Newsletter: Recap December

Newsletter: Recap December

Welcome to our monthly newsletter. Every month we create an overview of the performance of our Hodl funds, the developments within Hodl, and the latest cryptocurrency news.

Market recovers after sharp correction

December was characterized by the horizontal movement of the market. After a downwards trend, which was caused by a series of liquidated leverage positions, the market slowly recovered. It was a quiet month in regard to cryptocurrency news. During December investors mainly focused on the U.S. Senate hearing and U.S. interest rate policy.

Early December, the Senate held their first hearing about cryptocurrencies. Multiple topics were covered during the hearing such as the underlying technology, regulation, and stablecoins. The Senate is still experiencing multiple difficulties on how to classify these assets and how to regulate them.

This was the first time that crypto-executives were summoned by the Senate, a sign of a maturing industry. Sentiment in the market improved due to the quality of the questions being asked by Senate members and their open-mindedness towards this industry.

Later in December, Powell, chairman of the FED, gave a press conference about his current policy and views. Once again, cryptocurrency came up to discussion and Powell also seemed open to the possibilities that it could offer. He even mentioned that stablecoins “could be a beneficial and efficient part of the financial system, if they are properly regulated.” Once again, a positive sign giving the market time to slowly recover.

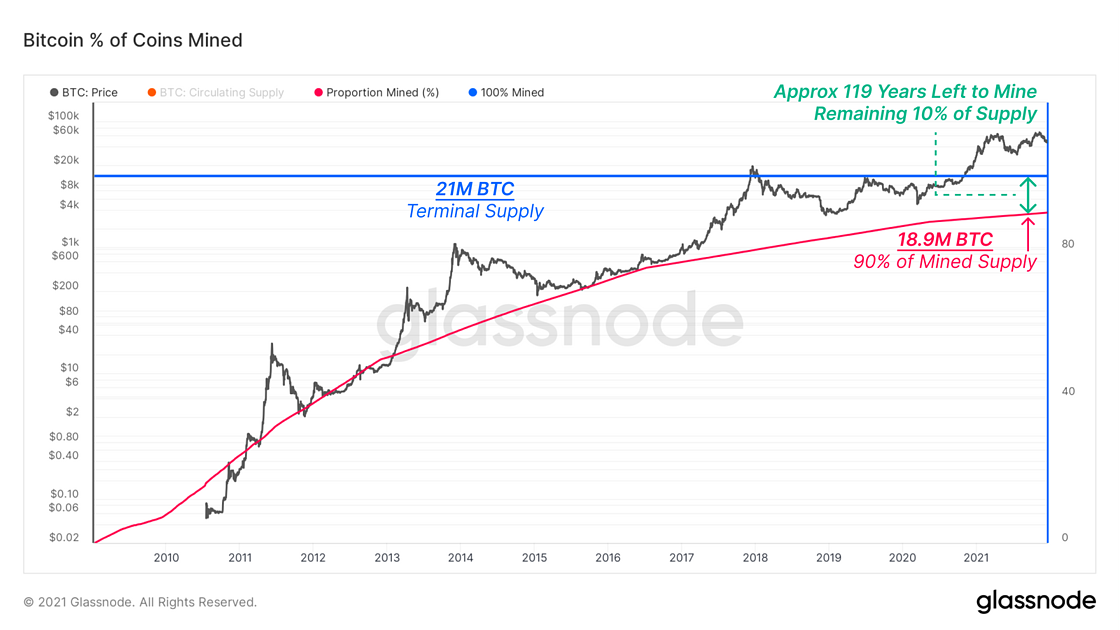

Despite the sharp drop in Bitcoin’s value earlier in the month, it reached a significant milestone. 90% of Bitcoins total supply has been mined and the remaining 10% will be mined in the upcoming 119 years. The deflationary method that made Bitcoin so revolutionary is starting to become visible.

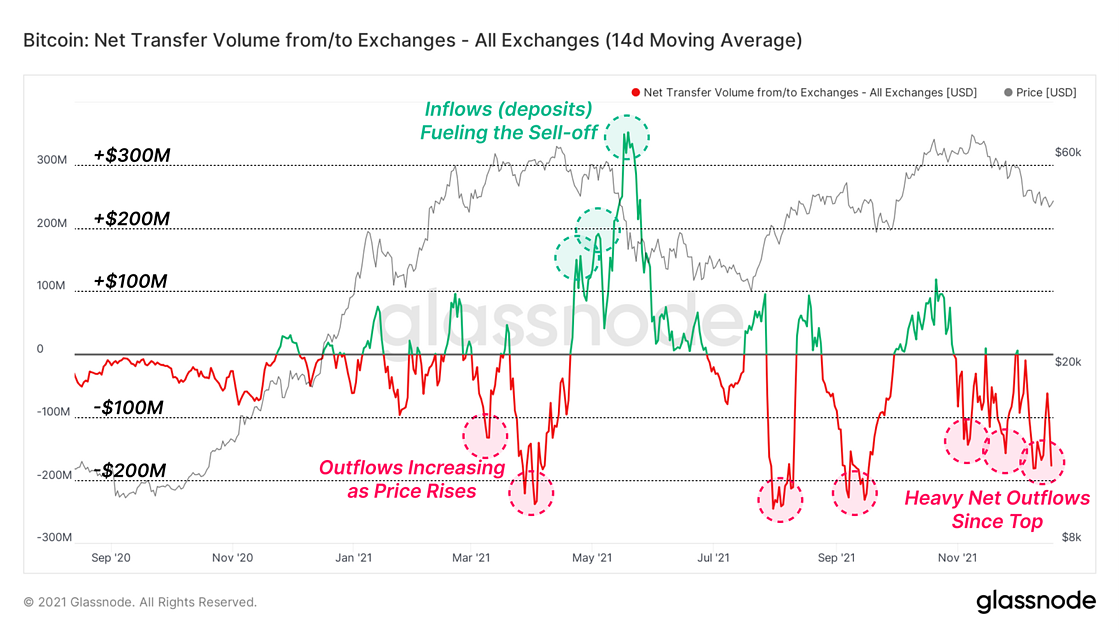

When Bitcoin began its downward trend at the beginning of the month, the entire market was drawn into a decline. Throughout the month, Bitcoin recovered and so did the sentiment towards other cryptocurrencies. In the chart below, you can see that in the last month there has been a large outflow of bitcoins from exchanges.

The total supply of Bitcoin stored at exchanges has reached its lowest point in a few years’ time. This is a bullish signal because with large deposits into the exchanges large sales are more likely to occur. People are showing confidence in the market and are currently holding onto their bitcoins for longer periods of time.

The Hodl funds

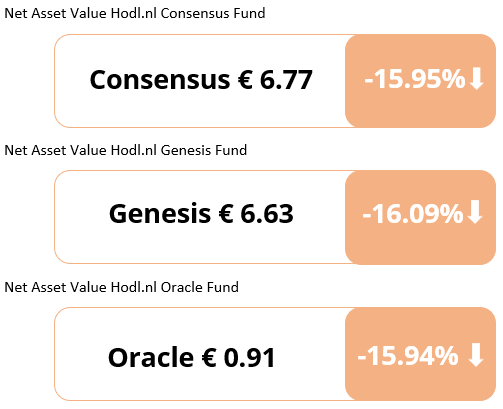

Although the market showed positive sentiment at the end of the month, it did not manage to make up for the sharp decline in early December. December was a negative month in what was ultimately a particularly positive year for the overall crypto market. Bitcoin fell by around 18% in December and the funds showed a similar decline of around 15%.

For 2021 in general, the picture looks a lot better. Bitcoin rose by around 69% in 2021 whereas the Hodl.nl Consensus Fund and the Hodl.nl Genesis Fund did significantly better at 413% and 380% net.

The results of December 2021:

Hodl in the media

Hodl was featured in last month’s addendum of the Financial Times (FD); Analysis. The Future of the Economy and Innovation. Our CEO Maurice Mureau and CFO Peter van Dam discussed an issue we’ve touched on many times: the ongoing inflation and declining interest rates. In the article, we also highlight how investors can invest a small portion of their portfolio in cryptocurrency to offset inflation.

Highlighted: Constellation Network

Every month we highlight a cryptocurrency and this month we focus on Constellation Network (DAG).

Constellation aims to make the integration of blockchain and cryptocurrency into organizations as easy as possible. Currently, a significant portion of cryptocurrency projects doesn’t have the infrastructure to handle the complex business processes and data schemes of modern business.

As Constellation offers a so-called universal Layer-0 solution, it is possible to implement these business processes in a decentralized manner. For these organizations, Constellation offers a user-friendly platform with open-source developer tools, infinite scalability, and an open and secure network.

Read more about Constellation Network

News overview December

Senator hearing with crypto executives

At the start of December, several top executives of multiple major cryptocurrency firms went to Capitol Hill for a hearing with the Senate. Several subjects were covered during the hearing such as regulation, stable coins, and the opinions of chiefs about the current market. Lawmakers still have difficulties determining what kind of steps they need to take on the legislation action; the hearing will help them get more insight into the market. This was the first time that crypto executives were summoned by the senate in this manner, which can be a sign of the maturing of the industry.

Jack Dorsey resigns from Twitter

Last month, Jack Dorsey resigned as the CEO of Twitter. The co-founder of Twitter tweeted about the situation on the 29th of November, after rumors were circulating about his resignation. Dorsey is still CEO of the company “Square”, a mobile payment company, which was recently renamed to “Block”.

The company posted about the rebrand and their outlook of the future and that the company will slowly focus on blockchain and Bitcoin. Dorsey has shown positive sentiment towards the market on multiple occasions and it seems to become his main focus. Recently, Dorsey expressed his critical opinion of the role of Venture Capitalist within the crypto ecosystem, which caused some uproar within the community.

Adidas launches first NFT Collection

Adidas successfully launched their first NFT collection on the 17th of December, called “Into the Metaverse”. The collection was created in collaboration with famous brands in the cryptospace such as the NFT collection “Bored Ape Yacht Club”. Adidas offered a total of 29.620 NFTs to their community, which differed in rarity and uniqueness. Purchasers of the collection could only buy 2 NFTs per wallet, in order to keep the sale in balance. All NFTs were sold against a price of 0.2 Ethereum per NFT, which generated a turnover of 23 million dollars.

Polkadot auctioned 5 parachains

Recently, Polkadot held an auction to welcome five parachains to their network; these networks are expected to go live in March 2022. A parachain is a layer 1 chain that operates parallel to the relay chain, which is the Polkadot main chain. These parachains have their own tokens and economies and are basically autonomous of the main chain.

Parachains use-case can differ from DeFi, Gaming, Oracles, et cetera. Due to being connected to the Polkadot main layer, a layer 0, interoperability is created with the other protocols connected to Polkadot. With the connecting parachains, Polkadot can create a crypto-economy that is interoperable and scalable due to Polkadots baselayer.

Receive our newsletter to stay on top of the crypto market.