Weekly Update: 13th of March

A new look

At the start of the year, we surveyed our participants, and one of the feedback points was our clients' preference for shorter but more frequent updates on the digital assets market. As a result, beginning now, our monthly newsletter and the biweekly market update will be replaced with a brief weekly update, scheduled for publication every Wednesday. As our latest newsletter was published on the 8th of March, the first weekly update will recap the 1st of March up to the 13th.

This also enables us to communicate with our clients sooner, as the newsletter previously included the net asset value (NAV) of the Hodl Funds, which typically requires more time to calculate as it must be verified by a regulated administrator. Therefore, the NAV will be shared in a separate email once it has been confirmed by the administrator.

What happened during the 1st and 13th of March?

After 846 days, Bitcoin broke its all-time high of $69,045.00, before retracing back to $59,000 but the digital asset quickly recovered and climbed above $71,000. Read more

Deutsche Börse launches a spot cryptocurrency trading platform for institutional investors, allowing them to trade, settle, and store digital assets. Read more

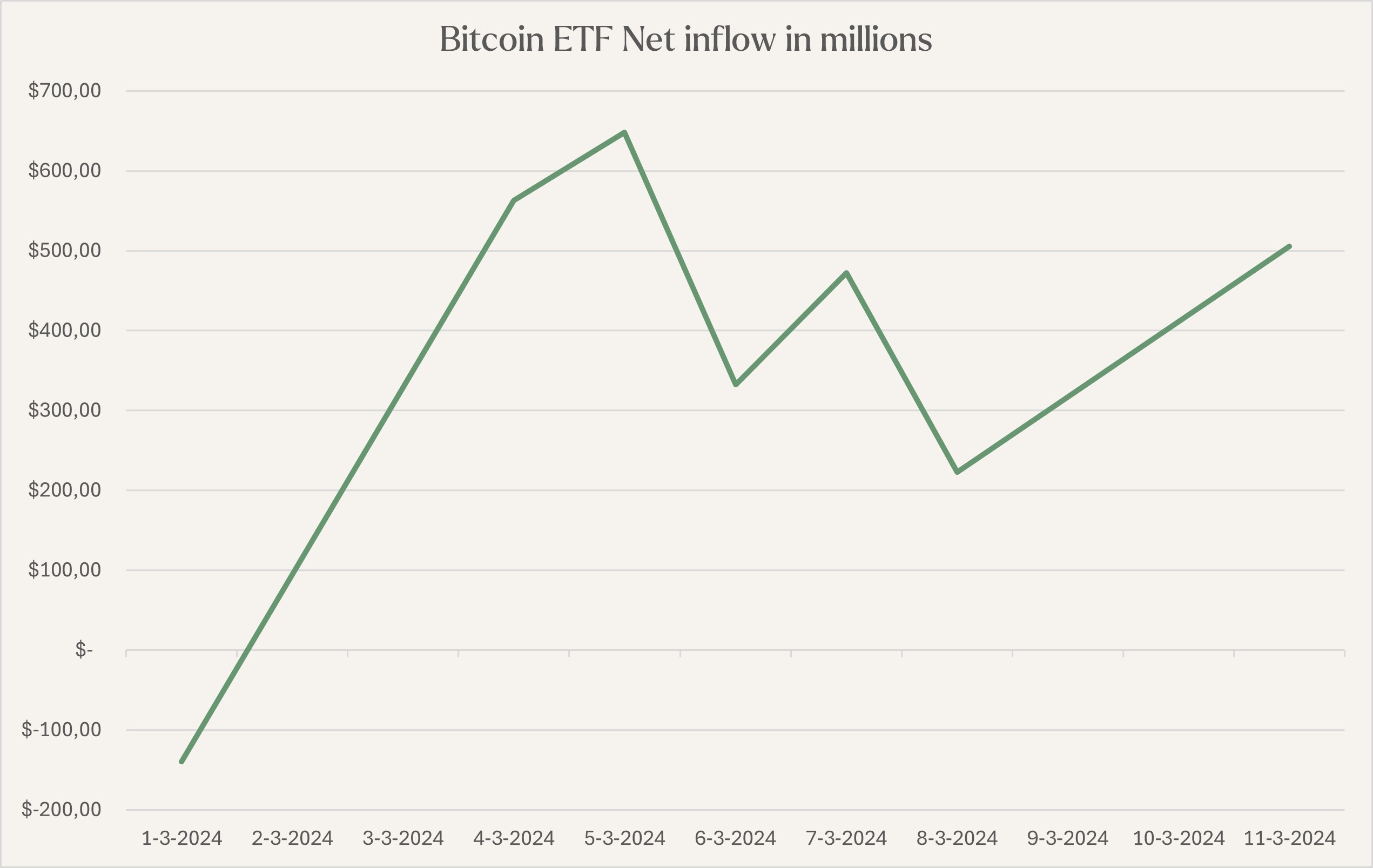

Throughout the beginning of March, the Bitcoin spot ETFs continued to see strong net inflows, except Grayscale’s GBTC which has seen 200,000 Bitcoin flow out of the ETF since its launch. Read more

On the 13th of March, the Ethereum Network will undergo the long-awaited Dencun Upgrade, allowing Layer 2 solutions on Ethereum to increase their transaction throughput and lower their transaction costs. Read more

Bitcoin breaks all-time high

On March 5th, Bitcoin surpassed its all-time high of $69,045, a price level not seen since November 2021, shortly after it retraced back to 59,000. With ETF inflows ongoing and bullish sentiment intact, fueled by the approaching Bitcoin Halving, we anticipate this upward trend to continue as Bitcoin surpasses the $71,000 mark. However, market participants still need to anticipate moments when the Bitcoin price retraces, the price won’t only go up in the coming months.

Deutsche Börse launches institutional trading platform

In early March, Deutsche Börse, a German security marketplace, launched its institutional spot trading platform Deutsche Börse Digital Exchange (DBDX). Initially, it allows the trading of Bitcoin and Ether against the euro, in collaboration with Crypto Finance, a crypto custody provider.

Spot ETFs continue to experience strong inflows

Throughout March, the US Bitcoin ETFs continued to experience strong net flows, except Grayscale’s GBTC, which has lost 33% of its assets under management since launch. The net flows during March accumulated to over $2.6 billion, resulting in a net inflow of over $10B since the 11th of January. Furthermore, BlackRock’s IBIT ETF has become the fastest ETF to reach $10 billion in assets under management.

The Ethereum Dencun Upgrade closes in

For months, the Ethereum network has been preparing for the Dencun upgrade, which will introduce various improvements, with the most significant being proto-danksharding. In essence, it's a new transaction type enabling Layer 2 solutions like Arbitrum and Optimism to bundle transactions to Ethereum’s network, boosting transaction throughput and lowering costs on these networks. Together with the speculation on an Ether spot ETF, this could further drive Ether’s price.

In other digital asset news

Stablecoin Tether (USDT) has reached a market capitalization of $100 billion, bolstering its place as market leader as its closest rival USD Coin (USDC) has a market capitalization of ~$29 billion

Ethereum staking protocol Eigenlayer has become the second largest DeFi project in the industry as its total value locked surpasses $10.4 billion, flipping lending protocol Aave of its place.

Sign up for our newsletter to stay on top of the cryptocurrency market.