The Correlation between Digital Assets & Financial Markets

- Correlation between the S&P 500 and Bitcoin

- Correlation between the NASDAQ and Bitcoin

- Correlation between the Gold and Bitcoin

- Correlation between the US dollar and Bitcoin

- Fiat Liquidity Cycle

- So, how does Bitcoin compare to other asset classes?

- What does the future hold?

In recent years, the digital assets industry has seen a surge in adoption by financial institutions. With the arrival of the Bitcoin spot exchange-traded funds (ETF), digital assets will be fully integrated into financial markets. However, the question arises: how do digital assets perform compared to traditional financial markets? Bitcoin was designed to operate independently of financial institutions, or has the industry become inherently linked to the trends of these markets? In this blog, we aim to explore the existence of any correlation between digital assets and financial markets, or if there are other significant correlations to consider.

Correlation between the S&P 500 and Bitcoin

The digital assets market is young compared to traditional assets such as stocks, so, the historical data of digital assets could be more robust. Nonetheless, with the current data, we can conclude various findings. When calculating the correlation between digital assets and the S&P500 we will use Bitcoin as the benchmark as it acts as a barometer for the industry.

The correlation coefficient helps assess the relationship between two assets. Ranging from -1 to +1, a -1 suggests perfect opposite movement: when one asset increases, the other decreases. A +1 signifies a strong positive correlation where both move predictably in the same direction.

Examining the illustration below, Bitcoin showed a notable correlation with the S&P 500, notably from 2020 to early 2021, with correlation coefficients fluctuating between 0.66 and 0.92, indicating a very strong positive correlation. However, there were periods of negative correlation, notably in mid-2021, with a correlation coefficient of -0.72. Notably, Bitcoin has shown longer periods of positive correlation than negative with the S&P 500.

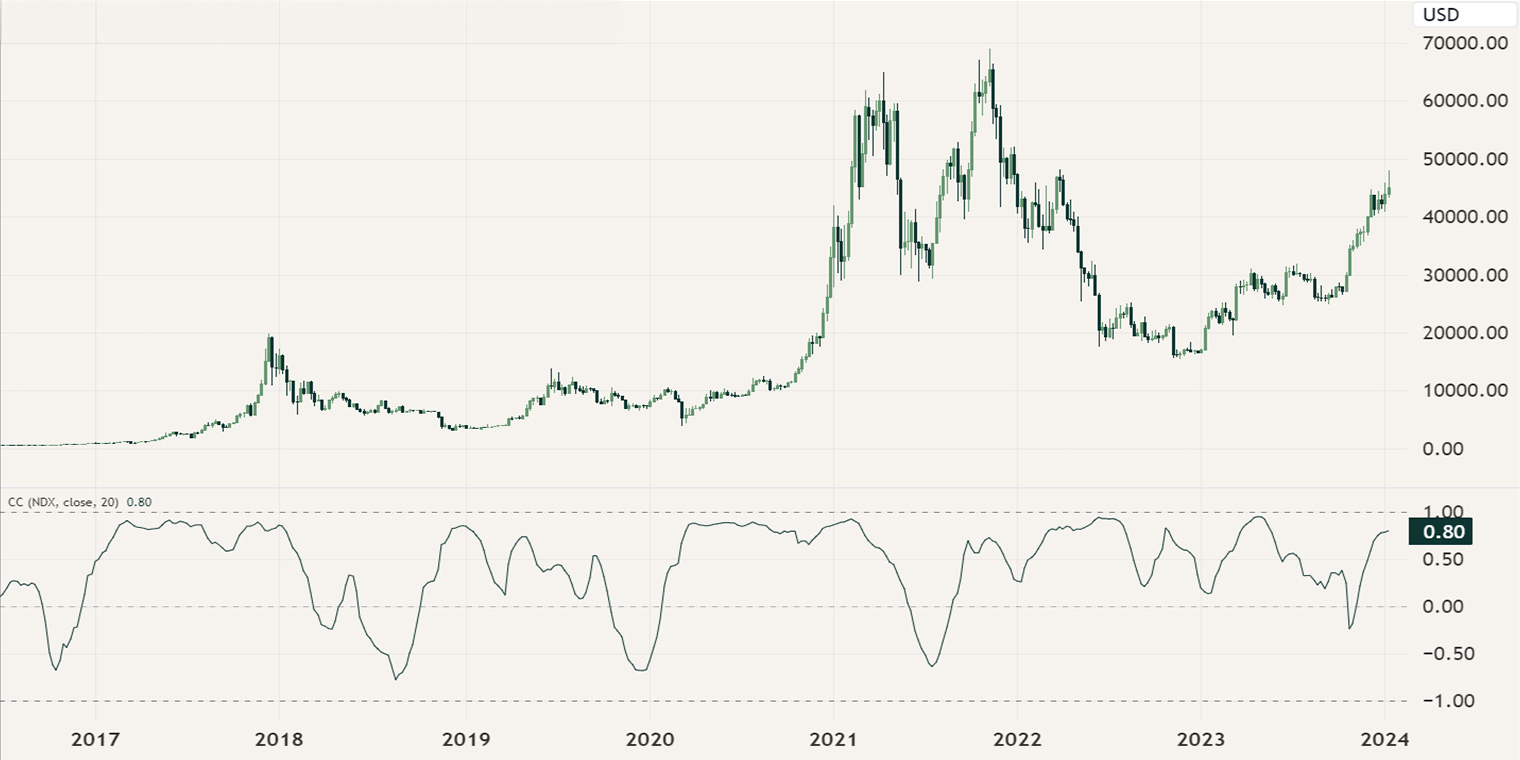

Correlation between the NASDAQ and Bitcoin

When analyzing the correlation between the NASDAQ and Bitcoin, it's evident that Bitcoin has shown extended periods of strong correlation, with occasional periods of negative correlation. These negative correlations often coincided with flash crashes in the digital assets market. In recent years, the correlation between the NASDAQ and Bitcoin seems to strengthen further as the negative correlations are getting less significant.

This correlation is largely due to their shared characteristics as risk-on assets: both demonstrate volatility, are more sensitive to market sentiments, drive innovation and disruption and possess a cyclical nature. Moreover, given that Bitcoin operates as a technology itself, its correlation with other technological assets is not unexpected.

Correlation between the Gold and Bitcoin

The correlation between Gold and Bitcoin showcases an intriguing evolution. Before 2023, these assets primarily displayed a negative correlation, meaning when gold rose, Bitcoin tended to fall, occasionally showing brief periods of positive correlation. However, since 2023, a shift has emerged. More investors now perceive Bitcoin as 'digital gold'—a reliable store of value. Statements from influential figures like Larry Fink, founder of BlackRock, and other industry leaders have reinforced this perception.

Consequently, Bitcoin and Gold are exhibiting more extended periods of positive correlation. This trend may strengthen further if Bitcoin successfully solidifies its position as a trusted store of value.

Correlation between the US dollar and Bitcoin

Given Bitcoin's categorization as a risk-on asset and the US dollar as a risk-off asset, it's unsurprising to observe a negative correlation between the two. However, occasional spikes of positive correlation occur, although brief and not indicative of prolonged periods of strong correlation.

Throughout 2022, a notable shift occurred: as the dollar gained popularity due to increasing rate hikes, Bitcoin's attractiveness decreased, leading to a sustained downward trend for Bitcoin. Conversely, the dollar experienced a prolonged upward trajectory, reinforcing the negative correlation observed. As a result, Bitcoin can act as a hedge against the dollar during specific periods.

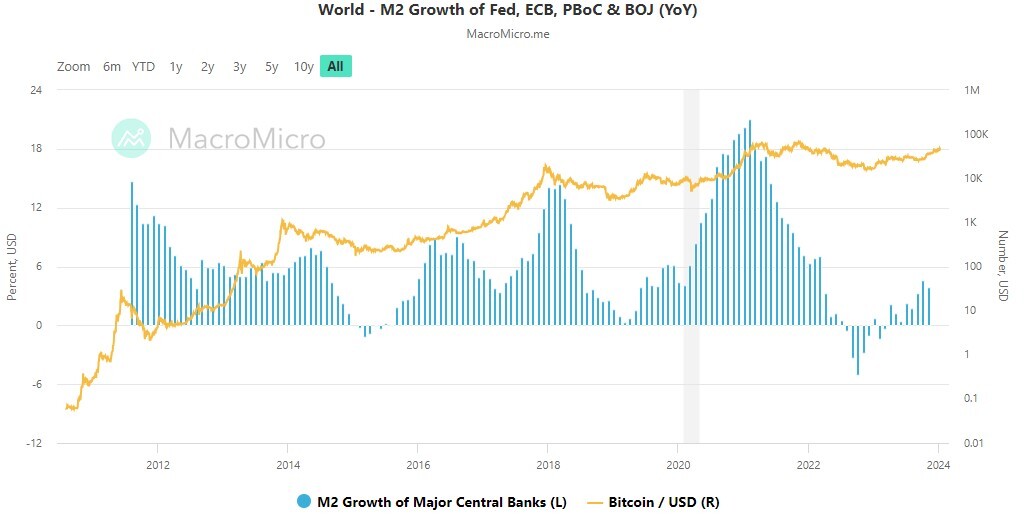

Fiat Liquidity Cycle

Another crucial correlation worth considering is the aggregated supply of money, particularly its expansion. When we examine the M2 supply, a clear positive correlation emerges between the expansion or contraction of M2 and Bitcoin's price movements. The combined M2 of the four major central banks—the U.S. Federal Reserve, European Central Bank, Bank of Japan and People's Bank of China—represents the total value of their respective fiat currencies circulating in the market.

Historically, post-halving bull runs were characterized by a 6% or higher growth in the aggregate M2 money supply of these central banks. Conversely, bear markets aligned with a slowdown in the money supply growth rate. Presently, we are in a market phase where interest rates remain high. Although market observers anticipate the first rate cut in March, money is expected to remain relatively expensive. Consequently, some investors speculate that Bitcoin might not initiate a prolonged upward trajectory unless the M2 supply undergoes expansion once again.

So, how does Bitcoin compare to other asset classes?

Bitcoin's correlation with financial markets has seen diverse phases of evolution. In its early years until 2017, Bitcoin lacked strong correlations with financial markets, primarily driven by speculative trading. However, as the asset matured over time, notably stronger positive correlations emerged, particularly with indexes like the S&P 500. The NASDAQ demonstrated the strongest positive correlation with Bitcoin, attributed to its risk-on and technological nature. This strengthened correlation between these indexes is a result of Bitcoin's maturation, attracting an influx of professional investors to the market, resulting in Bitcoin slowly following overall market trends.

The industry also observed notable negative correlations, particularly with the US dollar. Over time, investors have perceived Bitcoin as a counterbalance to the dollar, leading to an inverse relationship where a drop in the dollar coincides with a rise in Bitcoin. Similarly, gold, traditionally regarded as a store of value, also experienced a negative correlation with Bitcoin. However, in the past two years, Bitcoin has gradually shifted toward a positive correlation as more investors recognize it as digital gold and a new safe haven detached from the conventional financial system.

What does the future hold?

Since its inception, Bitcoin has operated independently from traditional financial markets, but with the approval of the Bitcoin spot ETFs, integration between the two industries has begun. This milestone grants traditional institutions and retail investors access to Bitcoin through conventional channels. We anticipate that this integration will strengthen Bitcoin's correlation with indexes like the S&P 500 and NASDAQ due to shared risk-on strategies. During risk-on periods, Bitcoin is poised for upward trends, yet in economic downturns, it may mirror the decline of these indexes, potentially being among the first to experience a downturn due to its liquidity and small market size.

However, should Bitcoin continue its transition from a risk-on asset to a store of value during economic downturns, a stronger positive correlation with gold could emerge and a less strong correlation between financial indexes.

Currently, Bitcoin follows the overall trend of the financial markets with short spikes of negative correlation. However, Bitcoin is still an emerging asset class and is relatively young compared to other financial markets. Bitcoin has already transformed from a speculative decentralized cash to a real investment class and it may evolve further. So, it is important to remain informed about its developments within financial markets and how investors perceive the asset class.

Sign up for our newsletter to stay on top of the crypto market.