Newsletter: Recap August

- SEC under pressure as it loses second legal battle

- Grayscale wins ETF appeal against SEC

- Coinbase acquires stake in Circle

- The Netherlands enters recession

- Hong Kong sees tokenization as bond market improvement

- The Hodl Funds

- Hodl Research - Perpetual Protocol

SEC under pressure as it loses second legal battle

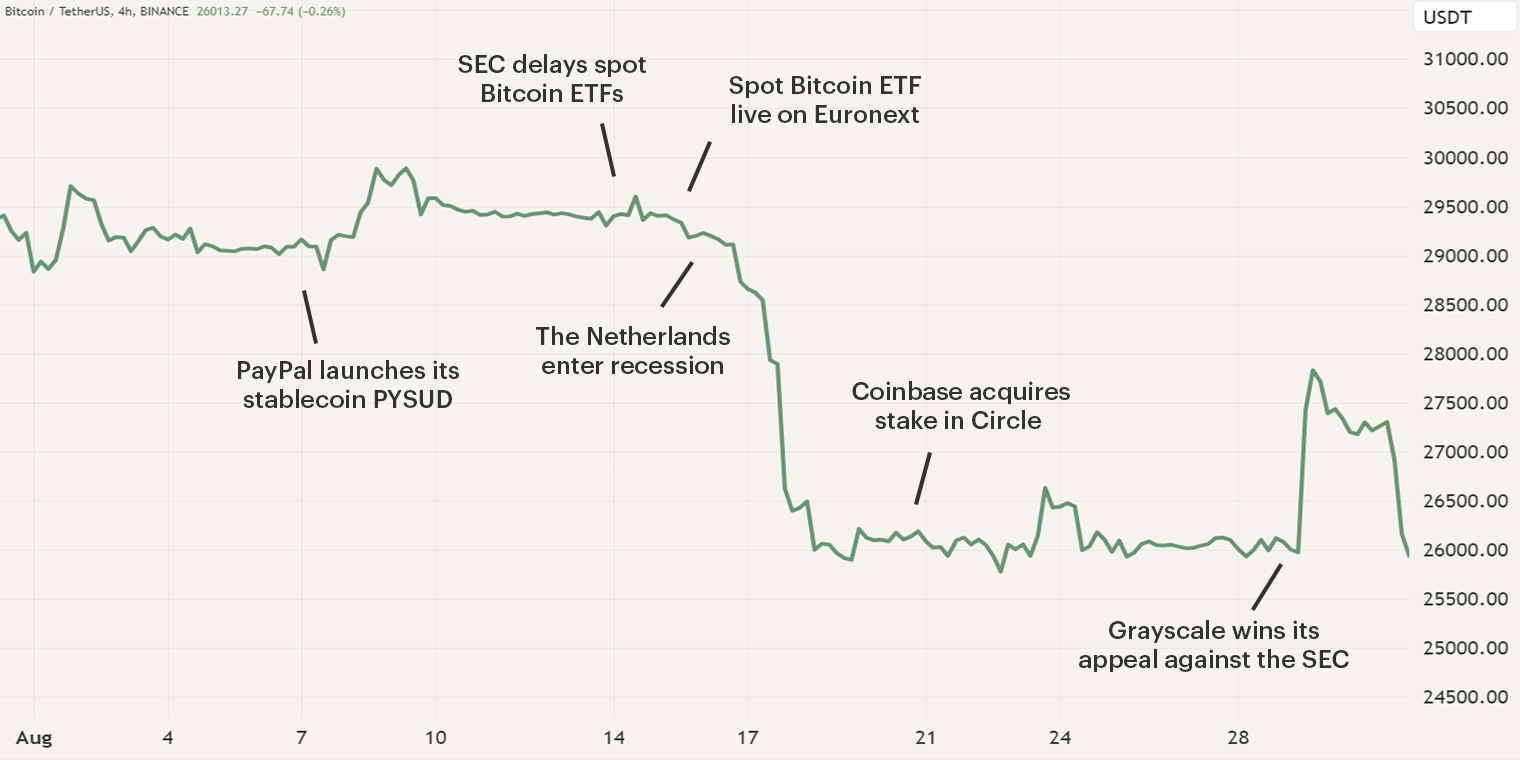

The month of August was once again highlighted by the developments in the exchange-traded funds (ETF) filings. In the first two weeks of August, the Securities and Exchange Commission (SEC) announced it would delay its decision about the application of Ark Invest, and in Europe, the market experienced a significant milestone as the first European Bitcoin Spot ETF was launched on Euronext Amsterdam. The interest in digital asset ETFs trickled down to other assets as various asset managers applied for Ethereum-based futures ETFs. Furthermore, the market experienced further adoption as payment provider PayPal entered the market by launching its dollar-pegged stablecoin on the Ethereum network. You can read more about the events of the first half of the month in our market update of August.

As August progressed, market observers saw a handful of events unfold. After Bitcoin’s initial correction on the 17th of August, its price has remained relatively stable, fluctuating between the price levels of $25,300 and $26,800. This range was disrupted when news emerged of Grayscale's successful appeal against the SEC to transform their Bitcoin Trust into an ETF. As the news sparked positive sentiment for all outstanding filings, the announcement of this legal victory propelled Bitcoin's price above $28,000, however, due to a lack of spot acquisitions, Bitcoin’s price dropped back to $26,000.

Another significant development was Coinbase's strategic investment in Circle, the parent entity of stablecoin USD Coin (USDC). Concurrently, the market observed Hong Kong reaffirming its status as a global digital asset hub, this time through a strategic exploration of bond market tokenization.

Grayscale wins ETF appeal against SEC

For the past seven years, digital asset manager Grayscale has been trying to convert its Bitcoin Trust into a spot ETF, however, this application was continuously denied by the SEC in fear of price manipulation of the digital asset. In June 2022, Grayscale initiated a lawsuit against the agency as they believed these decisions were based on false arguments.

On August 29th, a pivotal legal development occurred as the District of Columbia Court of Appeals ruled a verdict in favor of Grayscale. The court's decision centered on the SEC's apparent inconsistency in approving futures-based ETFs while denying Grayscale's proposed Bitcoin ETF. Grayscale’s main argument was that futures-based ETFs derive their value from the spot price, effectively challenging the rationale behind approving futures ETFs while withholding approval for spot ETFs.

As a result of the court ruling, the SEC is compelled to either reevaluate the application or appeal within a 45-day timeframe, potentially escalating the legal dispute to the U.S. Supreme Court. It's important to note that while the court's decision marks a significant milestone, it doesn't automatically guarantee the launch of a U.S. Bitcoin ETF. The SEC retains the authority to reject the application based on factors other than price manipulation concerns. However, this legal verdict does strengthen the position of all other ETF applications as one of the main counterarguments has now been refuted.

The court's ruling has also triggered a surge in positive sentiment, evident in a 5% price increase in Bitcoin, which briefly exceeded $28,000, before dropping back to $26,000. Furthermore, market observers feel that the SEC can almost not escape the approval of a Bitcoin spot ETF. This sentiment is echoed by Bloomberg's ETF analysts, who project a 75% probability of a spot Bitcoin ETF receiving approval by year-end, rising to 95% by the end of 2024.

Coinbase acquires stake in Circle

On August 21st, cryptocurrency exchange Coinbase and payments technology company Circle jointly announced that Coinbase had invested in Circle. According to Coinbase, this strategic move was driven by the intention to enhance its backing of stablecoins. Back in 2018, the two entities collaborated to launch the dollar-pegged stablecoin, USDC. Since then, USDC has evolved into the second-largest stablecoin by market capitalization, amounting to approximately $25 billion. Furthermore, USDC has positioned itself as the go-to stablecoin for institutions and businesses, mainly due to its transparency regarding its reserves, resulting in enhanced trust and legitimacy in USDC.

Both companies share a belief that stablecoins will emerge as a pivotal cornerstone within the new financial system. This is particularly due to the capacity they offer for individuals and organizations to conveniently access U.S. dollars and other currencies, enriched by the advantages of cryptocurrency.

To further propel USDC's adoption, the stablecoin is set to debut on six new blockchains between September and October. This expansion accentuates Coinbase's augmented influence within the payment provider sector. Echoing the visions of Coinbase and Circle, we also hold the view that stablecoins will play a critical role in shaping our financial system. The utilization of diverse reserves, whether crypto-assets or gold, affords users swift, scalable, and global access to the financial realm.

The Netherlands enters recession

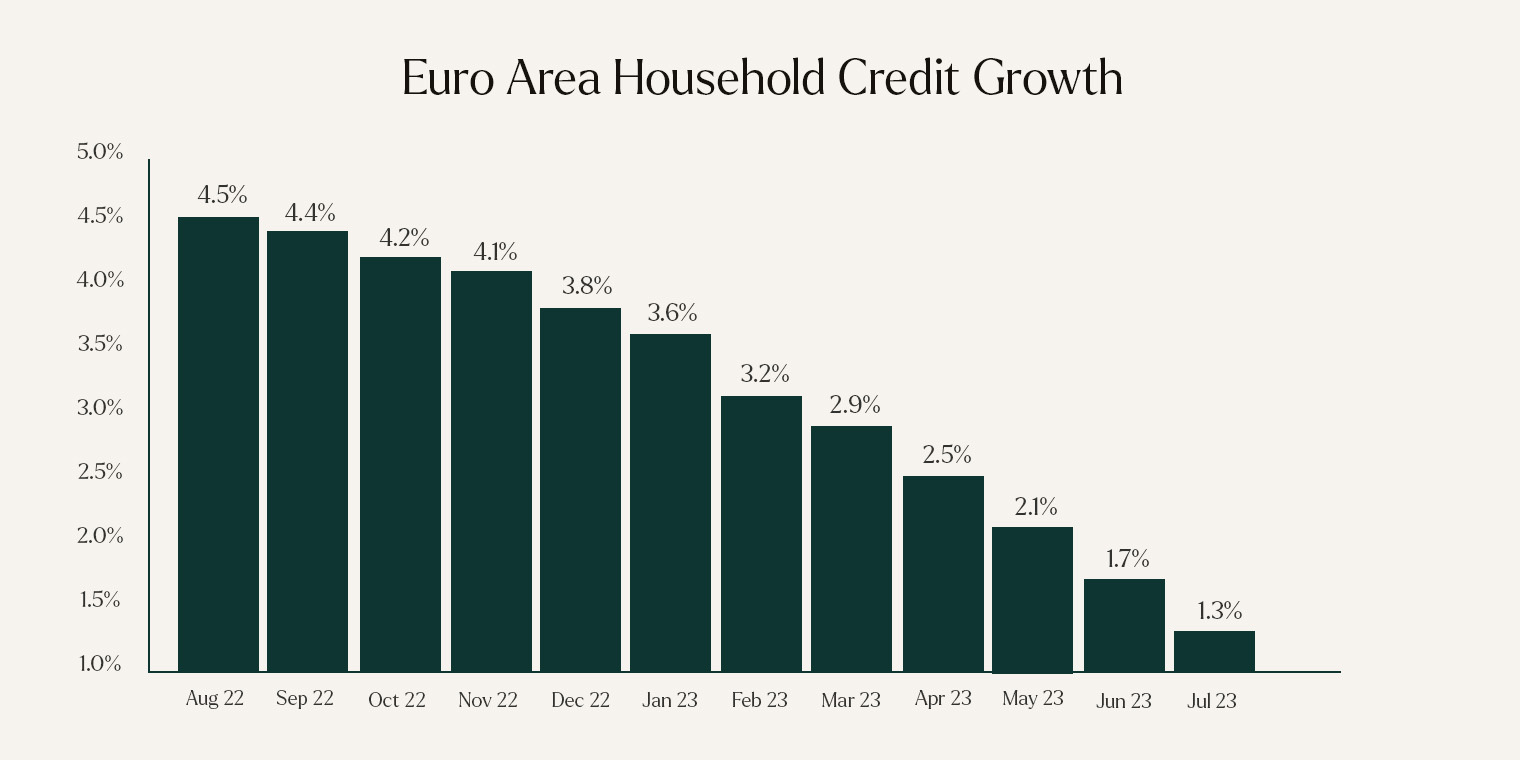

On August 16th, the latest economic data for the Dutch economy was published, revealing a second consecutive quarterly contraction. This development officially designates the Netherlands as being in a state of recession, albeit a relatively mild one. In the initial quarter of 2023, the Dutch economy contracted by 0.4%, followed by a 0.3% contraction in the second quarter.

Across the Eurozone, multiple economies are undergoing contractions, spurred by various factors, with a significant contributor being the tightening of monetary policies. This effect is evident in bank lending to Eurozone households, which has risen by a mere 1.3% year-on-year, marking the slowest growth since November 2015. This deceleration in credit expansion extends to the broader private sector, encompassing both households and non-financial corporations, which has cooled to a pace of 1.6%, the weakest growth rate since 2016.

We expect that the Eurozone will likely continue experiencing a period of economic contraction in the foreseeable future. The tightening economic conditions are gradually taking effect, although inflation remains relatively high across the Eurozone. As a result, it's anticipated that the European Central Bank will allow for further contraction throughout the remainder of 2023. This approach aligns with the backdrop of a healthy unemployment rate, indicating that despite the economic contraction, the overall health of the economy remains robust.

Hong Kong sees tokenization as bond market improvement

On August 25th, the Hong Kong Monetary Authority (HKMA) unveiled a report detailing the outcomes of their ‘Project Evergreen’ study. The report comprehensively outlined use cases, advantages and the encountered challenges throughout the study. In conclusion, the report expressed a positive sentiment, emphasizing that tokenization offers substantial enhancements to the bond market.

The tokenization of bonds yields significant efficiencies, foremost among them being the elimination of paper-based processes and the elimination of physical global certificates. Additionally, the integration of various stakeholders on a shared Distributed Ledger Technology (DLT) network, coupled with heightened transparency via data synchronization, will further enrich the financial landscape.

The Hodl Funds

The month of August led to a decrease in the Hodl funds. The Hodl Gib Fund, the Hodl Numeri, the Hodl Algo Fund, the Hodl.nl Genesis Fund, the Hodl.nl Consensus Fund and the Hodl.nl Oracle Fund ended at an NAV of €844.42, €21,975.00, €903.46, €2.60, €2.50, and € 0.30. True Asset Fund II ended the month with an NAV of €14,075.02. Clients of True Asset Fund can view their personal performance in the IQ-EQ portal.

Hodl Research - Perpetual Protocol

The Decentralized Finance (DeFi) sector is a crucial component of the digital asset industry, and perpetual futures are becoming a favored instrument among traders. A futures is a derivative that obligates a trader to buy or sell an asset/security at a predetermined price and date. However, situations might occur where the predefined future date does not optimally align with the trader's needs, potentially resulting in missed opportunities for returns.

In contrast, perpetual futures are futures with no end date, enabling users to maintain their position as long as they have sufficient margin in their account. The downside is that most futures are traded on centralized entities such as exchanges. To offer a suitable decentralized solution, Perpetual Protocol provides a decentralized exchange on which these futures can be traded. To read more about the Perpetual Protocol exchange and its token, tokenomics, team, coin metrics and more, access the report through the button below.

Sign up for our newsletter to stay on top of the cryptocurrency market.