Newsletter: Recap November

- Bitcoin remains resilient as Binance settles with US agencies

- Binance settles for $4B with the Department of Justice

- Kraken sued by the SEC

- Banco Santander and Commerzbank enter the industry

- 2024 closes in

- Hodl Funds - European Blockchain Convention

- The Hodl Funds

Bitcoin remains resilient as Binance settles with US agencies

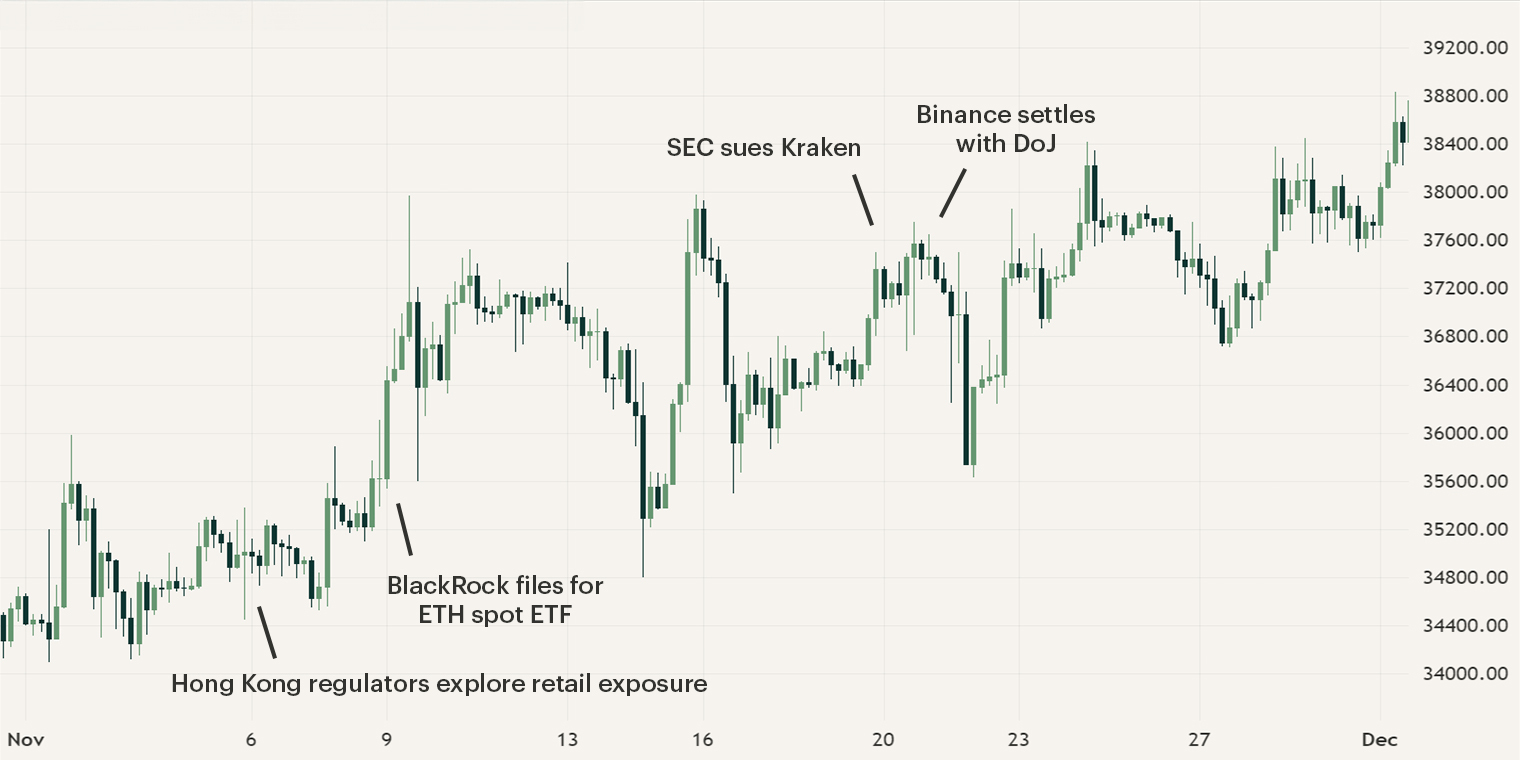

During the first two weeks of November, the industry was captured by BlackRock's initiation of an Ether exchange-traded fund (ETF), marking the registration of an iShares Ethereum Trust. Additionally, the stablecoin supply saw a notable surge, hinting at the arrival of new investors and capital. This may indicate a resurgence in market confidence, with investors placing their bets on an upward market trajectory. Apart from these developments, the first weeks of November remained relatively quiet. You can read more about these market events in our market update.

This tranquillity was followed by a very eventful second half of November. The biggest story was the settlement between cryptocurrency exchange Binance and its CEO, Changpeng Zhao (CZ), and the Department of Justice, ending a four-year probe into the firm. Furthermore, the Securities and Exchange Commission (SEC) continues its legal attack as it sues the exchange Kraken for operating as an unregistered securities exchange, broker, dealer, and clearing agency. The industry also witnessed traditional financial institutions Banco Santander and Commerzbank enter the industry by providing trading and custodial services.

Binance settles for $4B with the Department of Justice

On November 21st, the Department of Justice and the US Treasury made a significant announcement: Binance acknowledged its wrongdoing, admitting to Anti-Money Laundering breaches, Unlicensed Money Transmission, and Sanctions Violations. Changpeng Zhao (CZ), Binance's CEO and founder, pleaded guilty to a felony charge—failing to maintain an effective Anti-Money Laundering program at the crypto exchange, breaching the Bank Secrecy Act. In a resolution, the firm paid $4 billion, while CZ personally incurred a fine close to $50 million. Additionally, Binance must operate under supervision for the next three years, and CZ faces a potential 18-month jail term pending sentencing in February 2024.

The industry's reaction to the settlement was largely positive, marking the conclusion of a four-year investigation into the world's largest exchange. Throughout the investigation's duration, there was substantial uncertainty, with some anticipating the firm's potential closure. Despite the hefty fine, Binance retains the ability to continue its operations. However, the parent company, Binance, is compelled to exit the US market, while its independent subsidiary, Binance.US, retains its operational status.

The mandated supervision of Binance carries positive implications, supporting the company's international aspirations while receiving direct guidance from US regulators. Despite the global coverage of the news, it was met with negative perceptions from market observers. Nevertheless, the majority of investors and traders view this development as a positive step forward.

Kraken sued by the SEC

On the 20th of November, the SEC leveled charges against Kraken, alleging the operation as an unregistered securities exchange, broker, dealer, and clearing agency—a situation similar to Binance and Coinbase. According to the SEC, Kraken unlawfully facilitated the buying and selling of crypto asset securities since 2018, yielding hundreds of millions of dollars. Following the SEC's announcement, Kraken issued a statement countering the charges, citing grounds recently refuted in Coinbase's legal battle against the SEC.

Despite multiple occurrences of such charges throughout the year, the price of Bitcoin remained relatively stable. However, the persistent allegations—particularly regarding the sale of unregistered securities and operation as an unregistered exchange—without offering clear legal guidance on crypto-assets, appear unjustified within the industry. Notably, earlier this year, the exchange settled for $30 million with the agency concerning staking, concurrently seeking additional legal clarification.

Banco Santander and Commerzbank enter the industry

Throughout 2023, the industry has seen a surge in the integration of digital assets and blockchain technology within traditional financial institutions. In November, Santander Private Banking, the asset management arm of Banco Santander, joined this trend by announcing its plans to introduce Bitcoin and Ethereum trading and custody services for their high net-worth clients in Switzerland. As they move forward, the asset manager aims to explore potential expansions to their current offerings. However, the exact commencement date for these new services from the private bank remains undisclosed.

Simultaneously, Commerzbank, Germany’s fourth-largest bank, made a significant move by securing a crypto custody license in Germany on November 15th. This newly acquired license positions the bank to launch an extensive array of digital asset services, primarily focusing on crypto assets. As time progresses and the industry matures, we continuously witness financial firms entering the space, and with Bitcoin Halving and the first ETF deadlines looming, we expect that this trend will continue and even intensify.

2024 closes in

As we move towards 2024, two pivotal events are planned, the potential approval of the Bitcoin spot ETF in January and the Bitcoin Halving in April.

Bloomberg analysts estimate a 90% likelihood of the spot ETF being approved between January 5th and 10th, 2024. The approval of the ETF would allow institutional capital to access the market, potentially resulting in larger influxes of capital.

Historically, the Bitcoin Halving, planned for April 2024, has resulted in significant upward market movements. The reduction of inflation while demand remains equal or increases, usually resulting in a price increase, previously, over 200% within 365 days after previous Halvings.

While there are never guarantees in investing, these developments offer an extremely promising future outlook. If you are wondering if your portfolio is correctly positioned or exploring your options for digital asset investments? Feel free to schedule an appointment with one of our advisors, either online or at our office, by clicking the button below.

Hodl Funds - European Blockchain Convention

In November, various team members of Hodl attended and spoke in panels at the leading digital assets event in Europe, the European Blockchain Convention. One of the panel speakers was our CEO, Maurice Mureau, in which he delved into the latest developments concerning the Bitcoin spot ETF and its potential impact. You can watch the recording of the panel below.

The Hodl Funds

The month of November led to an increase in the Hodl funds. The Hodl Gib Fund, the Hodl Numeri, the Hodl Algo Fund, the Hodl.nl Genesis Fund, the Hodl.nl Consensus Fund, the Hodl.nl Oracle Fund and Hodl Artemis ended at an NAV of €1,233.95, €31,3861.60, €1,262.82, €3.81, €3.65, € 0.42 and €1,199.15, respectively.

Sign up for our newsletter to stay on top of the cryptocurrency market.