,000, but as June progressed, the digital asset dropped to approximately $25,600. Bitcoin and Ethereum experienced relatively minor declines of 3% and 5% respectively. In contrast, altcoins such as Cardano (ADA) and Solana (SOL) suffered the most, with both losing 24% within a mere 24-hour period.

Another trigger event for the market to move was wallet provider Atomic, which fell victim to a hack. Nearly $100 million from its users was stolen. Similar to previous months, market participants closely followed the release of the latest U.S. Consumer Price Index (CPI) figures and the announcement of new interest rates.

Atomic Wallet hacked for $100 million

On the 3rd of June, Atomic Wallet confirmed that the organization had experienced a hack, resulting in the theft of clients' funds. Atomic Wallet stated that less than 1% of its monthly active users were affected, but still approximately $100 million worth of digital assets were stolen. Among the compromised users, it was discovered that the five largest wallets accounted for $17 million of the total losses. The investigation into the root cause of the hack is still ongoing, as the firm seeks to determine how the hackers gained access to the wallets. Notably, most of the stolen funds have been traced to Sindbad.io, a cryptocurrency mixer that obscures the transaction history of the assets, thus complicating recovery efforts.

In a blog post, Elliptic, a blockchain intelligence firm, suggested that the attack was likely orchestrated by the Lazarus Group, an infamous hacking group associated with North Korea. The Lazarus Group has been connected to various high-profile hacks, including the Ronin hack in March 2022, which resulted in a staggering loss of over $600 million. It is worth mentioning that last year, security audit firm Least Authority identified vulnerabilities in Atomic Wallet, particularly in its implementation of cryptography, which may have contributed to the occurrence of the hack.

SEC targets leading exchanges

On June 5th, the SEC filed 13 charges against Binance, a cryptocurrency exchange, and its founder Changpeng Zhao (CZ). These charges included operating an unregistered exchange, broker-dealers, and clearing agencies. Shortly thereafter, on June 6th, Coinbase faced a second charge of operating as an unregistered securities exchange, broker, and clearing agency. These charges have triggered significant outrage within the cryptocurrency market, as both Binance and Coinbase have been seeking regulatory clarity for years. Unfortunately, the SEC has not responded to their requests. Consequently, the number of cryptocurrencies considered securities by the SEC has now increased to 68, encompassing notable assets like Cardano (ADA), Polygon (MATIC), and Solana (SOL).

Throughout 2023, the SEC has adopted a more aggressive stance towards cryptocurrency organizations while failing to provide any regulatory clarity. Although these charges have generated negative sentiment among investors, they also present an opportunity. If the SEC and the exchanges are compelled to go to court, it could offer a chance to demonstrate that cryptocurrencies are not securities and that new regulations need to be introduced.

However, the process from filing charges to the court date may take several months or even years, and the likelihood of the SEC slowing down its current approach seems relatively low.

Consequently, we anticipate that U.S.-based organizations will seek alternative jurisdictions for relocation. The European Union, with its introduction of the Markets in Crypto Assets Regulation (MICAR) to establish regulatory clarity, and the gradual opening of doors in Asia, are becoming attractive options. Meanwhile, the United States is actively pushing cryptocurrency organizations away. Over the coming years, we expect to witness an exodus of these firms, shifting their operations to other jurisdictions who provide more clarity on regulation.

The first signs of this shift are slowly becoming apparent as Andreessen Horowitz (a16z), the Venture Capitalist giant, makes the decision to open its first office outside of the U.S. in London. The company has expressed that the U.K. government's willingness to embrace regulations that encourage entrepreneurs to explore decentralization played a crucial role in this choice. Scheduled to open later this year, the office will not only concentrate on the U.K., but also extend its focus to the European crypto and startup ecosystem. Nonetheless, it's important to note that the firm remains strongly committed to its investments in the U.S. and will continue advocating for increased regulatory clarity.

Market focus shifts to CPI figures and interest rates

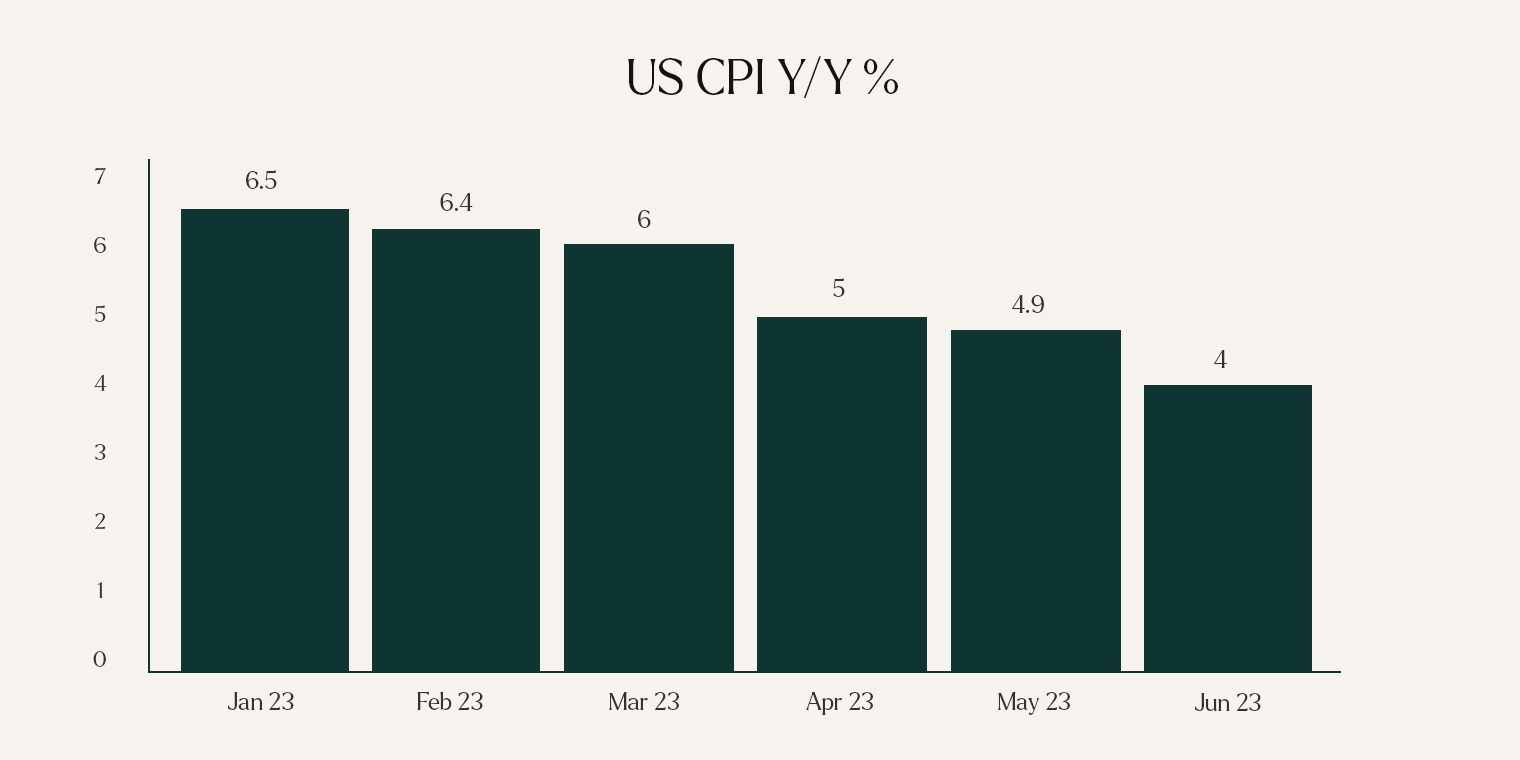

On the 13th of June, the latest Consumer Price Index (CPI) figures were published, revealing a month-over-month increase of 0.1% and a year-over-year increase of 4.0%. The Core CPI, which excludes food and energy, remained steady at 0.4%. Notable increases were observed in shelter, used cars and trucks, and personal care items during May. These current figures resemble those of April and March, indicating a cooling down of inflation.

However, it's important to note that the current inflation is calculated in comparison to the high levels of inflation from the previous year and months. While this is a step in the right direction, sustained and consistent decline in inflation is necessary to encourage a more cautious approach from the Federal Reserve (Fed). The financial markets experienced a minor relief rally as the S&P 500 reached levels not seen since April 2022. On the other hand, Bitcoin has struggled to break through the $26,000 price level, currently standing at $25,800.

Moving on to the 14th of June, the Federal Open Market Committee (FOMC) held its fourth meeting of the year and decided to keep the interest rate unchanged. This decision holds significant importance for US monetary policy, as it will determine whether inflation continues to cool down or experiences a reversal. If the latter occurs, the Fed may be compelled to raise interest rates. Surpassing the expected endpoint could lead to a downward trend in financial markets, as a soft landing may become less achievable.

Introduction to the Hodl Team

Over the past three years, Hodl has grown from a small company into a brand with an international presence. During this period, Hodl’s team has grown to a team of 25+ colleagues. All team members have a valuable contribution to Hodl, however, there are some who have made Hodl as we know it today. In the series "Introducing the Hodl Team '', we delve deeper into key team members of Hodl and the second of this series is our Chief Operating Officer and co-founder, Nick Friedrich. To read this blog, click the button below.

Read the interview with Nick Friedrich

Sign up for our newsletter to stay on top of the crypto market.