Newsletter: Recap January

- Bitcoin enters traditional financial markets

- The impact of the spot ETFs

- Binance and Coinbase face off with the SEC

- SEC delays its Ether ETF decision

- The Hodl Funds

Bitcoin enters traditional financial markets

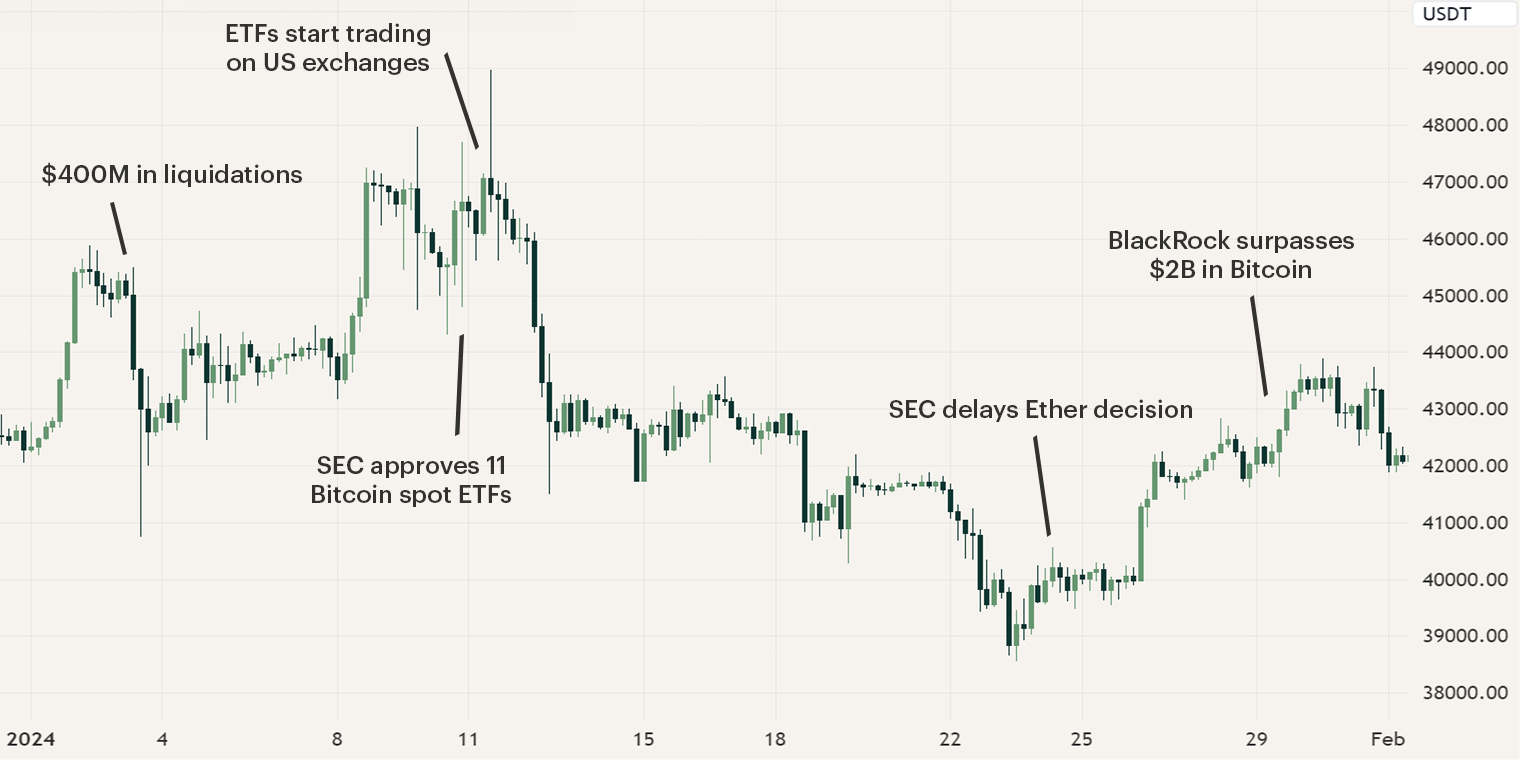

January has arguably been one of the most important months in the digital assets industry. The market underwent a rough start as a deleveraging event occurred, liquidating over $500M in a few hours. This caused Bitcoin to drop below $41,000 before rising once again to $44,000. As the final deadline of the Bitcoin spot exchange-traded fund (ETF) closed in, market tensions rose. Then on the 9th of January, the X account, formerly known as Twitter, of the Securities and Exchange Commission (SEC) stated that all Bitcoin spot ETFs were approved, this was refuted as the account was compromised. The following day the market received the decisive statement that eleven Bitcoin spot ETFs were approved and allowed to start trading the following day. You can read more about these events in the market update of January.

As the ETFs started trading, Bitcoin surged towards $49,000 where it failed to break through. This resulted in a period price decline, reaching a monthly low of $38,555 before bouncing back to above $40,000. Furthermore, leading cryptocurrency exchanges Coinbase and Binance had their days in court as the SEC continued its legal attack. Additionally, the SEC delayed its decision on various applications for the Ether spot ETF and the first Bitcoin spot ETF application in Hong Kong was filed.

The impact of the spot ETFs

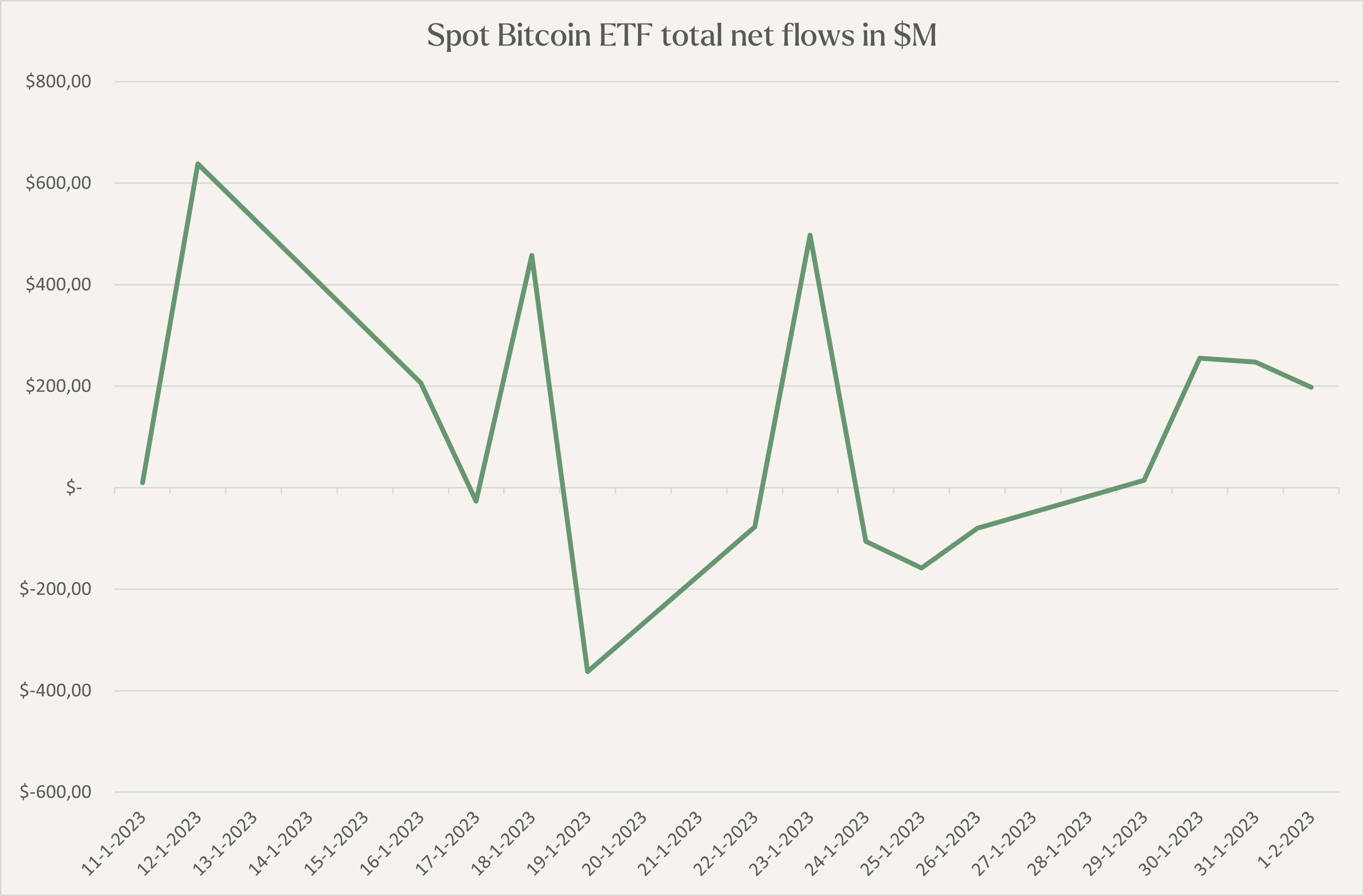

After three weeks since its first trading day, there were a couple of clear winners among the eleven Bitcoin spot ETFs. As expected, Grayscale’s ETF (GBTC) experienced the highest trading volume as it provided its investors a chance to sell after experiencing a prolonged period of being underwater. Furthermore, GBTC is by a long way the most expensive option with a 1.5% fee, compared to 0.10% - 0.25% of other competitors. As a result, GBTC has experienced significant outflows totaling around $5bn, a daily average of $500M. On a positive note, the outflows of GBTC are slowing down, resulting in lower selling pressure.

Arguably the biggest winner across the ETF providers is BlackRock, who besides Grayscale is the first to cross the $2bn mark in assets under management and has amassed $5.9bn in trading volume. Across the eleven ETF providers, the industry has mostly witnessed days of capital outflow, caused by GBTC. However, as GBTC outflows are decreasing, we expect that in the upcoming weeks, the industry will witness positive net flows.

In other news, the industry is witnessing an acceleration for Bitcoin spot ETFs in other economic zones as the first spot ETF application was filed by Harvest Global Investments in Hong Kong on the 29th of January.

Binance and Coinbase face off with the SEC

During January, leading cryptocurrency exchanges Coinbase and Binance fought against the SEC in court. In June 2023, the SEC sued Coinbase and Binance for the facilitation and trading of tokens which according to the SEC should have been registered as securities. Both exchanges are aiming to dismiss the case by providing that crypto-assets don’t meet the definition of an investment contract and therefore fall outside the scope of the SEC. Conversely, the SEC is aiming to prove that they are securities.

The estimations of approval by May vary widely. One Bloomberg ETF analyst forecasted a 70% chance of approval, while others don’t expect approval by late 2025 to early 2026. We expect that the SEC will follow a similar strategy as the Bitcoin ETF by delaying its decision until the final date. Furthermore, we think that approval by May may be on the early side, due to the undefined legal nature of Ether and the criticism Gensler, chair of the SEC, received from his party. So, we expect that a potential approval is more logical at the end of the year. However, if we witness similar trends as with Bitcoin, such as the SEC actively interacting with the offering asset managers, it may be possible to see an Ether ETF by May.

SEC delays its Ether ETF decision

On the 24th of January, the SEC announced that it delayed its decision regarding the application of BlackRock for an Ether spot ETF. The following day the agency also delayed its decision for the Grayscale Ether ETF. Currently, there are seven asset managers in the race for the financial instrument, Van Eck is the first in line with its final deadline on the 23rd of May, 2024. This could enable the second digital asset to enter the traditional financial system.

The estimations of approval by May vary widely. One Bloomberg ETF analyst forecasted a 70% chance of approval, while others don’t expect approval by late 2025 to early 2026. We expect that the SEC will follow a similar strategy as the Bitcoin ETF by delaying its decision until the final date. Furthermore, we think that approval by May may be on the early side, due to the undefined legal nature of Ether and the criticism Gensler, chair of the SEC, received from his party. So, we expect that a potential approval is more logical at the end of the year. However, if we witness similar trends as with Bitcoin, such as the SEC actively interacting with the offering asset managers, it may be possible to see an Ether ETF by May.

The Hodl Funds

The month of January led to a small decrease in the Hodl funds. The Hodl Gib Fund, the Hodl Numeri, the Hodl Algo Fund, the Hodl.nl Genesis Fund, the Hodl.nl Consensus Fund and the Hodl.nl Oracle Fund ended at an NAV of €1,469.00, €38,165.73 €1,405.76, €4.54, €4.33 and €0.47, respectively.

Sign up for our newsletter to stay on top of the cryptocurrency market.