What is Perpetual Protocol (PERP)?

- Introduction Perpetual Protocol

- Perpetual Protocol Technology

- Perpetual Protocol Use Case

- Perpetual Protocol Ecosystem

- Perpetual Protocol News

- Perpetual Protocol Price Predicition

Introduction Perpetual Protocol

One of the biggest sectors within the digital asset industry is Decentralized Finance (DeFi). Within this sector, we see a financial instrument growing at a significant pace, which is perpetual futures. A future is a type of derivative that obligates parties to buy or sell an asset at a predetermined price in the future. In traditional finance, futures have an end date on which the trader is obligated to meet this contractual obligation, however, this may not be the preferred entry or exit of the trader.

To tackle this problem, perpetual futures contracts were introduced in the cryptocurrency market. Traders were then able to enter a short or long trade without the fear of their contract ending. As long as he/she has sufficient margin in their account to withstand the volatility of the market, the trader could hold this position as long as desired.

A large portion of the perpetual future trading took place on the cryptocurrency exchange FTX, whose implosion illustrated the importance of decentralized solutions, also for futures trading. Perpetual Protocol provides this solution as it offers a decentralized perpetual futures platform that utilizes the unique Uniswap v3 virtual Automated Market Maker (vAMM) which provides on-chain liquidity with predictable pricing set by constant product curves

Perpetual Protocol Technology

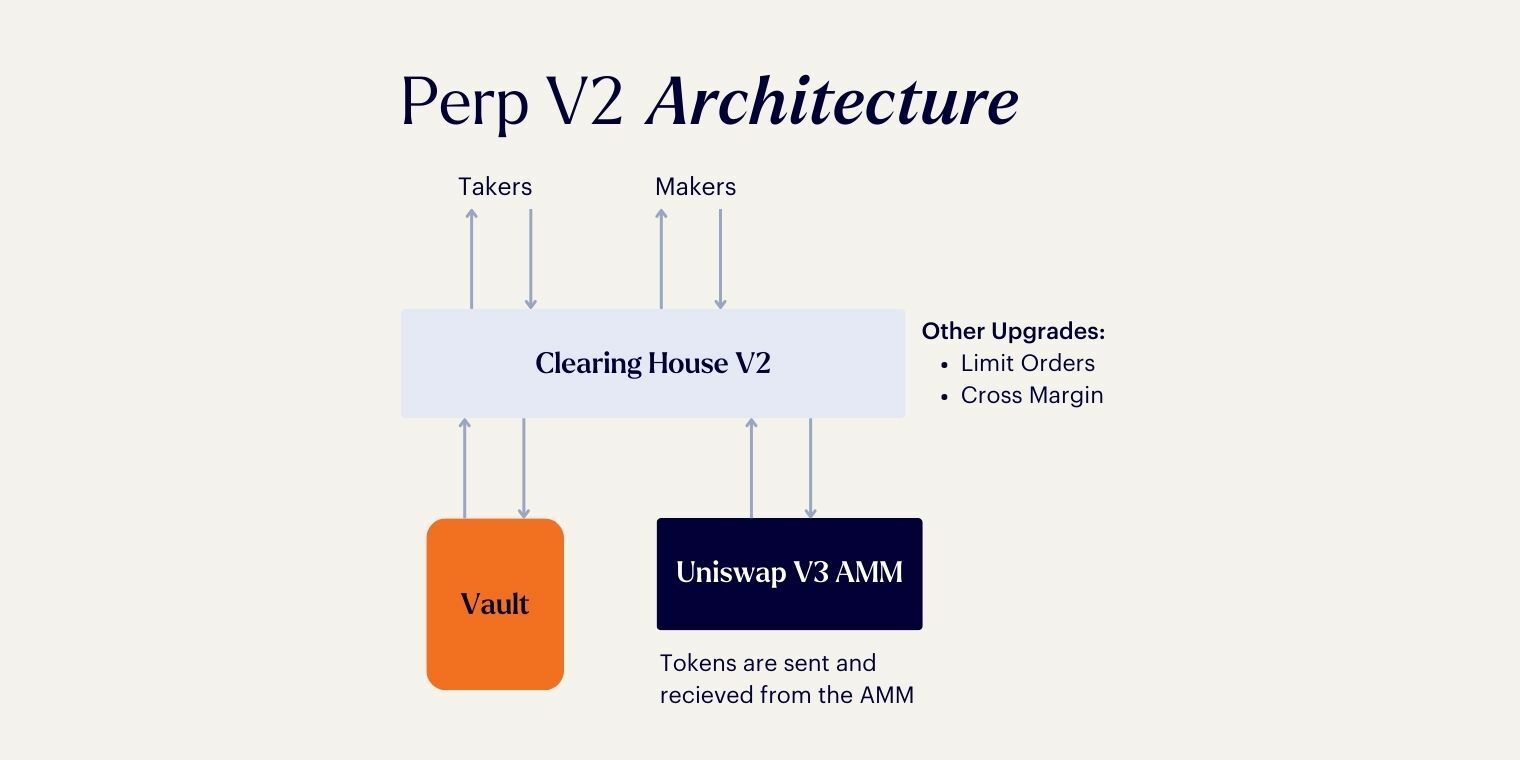

The most important technologies within Perpetual Protocol are the virtual Automated Market Maker (vAMM) and collateralized debt system. Usually when trading in a decentralized environment, decentralized exchanges use an AMM for price discovery and the trading of assets. An AMM is a mathematical formula that uses the weighted balances of two or more assets to determine the price. With the trading of futures, no actual spot trading occurs as these contracts derive the price of the underlying asset.

As no spot trading occurs, Perpetual protocol utilizes a vAMM, which calculates the entry or exit price of each trade. The vAMM doesn’t swap assets but derivative contracts and only acts as a price discovery system. The second technology is the collateralized debt system, this technology manages the margin deposited by the traders and creates the leverage needed when requested.

Perpetual Protocol Use Case

Perpetual offers users an easy and accessible way to trade futures contracts up to 10X leverage. Users can long and short a total of 18 cryptocurrencies and the exchange has experienced an abundance of volume of well over $21B. As Perpetual Protocol is a decentralized exchange, users deposit their funds into a collateral vault from their personal wallet. This provides users with a non-custodial derivatives platform without a single point of failure.

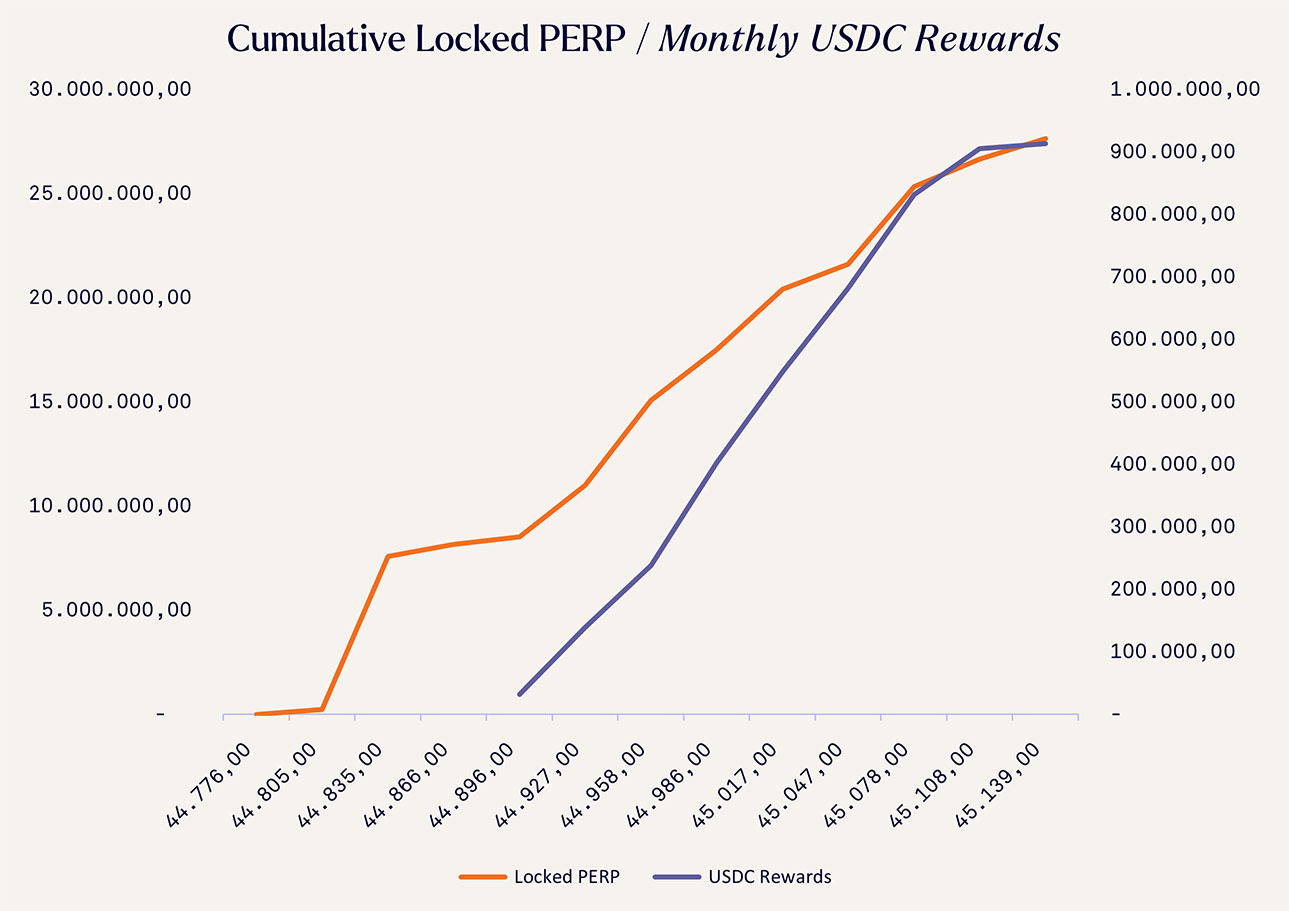

Another use-case of the exchange is the ability to distribute a portion of the trading fees amassed by the platform back to PERP token stakers who can vote-escrow their tokens up to a year. Since this model went live, the platform has collected over $19M in fees and has distributed $900K in fees to PERP token stakers in USDC as well as an additional boost of locked PERP tokens.

Perpetual Protocol Ecosystem

The DeFi sector is heavily intertwined with all the different projects as developers build their products on other existing projects. This is also seen with Teahouse, a DeFi platform that provides secure and flexible asset management. Teahouse offers various pools that are based on PERP’s v2, one of these is the Perpetual Protocol LP Strategy, which executes a concentrated liquidity provision strategy.

Another partner in Perp´s ecosystem is DappOS, an operating protocol that manages crypto infrastructures for users. The protocol has developed a unique frontend through which users can access the Perpetual Protocol exchange from different chains, such as the BNB Chain. This lowers the entry barrier for new users while providing these users with a user-friendly interface.

Perpetual Protocol News

There also have been some interesting developments within the Perpetual Protocol platform as a statement was published on June 26th that Perpetual Protocol and Yearn Finance, a DeFi yield aggregation platform, entered a partnership. Traders will be able to earn interest on their collateral while trading on the platform, the assets that are supported are the stablecoins USDC and USDT plus Wrapped Ether. The new strategy is called Yield+ and users earn a stable ~6% APR and is accessible for all users.

Another interesting development within the Perpetual platform is the introduction of a Smart Maker, a beta feature to improve execution prices and reduce slippage when opening large positions. The Smart Maker achieves this through the use of Over-the-Counter (OTC) trades to deepen the liquidity across the four most popular assets on the platform: BTC, ETH, OP and PERP. Before the traders enter the trade, the Smart Maker will calculate if a better price can be found, if not, the trade will be executed as before.

Perpetual Protocol Price Prediction

After its launch, the PERP token began its uptrend at the start of 2021, aligning with the general trend of the cryptocurrency market at that time. The price quickly soared past $5, where it settled between this level and $10 for a duration of three months. Subsequently, the price climbed further, reaching its all-time high in September at $24.2.

When the broader cryptocurrency market peaked, the PERP token price began to decline. The 50-day moving average crossed the 200-day moving average, a phenomenon known as the death cross, at the close of December 2021. This event triggered a sharp downtrend, exacerbated by the overall bearish market sentiment, regulatory ambiguity, and the token’s vesting schedule. Six months later, the price found support near its starting levels of around one dollar.

Since that time, PERP has exhibited a consolidation range between $1 and $0.3, showing slower rates of price decline, even as fundamentals have improved. It's widely understood that such phases can result in fatigue for current holders but can also offer attractive entry points from a long-term perspective.

Would you like to read the full report? Our report provides an in-depth analysis of team, tokenomics, technology and more. Do you want to gain access to all our research reports? Create an account in our portal.