Market update: September

- The Digital Assets ETF race heats up

- Asset managers start exploring Ether-based ETFs

- London Stock Exchange Group explores blockchain technology

- JPMorgan considers blockchain technology for settlements

- FTX obtains approval to sell holdings

- Bitcoin Amsterdam - European Blockchain Convention

The Digital Assets ETF race heats up

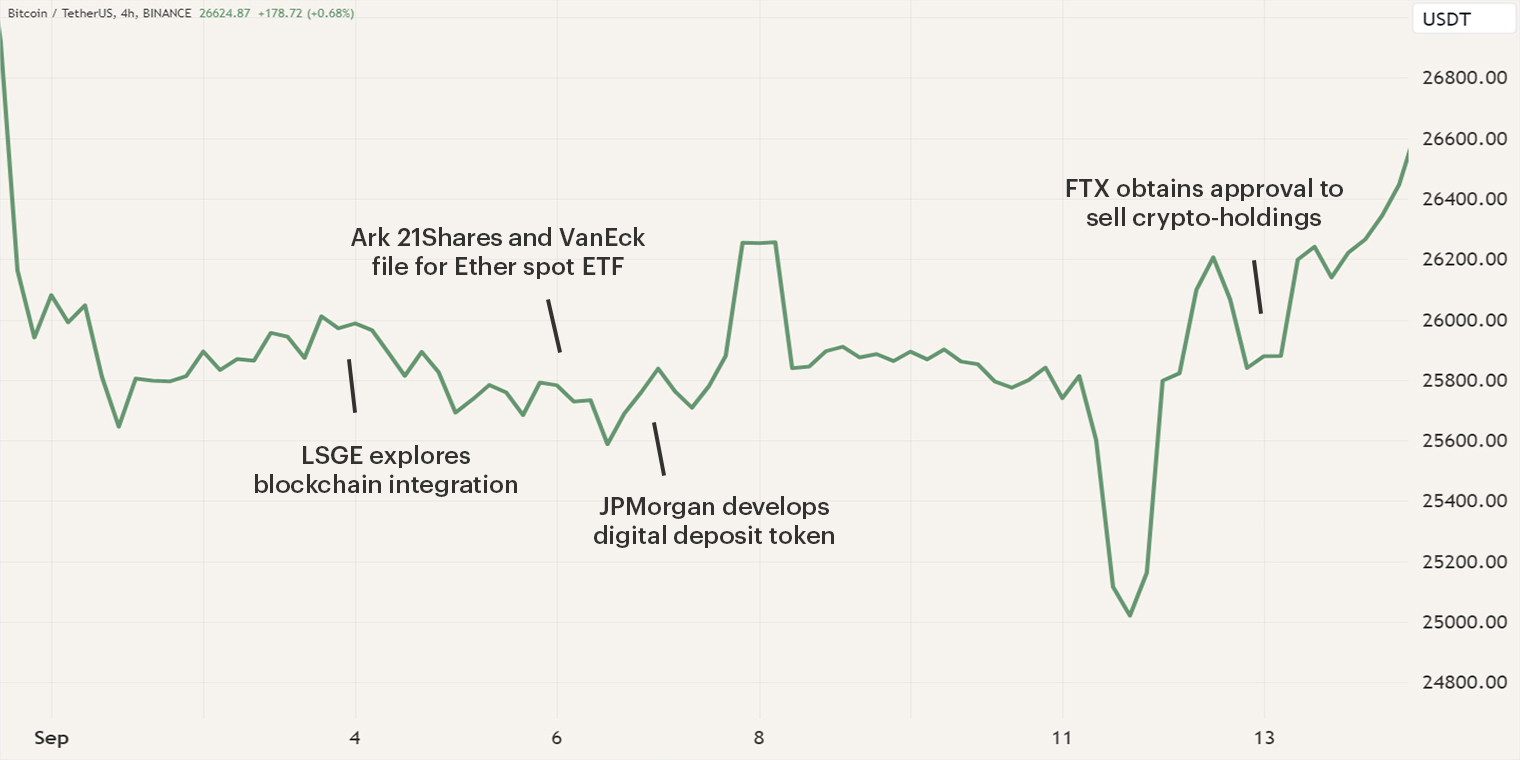

During the first two weeks of September, regulatory developments in the U.S. market again took the spotlight as the Securities and Exchange Commission (SEC) delayed its decision regarding all Bitcoin spot exchange-traded funds (ETF) applications. This pushes the applications towards the new deadline date in October. In August, market observers witnessed increasing interest among asset managers for an Ether futures ETF as the applications flooded in. This interest has taken a new form as the Chicago Board Options Exchange (CBOE) officially filed the request at the SEC to list Ark Invest, 21Shares and VanEck Spot Ether ETFs, accelerating the race between institutions for digital assets-based financial instruments. Bitcoin’s price remained relatively stable as the news broke and continued to fluctuate between $25,000 and $26,600.

Furthermore, JPMorgan is exploring the cryptocurrency space with a new blockchain-based solution for cross-border transactions. Moreover, in Europe’s financial center, the London Stock Exchange Group announced it’s looking into implementing blockchain to improve the transactions and holdings of traditional assets such as stocks.

Asset managers start exploring Ether-based ETFs

On September 6h, Ark Invest and 21 Shares jointly announced the filing of an application for an Ether spot ETF. For the past few months, the digital assets market has been captivated by the events regarding a Bitcoin spot ETF. Now, financial institutions are starting to focus on Ether-based instruments, the second-largest cryptocurrency in terms of market capitalization.

The possibility of a Bitcoin spot ETF has led other asset managers to explore new opportunities, resulting in a wave of Ether futures ETFs during August. Ark Invest and 21Shares aim to be the first to offer an Ether spot ETF. Notably, VanEck already initiated an S-1 filing as early as 2021, which signifies a company's intention to list a specific investment product on a national exchange. The filing has now progressed to the next stage, with the CBOE exchange officially submitting the documents to the SEC. Once the SEC acknowledges the filings, the agency will initiate a 240-day countdown for a final decision

We expect a growing number of financial institutions will seek to launch Ether spot ETFs, given that Ether presents distinct use cases compared to Bitcoin. Moreover, in line with what's observed in traditional markets, ETFs can take various forms and sizes. Should an Ether ETF receive approval, we expect that other digital assets with a proven track record will also see an influx of ETF applications.

London Stock Exchange Group explores blockchain technology

On September 4, the London Stock Exchange Group (LSEG) revealed its intention to explore the integration of blockchain technology. This initiative aims to establish a digital market environment facilitating the efficient raising and transfer of capital across diverse asset classes. LSEG's interest in this endeavor is not impulsive; globally, institutions in various economic zones and financial markets are gravitating towards blockchain to streamline the issuance and trading of financial assets.

In their announcement, LSEG emphasized that their focus is not centered on constructing an infrastructure centered around cryptocurrencies. Instead, they are looking into how to leverage blockchain technology to enhance the effectiveness of transactions involving traditional assets, including buying, selling, and holding.

JPMorgan considers blockchain technology for settlements

On the 7th of September, news outlet Bloomberg published an article that indicated that leading investment bank JPMorgan is developing a new blockchain-based digital deposit token. The institution has built the underlying infrastructure on which this token will operate, aiming to speed up payments and settlements. The deposit token will represent customer deposits and will be implemented for settlements between other financial institutions and trades of tokenized securities, not retail settlements. It’s important to note that JPMorgan hasn’t created the deposit token yet as this process would require the necessary approval of U.S. regulatory agencies.

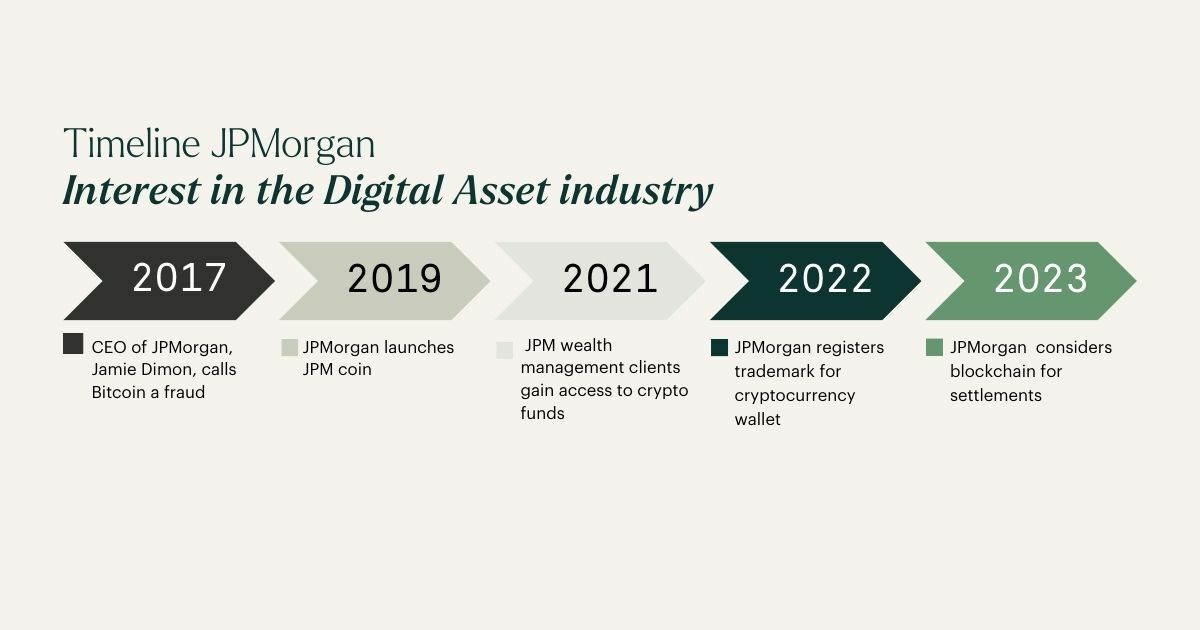

For the past 4 years, the investment bank has slowly positioned itself more in the cryptocurrency space. One of its earliest endeavors was the launch of JPM Coin in 2019, a digital asset that is being used for transactions between clients of its wholesale payments business. Since its inception, JPM Coin has processed over $300B in transactions, making it one of the most used blockchain implementations among financial institutions. However, $300B is insignificant compared to the $10 trillion JPMorgan processes daily but it remains an exciting development as the bank was first a harsh critic of the technology.

FTX obtains approval to sell holdings

On the 13th of September, collapsed cryptocurrency exchange FTX obtained approval from the U.S. Bankruptcy Court for the District of Delaware to sell $3.4B of its cryptocurrency holdings. The biggest holdings of the infamous exchange are Solana, Bitcoin and Ether, worth $1,162M, $560M and $192M, respectively. Important to note, that the exchange has a substantial holding in Solana but this holding is subjected to a vesting schedule, which will be unlocked during 2025 - 2028. Before the ruling, many market participants feared this ruling would increase the selling pressure in a market where volume has significantly decreased.

However, in August the plan of offloading was already outlined and stated that the exchange may only sell $100M worth of assets per week, this limit can be increased to $200M, only with court approval. Nevertheless, the offloading of Bitcoin, Ether, stablecoins, and the redemption of stablecoins will not count towards the $100 million weekly cap, but these holdings are insignificant compared to the total market capitalization of these assets.

Bitcoin Amsterdam - European Blockchain Convention

In the month of October, the Hodl team will be attending and speaking at leading events in the Netherlands and Europe. On the 12-13th of October, various team members will attend Bitcoin Amsterdam, the biggest Bitcoin event in the Netherlands. At the event, there will be various industry-leading speakers to talk about the development of the space and what the future might hold.

Shortly thereafter, on 25-26th of October, the Hodl team will be attending and sponsoring the European Blockchain Convention (EBC), the largest blockchain event in Europe, in Barcelona. Our CEO, Maurice Mureau, and Head of Ventures, Anton Shakur, will both be speaking at the event. Maurice is speaking about the intermingling of traditional finance with digital assets while Anton elaborates on the developments within the Venture Capital industry. For this unique event, we have a couple of free tickets for our participants who wish to join. Want to experience the leading blockchain convention in Europe up close? Let us know via [email protected].

Sign up for our newsletter to stay on top of the crypto market.