The growing applications of blockchain technology

- Blockchain adoption outside the market is growing

- Blockchain in supply chain management

- Blockchain in healthcare

- Blockchain in real estate

- Future possibilities for blockchain implementations

Blockchain adoption outside the market is growing

Where Bitcoin initially started as a payment solution, the market has grown into thousands of cryptocurrencies with each its own application. After the successful implementation of a digital currency without an intermediary such as a bank, many started to explore the endless possibilities. Especially the arrival of Smart Contracts allowed for many implementations such as Decentralized Financial instruments.

Where a lot of cryptocurrencies have use cases bound to their native sector, such as staking, we would like to dive deeper into the implementation of cryptocurrency and Distributed Ledger Technology in our day-to-day society.

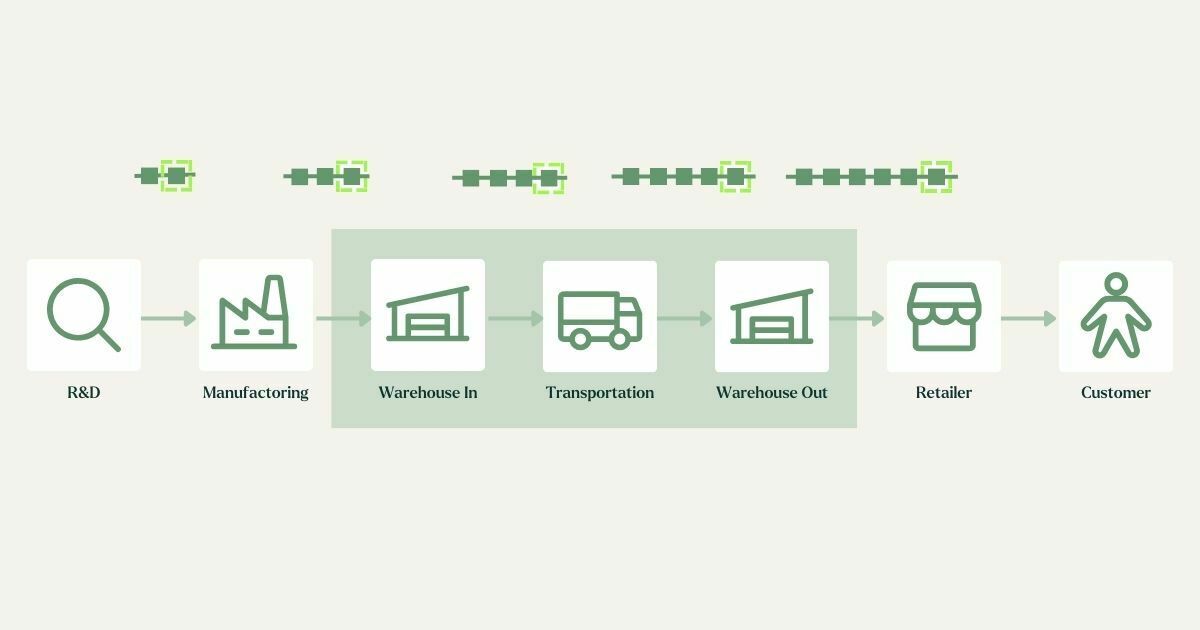

Blockchain in supply chain management

Supply chain management (SCM) is one of the most commonly implemented use cases of digital assets and distributed ledger technology. Over the past 50 years, globalization has significantly increased the complexity of global supply chains. The production and shipping of a single product now involve multiple suppliers, presenting the challenge of ensuring visibility throughout the entire process. In SCM, various types of data, including information, inventory and financial flows, need to be managed efficiently. However, the current supply chain management systems, such as enterprise resource planning (ERP), fail to some extent to integrate all three flows, resulting in difficulties when eliminating execution errors, making informed decisions and resolving conflicts.

Blockchain technology has shown to be a promising solution for these issues. The blockchain's ability to store diverse data points enables the consolidation of all flows in a single database. By implementing blockchain, organizations can easily pinpoint the exact point where an error occurred. For instance, inventory can be linked to a token and each step of the supply chain will be recorded chronologically and immutably. This transparency makes it easier to detect and rectify any mistakes.

An excellent example of this blockchain solution is the collaboration between IBM Food Trust and Walmart, where blockchain is used to trace fresh produced and other food products. The advantages of this approach are evident. If a corporation discovers a piece of meat that contains unhealthy parts, the blockchain allows them and their supply chain partners to trace the product's journey, identify all suppliers involved and track manufacturing and shipment batches associated with it, ultimately facilitating an effective recall process. The IBM Food Trust enables traceability, tokenization of certifications and data sharing among the blockchain participants. Another example of an organization onboarding blockchain technology is the Port of Rotterdam which entered a collaboration with Deloitte and Chainlink to create more efficient processes.

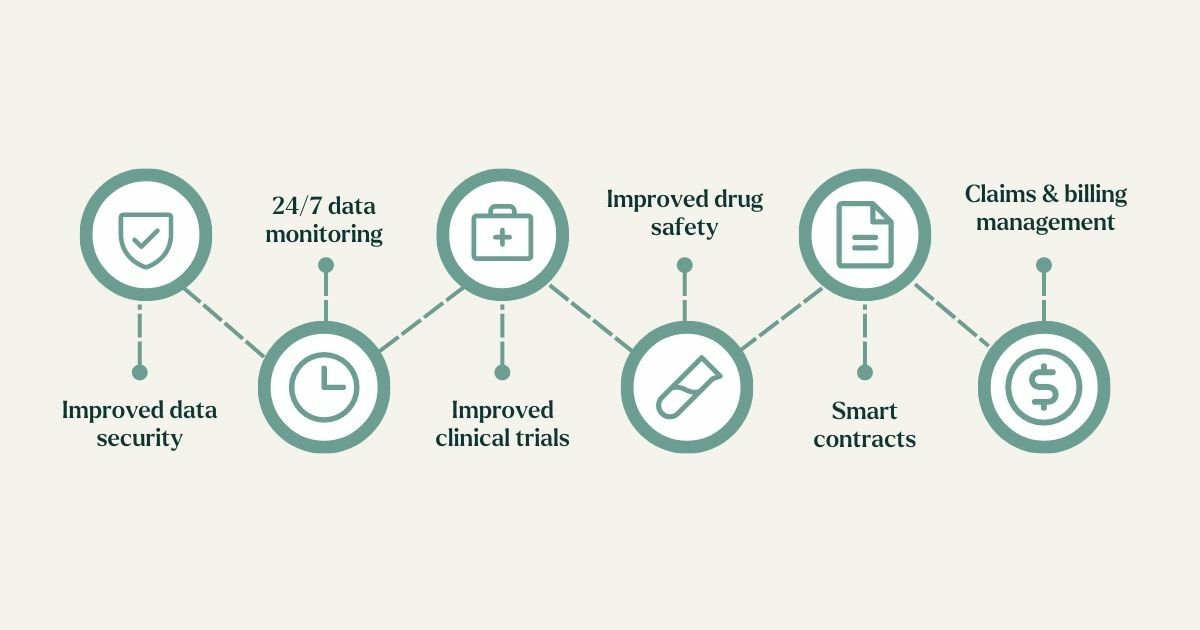

Blockchain in healthcare

The corruption of data and/or data breaches can have dire consequences, especially in critical fields like the healthcare industry. The healthcare industry requires secure storage and transmission of medical records to relevant parties. Unfortunately, the healthcare sector has been plagued by a constant stream of data breaches. For example, in 2022 alone, a staggering 590 healthcare organizations in the U.S. reported data breaches, affecting a total of 48.6 million individuals.

To address this pressing issue, companies within the healthcare industry have turned to implementing blockchain technology in various processes. Typically, healthcare organizations operate in their own siloed ecosystems and, as expected, only share medical data when requested by other firms. By hashing this information, this data can be used by other companies without compromising privacy. When data is hashed, only an individual or department with a specific key can unhash or reveal the data. This way data, such as the results of certain medications, can be shared without the other party knowing specific client data, improving drug safety.

This results in a more open but also better-secured environment where data can flow freely. One notable application involves the creation of shared databases and personalized health plans. Aveneer Health, for instance, collaborates with prominent healthcare organizations such as Cleveland Clinic, Optima Health and Carelon to enhance healthcare efficiency. They achieve this through a shared ledger, which supports improved claims processing and secure exchanges of healthcare data.

Another crucial implementation revolves around the secure storage of medical data. For example, Medicalchain has developed a blockchain platform that safeguards the security of health records while providing a reliable single point of truth. This means that doctors, hospitals, and laboratories can all access patient information in a traceable manner, while still ensuring the patient's identity remains protected from prying eyes. Additionally, users can give permission through blockchain-based databases to share their medical records with their own and/or new healthcare organizations. Thereby, individuals have more control over their personal data.

This development has also been highlighted by Deloitte which published a research paper that covered the opportunities for the healthcare industry. This includes the immediate visibility of data to all connected organizations and creating a single source of information and truth.

Blockchain in real estate

Distributed ledger technology presents unique opportunities for individuals and organizations operating in the real estate sector. Real estate transactions involve the transfer and storage of large amounts of information, requiring all parties involved to agree on a single truth. Blockchain can be utilized to store and share data points, but there is an additional element that can revolutionize the sector: smart contracts.

A smart contract is a computer program that automatically executes specific tasks when predetermined requirements are met. These contracts can streamline the current paper trail of documents for realtors. For instance, when party A deposits funds into party B's bank account, the contract triggers the transfer of ownership. Moreover, these smart contracts operate in a decentralized manner, enabling buyers and sellers to reach agreements without intermediaries.

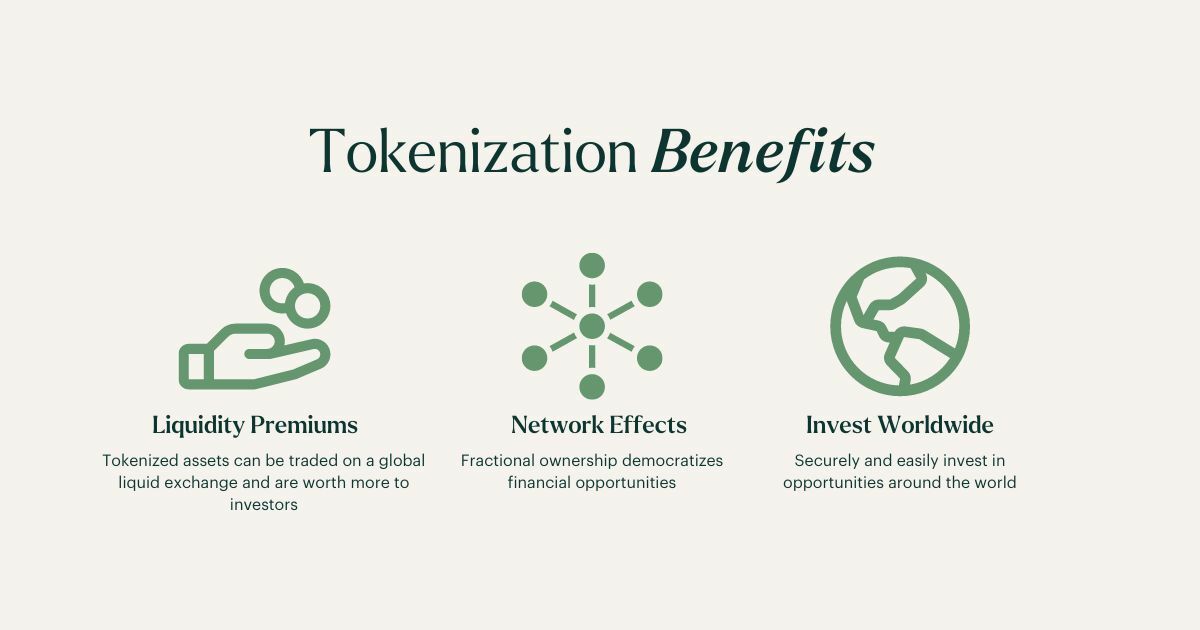

Numerous organizations have already introduced blockchain-based solutions to revolutionize the real estate sector. Among these solutions, the smart contract stands out as a powerful tool enabling realtors to automate various processes, including ownership transfers and rent billing. Additionally, the concept of tokenizing real estate assets has gained traction. Through tokenization, realtors can represent a house as a series of digital tokens and offer fractional ownership to interested buyers. This innovative approach makes renting and investing in real estate more accessible, as individuals can now own smaller portions of bigger properties.

By leveraging blockchain technology, the real estate industry is witnessing a transformation that streamlines operations and opens up new possibilities for both realtors and investors. The introduction of smart contracts and tokenization marks a significant step towards a more efficient and inclusive renting business. One example is RealBlocks, which leverages tokenization to enhance security and transaction speed, reduce fees and improve liquidity for investors. Another example is Ubitquity, which tokenizes properties, leverages smart contracts for more efficient processes and manages escrow payments.

With the adoption of blockchain technology and smart contracts, the real estate industry experiences more cost-effective transfers of assets and faster transaction finality compared to traditional methods. These advancements signify a promising future for the real estate sector, empowering it with enhanced efficiency and transparency.

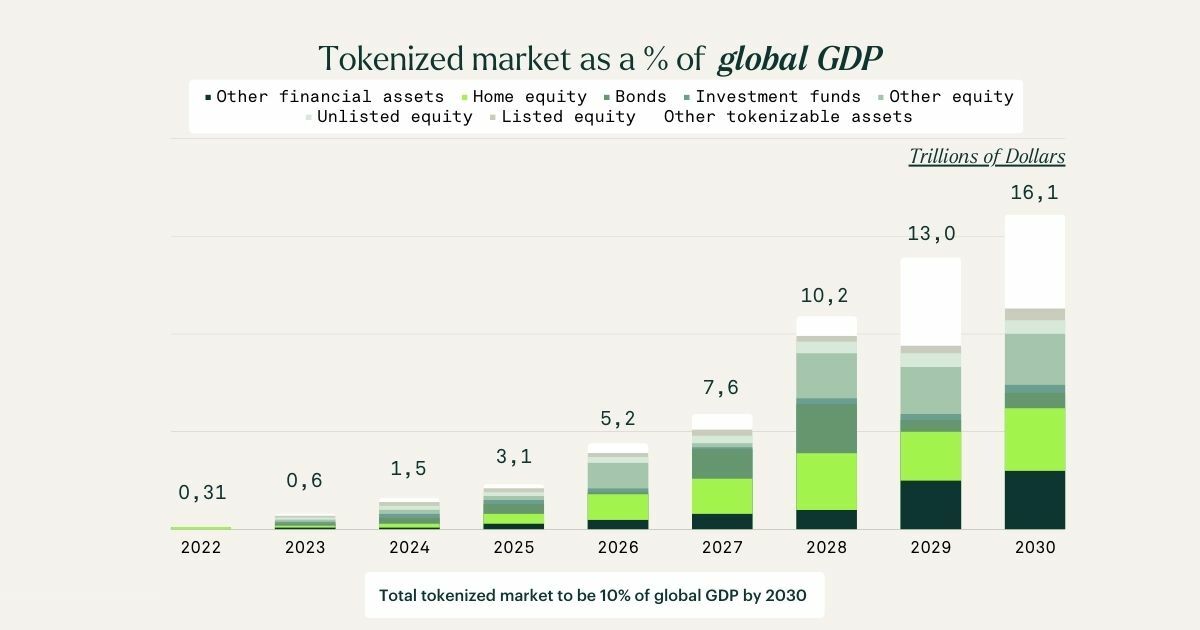

Despite being in its infancy, the blockchain real-estate sector has garnered attention from notable players like the management consulting firm Boston Consulting Group. In a paper they covered the concept of tokenization of real estate. Drawing data from the World Economic Forum, the conservative forecast suggests that the tokenization of real estate is projected to evolve into a staggering $3.2 trillion market by the end of 2030.

Future possibilities for blockchain implementations

Tokenization and distributed ledger technology offer limitless possibilities. Despite their adoption in various fields, there are still many areas where they are not fully utilized, and one such area is voting. During the past decade, we have seen an increase of people who have started to mistrust the correctness of elections. While some cases of suspicion may be warranted, our current system lacks transparency, leaving us no choice but to trust that all operations were conducted lawfully. However, why should we rely solely on trust when we can achieve public verification of the results?

By integrating blockchain technology into voting systems, we can provide the much-needed transparency to the public. This transparency will instill confidence in the results, allowing people to accept them with more certainty. Moreover, in the rare instances when something does go wrong, blockchain technology enables us to pinpoint exactly where the issue occurred.

In conclusion, embracing blockchain technology for voting systems can revolutionize the way we conduct voting. From lowering the overall costs of conducting elections to increasing the efficiency of voting rounds at smaller venues such as at your local sports club. It will not only enhance trust and acceptance of the results but also empower us to identify and rectify any potential irregularities. The time has come to usher in a new era of transparency and integrity in the democratic process.

Additionally, we firmly believe that the traditional financial sector will wholeheartedly embrace the tokenization of assets and the widespread implementation of distributed ledger technology. A significant milestone towards this vision was reached on the 9th of May, 2023, when financial powerhouses BNP Paribas and Goldman Sachs made a joint announcement. Alongside other industry giants like Microsoft, they revealed their plans to launch a cutting-edge global blockchain network. The overarching goal of this collaboration is to unlock the vast potential of synchronized financial markets responsibly, possibly enabling 24/7 tradability of financial assets as it’s currently too expensive.

Notably, influential figures in the traditional financial landscape, such as Larry Fink, the esteemed CEO of BlackRock, also share the belief that the future will inevitably be tokenized. The advantages of this transformative shift range from decreased transaction costs to heightened transparency and the ability to verify asset ownership with ease. As time progresses, we can expect a growing number of institutions to delve into these emerging technologies, experimenting with their capabilities.

Interestingly, despite this significant shift towards tokenized assets and blockchain technology, the general public might not even be aware that they are using such innovations. These transformative changes are setting the stage for a more efficient and transparent financial landscape, empowering both institutions and individuals alike.

Sign up for our newsletter to stay on top of the crypto market.