What will Bitcoin's new all-time high be?

In the last two months, Bitcoin has experienced an acceleration in its upward momentum, and on the 5th of March 2024, Bitcoin broke its previous all-time high (ATH) of $69,045, a price level not witnessed since November 2021. As Bitcoin touched its previous ATH, the price corrected to ~$59,000, before increasing back to the desired price level once again. However, it only seems a matter of time before we are there again.

As Bitcoin slowly enters unknown territory, the question on many people’s minds is: where will Bitcoin’s price end? Although no one can exactly determine the new all-time high of Bitcoin, our analysts can give insights into how we currently look at the market and what other industry leaders expect in the upcoming years.

Bitcoin enters uncharted territory

On January 10th, the industry witnessed the approval of eleven Bitcoin spot ETFs, officially integrating Bitcoin with traditional US markets. These ETFs allow investors and institutions to invest in Bitcoin without the challenges of holding it directly. As a result, the market is experiencing large capital inflows from traditional markets, a sight the industry doesn’t know what the full potential will look like. Currently, BlackRock’s ETF (IBIT) alone has amassed over $9B in assets under management, a significant amount regarding its trading time. Furthermore, all ETFs together hold 3.75% of the current Bitcoin supply with expectations that this number will increase, which may cause a supply shock.

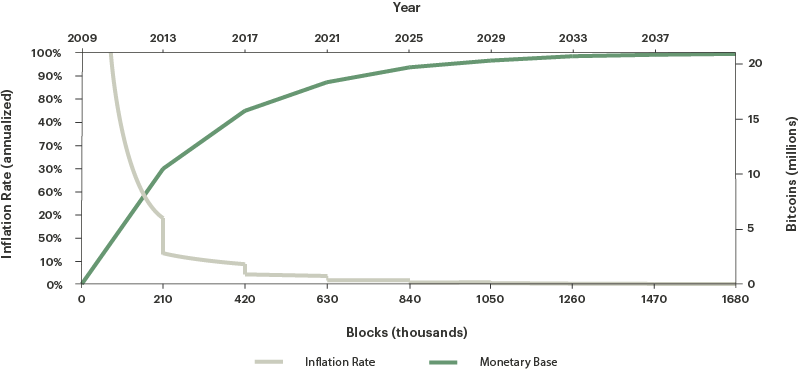

This supply shock can be caused by the upcoming Bitcoin Halving, planned for April 2024. The Bitcoin Halving is an event that halves the issuance of Bitcoin per mined block, which is currently 6,25, approximately 900 Bitcoin per day. The Halving will decrease this issuance to 3,125 Bitcoin per block and approximately 450 Bitcoin per day. This causes Bitcoin to become even more scarce than before and with demand increasing, a stronger upward trajectory may be on the horizon. You can read more about the Bitcoin Halving via the button below.

Read more about the Bitcoin Halving

What are others expecting?

As new capital flows into the market and Bitcoin approaches the Halving, it appears only a matter of time before it seeks to surpass the previous All-time High of this cycle. However, how do other market participants look at future market conditions?

The expectations of Bitcoin’s price vary significantly and are based on different arguments. But both traditional and digital asset managers foresee positive price action in the upcoming 1-2 years as Bitcoin’s market conditions are favorable and financial markets will become less tense due to expected interest rate cuts.

Pantera Capital

Pantera Capital, an American hedge fund specializing in digital assets, anticipates the Bitcoin price to surge to $147,000 within this cycle, ending approximately at the end of 2025. Their rationale revolves around shifting supply-demand dynamics and the accelerated institutional adoption triggered by ETFs, forecasting an upward trajectory for Bitcoin.

Ark Invest

Ark Invest, a US investment firm that primarily invests in technology stocks, has forecasted that Bitcoin’s price will eventually reach $1M around 2030, withholding themselves from giving short-term price action. Nevertheless, this is an incredible growth as this would mean that the Compound Annual Growth Rate of Bitcoin would be ~59%. However, due to the cyclical nature of the digital currency, in some years this figure will be way higher, and in other years it will be negative.

Standard Chartered

Standard Chartered, a multinational bank, forecasted as early as the summer of 2023 that Bitcoin’s price could reach $100,000 at the end of 2024. At the time of this statement, Bitcoin was trading at around $30,000, an optimistic view as the industry had just departed from the crypto winter.

What do we expect?

Based on our market analysis, we aim to reach a Bitcoin price of $116,000 by the cycle's end, approximately between June 2025 and the end of the year. This analysis represents a fluctuating average of Bitcoin's price and will adapt as time progresses. It serves as a projected risk assessment that considers factors such as Bitcoin's price, time frame, volatility, and diminishing returns.

While our price target may seem conservative, there's a potential variable to consider: the influx of capital from ETFs could disrupt the typical deceleration in Bitcoin's price appreciation. Observing the substantial capital inflow into ETFs provides a strong reason to be optimistic about Bitcoin's future trajectory, potentially leading to higher price targets due to disruptions in supply and demand dynamics. Despite recognizing this possibility, we are maintaining our target until we detect definitive indicators of a market shift.

An equally significant anticipation is the expected capital rotation towards alternative coins like Ethereum and other altcoins later this year or early next year. We believe that the next two months present an interesting opportunity for market participants to capitalize on substantial returns on investment stemming from this capital rotation.

To leverage this capital rotation and the overall growth of the industry, we recommend a diversified portfolio of crypto assets. Nobel Prize laureate, and economist Harry Markowitz, once said that “Diversification is the only free lunch” in investing, and we agree. Choosing the winners of a cycle is extremely difficult and when choosing wrongly rather expensive. We aim to solve this by providing investors with a diversified portfolio that is managed and rebalanced by experienced research analysts, allowing investors to gain exposure to this new asset class.

For more information about the industry, our strategies, and how crypto plays a role in a modern investment portfolio, download our brochure.