Newsletter: Recap December

- Bitcoin closes the year strong

- IMF: Taming Crypto and Unleashing Blockchain

- Digital Currency (Re)Group

- Mt. Gox starts reimbursements

- The Hodl Funds

Bitcoin closes the year strong

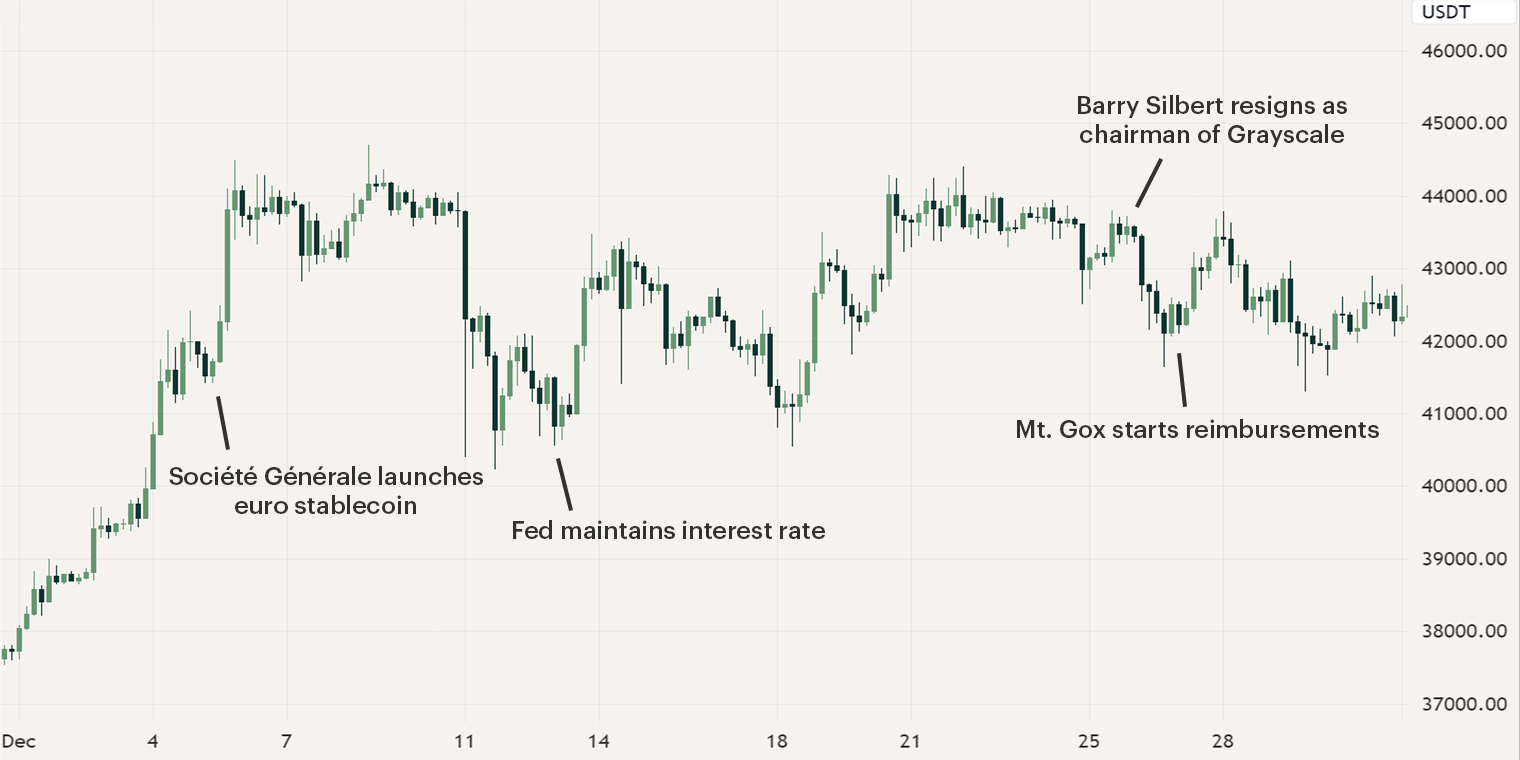

The digital assets industry experienced a quiet period in the first two weeks of December. The main highlight was the Federal Reserve's (Fed) final Federal Open Markets Committee (FOMC) meeting, which upheld the current interest rate. Alongside, the Fed released its new Dot Plot indicating a projected median interest rate of 4.75% by the end of 2024. As interest rate cuts are on the horizon, financial indexes like the S&P500 and Nasdaq experienced an upward rally. Additionally, Société Générale and AllUnity, a new company formed by DWS Group, Flowtraders, and Galaxy Digital, unveiled both their euro-denominated stablecoin during this period.

As December unraveled, Bitcoin fluctuated between the price levels of $40,200 and $44,700. The biggest story in the second half of December was the International Monetary Fund (IMF) stating its positive outlook regarding crypto assets. Furthermore, Barry Silbert, CEO and founder of Digital Currency Group (DCG), resigned as chairman from its asset management division, Grayscale, and failed cryptocurrency exchange Mt. Gox has started repaying its creditors.

IMF: Taming Crypto and Unleashing Blockchain

On December 13th, IMF Managing Director Kristalina Georgieve delivered some remarks about the industry at the MOEF-BOK-FSC-IMF International Conference on Digital Money. Georgieve started with her presentation by focusing on crypto’s past, comparing it to the American Wild West listing the negative aspects such as volatility, fraud and limited regulation and legislation.

Where her remarks were initially negative, she had positive remarks on the present and future. She began by emphasizing that crypto assets are here to stay, particularly highlighting their high adoption in emerging markets. Notably, she pointed out that the word "Bitcoin" is searched twenty times more than "health and wellness" and seven times more than "climate change." Furthermore, she stated that we should consider the effects if they become widespread. A major concern is that extensive adoption of crypto assets might jeopardize macro-financial stability. For example, raising interest rates on a fiat currency few people hold will have less impact, making central banks lose their control.

She emphasized a bright future for crypto assets but strongly advocated for governments to establish clear, consistent laws for the industry. Additionally, she stressed the urgency of developing infrastructure for these assets.

Digital Currency (Re)Group

On the 26th of December news broke that Barry Silbert, CEO of DCG, and Mark Murphy, president of DCG, will leave the board of directors of its asset management division Grayscale effective January 1st, 2024. Market participants expect that this resignation has to do with Grayscale's application to convert its Bitcoin Trust into a US spot exchange-traded fund (ETF), which is currently under revision at the Securities and Exchange Commission (SEC).

Silbert will be replaced by Mark Shifke, the current chief financial officer at Grayscale, who has a history at JPMorgan Chase and Goldman Sachs. Some market observers believe that this is a sign that the Bitcoin ETF approval is looming and that the SEC is urging to insert traditional finance leaders in place for trust and reliability.

Over the past two years, DCG under Silbert's leadership has experienced various issues from being sued for allegedly defrauding investors and owning $600M in loans to the collapsed Genesis. So, it's also possible that Silbert is trying to distance Grayscale from the negative issues that DCG is experiencing.

Mt. Gox starts reimbursements

On the 27th of December, reports began circulating that the first creditors of the collapsed exchange Mt. Gox received rehabilitation payments through PayPal. In 2014, Mt. Gox was hacked for 840.000 Bitcoin, the biggest cryptocurrency hack to date, which caused the exchange to collapse. Mt Gox was able to recover ~20% of the stolen Bitcoin and since then has been in legal dispute on how to redistribute the assets.

After years of anticipation, creditors are finally able to reclaim a portion of their lost assets. However, the process hasn't been seamless, with reports of some creditors receiving double payments. As repayments started, some investors are concerned about potential selling pressure, raising fears and uncertainties. Despite this, earlier statements from financial powerhouse UBS suggested that these repayments were unlikely to destabilize Bitcoin. So, while some selling pressure is anticipated, significant price fluctuations resulting from the Mt. Gox repayments are not expected, especially considering the prolonged timeline for repaying each creditor.

The Hodl Funds

The month of December led to an increase in the Hodl funds. The Hodl Gib Fund, the Hodl Numeri, the Hodl Algo Fund, the Hodl.nl Genesis Fund, the Hodl.nl Consensus Fund and the Hodl.nl Oracle Fund ended at an NAV of €1,482.17, €38,605.26, €1,414.43, €4.59, €4.40 and €0.47, respectively.

Sign up for our newsletter to stay on top of the cryptocurrency market.