The Cyclical Nature of the Digital Assets Market

When examining our daily lives, we observe numerous phenomena adhering to rhythms or cyclical patterns, much like the changing seasons. Similarly, in financial markets, cyclicality is evident. Economic booms and downturns manifest in cycles, influencing financial markets with their periods of prosperity and decline. Nevertheless, the duration and returns of these cycles vary significantly among asset classes, driven by diverse factors.

For instance, within the digital assets market, periods of climbing returns often coincide with the Bitcoin Halving, an event that occurs every four years and halves the issuance of BTC. It is often referred to as the Big Cycle but it can also be divided into smaller cycles. We aim to highlight these smaller cycles and demonstrate how to harness the market's cyclical nature.

Dissecting the market cycle

When examining the Big Cycle, we can divide it into four phases: accumulation, markup, distribution and markdown. Below we will start by breaking down each phase of the cycle.

Accumulation

The first phase of the new cycle is the accumulation phase. This can be regarded as the conclusion of the previous cycle as it usually follows after a steep correction. This phase is known for the absence of interest among the majority of investors. Most retail investors have left the market, resulting in low trading volume, which in itself results in a stable or sideways-moving market.

The overall sentiment in this phase is mainly negative and or skeptical. Those who are entering the market or continuing to invest at this stage are typically seasoned investors, true believers in the technology or individuals who perceive Bitcoin as undervalued. As investors slowly accumulate, Bitcoin’s price experiences a gradual ascent. The market commonly experiences an influx of new investors shortly before or after the Bitcoin Halving. As the halving decreases the issuance of BTC, investors will have a sense of scarcity and due to the laws of supply and demand, the price of Bitcoin is expected to increase.

Markup

As the Bitcoin Halving closes in and or occurs, the market undergoes a significant transformation, entering what is known as the "markup phase." This phase is characterized by the market transitioning from moving sideways to a consistent upward trajectory. Initially characterized by skepticism and negativity, market sentiment gradually evolves into optimism, marking the beginning of what is commonly referred to as the "bull run."

During this exciting phase, the increasing returns associated with Bitcoin begin to capture the attention of new investors. These newcomers are often retail investors who are eager not to miss out on the potential gains. Consequently, this influx of fresh capital leads to a noticeable uptick in trading volume, which, in turn, propels Bitcoin's prices even higher. This upward momentum frequently results in the creation of new all-time highs, demonstrating the fervor and excitement surrounding the market.

Meanwhile, savvy investors who had earlier purchased Bitcoin during the accumulation phase or at other favorable price levels begin to seize the opportunity to take profits. This measured approach allows them to reap the rewards of their earlier investments, further contributing to the dynamic nature of the market during the markup phase.

Distribution

After the market has reached its peak, the distribution phase kicks off. During this phase, a delicate balance is struck between buyers and sellers. Professional investors, both early and institutional investors, begin to take profits. Some of the market participants believe the market has peaked while others remain optimistic the bull run can continue. Trading still heavily occurs but price movements start to oscillate within defined levels, unable to break free from either support or resistance.

As the price continues to fluctuate without a clear indication of which direction it will move, sentiment begins to shift from positive to uncertain. As the prices of the assets begin to stagnate, increasingly more investors think that the bull market is over. At the end of this phase, the market slowly starts its downward trajectory.

Markdown

The market then enters its prolonged period of downward movement, commonly referred to as the Markdown phase or the bear market. During this period, almost no new investors enter the market, resulting in a decreased demand for assets while the supply remains constant. Consequently, prices take a hit and start to plummet.

As more investors started to offload their positions, prices experienced a rapid decline, leading to growing negativity and fear among market participants. As prices rapidly fall, investors observing from the sidelines lose interest and the chances of new investors and capital entering the market are extremely low. Prices will continue to decline until the majority of remaining investors think the worst part is over. At this point, investor sentiment gradually shifts, leading to a cautious accumulation of assets, and the market cycle restarts.

How to leverage the market cycle?

When you understand that there are different phases in the market cycle, it becomes possible to leverage them. To achieve this there are two important elements:

Understanding in which part of the cycle you are in

How to position yourself

A good indicator to determine which phase the market is currently in is the Bitcoin Dominance chart. When Bitcoin was the only cryptocurrency, its dominance was 100%. However, as the market has expanded significantly, its dominance has gradually decreased. Currently, Bitcoin dominance fluctuates between 40-60%, and it typically correlates with the market trend. Below you will find some guidelines:

If the price of Bitcoin rises and takes dominance with it, there's a high probability that the market is still in the accumulation phase.

If Bitcoin's price rises while dominance falls, it's most likely the markup phase. This is due to a stronger increase in the prices of other cryptocurrencies.

If the Bitcoin price remains stable while dominance drops, it's highly likely the distribution phase. This occurs because profits are being taken from Bitcoin and reinvested in smaller cryptocurrencies that haven't experienced a strong upward movement yet.

If the Bitcoin price drops and dominance increases, the market is probably in the markdown phase. During this phase, the market experiences a sharp decline, but Bitcoin's drop is relatively less severe in comparison.

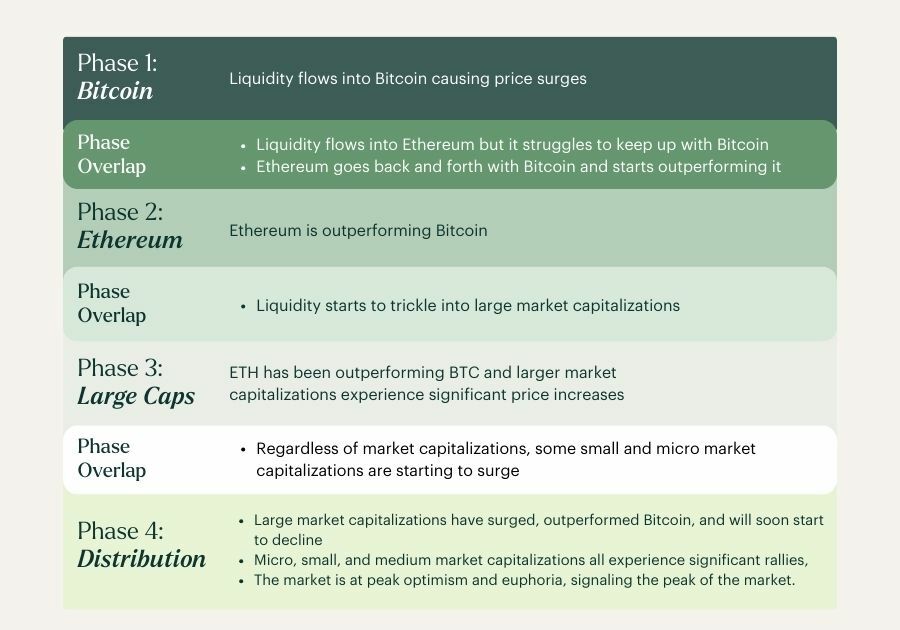

What is characteristic during an upward movement is that investors position themselves based on market capitalization. During the markup phase, investors who have bought Bitcoin during the accumulation phase will slowly take profits to further invest in other projects with a relatively smaller, but still significant market capitalization. These often follow Bitcoin's strong upward movement first.

The profits made in these medium market capitalizations will eventually shift towards the small and micro market capitalizations, spreading further as the market progresses in the cycle. Typically, as the market phase advances, investors tend to take more risks. By accurately defining the market phase, one can optimize the benefits of its characteristics.

How does Hodl leverage these shifts?

As investors position themselves, it is important to note that not every asset will experience a boom when profits shift to medium & small market capitalizations, the fundamentals, use-case and narrative still need to be sufficient for an investor to invest. So, it is a delicate task to position yourself correctly, even for professional investors it can be challenging.

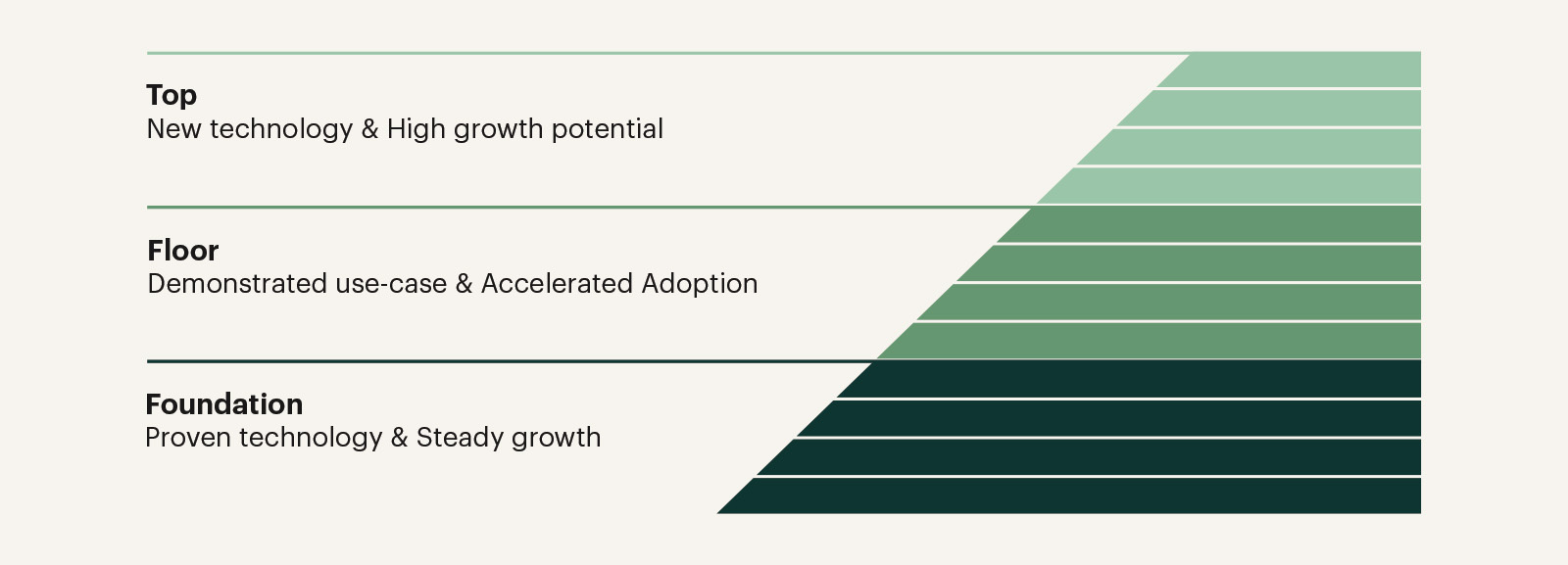

We capitalize on these cycles through one of our offered strategies, which is actively managed. This is accomplished through a method known as "Bottom-up." These actively managed funds are designed to strategically leverage these cycles and navigate liquidity shifts. The assets are divided into three distinct layers: Foundation, Floor, and Top.

The Foundation consists of renowned digital currencies that are characterized by high liquidity, listings on multiple exchanges and a proven track record.

The Floor consists of cryptocurrencies with a technological application and/or blockchain developed by renowned teams, demonstrated practical use cases and great potential.

The top is a smaller part of the portfolio and contains more speculative assets of which the business model has yet to prove itself but with substantial growth expectations. These investments consist of early access offerings for high-risk, high-reward opportunities.

In our approach, the distribution of the layers has a dynamic nature. For instance, as the market transitions from the distribution to the markup phase, the fund strategically allocates assets to the foundation layer, decreasing the potential downsides. Additionally, as our research analysts follow the latest news and developments closely, Hodl can rebalance the holdings to fully leverage liquidity shifts, for example, with a greater allocation directed towards the floor and top layer of the fund.

Within these layers, we invest in various projects. It's important to note that predicting the future is inherently uncertain. Therefore, to effectively manage risk and maximize returns, we adopt a diversification strategy across a wide array of projects spanning different sectors. This diversified approach enables us to fully harness the opportunities presented by liquidity shifts while minimizing exposure to potential downside risks. If you're interested in delving deeper into Hodl's strategy and discovering how to fully optimize your digital asset investments, we invite you to reach out to us. We will guide you through the possibilities and help you make informed decisions.

Sign up for our newsletter to stay on top of the crypto market.