Why you should add digital assets to your 60/40 portfolio

- What is the 60/40 portfolio?

- Adding digital assets to a traditional 60/40 portfolio

- Adding digital assets to a risk-averse 60/40 portfolio

- What we think a modern portfolio should look like

What is the 60/40 portfolio?

For the last 50 years, the traditional 60/40 portfolio has been the gold standard among investors as it provided steady returns with relatively low risk. However, over the past two decades, the economic landscape has been changing. From more aggressive monetary policies to disruptive technologies which change our lives and the economy every day, for example, widespread quantitative easing (QE) and digitalization of our society.

The traditional portfolio for investors consists of 60% stocks which can be seen as the more “aggressive” part of the portfolio and 40% bonds, which is the risk-averse and yield-earning part of the portfolio. For institutional investors such as pension funds, however, it is 60% bonds and 40% stocks as they aim to slowly build wealth and can’t afford unnecessary risks. This investment strategy is more risk-averse as capital will grow or decline steadily, avoiding high risk and volatility.

In the rapidly changing economic landscape, however, we increasingly see the need for an adjustment to this ratio. One of these reasons is that the portfolio was introduced at a time when the economy operated on older industries with the heavy use of commodities.

Additionally, QE has caused economic cycles in which QE causes capital to flow toward securities such as bonds and stocks, creating bubbles in asset markets. While during quantitative tightening, stocks and bonds tend to decrease in value as the capital flow halts and interest rates go higher.

We have always believed that the modern investor should have a modest exposure to cryptocurrency as the financial market is slowly evolving. In this blog, we want to illustrate what a small exposure to the digital asset industry can do for your investment portfolio. In the following three scenarios, we will add an allocation of 1%, 3% and 5% of our Hodl Genesis Fund to the traditional 60/40 portfolio and the risk-averse strategy, 40% stocks and 60% bonds.

Adding digital assets to a traditional 60/40 portfolio

Before we add digital asset exposure, we create a base scenario. In this scenario, an investor will hypothetically invest a total of $10M. 60% or $6,000,000 of this amount is invested in the Vanguard Total Stock Market Index Fund ETF and 40% or $4,000,000 in the Vanguard Total Bond Market Index Fund ETF.

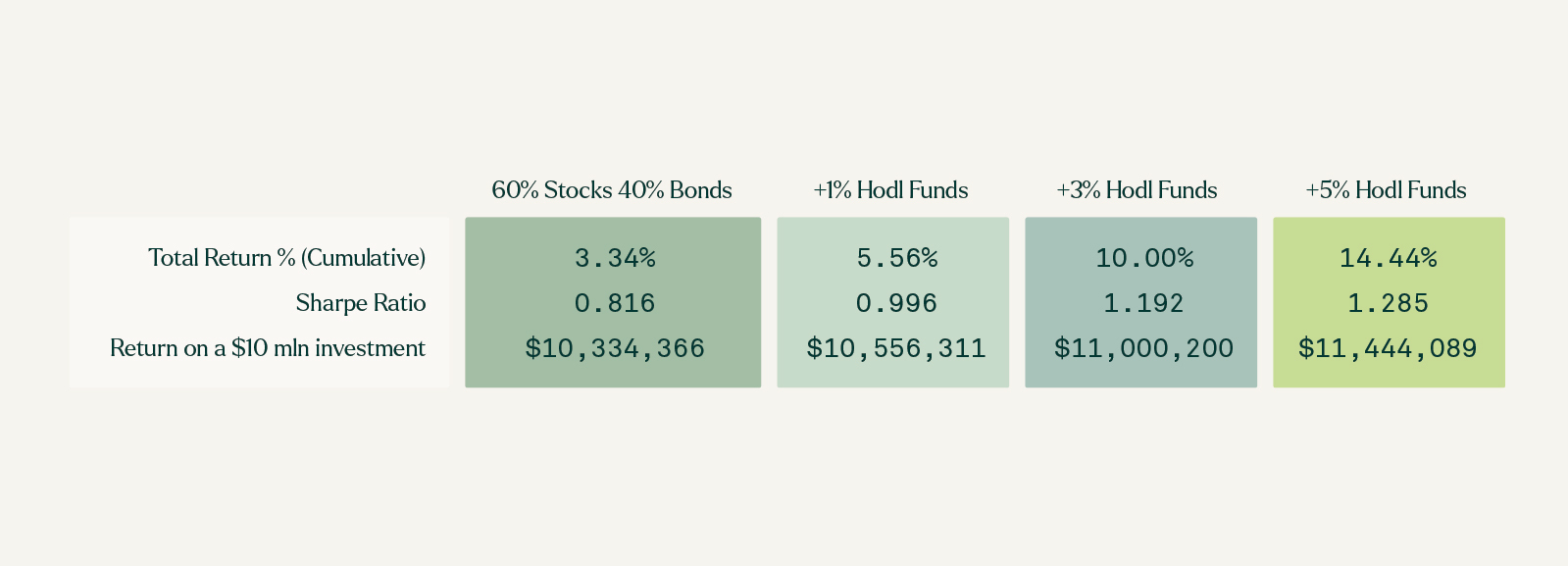

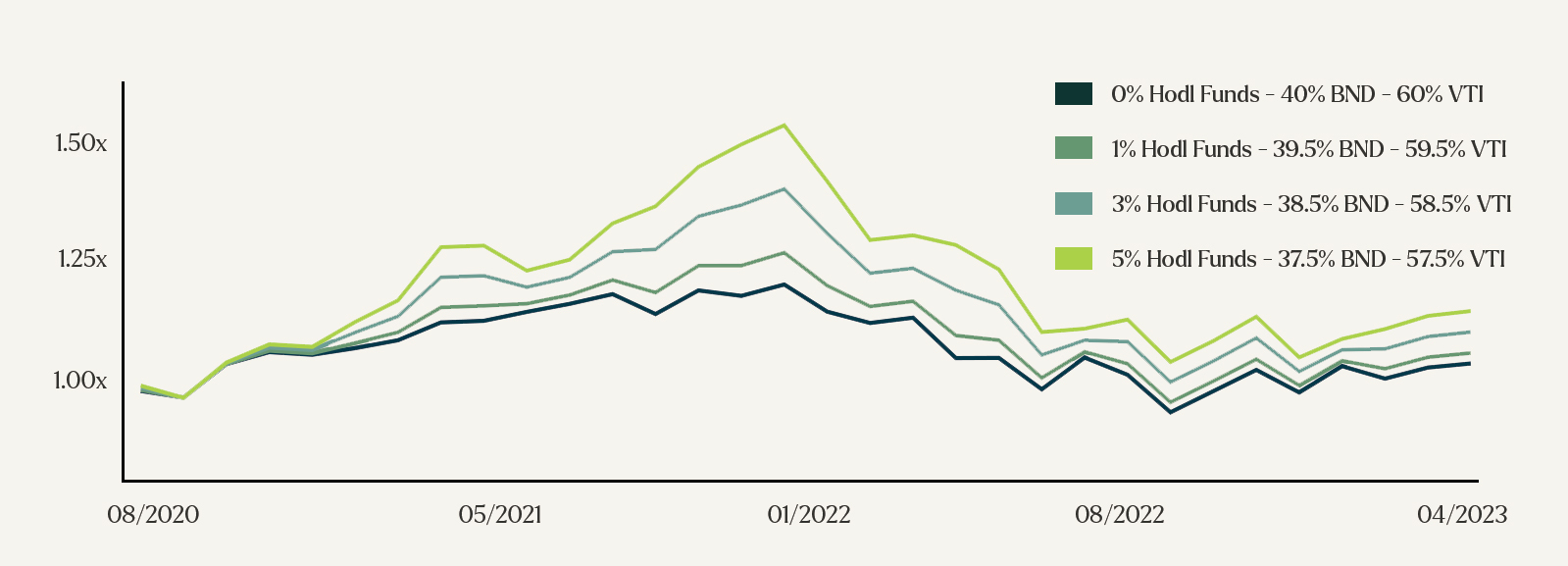

The investor invested this amount from the 31st of July 2020 to the 31st of March 2023. In this scenario, the investor generated a total return of 3.34%, in monetary value this accrued to $334,366. Additionally, the Sharpe ratio, a mathematical formula which we will simplify to reward earned divided by the risk taken, for the base scenario is 0.816, which is an undesirable ratio as it indicates that the reward earned was lower than the risk taken. A Sharpe ratio above 1 indicates that the reward generated was higher than the risk taken, above 1 and between 2 is good, above 2 is excellent. Lastly, the S&P 500 (SPY) index was used as the benchmark in computing the Sharpe ratio, given the U.S.-centric nature of the composition of this 60/40 portfolio. In the following scenarios, we will add 1%, 3% and 5% exposure to the digital asset market through the Hodl Funds. Additionally, a graph has been provided to illustrate the total results according to the different distributions.

1% Hodl Funds allocation

In this scenario, we will add a 1% allocation in the Hodl Genesis Fund, resulting in a distribution of 59,5% in stocks, 39,5% in bonds and 1% in digital assets. In this scenario, $100,000 will have been invested in digital assets, however, even with a small allocation of digital assets, we see that the traditional portfolio would generate significantly more returns. At the end, the total returns as the total return ends at 5.56%, in monetary value this $556,311. As we add digital assets to the portfolio, the Sharpe ratio improves as it becomes 0.996.

3% Hodl Funds allocation

In the second scenario, we will add a 3% allocation, or $300,000, in the Hodl Genesis Fund, resulting in a distribution of 58,5%, 38,5% and 3%. As we add two percent more in digital assets, we slowly see the returns to increase significantly as the portfolio generates 10% total returns, or $1,000,200. This is almost three times the traditional 60/40 portfolio, displaying the strength of a diversified portfolio with a modest exposure in digital assets. Here again, the Sharpe ratio improves as it increases to 1.192, ending above the 1 threshold.

5% Hodl Funds allocation

In the final scenario, 5% or $500,000, of the portfolio is allocated in the Hodl Genesis Fund, resulting in a distribution of 57,5%, 37,5% and 5%. With a 5% allocation, we can see in the illustration that the portfolio experienced a significant growth, even generating over 50%, $5,000,000 returns in a little bit over a year. As financial markets reversed, a long and strong downward movement occurred. However, even with this movement, the newly distributed portfolio generated a total of 14.44% returns or in monetary value $1,440,089. With a greater addition of digital assets, the Sharpe ratio improves to 1.285.

Adding digital assets to a risk-averse 60/40 portfolio

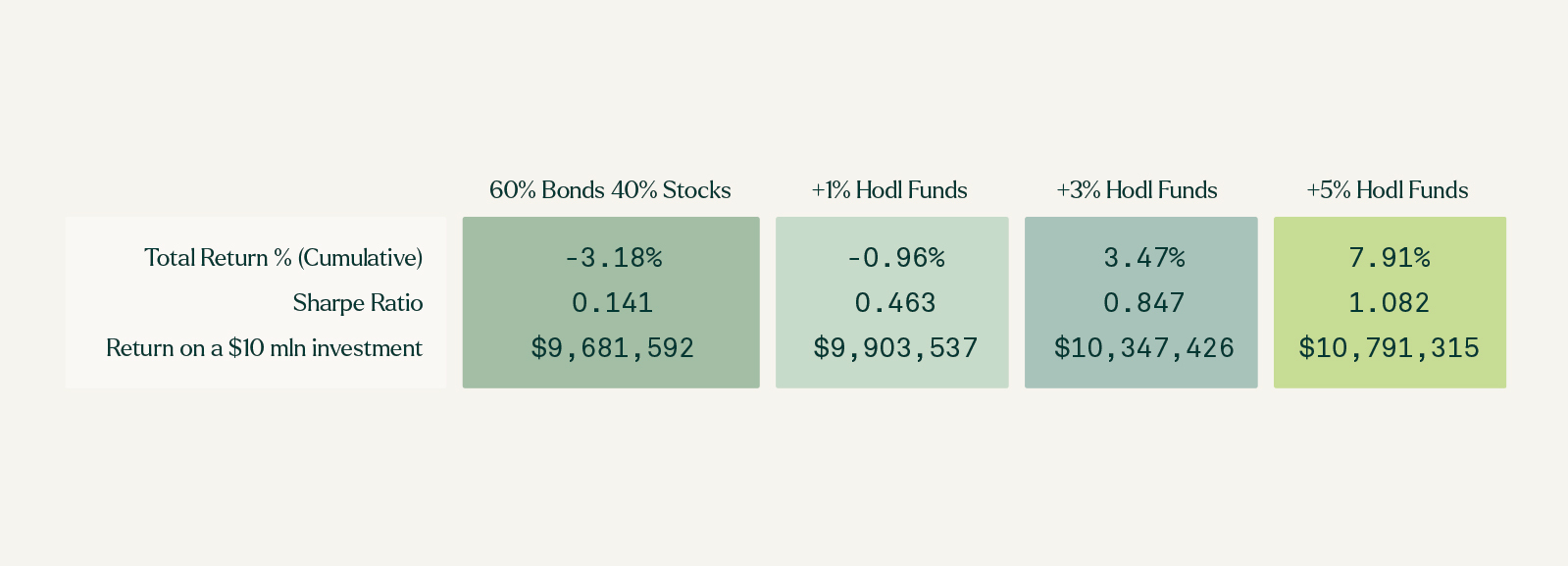

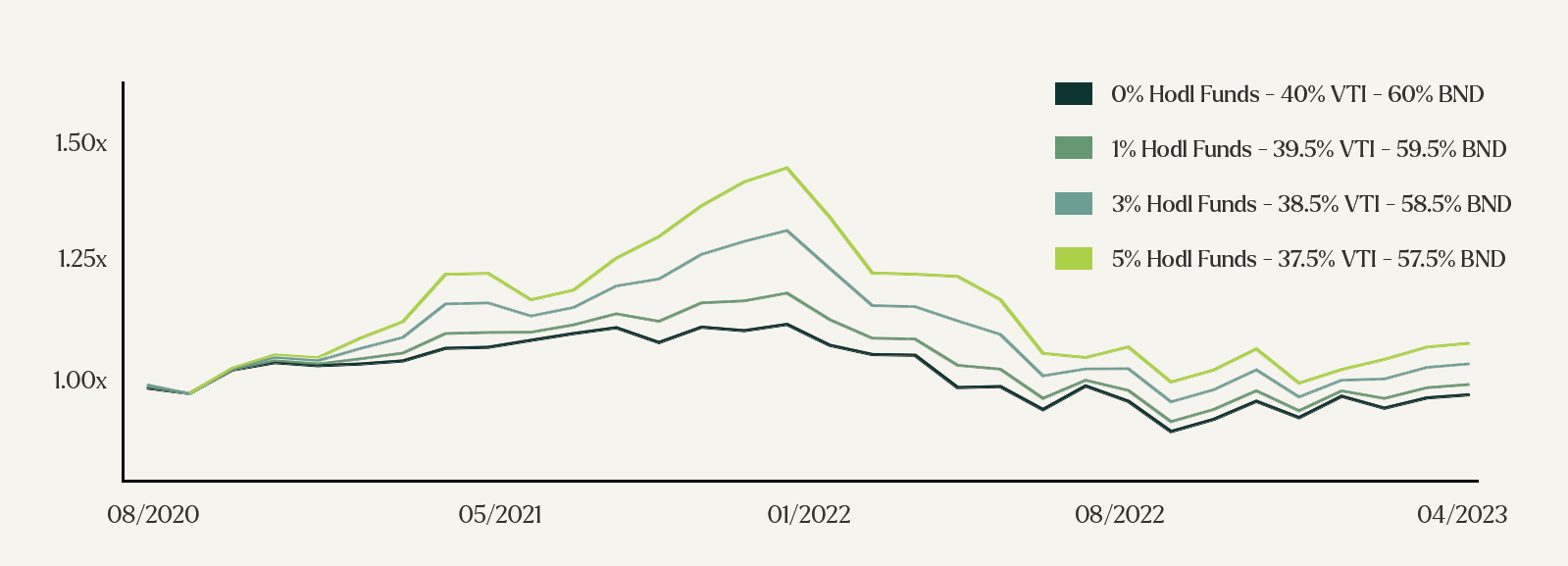

As institutional investors are more risk averse and aim for long-term wealth building and wealth preservation, 60% of their portfolio is invested in bonds and 40% in stocks, the same indexes are used. As with the aforementioned investment period, the base portfolio would have generated a loss of -3.18%, in monetary terms -$318,408. Additionally, the Sharpe ratio is dreadful as it ends at 0.141. Indicating that the reward earned (or loss) is proportionally worse than the risk taken. Bonds are a relatively “safe investment” so when the risk-averse tactic resulted in a loss, the Sharpe ratio was affected heavily.

1% Hodl Funds allocation

In the risk-averse portfolio of institutional investors, we added a small allocation of digital assets, however, this still resulted in a loss but a minor one. The portfolio would have generated a loss of -0.96% or -$96,463. Nevertheless, the Sharpe ratio did improve as it increased to 0.463, still unfavorable but better than the base scenario.

3% Hodl Funds allocation

As we add more digital assets to the portfolio, the risk-averse strategy generates a positive return of 3,47% or $347,426. Illustrating the potential of digital assets in a modern investment portfolio. Although a minor positive return has been generated, the digital assets created a buffer for negative returns of the stocks and bonds. Additionally, the Sharpe ratio significantly improved as it increased closer to the 1 threshold as it resulted in a ratio of 0.847.

5% Hodl Funds allocation

In the final scenario, the risk-averse strategy achieves the best results, the strategy generates a positive return of 7,91% or $791,315. This total return is quite favorable as we need to consider that the market experienced a strong downward movement for over a year. Additionally, the Sharpe ratio finally surpasses the 1 threshold, indicating a suitable risk/return, as it increases to 1.082.

What we think a modern portfolio should look like

As aforementioned, we believe that investors should have a modest exposure to digital assets, the industry is still young and the volatility would cause most investors restless nights when fully exposed. What a modest exposure should look like is completely up to the investor as more digital assets results in higher volatility. The investor needs to ask himself what kind of strategy suits him/her. However, as illustrated in the different allocations, a modest exposure can provide significant benefits for your portfolio. Although it is important to note that past results don’t guarantee future performance. Nonetheless, during the past decade, digital assets have been the best-performing asset and the industry continues to grow in users and organizations.

During 2023, we have seen traditional institutions slowly soften their stance as various asset managers such BlackRock and Valkyrie apply for Bitcoin ETFs. Moreover, other organizations such as Deutsche Bank are looking into custodial services as a method for digital assets exposure. Although the market has experienced a long period of negative sentiment, some genuinely interesting developments are occurring.

Our financial landscape is evolving, and we believe that the modern portfolio needs to evolve with it. As time progresses, our lives are moving to an ever more digital environment and we believe that digital assets are the logical next step in financial evolution. Want to talk about what digital assets can offer your portfolio? Please contact us through the button below to discuss the possibilities.

Sign up for our newsletter to stay on top of the crypto market.