Newsletter: Recap September

- Financial market move sideways after hawkish tone Federal Reserve

- Hawkish FED put pressure on financial markets

- Digital assets ETF continues to see progress

- Institutional adoption continues effortlessly

- Axel Hörger joins Hodl Group as Executive Advisor

- The Hodl Funds

Financial market move sideways after hawkish tone Federal Reserve

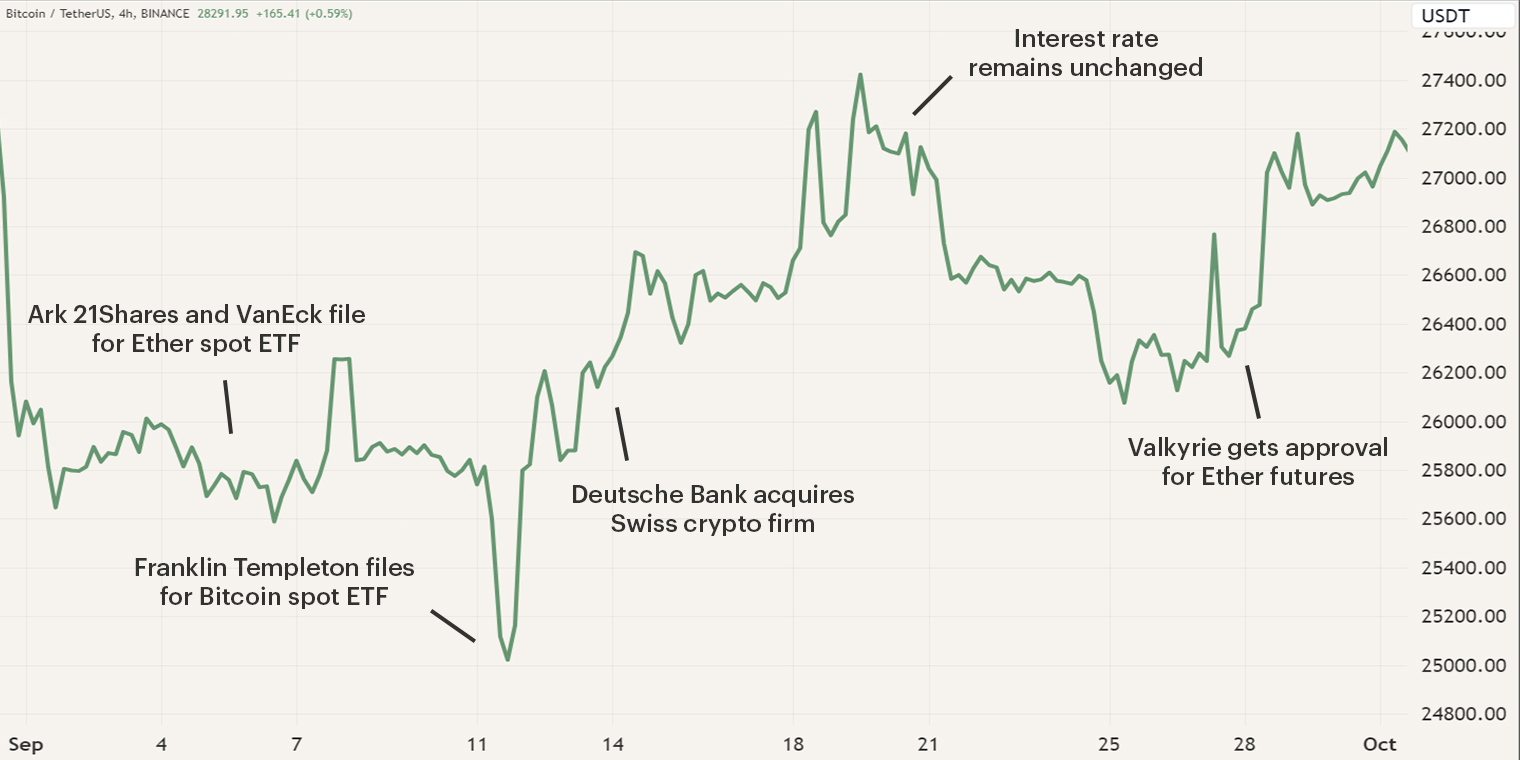

For the past quarter, the digital assets industry has been captivated by the development of financial instruments based on cryptocurrencies, a trend that continued into September. After witnessing various applications for a Bitcoin spot exchange-traded fund (ETF), followed by a surge in Ether futures ETFs, Valkyrie together with other asset managers received approval and will start trading in early October. Ark 21Shares and VanEck filed the first applications for an Ether spot ETF in early September. We anticipate that more asset managers will join this competitive landscape. Additionally, there is a likelihood that other institutions may shift their focus toward different digital assets to secure a first-mover advantage.

Moreover, the industry saw numerous traditional institutions venturing into digital assets and distributed ledger technology. Europe's leading stock exchange, the London Stock Exchange Group, announced its intention to explore blockchain integration. This move was soon followed by JPMorgan's announcement of their development of a new blockchain-based digital deposit token. You can read more about the events of the month's first half in our September market update.

Later in the month, various noteworthy events unraveled in financial markets and the digital assets industry. First, the Federal Reserve (FED) indicated they could approve another 0.25% interest increase by the end of the year before beginning to cut a few times in 2024. This tensed-up financial markets Treasury Yields reached highs not seen since 2007 while stocks lost ground. Additionally, the digital assets industry witnessed further development in the ETF space as Franklin Templeton joined the race and Ether ETFs saw asset manager Grayscale enter. Furthermore, financial institutions continue to explore their options as Deutsche Bank, HSBC, Citi Bank and ABN AMRO experiment with the technology. As the various developments unfolded Bitcoin’s price fluctuated between the price levels of $24,900 and $26,800

Hawkish FED put pressure on financial markets

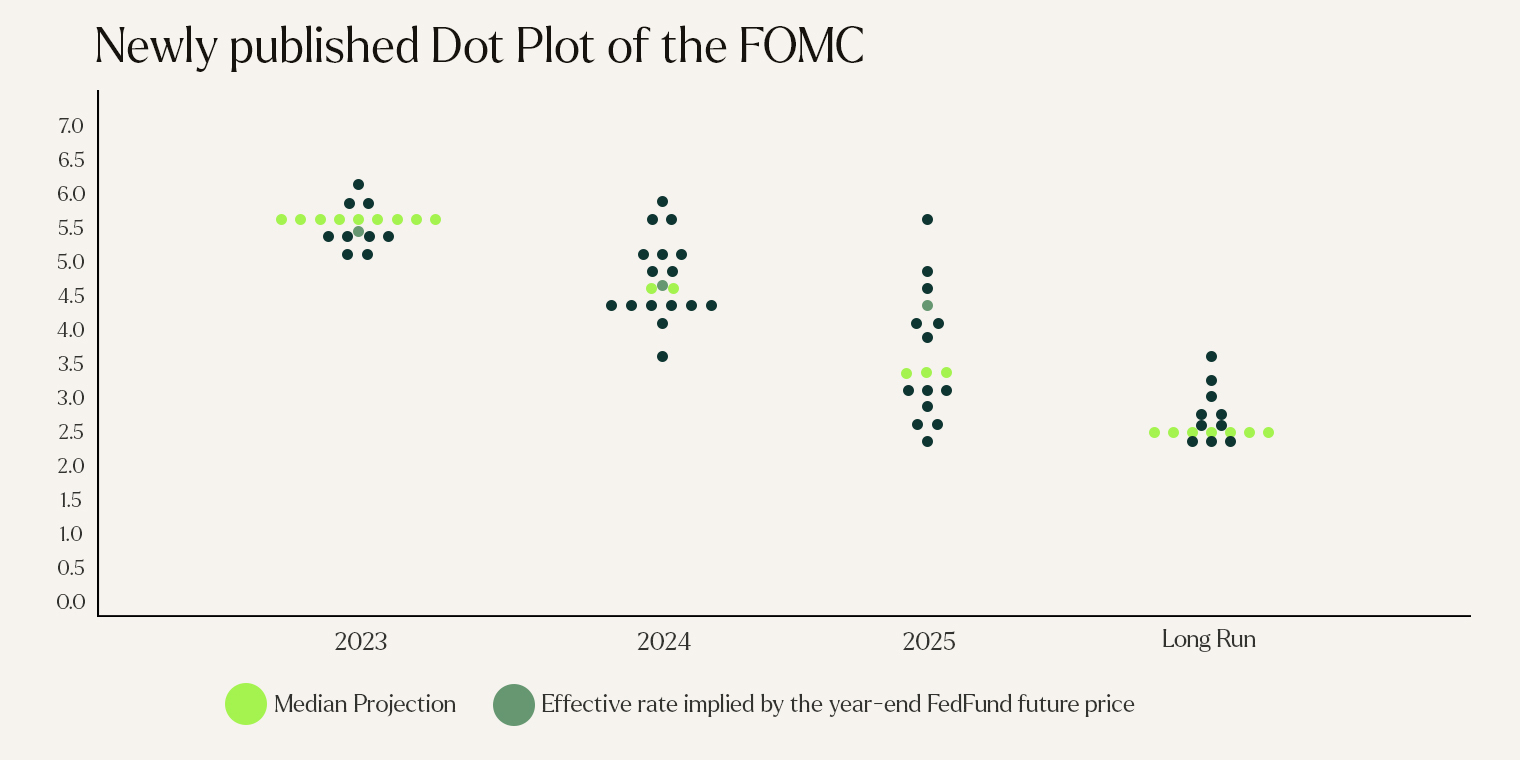

On September 20th, the Fed announced no change in the interest rate, marking the second such occurrence this year. While a large majority of market participants anticipated this decision, Fed Chairman Jerome Powell stated that the likelihood of an additional hike in interest rates is high. This probability prompted investors to sell financial instruments such as bonds as a hike rate will depreciate their value, driving Treasury Yields to levels not seen since 2007. Consequently, major U.S. stock indexes like the Dow Jones, S&P 500, and Russell 2000 began to lose ground.

The concern over another rate hike intensified as crude oil price surged to new yearly highs, potentially exerting upward pressure on inflation and potentially compelling the Fed to take additional measures.

In U.S. markets, investor sentiment appears mixed. According to a CNBC survey, over 60% of respondents believe this year's stock market gains are merely a bear market bounce, signaling potential challenges ahead. Industry leaders, including Jamie Dimon, have even cautioned that interest rates could see a sharp increase, outlining a worst-case scenario of 7%.

Digital assets ETF continues to see progress

Since BlackRock’s Bitcoin spot ETF application in June, many asset managers have entered the race to obtain the Holy Grail of investment products. On the 12th of September, Franklin Templeton, a global leader in asset management with $1.5T assets under management, entered the financial giant race as the digital asset market eagerly awaits approval of a Bitcoin spot ETF. A noteworthy element of the filing is that cryptocurrency exchange Coinbase is again mentioned to act as custodian, the firm is actively involved with almost every ETF application.

The market also saw a significant development in the Ether ETF space. On the 28th of September, asset manager Valkyrie became the first to provide exposure to Ether through its newly integrated Bitcoin and Ether Strategy futures ETF. Previously, Valkyrie had offered a Bitcoin futures ETF, and the Security and Exchange Commission (SEC) approved an extension of this strategy. Additionally, the market saw the entry of digital assets manager Grayscale into the Ether futures ETF competition, gaining momentum following their legal victory against the SEC. Moreover, the SEC has initiated a public comment period for applications from Ark 21Shares and VanEck for their Ether spot ETFs, allowing a 45-day window for feedback on both submissions.

Institutional adoption continues effortlessly

Since 2021, the market has seen a surge in institutional adoption. Financial giants like Goldman Sachs, BNY Mellon, and Morgan Stanley have dipped their toes into the industry. This momentum has continued, even after a period of extended market downturn. In September, the market witnessed Deutsche Bank, HSBC, Citigroup, and ABN AMRO explore digital assets and blockchain in their own ways.

ABN AMRO made a significant move by becoming the first Dutch bank to register a green bond on the public blockchain Polygon. This move raised €5 million for real estate investor Vesteda. Deutsche Bank also made strides by finalizing a deal with Swiss tech firm Taurus SA, a step toward integrating custody and tokenization services for their clients.

HSBC has reportedly been collaborating with Fireblocks, a company specializing in secure digital asset storage, indicating potential custody services in the future. In recent months, the bank's Hong Kong branch even enabled clients to trade Ether and Bitcoin futures ETFs. Lastly, Citigroup is exploring blockchain technology to enhance its product offerings. This new service will empower institutional clients to convert their customers' deposits into digital tokens, which can then be seamlessly transmitted via their privately owned and managed blockchain.

Axel Hörger joins Hodl Group as Executive Advisor

We are proud to announce that Axel Hörger, a former executive at Goldman Sachs and UBS, has joined Hodl Group as Executive Advisor to the board. Axel boasts three decades of financial sector expertise, honed at industry-leading institutions. He spent sixteen years at Goldman Sachs, culminating in the role of Managing Director for Asset Management (EMEA). Axel then held CEO positions at UBS Deutschland AG, Lombard International Assurance, and Petiole Asset Management. He also chaired and co-founded the American International Bank Acquisition Corp and advised across various industries.

As Executive Advisor to the board, Axel will drive Hodl Group's growth and international aspirations, bridging the gap between digital assets and traditional finance. To read more about Axel Hörger and about Hodl Group, you can access the article through the button below.

The Hodl Funds

The month of September led to a small increase in the Hodl funds. The Hodl Gib Fund, the Hodl Numeri, the Hodl Algo Fund, the Hodl.nl Genesis Fund, the Hodl.nl Consensus Fund, the Hodl.nl Oracle Fund and Hodl Artemis ended at an NAV of €861.19, €22,376.00, €901.17, €2.65, €2.55, € 0.31 and €933.37, respectively.

Sign up for our newsletter to stay on top of the cryptocurrency market.