What to expect from the BTC ETF approval?

- Spot versus Futures ETFs: What's the Difference?

- Historical Parallel with Gold ETFs

- Market Expectations

- Capital Inflows

- Price Impact

- The Debate Over Decentralization and Custodianship

- Conclusion

The digital assets market is on the brink of a significant transformation, as the potential for a Bitcoin spot Exchange Traded Fund (ETF) approval by the U.S. Securities and Exchange Commission (SEC) looms. This event is not merely a milestone for Bitcoin investors, it could be a paradigm shift in the financial world's embrace of digital assets. In this article, we explore the implications of a Bitcoin ETF, from market dynamics to philosophical debates. Also, given that the true impact of a Bitcoin spot ETF is still unclear to many observers, we will shed light on these complex aspects.

Spot versus Futures ETFs: What's the Difference?

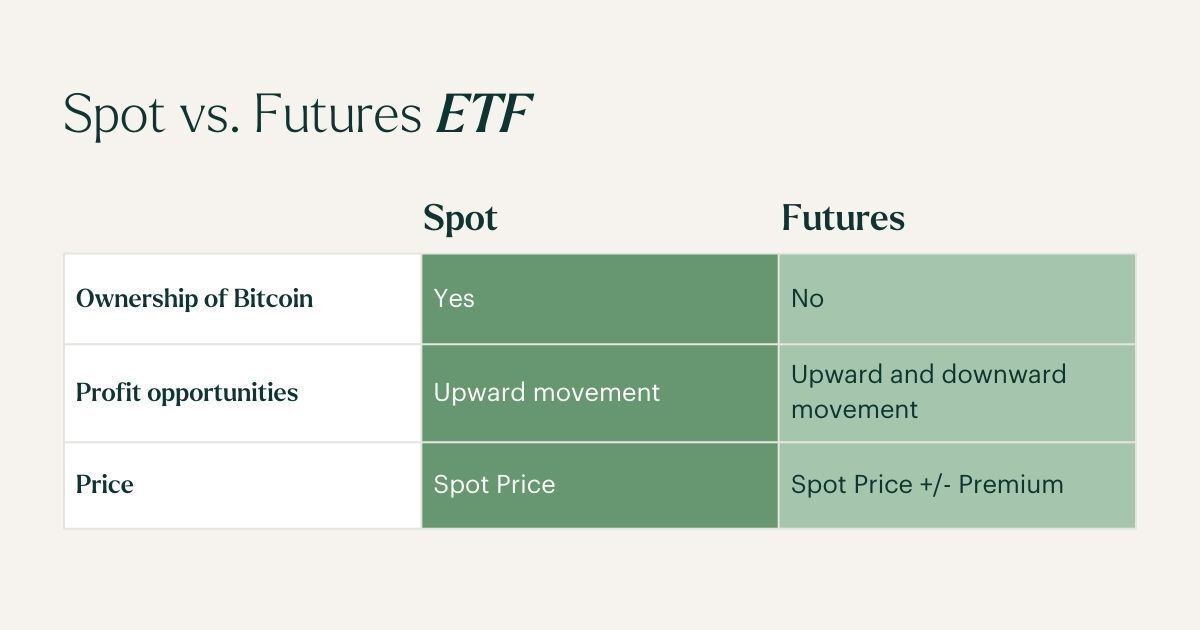

The market has already seen the introduction of several Bitcoin futures-based ETFs, offering insights into the interaction between these financial instruments and the digital assets market. Futures-based ETFs are centered around Bitcoin futures contracts, a financial derivative that represents an agreement to buy or sell Bitcoin at a predetermined future price, rather than a direct transaction of the cryptocurrency itself. As a result, capital invested in these ETFs does not directly flow into the Bitcoin market. These ETFs primarily settle price differences in contracts, leading to a disconnect between the ETF's performance and Bitcoin's immediate market price.

In contrast, a spot Bitcoin ETF would be a more direct investment vehicle. By actually holding Bitcoin, a spot ETF would offer investors exposure to the cryptocurrency, potentially making it an attractive option for those seeking exposure to Bitcoin. This type of ETF not only provides actual ownership of the asset but also represents a more traditional and institutional investment method in Bitcoin. It's important to note, however, that the impact of a spot ETF on the Bitcoin market is connected with investor participation. The introduction of a spot ETF means that capital will enter the Bitcoin market if there is investor uptake. It's not a guarantee but a potential for direct market impact, making it a noteworthy evolution in Bitcoin investment opportunities, particularly for those considering long-term investment strategies.

Historical Parallel with Gold ETFs

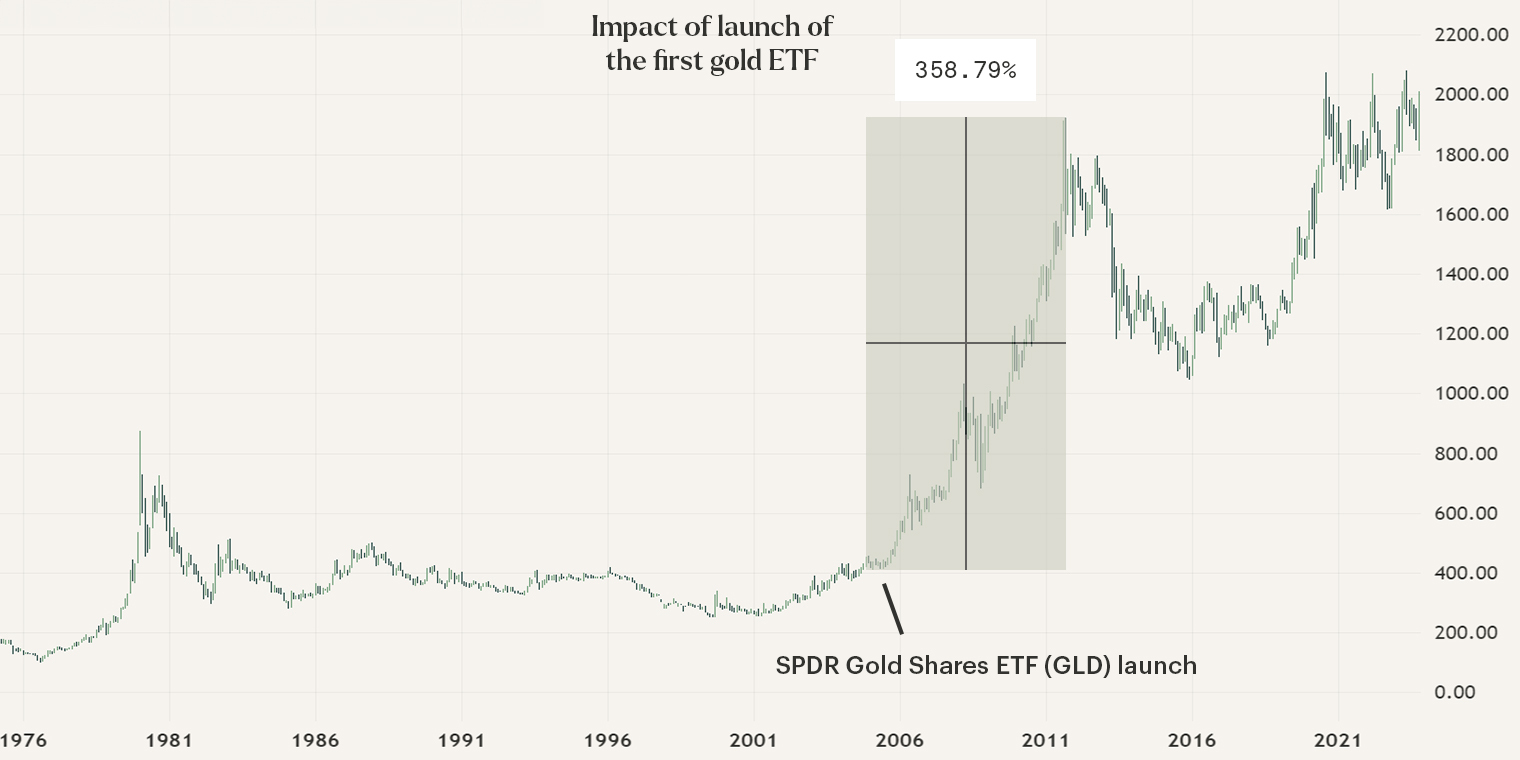

The impact of introducing a spot ETF can be best understood by looking at historical precedents such as the launch of Gold ETFs. This event was a defining moment in investment history, significantly transforming how gold was accessed and traded. By simplifying the investment process, Gold ETFs opened up gold investment to a broader audience and eliminated the complexities involved in acquiring and storing physical bullion. Maurice, CEO of Hodl Group, noted that 'During the initial phase of Gold ETFs, investor concerns predominantly centered around the physical storage of gold. Questions regarding the exact locations of storage, the security of these facilities, and the protective measures in place for the gold were paramount, reflecting the natural apprehension that accompanies innovative financial instruments.'

The success of Gold ETFs reflects the powerful role of financial innovation in expanding market access. It not only provided a hedge against market volatility and a shield against inflation but also became a component of diversified investment portfolios. The ease of trading gold ETF shares like stocks on exchanges and the cost-efficiency they offered over handling physical gold attracted both retail and institutional investors.

In essence, Gold ETFs transformed the gold market, making it a more integrated part of the financial system and offering investors an avenue to include this traditional asset in their investment strategies.

Market Expectations

The looming possibility of a Bitcoin ETF approval by the SEC has led to a web of expectations among investors and analysts. Opinions are divided: some forecast a bullish surge in Bitcoin's value, while others, wary of over-optimism, point to the potential for a 'sell the news' scenario. This cautious stance is not unfounded, as financial markets have previously seen assets undergo corrections post-anticipation of significant events since they are forward-looking by nature.

The historical responses, such as those to the CME Bitcoin futures launch, offer valuable insights but are not foolproof predictors. The Gold ETF launch serves as a pertinent example, where, against the grain of immediate surge expectations, the market initially experienced a downturn before prices eventually climbed. This pattern underscores the multifaceted and sometimes unpredictable nature of market reactions.

Capital Inflows

The prospect of a Bitcoin spot ETF has been met with great anticipation. Regulatory uncertainties and the absence of conventional investment avenues have deterred a segment of the market, especially institutional investors, from participating in the cryptocurrency space.

Former BlackRock Managing Director Steven Schoenfeld mentioned at CCData’s Digital Asset Summit in London that an ETF approval could bring $200 billion to Bitcoin. AllianceBernstein, a global asset management company, also expects a significant increase in crypto asset management following an ETF approval. These forecasts suggest that the ETF approval could be a transformative moment for Bitcoin.

Maurice further emphasized this point by stating, 'The approval of a Bitcoin spot ETF would notably simplify the process for U.S. investors to gain exposure to Bitcoin, as it integrates the cryptocurrency into a familiar and regulated investment framework. This ease of access, combined with the regulatory clarity that comes with an ETF, makes Bitcoin a more approachable asset for a broader range of investors in the United States.'

This growth is expected to be driven by institutional capital hedge funds, pension funds, and private wealth managers who are increasingly interested in the diversification benefits and the potential for high returns that Bitcoin offers. The accessibility of a Bitcoin ETF could catalyze these investors, providing a regulated and liquid means to enter the market.

Price Impact

The immediate market response to a Bitcoin ETF approval is a complex interplay of investor sentiment, market readiness, and comparative historical events. While some market participants anticipate a swift and significant price surge, others are more skeptical, drawing parallels to the initial aftermath of Gold ETFs. The Gold ETF example is particularly instructive, revealing that immediate market reactions can be counterintuitive. In that case, despite the positive long-term impact, there was an initial period of price decline, suggesting that markets may need time to adjust to the introduction of a new financial instrument. In Bitcoin's case, an immediate spike could be tempered by a range of factors, including profit-taking or market saturation.

Looking beyond the immediate reaction, the long-term price trajectory of Bitcoin in the wake of an ETF approval could be characterized by greater stability. The entry of institutional investors, brought by an ETF, is expected to play a role in this. Institutions typically bring long-term investment horizons and larger capital bases. Thus the long-term impact of a Bitcoin ETF might see a gradual and sustained price growth, reflecting a maturing market and a broader acceptance of Bitcoin as a legitimate asset class.

The Debate Over Decentralization and Custodianship

However, not everyone welcomes the arrival of a Bitcoin ETF. The foundational philosophy of Bitcoin centers on the concepts of decentralization and self-custody, echoed by the popular saying within the crypto community 'not your keys, not your coins.' A Bitcoin ETF introduces a centralized component to Bitcoin investment, as the ETF provider holds the actual bitcoins and issues shares that represent ownership.

This centralization represents a shift from Bitcoin's original ethos, which emphasized operating outside centralized financial systems. Bitcoin's journey from a decentralized digital cash to a store of value, and now potentially an established asset class, reflects its evolving role in finance.

Despite this, Maurice points out, 'Investors still have the choice to adhere to Bitcoin's principles – they can opt for self-custody.' This emphasizes that the introduction of a Bitcoin ETF doesn't eliminate the traditional methods of Bitcoin investment, but rather adds to the options available to investors. Some may prioritize the convenience and regulatory clarity of an ETF, while others might choose to stick to Bitcoin's original principles of decentralization and direct ownership. The choice between an ETF and holding Bitcoin directly ultimately depends on an individual's investment strategy and their view on the importance of Bitcoin's foundational ethos.

Conclusion

The approval of a Bitcoin ETF by the SEC would represent a significant milestone for Bitcoin and the wider digital assets market. While the historical precedent set by Gold ETFs suggests a positive outcome for market growth and investor participation, the complexity of price dynamics and market expectations requires consideration. The capital inflows following the introduction of a Bitcoin ETF could be transformative. However, it also raises questions about centralization and the core values of Bitcoin.

Do you want to learn more about the opportunities this can provide for your portfolio? Schedule an appointment with one of our advisors to get personal advice.

Sign up for our newsletter to stay on top of the crypto market.