What is Stader Labs (SD)?

- An Introduction to Stader Labs (SD)

- Stader Labs Solution

- Stader Lab's Use Case

- Stader Labs Ecosystem

- Stader Labs News

- Stader Labs Price

An Introduction to Stader Labs (SD)

Ethereum’s switch from the consensus mechanism Proof-of-Work (PoW) to Proof-of-Stake (PoS) had widespread influences on the network. These positive effects included enhanced energy efficiency, scalability, and accessibility of the network. In contrast to PoW, users can become a validator without the need for specialized hardware, simple hardware with a “stake”, which can be seen as a security deposit, is needed to become a validator. However, PoS comes with its own set of drawbacks.

One of the main disadvantages of PoS is that the required staked amount to become a validator is usually rather high, in Ethereum’s case it’s 32 Ether, worth ~$50,000. Additionally, the staked assets are required to be locked for long periods of time, causing liquidity issues for the stakers and limiting their financial opportunities by not being able to further participate in the digital assets ecosystem.

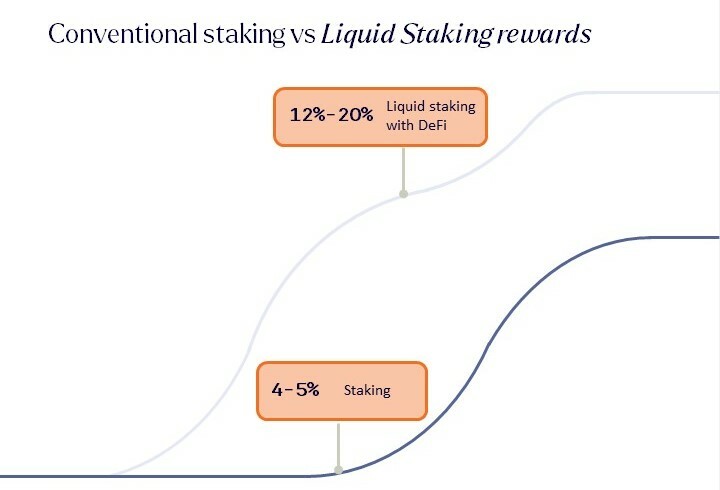

To combat this problem, developers created liquid staking solutions. These solutions allow users to pool their assets, removing the need for individual users to fully meet staking requirements. Users can also mint a token that represents their staked assets and grows in value as staking rewards accrue. With this token, users can participate in DeFi while still having their assets staked, creating a more suitable and liquid solution for the wider PoS ecosystem.

An upcoming project in the Liquid staking sector is Stader, a protocol that supports seven Proof-of-Stake networks through which users can access the platform and stake their assets. The liquid staking token of Stader has been integrated with various DeFi protocols, enabling users to participate in DeFi protocols while maintaining their liquidity actively.

Stader Labs Solution

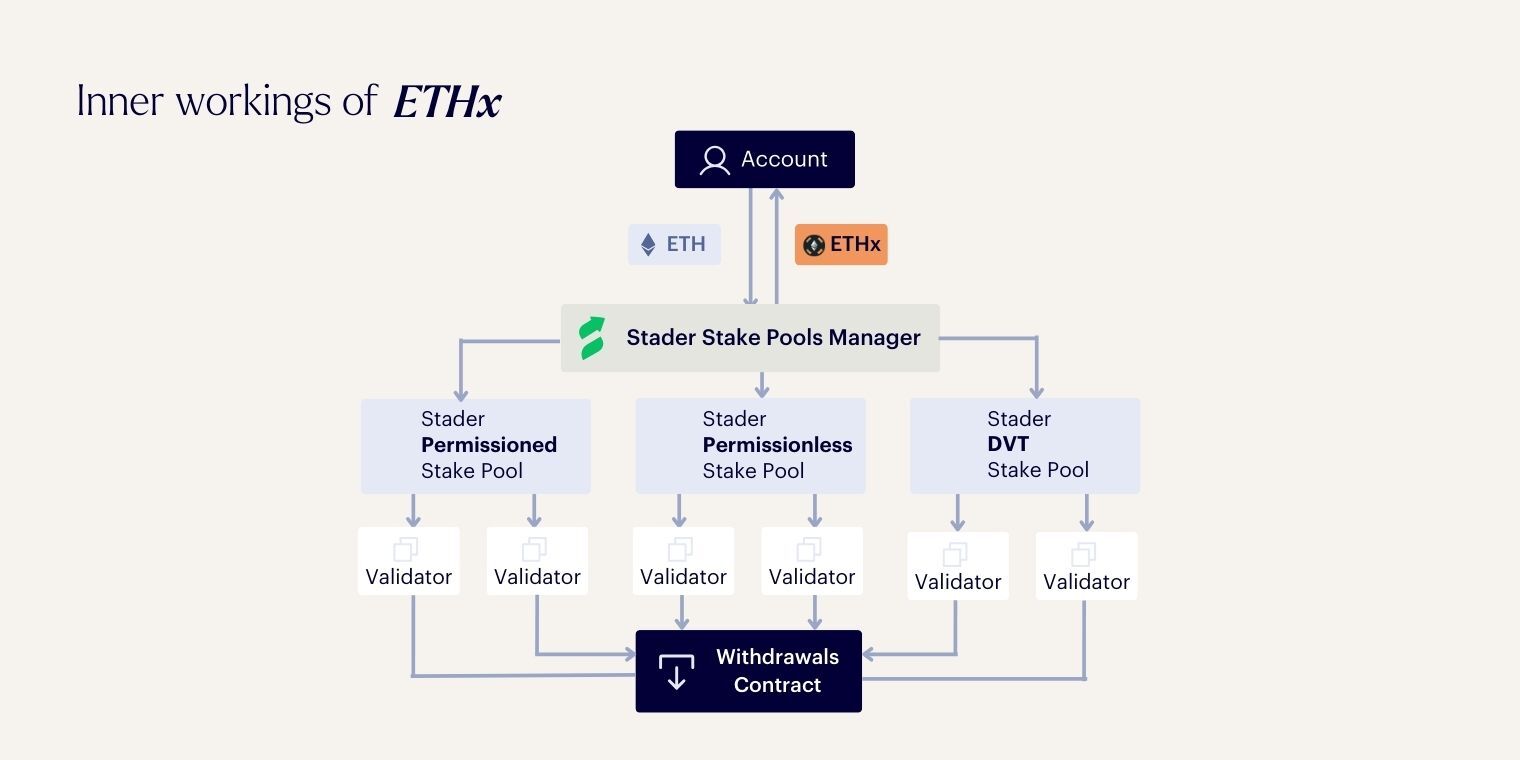

The solution provided by Stader lies in its infrastructure. Stader has built a web of smart contracts across seven networks: Ethereum, Polygon, Hedera, BNB, Fantom, Near and Terra 2.0. Stader operates on multiple networks, each with a dedicated staking contract for users to stake their assets. These assets are then transferred to network validators.

Stader offers two distinct pools on the Ethereum network: a permissionless pool and a permissioned pool. In the permissionless pool, any user can operate a node with just four ETH and an equivalent of 0.4 ETH in Stader tokens (SD). Conversely, the permissioned pool is composed of carefully curated validators known for their consistent performance. Moreover, the team is actively working on a pool based on Distributed Validator Technology (DVT). While DVT is an emerging technology, once it achieves stability, it promises to significantly reduce the risk of slashing as the validation process is distributed across multiple nodes. When this succeeds, Stader stands to lower the necessary bond requirement for permissionless pools, thereby enhancing the safety and decentralization of the Ethereum network.

Validators in these pools leverage the staked assets to validate blocks, earning staking rewards that are subsequently shared between all parties. Stader deducts a 10% fee from earned rewards. In addition to staking rewards, users can earn extra rewards by supplying the represented token to various DeFi protocols. This token is integrated with Curve Finance, Balancer, Uniswap, Aave, Beefy, and more, expanding user options across DeFi protocols and elevating the user experience.

Stader Lab's Use Case

The Stader token and its platform primarily revolve around DeFi and Liquid Staking, with use cases spanning individual and industry levels. As an individual investor, you can stake your assets to earn rewards while still having the ability to engage in the broader DeFi ecosystem.

However, conventional staking methods often require longer lock-up periods, which can negatively impact user experience and network security. If staking is not appealing, it can lead to a decrease in network safety as no assets are staked, thus no validators are maintaining the network. Additionally, excessive staking can reduce liquidity. But, with liquid staking, these issues can be resolved by incentivizing staking, enhancing network security, and maintaining liquidity. Other token utilities include:

Governance

Operating as a DAO, the Stader protocol grants SD token holders the ability to engage in crucial voting rounds, such as deciding on the issuance of new tokens as rewards. This decentralized approach compels SD holders to adopt a long-term perspective, discouraging hasty gains that could devalue the token.

Bonding

For entry into the permissionless Stader validator pool, users must possess four ETH and bond an equivalent of 0.4 ETH in SD tokens. With an increasing number of validators joining the Stader protocol, more Stader tokens are bonded and subsequently taken out of circulation. This diminishes selling pressure, paving the way for potential upward trends in the token's value as demand rises.

Borrowing and Lending

The Stader team is actively exploring the potential establishment of a borrowing and lending market for the SD token. The primary objective is to lower the barrier of entry for validators who wish to participate in Stader but don’t want exposure to the SD token. This market will facilitate the lending of Stader, reducing their exposure, while lenders stand to earn interest on their holdings.

Liquid Restaking

In its nascent stages, the latest use case involves the Liquid Restaking Token (LRT), signifying fractional ownership of the underlying LRT assets. This development will empower users to generate additional returns, as their staked assets can be deployed across various validation services.

Stader Labs Ecosystem

As with most DeFi protocols, the majority of Stader’s partners are located in this sector as well. Due to its unique use case and value proposition, the most important partners of Stader are decentralized exchanges and yield aggregators such as Balancer and Beefy Finance. This is mainly because Stader provides a liquid staking token and to have value, the token must be integrated with the wider DeFi ecosystem.

Other important partners within the Stader ecosystem are Ledger, the cold storage security solution provider and various exchanges on which it’s listed. Furthermore, the project is backed by various industry-leading venture capitalists such as Pantera Capital, Coinbase Ventures and Huobi Ventures, illustrating the interest and importance of Liquid Staking platforms.

Stader Labs News

On the 10th of August, Stader announced that it would decrease the staking rewards on Hedera (HBAR) from 6.5% to 2.5%. Unfortunately, this resulted from the HBAR protocol itself as they lowered the offered staking rate. Stader was forced to lower the offered staking rewards as otherwise it would result in operational loss.

On July 12th, Stader Labs unveiled an exciting partnership with Allnodes, a prominent noncustodial hosting and staking service provider. The primary aim of this collaboration is to simplify and broaden the accessibility of Ethereum staking, making it an effortless process for users. Thanks to this strategic partnership, users can now swiftly establish a Stader ETH node in just 5 minutes. Remarkably, this streamlined setup requires a mere 4 ETH to be staked, in stark contrast to the standard 32 ETH minimum requirement. Allnodes takes on the responsibility of operating the node on behalf of the user, offering this invaluable service for a modest monthly fee of $5 per validator.

Stader Labs Price

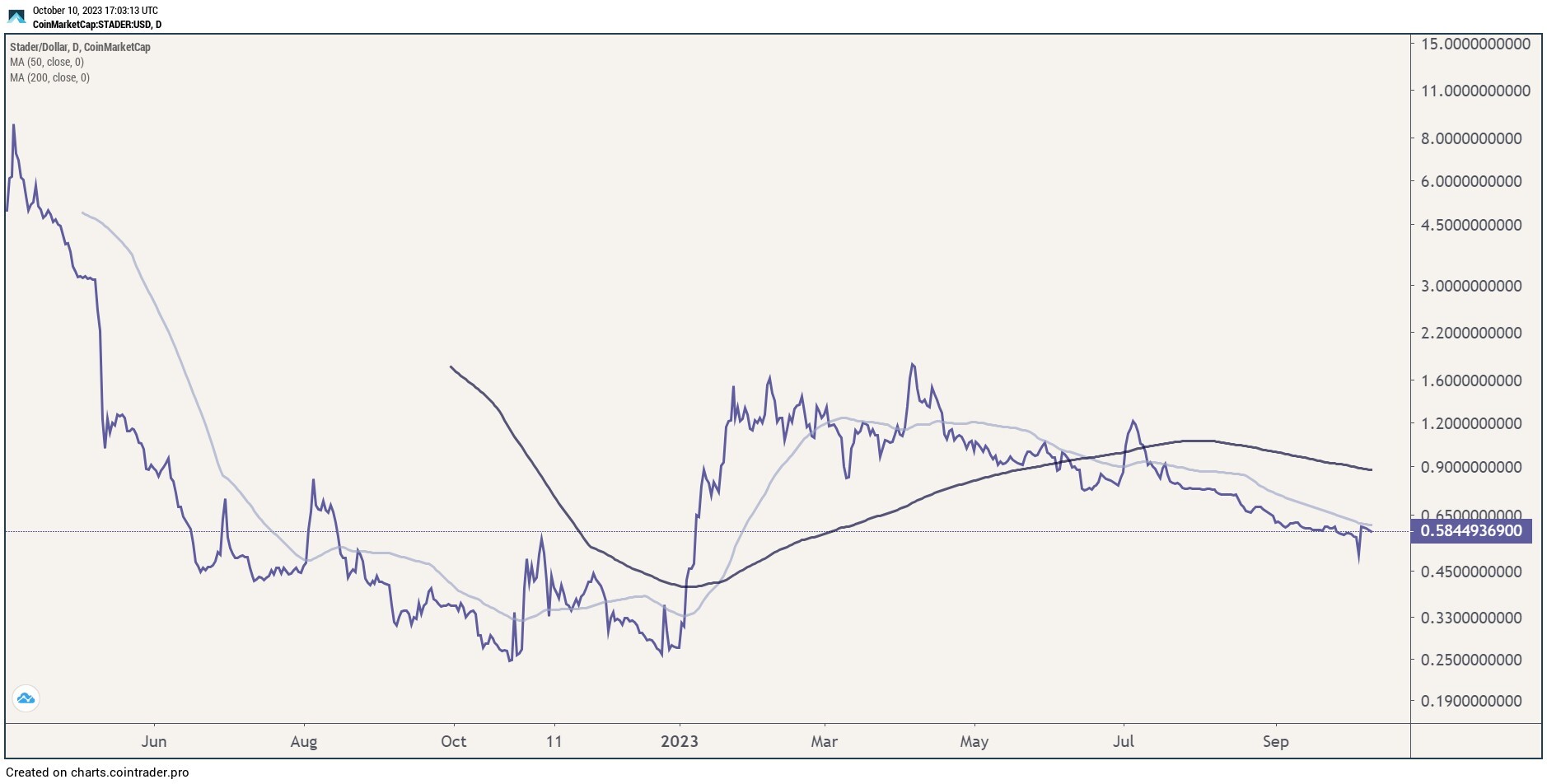

After launching in March 2022, the initial excitement of Stader’s Token Generation Event (TGE) slowly dissipated and the token price started trending downward, mirroring the general market. As a liquid staking provider on Terra Classic at the time, it quickly found itself caught up in the L1’s debacle, with the STADER token price dropping from above $3.00 to $1.00 in a span of a few short days.

This extreme event led the Stader Decentralized Autonomous Organization (DAO) to pivot and focus on providing its service to other chains. In a mix of uncertainty and fear, token price continued dropping for the next month, where it found strong support at around fifty cents. As the DAO continued to expand its service offerings across multiple chains, it is possible to observe that price grinded lower for the upcoming half a year, yet not in such an extreme manner as previously.

After establishing its presence on multiple chains, Stader Labs unveiled its goal to launch ETHx, its own liquid staking solution on Ethereum at the turn of the year. This news brought to light the work that the DAO had been doing for the previous months, catapulting price for the first time above its 200-day moving average (MA), reaching a local top at $1.50.

Since then, the attention from the project waned once more, which is reflected in the slowly downward trending price action observed in the past ten months. In parallel, ETHx has transitioned from a Whitepaper concept to a Testnet environment and, by July, it was launched on Ethereum’s Mainnet. Currently, ETHx has a Total Value Locked of $34M which is only trumped by Stader’s MATIC TVL which sits at $49M.

Today, Stader has amassed a TVL of $120M with the price still hovering above fifty cents which historically has proven to be strong support. As impatient sellers leave and an uptick in Stader’s product line continues to be observed, it is likely that the bulls will step in eventually, as a result of Stader’s underlying fundamentals.

Would you like to read the full report? Our report provides an in-depth analysis of team, tokenomics, technology and more. Do you want to gain access to all our research reports? Create an account in our portal.