Newsletter: Recap 2022

- A dynamic year for the cryptocurrency market

- Economic reversal

- The collapse of Terra

- Lending institutions in trouble

- The fall of FTX

- The growth of NFTs

- The Merge

- Layer 2's become mainstream

- Regulation continues

- Bitcoin Spot ETF

- Institutions continue to explore custodial solutions

- The year of Hodl

- The performance of the Hodl funds

- The developments of the Hodl bots

- Our plans for 2023

A dynamic year for the cryptocurrency market

As 2022 has officially ended, we as Hodl wish to provide our investors with a summary of the past year and further developments within the emerging sector. 2022 can be described as a remarkable year. A year that was known for the downtrend of financial markets and a significant decline of the cryptocurrency market. Despite the bear market, we have seen a continuous increase in interest by large institutions. We witnessed, for example, the entrance of parties such as the internet service provider Google and the world’s largest asset manager, BlackRock.

Unfortunately, we have also seen the collapse of several big players, which led to losses for many professionals, individuals and projects. The list consisted of names such as Terra Luna, Celcius, Three Arrows Capital and the second-biggest cryptocurrency exchange FTX. During 2021, these organizations experienced incredible growth and perhaps grew too quickly. When the markets reversed, many found themselves overleveraged and inexperienced as they expected more future growth. We must note, the number of collapses and the associated impact had an extraordinary scale compared to previous bear markets.

2022 was also a perfect year for building, which led to promising blockchain solutions for the future. All-in-all, this has led to a very dynamic year that has made the cryptocurrency market fundamentally stronger and future-proof for a new year full of innovation.

The market reversal also provided us the chance to further develop Hodl and seek new opportunities. As our company continued to grow, so did our identity. Hodl underwent a rebranding and the company formed into the Hodl Group as we expanded into new ventures. We opened a new fund in Luxembourg and developed a new investment product in Switzerland.

In this newsletter, we want to look back at all the developments of the past year and provide our outlook for 2023.

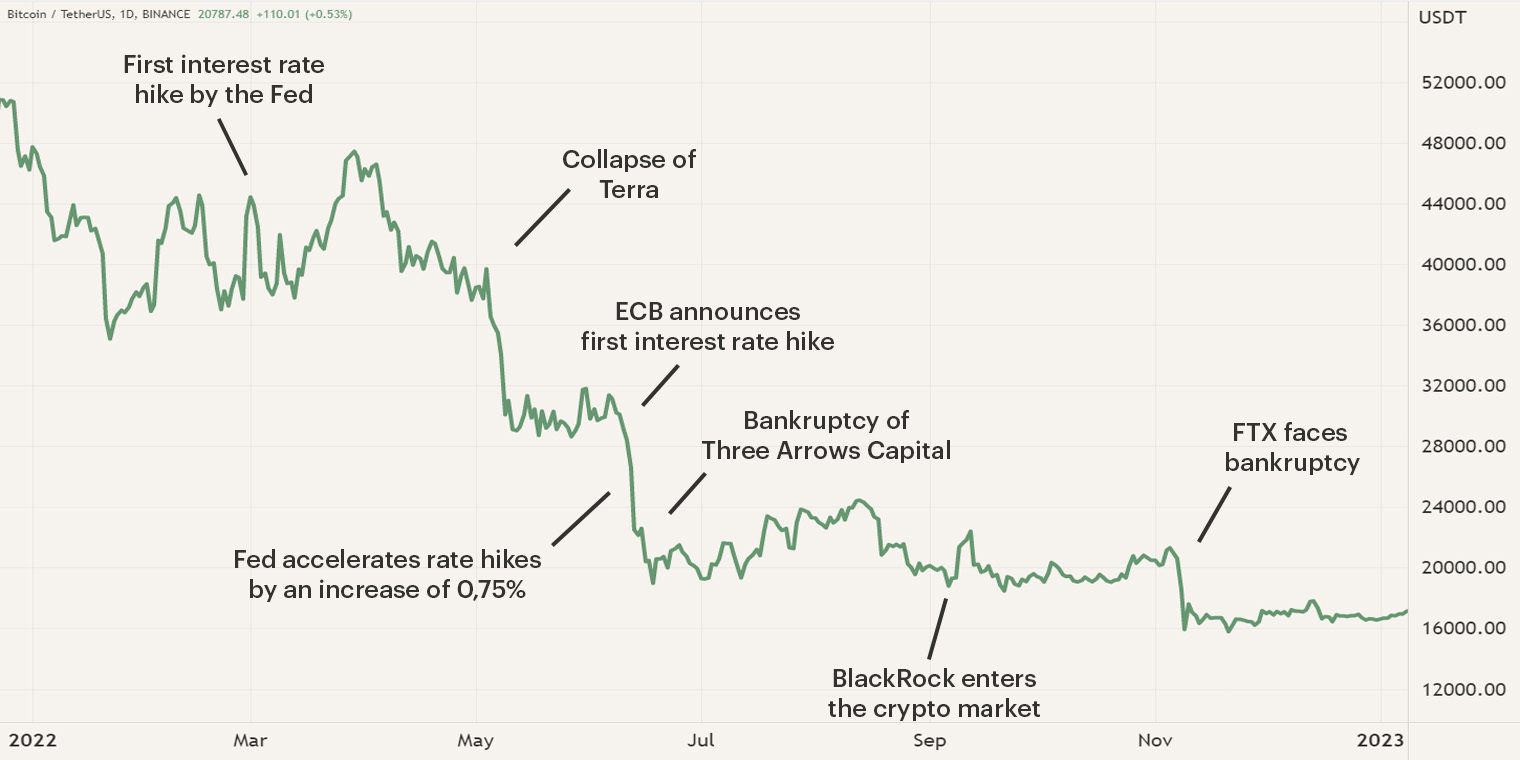

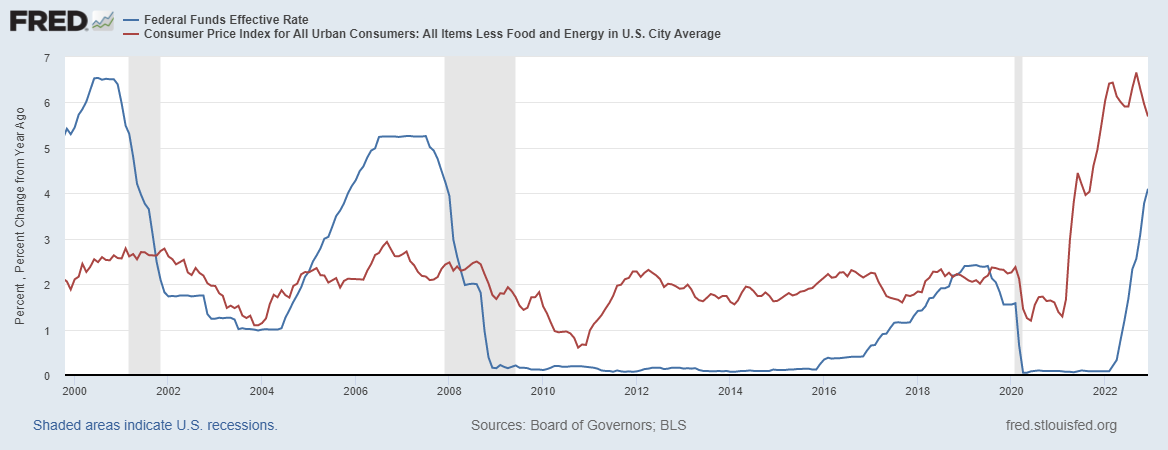

Economic reversal

2022 has been demanding for all financial markets as bonds, stocks and cryptocurrency all performed negatively. The first signs of market reversal were observed in the autumn of 2021, the period in which inflation across various economic zones such as the U.S. and Europe surpassed the 2% threshold. For the first time since March 2020, financial markets cooled down from their continuous rise. In 2022, the strong upwards movement was replaced with a downward trajectory. As inflation continued to rise, central banks around the world were forced into hawkish actions.

The world's most powerful central bank, the United States Federal Reserve (Fed) embarked on one of its most aggressive tightening campaigns ever, raising interest rates by 4.5% in just nine months. This strengthened the US dollar's position against other currencies. The aggressive rate hike and later balance sheet tightening had a particularly solid impact on riskier investments such as cryptocurrencies and tech stocks. Consequently, we saw a large portion opt for the dollar as a safe haven.

In late 2022, we saw inflation begin to reverse somewhat. Although it seems to be declining, it is still on the high side. The Fed has indicated it is looking at all the month-to-month data to see if it can switch to a more lenient policy. For now, interest rate hikes continue through 2023, although at a slower pace. According to the Fed's Dot Plot, the first time the yield curve will be able to be watched is in 2024. As a result, there will continue to be pressure on the financial market in 2023.

At Hodl, we expect financial markets to have a difficult time adjusting to the new economic conditions in 2023. Inflation is likely to remain high for an extended period, as many expect the energy crisis and food price inflation to persist. Both are caused by rising commodity prices and the war in Ukraine. In 2023, these will be the biggest drivers of inflation. With higher inflation, commodity prices and interest rates, we expect government budgets and economic growth to contract and a mild recession to be on the horizon.

As a result of deteriorating market conditions and rising corporate operating costs, equities will struggle. Sales and profits will decline, resulting in a decline in stock prices. Due to their defensive nature, bonds may be affected to a lesser extent, but further rising interest rates will negatively affect the prices of existing bonds. The value of existing bonds will fall as the coupon yield becomes lower relative to current interest rates. Newly issued bonds will have a higher interest rate at inception in order to raise the required capital. This will also affect the stock market, as the risk/return ratio of bonds will be improved over stocks.

We expect that cryptocurrencies may show a sideways movement during the first few months, as investors maintain their risk-off strategy. We expect more capital to shift toward the cryptocurrency market when commodity prices begin to fall and the energy crisis subsides. With the capitulation of the market in 2022, institutions and individuals who have thrown in the towel, or even been forced to sell, have exited the sector, creating room for an upside move as selling pressure has dissipated.

The collapse of Terra

One of the first big stories of 2022 was the crash of Terra (LUNA) and their algorithmic stablecoin TerraUSD (UST), the $60B collapse led to widespread panic among investors. Just before the collapse, Luna was a top 10 cryptocurrency in terms of market capitalization and its stablecoin grew into one of the biggest stablecoins with $17B in circulation.

Terra’s collapse was initiated by the failing underlying mechanism of its algorithmic stablecoin UST. Usually, a stablecoin is backed and pegged to a currency (US dollar) or a commodity (Gold) in order to retain its value. Terra’s stablecoin is an algorithmic stablecoin, these aren’t backed by an underlying asset but rely on buying and selling mechanisms to maintain a stable value. Thus, the mechanism creates UST by burning Luna. If the price of one Luna was $100, the mechanism burns Luna for 100 UST. To keep the peg, it operates also the other way, 1 UST could be converted for $1 worth of Luna.

A second contributing factor was the offered interest rate on the borrowing and lending platform “Anchor Protocol''. Anchor offered a fixed yearly 20% interest rate on UST deposits and in April - May the total deposits ($14B) outnumbered the borrowed sum ($3B). Due to these high rates, almost all of the issued UST was located on Anchor.

On the 7th of May, $2B worth of UST was withdrawn from the Anchor platform; most of the assets were liquidated shortly after the withdrawal. This huge sell-off of UST caused the price to drop to $0.91, causing traders to convert 91 cents worth of UST for $1 of Luna. During this period, the market was experiencing a significant price drop which strongly affected the price of Terra. This drop eventually caused the market capitalization of Luna to drop below its stablecoin. This caused UST to de-peg as the amount of issued UST couldn’t redeem the amount of Luna. The depegging caused more users to sell UST which caused the price to depeg at an even faster rate. The Luna Foundation tried to restore the peg by selling their Bitcoin reserves for UST, this was to no avail. As more investors sold UST, this led to the creation of more Luna due to the underlying mechanisms. The amount of Luna in circulation skyrocketed, this caused the price to drop and eventually become a fraction of its original value.

Lending institutions in trouble

The collapse of Luna had a snowball effect on the market which was already experiencing high levels of volatility. During the collapse, Bitcoins’ price dropped from $36K to $25K in a matter of four days as investors lost faith. Eventually, Bitcoin stabilized at $28K. One of the main drivers causing sell-pressure was the fact that the Luna Foundation Guard sold their $10B Bitcoin reserves in an attempt to restore the peg. As many companies and services rely on the value and activity of the cryptocurrency market, many organizations started facing liquidity issues as the interest of investors and the value of cryptocurrencies took a downturn.

Not only retail investors used Anchor for additional returns, but various crypto lending firms also utilized the platform. As a lot of the deposited assets on the platform were locked up, they became effectively zero during the fall of Luna. Organizations that noted big losses were the crypto lending firms Celsius and Voyager and the crypto hedge fund Three Arrows Capital (3AC). As rumors of the losses came to the ears of their clients, many started withdrawing their funds from the platforms, resulting in a bank run on the platforms. These lending firms aim to achieve positive returns for their clients by lending and locking capital at DeFi platforms. Naturally, the longer the assets are locked or lent, the higher the offered interest. As the bank run took place, both organizations couldn't redeem withdrawal requests, resulting in insolvency for both parties.

3AC was one of the biggest firms in the industry and holded $18B in crypto assets, the problems of this enormous hedge fund started with Luna. Due to their positions, 3AC Luna and UST holdings went from $560M to approximately $600. This position was created by counterparty funds who didn’t have any knowledge of the position. Things got worse when news broke that 3AC had various loans on DeFi platforms which they weren’t able to repay or raise the collateral. It was only a matter of time, 3AC started to default loans on various organizations, owing a total of $3.5B. On 29th of June, 3AC was ordered by court to liquidate their holdings and shortly after filed for bankruptcy.

All three have filed for bankruptcy due to the enormous losses made in the aftermath of Luna's collapse. The bankruptcy of three regulated institutions stirred up a lot of commotion as millions of retail investors lost their assets.

The fall of FTX

Perhaps the most significant event was the collapse of the cryptocurrency exchange FTX and its affiliated company Alameda Research. The plight arose when news agency Coindesk published an article detailing Alameda's possible balance sheet. Surprisingly, much of the balance sheet consisted of FTT, FTX's own cryptocurrency in which users pay their trading fees. Normally this is not a problem, but the trading firm used this capital as collateral for their loans. The risk then lies in the volatile nature of a cryptocurrency such as FTT. In a cryptocurrency loan, the collateral must have a certain value to represent the loan. If the value falls below a certain threshold, then the collateral is liquidated to pay off the loan. The news led to a sell-off that in turn caused problems for Alameda Research. The negative news soon began to affect the FTX stock market, as both organizations are highly interconnected. FTX was the next organization to face large withdrawals by users.

It only got worse when Changpeng Zhao (CZ), the CEO of Binance, announced that Binance was going to sell its entire FTT holding, approximately $500M. This news caused extra turmoil and resulted in another bank run. Shortly after, FTX announced that they were halting withdrawals and it seemed only a matter of time before they announced bankruptcy. On November 13th, FTX filed for Chapter 11 bankruptcy. When the news of the bankruptcy broke, it also came to light that $10B of funds was missing, also consisting of user funds. A lot still remains unclear, nobody is completely sure where the funds are located but many suspect that Alameda used the funds to invest in venture deals and seed rounds. If this is the case, the invested capital is locked in vesting schedules which can take years before the funds are open for trading. Besides the loss in capital, the contamination of FTX also hit traditional institutional investors such as Sequoia Capital, Softbank and pension fund Ontario Teachers Plan who all lost the millions they invested in the platform.

On the 12th of December, Sam Bankman Fried (SBF), founder of FTX, was officially arrested by Bahamian police after US prosecutors filed criminal charges. It only seemed a matter of time as more information came to light which insinuated that fraud and mismanagement of customer funds had been committed. Currently, eight criminal charges have been filed against SBF such as conspiracy to commit wire fraud, commodities and security fraud and money laundering. SBF can face up to 165 years in jail if proven guilty.

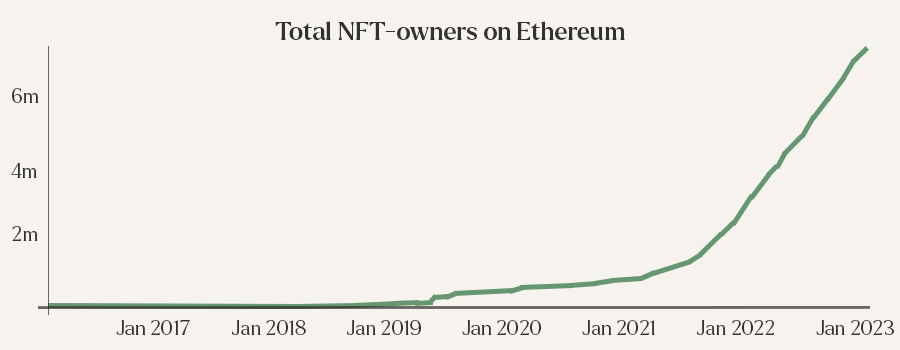

The growth of NFTs

In addition to overall cryptocurrency adoption, we have experienced a tremendous pace in the adoption of Non-Fungible-Tokens (NFT’s). In 2021, the growth of NFTs was largely contributed by the popularity of the Play-to-Earn industry, games in which users have digital ownership of their in-game assets, making it possible to sell these assets and make a profit. These games aided in the volume of sales as new users were attracted to the market.

In 2022, the volume in NFT sales has dropped since the beginning of the year, however, the adoption and implementation of NFTs has been increasing. The NFT ownership in America has almost doubled from 4.6M in 2021 to 9.3M in 2022. In 2022, we saw the implementation of NFTs in fashion as Dolce & Gabbana sold their nine-piece NFT collection for $5.65M. Related to fashion, we also saw the implementation of NFTs in supply chains as Prada & Cartier implemented NFTs to trace their high-value products. Solutions as such counter the counterfeit business and help consumers ensure they have a legitimate product in their hands. Gaming console giant Playstation is rumored exploring the implementation of NFT as they filed a patent that will allow users to acquire and trade ‘unique digital assets. The continuation of interest indicates that companies and investors are not only seeing it as an investment but also starting to understand the utility in real-world applications that NFTs might bring in the future.

Currently, the NFT space is still in its infancy and we may compare it to the cryptocurrency market in 2015, some have used it but adoption hasn’t been to the masses. The crypto sector is also experimenting with the use cases of NFTs such as distributing dividends to NFT holders of the project. We believe that the adoption of NFTs will continue in the crypto space as well as in traditional markets. One main driver of NFTs in the digital space will be the further development of the metaverse. As with other aspects of the crypto industry, the metaverse projects have taken quite a hit. However, our lives are still moving towards a more digital environment and the metaverse still has a place in it. To truly own your digital assets, NFTs are (currently) the best solution as it provides real self-custody. We have seen the first implementations in real-world applications and we expect it to continue in the upcoming year.

The Merge

After years of preparation, the Ethereum Merge was finally completed on September 15th. The purpose of the Merge was to change the consensus algorithm of Ethereum from Proof-of-Work to Proof-of-Stake. Most notable is the impact of the new consensus algorithm on the environment as the switch made the Ethereum ecosystem 99,95% more energy efficient. In addition to energy efficiency, the issuance of Ether has decreased sharply due to the new consensus algorithm. Before the Merge, Ethereum disbursed mining rewards, this has been replaced with staking rewards which distribute 90% less. Since the Merge, the total supply of Ether has only increased by approximately 2000 Ether. In the previous mechanism, there would have been roughly 1 million new Ether. The decrease in the issuance is also partly due to the burning mechanism of Ethereum. When the gas fee surpasses a certain threshold, more Ether is burned than issued. The limited issuance will create a deflationary protocol whenever transactional activity on Ethereum increases past the threshold.

The Merge has also been beneficial for the entire crypto market. Over the past few years, the sector has received criticism that the industry wasn’t energy efficient. More recent blockchains such as Avalanche, Cardano and Fantom are efficient as they consist of more modern technology. Bitcoin and Ethereum are the oldest in the sector and have more users but relatively old technology, making them less energy efficient. In conclusion, the switch has been beneficial as it provides the perspective that projects are willing to invest in a more sustainable future.

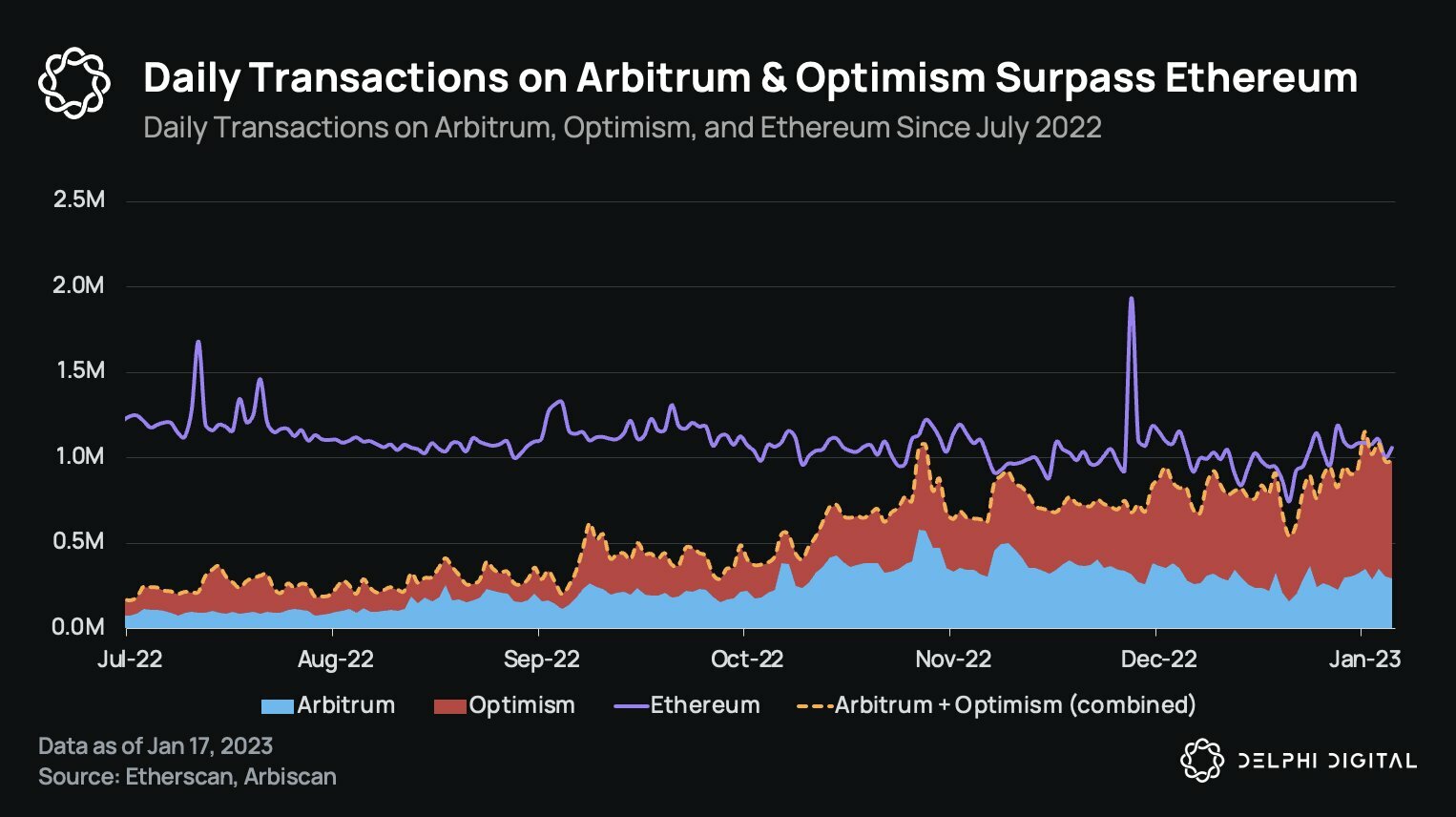

Layer 2’s become mainstream

At Hodl we believe that the various Layer 2 solutions on Ethereum will experience significant adoption during 2023. Even though the activity on the Ethereum Network has significantly declined since the downward trend of the market, there have still been occasional spikes that have caused significant increases in gas (transaction) fees. Layer 2 solutions are scaled environments built on top of Ethereum, users can enter these environments where they experience low transaction costs and high transaction speeds. This is achieved as the transactions are executed in the Layer 2 and a summary of multiple transactions is verified on Ethereum, increasing the transaction throughput while lowering costs. Despite the lower activity in the market, we have seen a continuous interest in various layer 2 solutions. On occasion, Optimism and Arbitrum, the two biggest Layer 2 solutions, combined have surpassed the total transactions on Ethereum, which currently executes a total 1M transactions per day. In 2023, we expect this growth to continue as gas fees increase and transaction speed decreases on Ethereum.

Over the past year, we experienced two Layer 2´s gaining adoption in a downwards-moving market, the optimistic rollups “Optimism” and “Arbitrum”. Slowly but surely, more users on Ethereum are moving to these optimistic rollups as they provide cheaper and faster transactions. This effectively creates greater returns for users and crypto protocols as operational costs are lowered. As users slowly relocate, more capital is being moved with it. We believe in 2023, the market will experience a shift in capital towards Layer 2’s and that more DeFi projects will be built in these scaled environments. This will create a second and more efficient layer of DeFi which will provide new investment opportunities in the market.

We have seen some cryptocurrency protocols already choose Layer 2’s over Layer 1’s such as Treasure, a Play-to-Earn (P2E) gaming driven protocol. Treasure has built their infrastructure on Arbitrum which lowers their operating costs and increases the user experience. A majority of the P2E use NFTs in their games and users are required to acquire these and on Arbitrum these NFTs can be bought at lower costs due to the lower fees. Furthermore, we believe that Gaming and especially P2E will remain an interesting sector in the crypto ecosystem. Blockchain technology and cryptocurrencies is currently the only option for gamers to truly own their digital assets and to earn money while simply playing games and not being a professional gamer. The gaming industry in the cryptocurrency market is relatively young and still needs to be finetuned. However, we expect that the gaming experience will increase and that more gamers will be attracted to the sector.

In addition to optimistic rollups, we expect that the scaling solution Zero Knowledge EVM (ZK-EVM) will do very well in the next year. ZK-EVM are scaled environments where Ethereum developers can easily migrate their smart contracts as the programming language remains the same. The uniqueness of ZK-EVMs are the cryptographic proofs that are provided (ZK proofs) with transactions, ensuring the validity of the transactions. Besides providing faster transactions and low gas fees, ZK proofs can offer users more privacy. ZK proofs are able to prove they are in possession of certain data without presenting the data, this is achieved through enhanced cryptography. As a result, ZK proofs can remove certain transaction information such as transaction amount, receiver or sender, providing more privacy within the scaled environment. Currently, most of these ZK-EVM are in their test phases but the main networks will be launched in 2023.

Regulation continues

Regulation has always been a topic of debate in the cryptocurrency market. Some participants of the market advocate that regulation will kill the industry as it interferes with decentralization, some say it is impossible to regulate and others see it as a necessary evil. However, in light of the events in recent months, we have seen more people advocating for the right regulation. Especially for institutional adoption to occur, there is a need for regulation. Over the past year we have seen several regulators debating over the regulation of the cryptocurrency market. And in the last year, this accelerated showing the maturity of the asset class.

One of the biggest crypto regulatory frameworks to date will be launched in 2023. The Market in Crypto Assets (MiCA) created by the European Union (EU) will provide institutions, organizations and individuals with more protection while providing more oversight to the EU. One of MiCAs focus points is the use and definition of stablecoins and if there should be a limited transaction volume on these cryptocurrencies. Besides the MiCA regulation, we expect that regulators will push for more regulation for institutions as various companies filed for bankruptcy causing losses of hundreds of millions of dollars. In 2022 we saw FTX, Celsius, BlockFi and Voyager filing for bankruptcy and the failure of these institutions is and will be a talking point among regulators.

More regulation for crypto-focused institutions will better protect retail investors, increasing the adoption by new users. Important to note, the created and implemented regulation must not suffocate the pace of creating new technologies as crypto thrives on this speed. If the progress in the industry stagnates due to increasing regulation, the industry may experience difficulties maintaining their current pace of adoption and innovation.

Countering this increase in regulation, we also expect to see an increased interest in privacy coins and other privacy-enhancing technologies. Earlier this year, the Dutch police arrested a developer of Tornado Cash, a cryptocurrency mixer, after the U.S. regulators sanctioned the protocol. This is probably the first of many steps as regulators and banks demand complete transparency when dealing with financial flows. Anything that harms this transparency may face regulation or critique from regulators. How these regulations will take shape remains unclear but if the market wants more economic regulation, crypto firms need to aid in the creation of these regulations

Bitcoin Spot ETF

In 2021, we saw the introduction of the first US Bitcoin Futures Exchange Traded Fund (ETF), a great step for the market. Even though it allows investors to speculate on the price of Bitcoin, it doesn’t mean the acquisition of Bitcoin as an ETF doesn’t hold Bitcoin as an underlying asset. Participants of the market prefer the introduction of a Spot ETF as this financial instrument allows investors to buy Bitcoin through traditional exchanges and instruments. In 2022, various stakeholders in the market believed that the first US Bitcoin Spot ETF was going to be launched, unfortunately, we need to wait a little longer. Many institutions applied for a possible Spot ETF such as asset managers Grayscale and VanEck, however, the applications have been denied ever since by the Securities and Exchange Commission (SEC). Currently, the SEC lacks the belief that an ETF can operate accordingly without the necessary regulation and may experience market manipulation.

The U.S and the European Union are working on various regulatory frameworks and we as Hodl expect that this will support certain aspects of the industry. If the market aims for adoption across financial markets and institutions, regulation is a necessary step. Regulation outlines the playing field, this will make it easier for traditional financial institutions to integrate the sector. For now, we believe that the SEC will maintain their hesitant stance as they believe more regulation is necessary. But this may change, the Australian and Dutch stock exchanges have launched a Bitcoin spot ETF and America may not want to fall too much behind.

Institutions continue to explore custodial solutions

Throughout the years, traditional financial institutions have voiced their opinions about cryptocurrencies, a majority wasn’t positive. In 2017, for example, the CEO of J.P. Morgan called Bitcoin a scam which was doomed to fail. Ever since, the market has continued to grow in users and the technology has been embraced by many. Financial institutions are slowly changing their stance and are exploring the possibilities of crypto exposure. One of the commonly used methods is by providing cryptocurrency custody to its clients assets.

Banks such as BNY Mellon, Citibank, and US bank already announced the offering of custody of digital assets and we believe that more banks will follow this trend. Custodial services are a relatively safe way of creating cryptocurrency exposure as it provides the chance for a bank to hold it indirectly. The approach of each bank differs as some allow cryptocurrency trading with their storage while others focus solely on the storage. In November, the U.S. investment bank J.P. Morgan filed a trademark application for a Bitcoin wallet, joining a long list of vendors which first criticized Bitcoin and later implemented it.

We believe that these custodial services are the first steps of many in order to integrate the two financial industries. In 2023, we expect that there will be an influx of traditional financial institutions which will offer the custody of digital assets as real exposure will first be deemed too risky. This period of time is also an interesting moment to enter the market as the sector is in dire need of trusted centralized entities. Names such as J.P. Morgan may have had their issues in the past but they are giants in financial services which may offer some new perspective to the market. Banks will for now focus on custody services, however, as the market matures investment opportunities will arise, making it really difficult for banks not to have real exposure

The year of Hodl

2022 was a long year for the cryptocurrency market as Bitcoin first experienced a strong downwards trajectory followed by a period of sideways movement. Due to the slow market conditions, it is also a perfect opportunity to build. This year our team continued to grow by onboarding several different specialists, agents and partners. Due to the international interest we experience due to our successful formula, we also set our eyes on international expansion. An interesting journey with promising developments for Hodl.

Late 2022, we were excited to share our first step in international growth. Together with Carre de Finance, a well-known financial services provider in Switzerland and Luxembourg, we launched the fund Hodl Numeri, the first addition to the Hodl Group. Hodl Numeri provides Luxembourgian investors with a professional and accessible approach to investing in the emerging industry. The new fund adopts a similar structure and strategy as the Hodl.nl funds, the fund is managed by highly skilled analysts and benefits from our algorithmic trading software.

Shortly after, the second addition to the Hodl Group was done by the introduction of Hodl Artemis, our first Actively Managed Certificate (AMC). Artemis is launched in collaboration with GenTwo, leader in structured products. Artemis provides investors with exposure to a basket of ten cryptocurrencies that have been carefully selected by our research analysts. The AMC has an ISIN-code and can be added to existing investment portfolios. However, traditional banks are still reluctant to include crypto products in the investment sector so Hodl is currently in talks with 2 Swiss banks to facilitate the purchase of the product.

The performance of the Hodl funds

In the market's downward trend, we also saw the Hodl funds undergo a similar trend. The Hodl.nl Genesis Fund and the Hodl.nl Consensus Fund fell 67.5% and 68.3%, respectively. As a result, Genesis outperformed its benchmark - Bitcoin - by about 2.3%. Consensus ended at 0.3% above Bitcoin. Considering that more than 70% of fund portfolios are made up of altcoins that fell even harder than Bitcoin, it is a good performance in relative terms. In absolute terms, of course, it is a very disappointing year, partly due to the events mentioned earlier in this newsletter.

The Hodl.nl Oracle Fund visibly performed more negatively with a 77,6% drop. This is caused mainly due to the large difference in altcoins compared to the Hodl Genesis and Consensus fund. Within Oracle, the weighting of altcoins is more evenly distributed among the various coins. In addition, the fund also has greater exposure to altcoins. We expect that with a recovery in the markets, Oracle could also start to outperform the other funds in a positive manner.

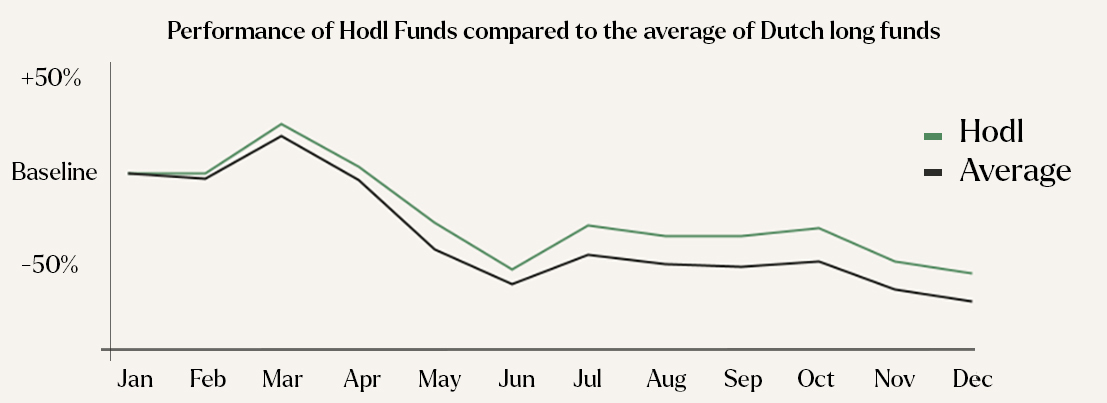

When we compare our long-only funds with the average of all Dutch long-only funds, we see that our performance is structurally at the top end of the market. We saw that our funds have the best performance in most months, putting the Hodl funds well above the market average. The table below shows the results of the Hodl funds relative to the average.

Although the year was marked by a negative trend, we are pleased that we outperformed Bitcoin with the Genesis and Consensus funds. This makes for an interesting average return when set against our strong performance in an up market. With strong pressure on traditional markets, the market declined further than we had previously expected. As a result, we continuously adjusted and further optimized our strategies and funds during the year. For the Hodl funds this was the first real bear market, so we were able to gain many learnings from this which we can use for good in the future.

The Hodl.nl Genesis Fund, the Hodl.nl Consensus Fund and the Hodl.nl Oracle Fund ended at a net asset value (NAV) of €2.15, €2.15 and €0.20, respectively. You can view your personal results in the client portal via the link below. Under 'My Documents' you will also find your fiscal report(s) for the calendar year 2022.

The developments of the Hodl bots

The sharp decline in market trading volume also provided us with the opportunity for further development and optimization of our algorithmic trading bots. Over the past year, numerous improvements have been made to our bot platform. Some of these will be activated in the near future, these are already running successfully in the test environment. In the meantime we have switched platforms, our new strategies have been tested and the bots have become much more efficient. This brings us down (transaction) costs, while at the same time increasing revenues.

In the upcoming month, our latest update will go live with which we expect a strong improvement in our performance. This will also allow us to better visualize our performance in reports and share it with our participants. We are therefore very much looking forward to implementing the last major update on the bot platform in the near future.

Our plans for 2023

As of 2023, we aim to improve Hodl Group with the further development of Hodl Ventures and Hodl Research, while maintaining our current process to professionalize the organization. We anticipate that by expanding our fund options, we will be able to assist more investors in diversifying their investment portfolios. Throughout the coming year, we will continue to improve our services. For example, we intend to make the client portal a more user-friendly environment in which we can offer more insights about the funds and other additional functionalities. In 2023, we will also develop and launch Hodl Ventures and Hodl Research. Hodl Ventures will raise capital for the further development of blockchain start-ups. Hodl Research will be launched and used as a resource for knowledge on a variety of issues, including technical and market developments in the cryptocurrency sector. We aspire to contribute to the overall growth of the sector through this multidisciplinary approach.

Want to stay up-to-date of the latest developments? Sign up for our newsletter to stay on top of the cryptocurrency market.