Newsletter: Recap April

- Volatility prevails in April

- Markets in Crypto Assets Regulation goes through European Parliament

- Coinbase sues the Security and Exchange Commission

- Countries and banks continue to explore Distributed Ledger Technology

- Navigating a Bear Market

Volatility prevails in April

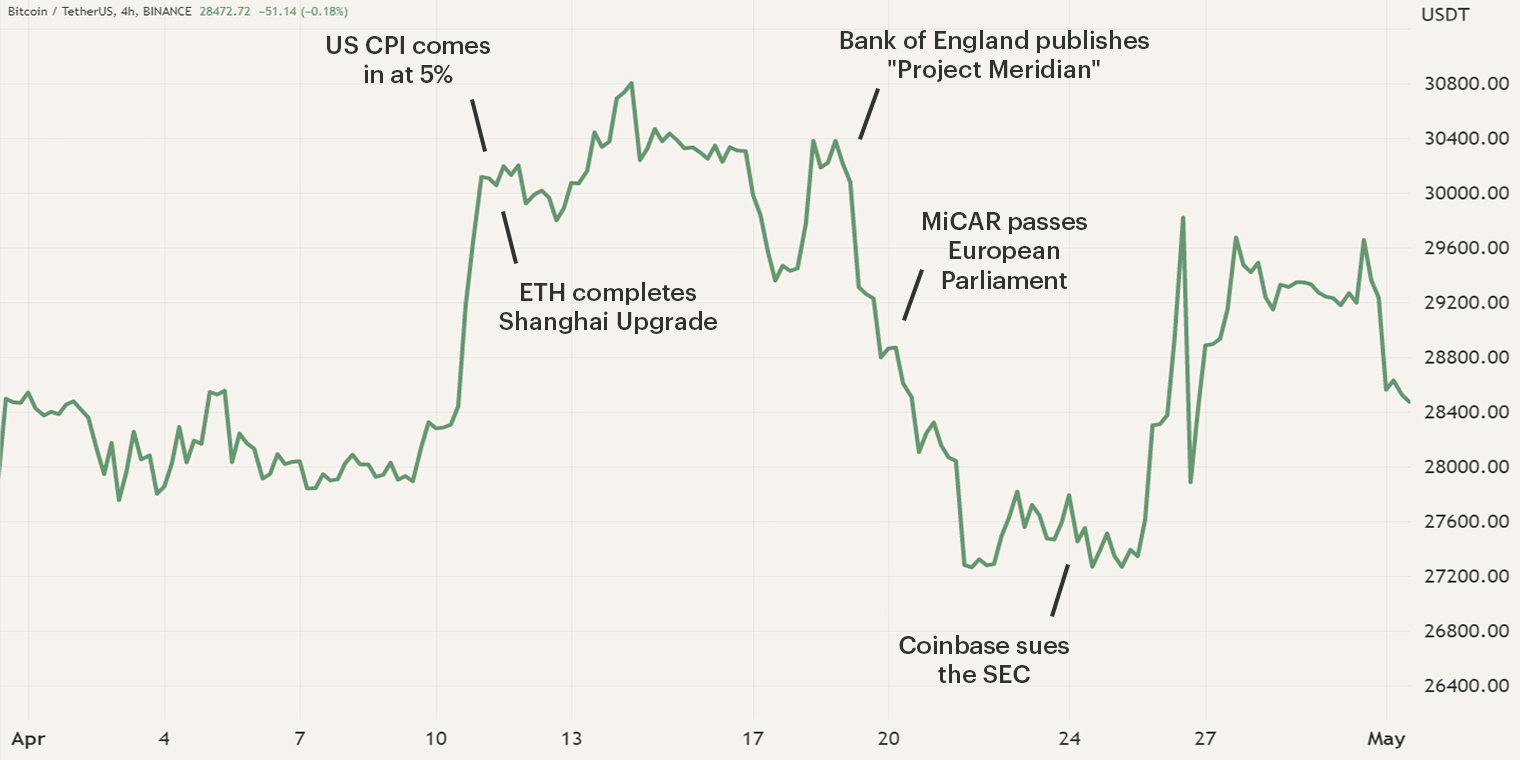

The month of April was known for its volatility. Where Bitcoin initially experienced a strong upwards trajectory reaching a new year high of $31.000, it later corrected to $29.000. At the end of the month, the volatility kept increasing as Bitcoin’s price fluctuated between $27.000 and $30.000. The first half of April was mainly focused on Ethereums’ Shanghai Update, enabling the unstaking of staked Ethereum, and the latest U.S Consumer Price Index figures. You can read more about the events during the first half of the month in the Market Update of April.

In the second half of the month, the cryptocurrency sector experienced the approval of MiCAR, the first comprehensive regulatory framework by the European Parliament and the switch of roles as the Securities and Exchange Commission (SEC) got sued by Coinbase.

Markets in Crypto Assets Regulation goes through European Parliament

On the 20th of April, the Markets in Crypto Assets Regulation (MiCAR) was officially passed by the European Parliament, making it the first comprehensive regulation for crypto assets. The new regulation passed through Parliament as 517 voted in favor, 38 against and 18 weren’t present. MiCAR covers a variety of topics such as the approval of new assets by the EU, it must be verified that their business model does not jeopardize the euro’s currency stability in the future.

In addition to new approval requirements, MiCAR will also subject stablecoin issuers to stricter rules such as the disclosure of holdings to ensure customer funds are backed. Other requirements are that cryptocurrency firms need to disclose considerably more information about their offered assets such as a detailed whitepaper.

The great advantage of the new regulations is that digital asset firms can obtain a “passport”, which will enable them to expand to other EU countries with relative ease. We mentioned in various newsletters and market updates that we believe that regulation is necessary if we want to see full adoption. This framework is one of (probably) many steps and as time progresses the lines of the playing field will become more clear, paving the way for more institutions and users to enter the market.

Coinbase sues the Security and Exchange Commission

On the 24th of April, cryptocurrency exchange Coinbase asked a US court to force the Securities and Exchange Commission (SEC) to respond to the petition the organization filed in July last year. This petition requested the SEC to “propose and adopt rules to govern the regulation of securities that are offered and traded via digitally native methods”, however, the SEC hasn’t responded to this petition yet. Instead, over the past months, regulatory action has increased significantly towards cryptocurrency organizations, including companies such as Coinbase.

To this unresponsiveness, Coinbase has filed an Administrative Procedure Act challenge, a legal process where an entity claims that a federal agency didn’t follow the proper procedures, against the SEC. In this process, Coinsbase has asked the Third Circuit Court of Appeals to order the SEC to share its decision on the petition, which will then provide regulatory clarity. This regulatory clarity is mainly about how and if the current securities laws apply to the digital asset sector.

In the month of March, Coinbase received a Wells notice, a statement that informs a company that the SEC has conducted an investigation and is considering enforcement action. The notice claimed that the exchange listed and offered unregistered securities. This legal response of Coinbase seems to be a preemptive move as it displays that the SEC's current approach and its lack of clear communication cause the current regulatory uncertainty.

For almost its entire existence, cryptocurrencies have been operating in a gray area in terms of legal nature. However, we believe that this gray area can be resolved if regulators seek the help of cryptocurrency organizations to create a regulatory framework. As we see now, the unwillingness to cooperate with each other only creates bigger problems and more regulatory uncertainty.

During the course of 2023, we have seen the SEC claiming various cryptocurrencies are securities, however, the Commodities Futures Trading Commission (CFTC) has also been claiming they are a commodity. The first good step would be to develop a precise regulatory framework that both federal agencies agree on. This will provide digital asset firms with the regulatory clarity they need to grow and a better understanding of their legal limits. But as of now, they will continue to operate in gray areas as there are no signs of a possible collaboration.

Countries and banks continue to explore Distributed Ledger Technology

On the 19th of April, the Bank of Russia stated that they are currently working on a bill that will introduce the implementation of cryptocurrencies in export-import deals, currently only as an experiment. However, the trading of cryptocurrencies and their use as payment will still be banned for the general public and other organizations which aren’t suitable for the experiment.

The Bank of Russia is now in talks with the government to determine which firms may take part in the experiment, what their business models should be and which banks they would use. In the early phases, it is probable that government-sponsored enterprises will be involved.

Additionally, the Bank of England and the Bank for International Settlements (BIS) Innovation Hub Center tested the use of distributed ledger technology-powered settlements between the two institutions. A report about this project, called Project Meridian, was published on the 19th of April. The report covered a variety of topics including how banks successfully purchased houses in England and Wales through this new network. Meridian's stated goal is to create a settlement system for Central Bank Digital Currencies (CBDC) as the report states on numerous occasions the potential advantages for central banks.

However, if the system wants to be implemented, there are some legal questions that need to be answered. Currently, there is some legal uncertainty about a variety of topics such as the final point of irrevocability of the settlement and digital representation of asset ownership.

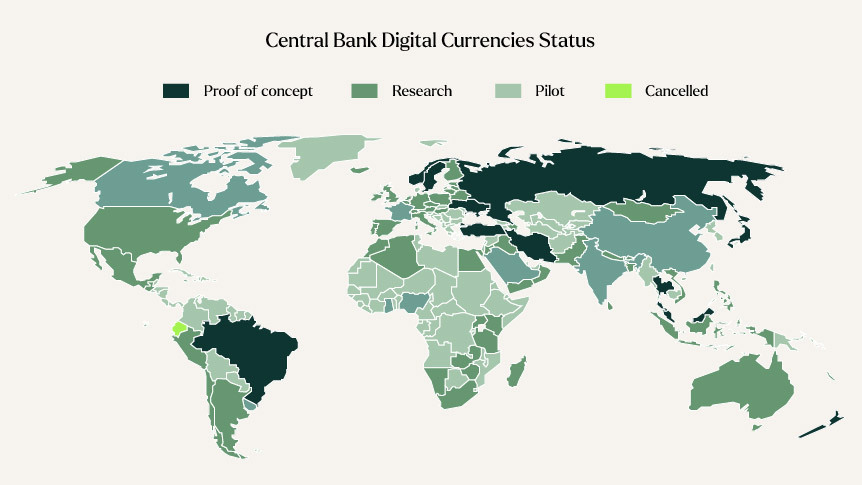

Over the past two years, there has been a significant increase in interest among central banks as more pilots are introduced. Currently, 18 countries are and or have conducted a pilot with a CBDC and 32 countries have been developing one.

Earlier this month, the Central Reserve Bank of Peru (CRBP) released the first in a series of papers examining the need for, design, and timing of a Peruvian Central Bank Digital Currency. In November 2021, the President of the CBRP announced that Peru will cooperate with India, Hong Kong and Singapore to develop a CBDC. Other parties such as banks are also exploring the possibility of self-developed digital currencies such as Société Générale. The French bank launched its own euro-pegged stablecoin on the Ethereum blockchain, however, for the time being, it’s only available to companies and institutional clients which have completed the Know-Your-Customer process.

The euro-pegged currency was bombarded with criticism as all transactions need to be approved by a centralized registrar, most likely the bank itself. Additionally, the code of the stablecoin states that the funds can be confiscated from the user’s wallet, thus, the user has no self-custody.

It’s not the question of if these new digital currencies are being introduced but when. Many are afraid that the introduction of CBDSs or centralized payment systems will cause a massive shift in power in favor of central banks. This will ultimately have negative consequences for the privacy of its users. With CBDCs, all payments will be processed by a central bank, whose interests may not be aligned with other participants in the financial system.

Over the past one and a half years, the cryptocurrency market has experienced a strong downwards moving market also known as a bear market. These periods are often characterized by pessimism among investors and investments falling beneath their true value. However, these periods do provide unique investment opportunities as investors can lower their average entry level, creating a better position for themselves when the market reverses.

Last month, we published an article to provide more insights about this topic. In the article, we delve deeper into the history of bear markets, their characteristics and how to use bear markets to your advantage. If you wish to read the article, click the button below.

Sign up for our newsletter to stay on top of the cryptocurrency market.