David vs Goliath: Bitcoin vs Gold

When Bitcoin was developed, it was introduced as a peer-to-peer electronic cash system. Although it is definitively used as a medium of exchange in El Salvador and individual businesses, as time progressed, most investors started to see Bitcoin as a store of value. Through its similar concepts, Bitcoin is therefore often referred to as digital gold. But what are the similarities, and what are the differences? In this blog, we would like to highlight the features of the physical established versus the digital emerging asset and what the future holds.

What is Gold?

Gold, originating from the core of stars and arriving on Earth via meteorites, remains rare and highly valuable due to its inability to be created on Earth and its unknown total supply. As early as ancient civilizations, people valued it for its scarcity, extracted through demanding mining efforts, bestowing inherent value upon the metal, like other mined valuable metals.

Initially prized for symbolism and aesthetics, gold later evolved into money due to its scarcity and universal acceptance, making it suitable for transactions. Despite its appeal, limitations such as portability and divisibility hindered its efficiency for everyday transactions.

Though no longer a primary medium of exchange, gold persists in jewelry, electronics, and aesthetic items. Its principal use remains a store of value, seen as a haven during economic distress and an investment opportunity due to its unexpandable supply.

What is Bitcoin?

In 2008, Satoshi Nakamoto released 'Bitcoin: A Peer-to-Peer Electronic Cash System', introducing a digital currency amid the financial crisis. Bitcoin aimed to decentralize financial control, offering autonomy outside traditional institutions.

The Bitcoin network operates through the blockchain, miners, and cryptography. Miners validate transactions by solving mathematical puzzles, adding new blocks to the chain, and receiving Bitcoin as a reward.

The blockchain's integrity is ensured by cryptographic hashes, making any data alteration detectable. This security measure safeguards the blockchain against unauthorized modifications.

Initially conceived as decentralized cash, Bitcoin is now considered digital gold due to its limited supply of 21 million, akin to gold's scarcity. Its evolution from speculation to a $1T market asset underscores its growing significance as a real-world asset.

Which asset is better, Bitcoin or Gold?

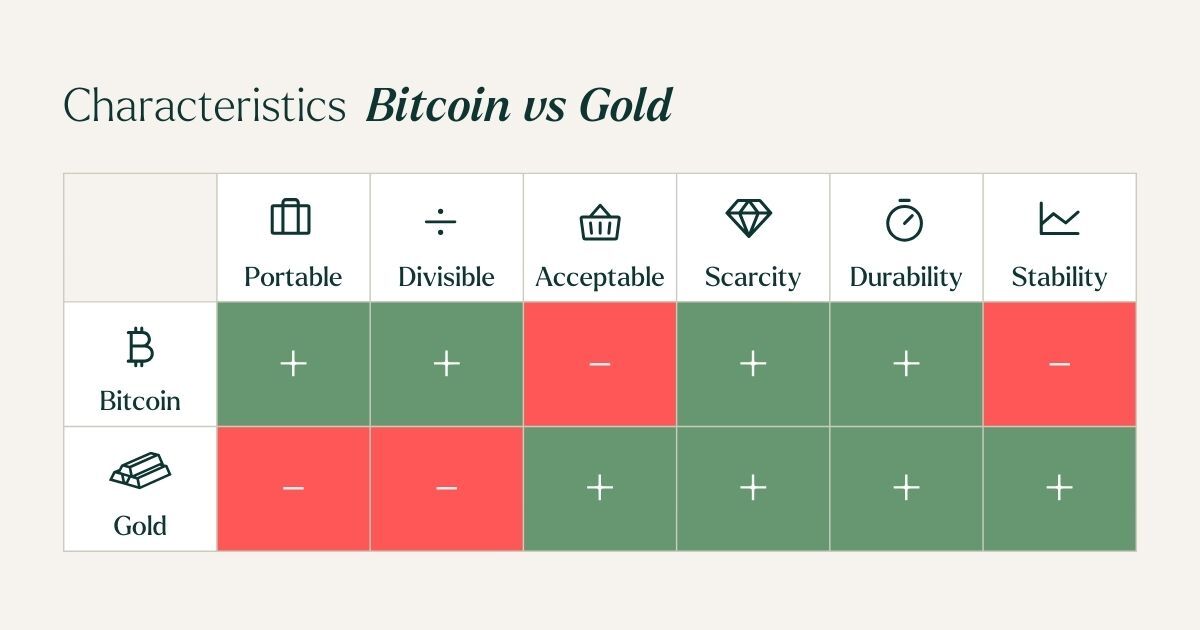

As Bitcoin slowly matured, increasingly more investors have started to compare the two assets, although there are some similarities, they are uniquely distinct. For example, when looking from divisibility, portability, acceptability, scarcity, durability, and stability in value perspective.

Divisibility

In the category of divisibility, Bitcoin is superior. A single unit of Bitcoin can be divided into 100 million satoshi, the smallest unit of a Bitcoin, just with a click of a button. While gold is divisible, people would have to use a melting oven and even then it can’t be divided into 100 million pieces.

Portability

Bitcoin also wins in the category of portability, as it exists solely in the digital environment. Large quantities of Bitcoin can be sent around the world with a simple internet connection, whereas gold’s portability is fairly limited, especially in large quantities, due to its weight and safety concerns.

Acceptability

In terms of acceptance, we would say that gold has an edge over Bitcoin. Gold has been considered a form of money and store of value for thousands of years and is universally recognized. Although more institutions and people are adopting Bitcoin, gold is more established and accepted by a larger audience. Over time, the acceptance of Bitcoin may increase but it has a long way to go for universal acceptance.

Scarcity

When it comes to scarcity, we would say the assets score fairly close. As aforementioned, gold originates from stars and can’t be recreated on Earth, even if we don’t know its maximum supply, it’s finite. Bitcoin has a maximum supply of 21 million but does exist digitally so technically it can be recreated, although the alternative Bitcoin wouldn’t be worth much as there is no adoption, so nobody will accept it. So, both assets derive their value from being scarce, additionally, both derive some of their value from a mining process, although Bitcoin’s is through computers and gold is through a physical mining process.

Durability

In durability, both assets are extremely durable. Bitcoin will continue to operate as long as the internet and the miners continue to operate. While not digital, gold is incredibly durable, it doesn’t react to oxygen or other chemicals, meaning it won’t rust or perish. Only if people expose gold to strong acids, it can be destroyed but this would be by deliberate action.

Stability

From a stability point of view, gold has been the most stable asset while Bitcoin has generated the highest returns in the long term, although it decreased in value in some years such as 2022. But if an asset decreases in value, can it be a store of value? Well, even gold has performed poorly over certain periods. For example, after reaching a high of $875 per ounce in 1980, it experienced a downward trend, reaching a low of ~$250 in July 1999, not even exceeding its all-time high until January 2008. Even the rarest of metals can’t always provide steady returns but over long enough periods it can, similar to Bitcoin. Although it has high levels of volatility, over longer periods, it has acted as a store of value.

Will Bitcoin surpass Gold?

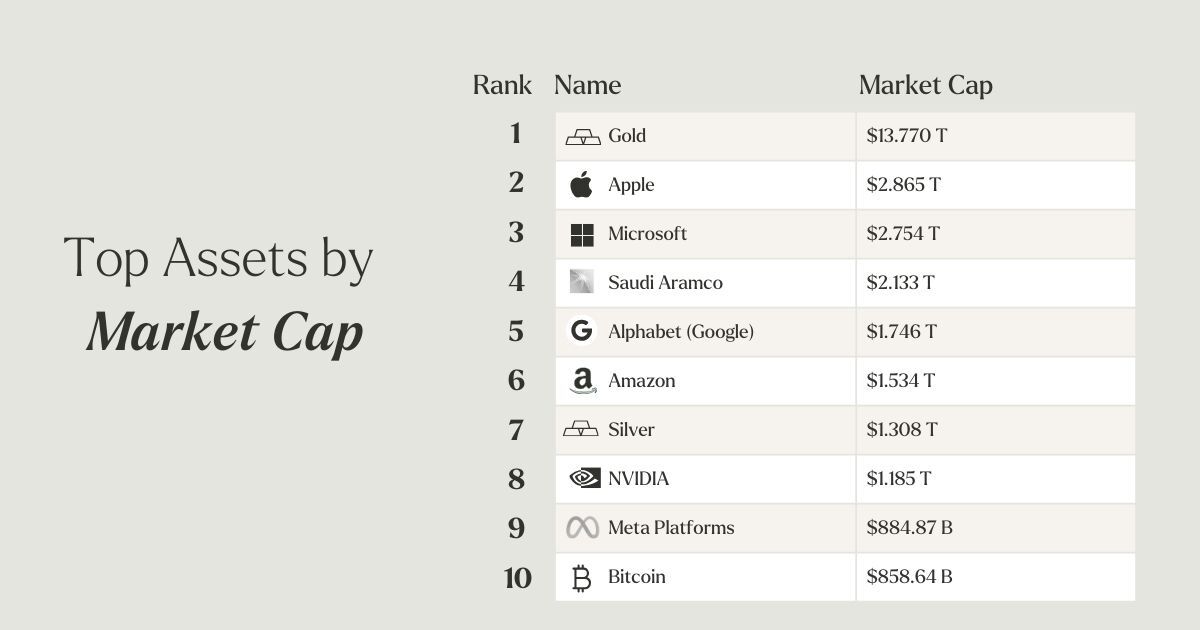

Currently, gold holds the top spot in terms of market capitalization, standing at $13 trillion, towering over Apple, the second-largest asset valued at $3 trillion. Gold undeniably reigns as the undefeated champion. Bitcoin, currently ranked ninth with a market capitalization of approximately $850 billion, doesn't quite match gold's stature, indicating it has a considerable distance to cover. For Bitcoin to reach the market capitalization of gold, its value would need to surpass $600,000 per Bitcoin, assuming gold's value remains constant. Meanwhile, gold's value is expected to continue growing, given its status as one of the rarest metals on Earth.

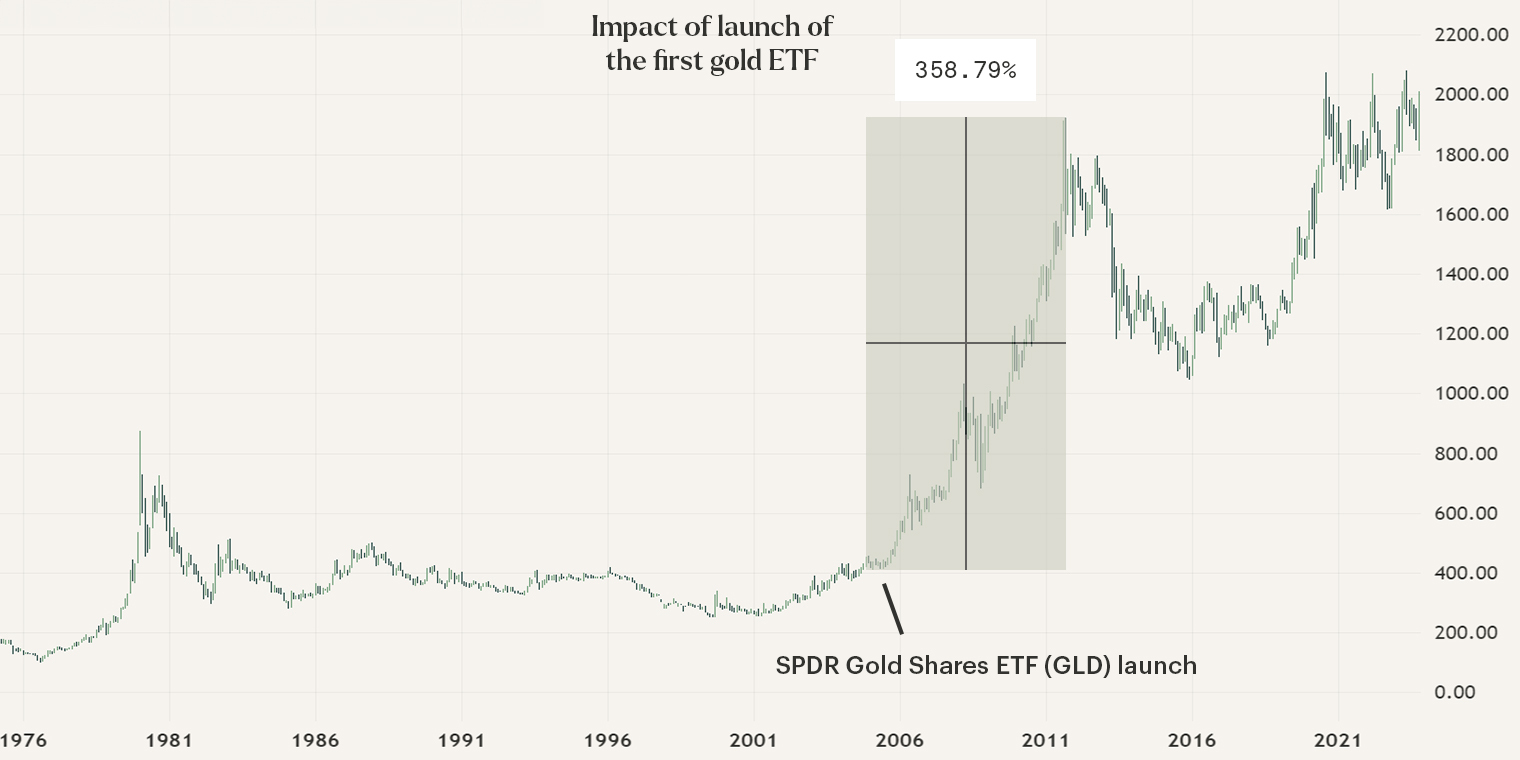

Bitcoin does possess a notable advantage: its rapid adoption rate and the potential integration into the broader financial system, especially with the looming approval of the Bitcoin spot Exchange-Traded Fund (ETF). The launch of a Bitcoin spot ETF stands to unlock opportunities for institutional capital, including hedge funds and insurers, potentially triggering a substantial price surge. The industry has firsthand experience of the impact a spot ETF can wield on an asset, as evidenced by the introduction of the gold ETF.

On November 1st, 2004, the SPDR Gold Shares ETF was launched on the New York Stock Exchange, simplifying gold acquisition for investors, and subsequently sparking a significant upward trend. Gold surged from ~$455 to unknown heights setting an all-time high of ~$1920. We have delved further into the potential impact of a Bitcoin spot ETF in a prior article, click the button below to read the article.

Read the Bitcoin spot ETF article

Will Bitcoin surpass gold? In the significantly long term, we believe it will. As we transition further into a digital environment, this digital asset is poised to assume an increasingly crucial role. While gold will maintain its status as a stable and secure store of value, persisting in its use for jewelry and luxury items, a digital currency currently ranked among the top 10 assets, yet existing outside the broader financial system, stands a significant chance of experiencing substantial growth when integrated within it.

Sign up for our newsletter to stay on top of the crypto market.