Market update: June

Market update: June

Upcoming rate hikes cause a ripple effect

The start of June was characterized by continued high inflation and the response of central banks to combat this economic trend. On the 9th of June, the European Central Bank (ECB) confirmed that there will be a first interest rate hike for the Eurozone in July. Where the current interest rate is -0.5%, the ECB announced that it will be raised to -0.25%. It also announced that it expected further and possibly more aggressive increases later in the year. A few days later, the ECB also called an emergency meeting to discuss inflation and interest rates. This clearly shows that the ECB feels compelled to take a more active stance to combat inflation.

The day after the ECB announcement, worrying figures also came in from the United States. The current inflation rate was 0.3% higher than expected by many economists. The employment rate also increased, which means there is more money to be spent, which with the current scarcity of many goods can cause a further increase in inflation.

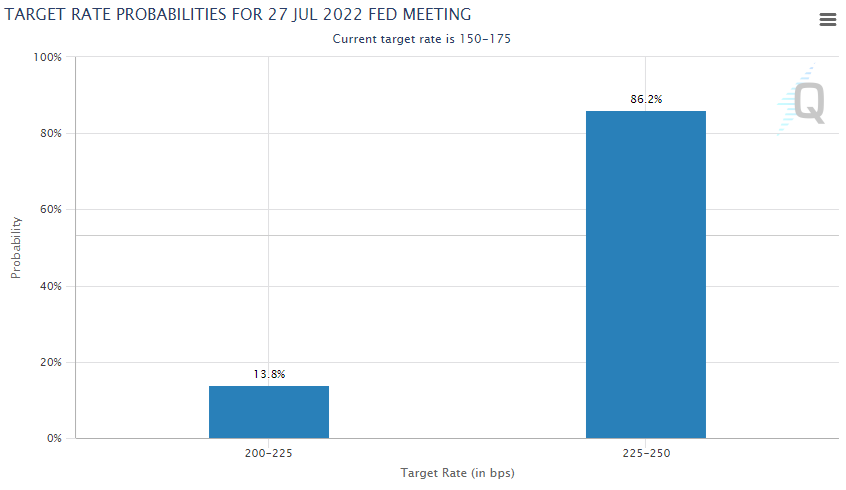

Due to these increases, the market no longer expected a 0.5% increase but prepared for an interest rate hike of 0.75%. This resulted in a risk-off movement in order to prepare for this increase. During the FOMC meeting on June 15, the Fed confirmed the increase and also announced that it would not rule out further increases of 0.75% for the upcoming July and September meetings. Currently, 86% of economists prepare for another 0.75% increase in July.

The pessimistic outlook for the upcoming rate hikes also had a negative impact on the cryptocurrency market. In the coming months, investors will have less access to capital for their alternative investments as their costs increase. The downwards spiral of the cryptocurrency market accelerated when rumors spread that crypto staking and loan platform Celsius may have liquidity problems.

Bank run on Celsius

During the first two weeks of June, rumors began to spread that centralized lending and staking platform Celsius may have liquidity issues. Celsius can be compared to a bank; assets deposited into the platform are divided among other platforms in order to achieve positive returns. Users who deposited these assets are rewarded in the form of interest. With 1,3 billion dollars, Ethereum is Celsius' biggest holding.

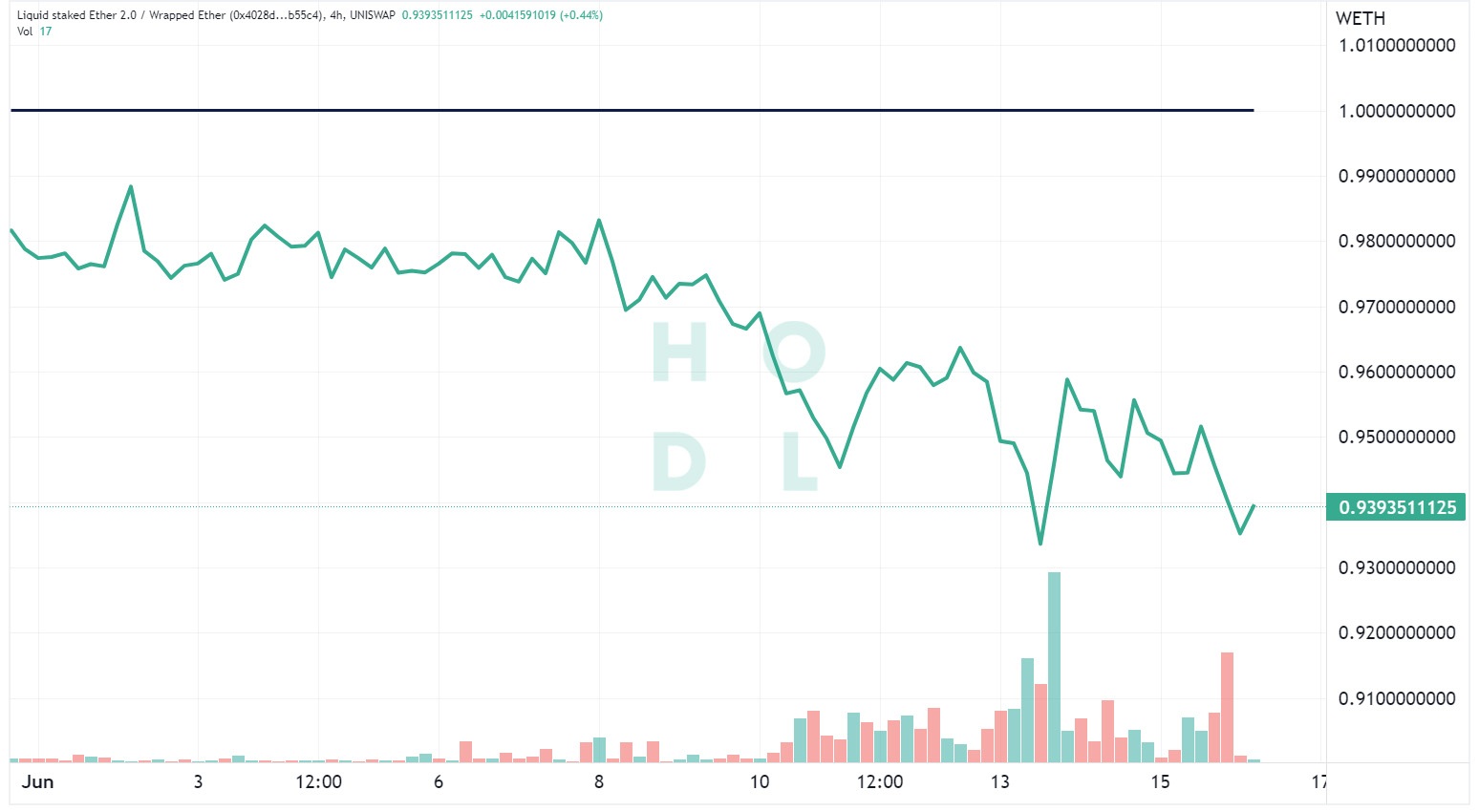

In order to achieve positive returns on ETH, they deposited the asset to the Lido Finance platform where they were staked. The return on Ethereum through Lido Finance is 4% per year. Lido provides stakers of ETH with the stETH token, a representation of the staked ETH. The stETH token can be traded on the open market against ETH, causing this ratio to normally be roughly 1:1.

However, due to the negative sentiment in the market, there was an increase in users who wished to withdraw their ETH from the Celsius platform. Due to Celsius' insufficient balance of ETH, the platform was forced to sell large amounts of stETH. Celsius' initial sales prompted other investors to sell their stETH as well. This large selling pressure eventually caused the value of stETH to ETH to fall sharply.

As investors began to fear that their other assets were potentially at risk, a bank run on Celsius began. The platform reacted with an immediate pause of all withdrawals, swaps and transfers. On the 12th and 13th of June, Celsius removed staked assets from other DeFi platforms, worth about $320 million. These assets were sent to the cryptocurrency exchange FTX. Celsius hasn't elaborated on why these transactions have been executed yet.

US regulators working toward clarity

The US market is one of the biggest drivers of the cryptocurrency market, a large number of investors and crypto organizations are located in this region. As the US market keeps growing, the legal nature of cryptocurrencies needs to be clarified. Two US senators released the eagerly anticipated cryptocurrency regulation bill. One of the key takeaways from the released bill is that the cryptocurrency market will fall under the jurisdiction of the Commodity Futures Trading Commission (CFTC).

As stated in the announcement, "Digital assets that meet the definition of a commodity, such as bitcoin or ether, which comprise more than half of digital asset market capitalization, will be regulated by the CFTC”. The bill will provide the CFTC authority over the spot markets in crypto commodities, however, it also calls for an SEC/CFTC self-regulatory organization. If the proposal gets passed and cryptocurrencies are seen as a commodity, investors will benefit from it greatly as commodities have more preferential tax treatment than securities. The bill will also eliminate taxes on cryptocurrency transactions of less than $200, which benefits the use of cryptocyrrency in payments.

Earlier in the month of May, cryptocurrency exchange FTX and the Commodity Futures Trading Commission (CFTC) had a meeting on FTX's proposal to allow a relatively new market structure for its derivatives trading. The submitted proposal should allow for the decoupling of derivatives trading on FTX's platform from the financial intermediation offered by banks. A decoupling from U.S. banks would mean that FTX gets more freedom in the offering of derivatives on their platform such as 24/7 trading. In the future, it may be able to offer derivatives outside the cryptocurrency market. The CFTC is still discussing the proposal and it is unclear when the final decision will be made.

European Blockchain Convention

During the past two years, Hodl has experienced strong growth and gained more stature within the market. Due to this growth, we are honored to announce that we are speakers at the European Blockchain Convention (ECB) in Barcelona. The ECB is the most influential blockchain convention in Europe and we are glad to attend in order to provide insights and learn more from the ever-evolving space.

The investor's guide to cryptocurrency

In this blog series on investing in cryptocurrency, we dive deeper into topics such as the evolution of our money, the origins of cryptocurrencies, the various applications of this new technology and the underlying differences.

In the fourth part, we talked about the most used applications of cryptocurrencies and what kind of advantages they could bring to organizations. In chapter 5 we will dive deeper into decentralized finance and the future of cryptocurrency.

Before investing in any cryptocurrency, it is highly recommended to understand the underlying fundamentals of each crypto project. In this sixth part of our series, we explore the basic steps of analyzing a cryptocurrency project.

Read the sixth chapter

Receive our newsletter to stay on top of the crypto market.