Newsletter: Recap February

- Bitcoin continues its upward trajectory

- Bitcoin’s all-time high in this cycle

- All eyes on Ether

- Nick Friedrich joins Hodl’s supervisory board

- The Hodl Funds

Bitcoin continues its upward trajectory

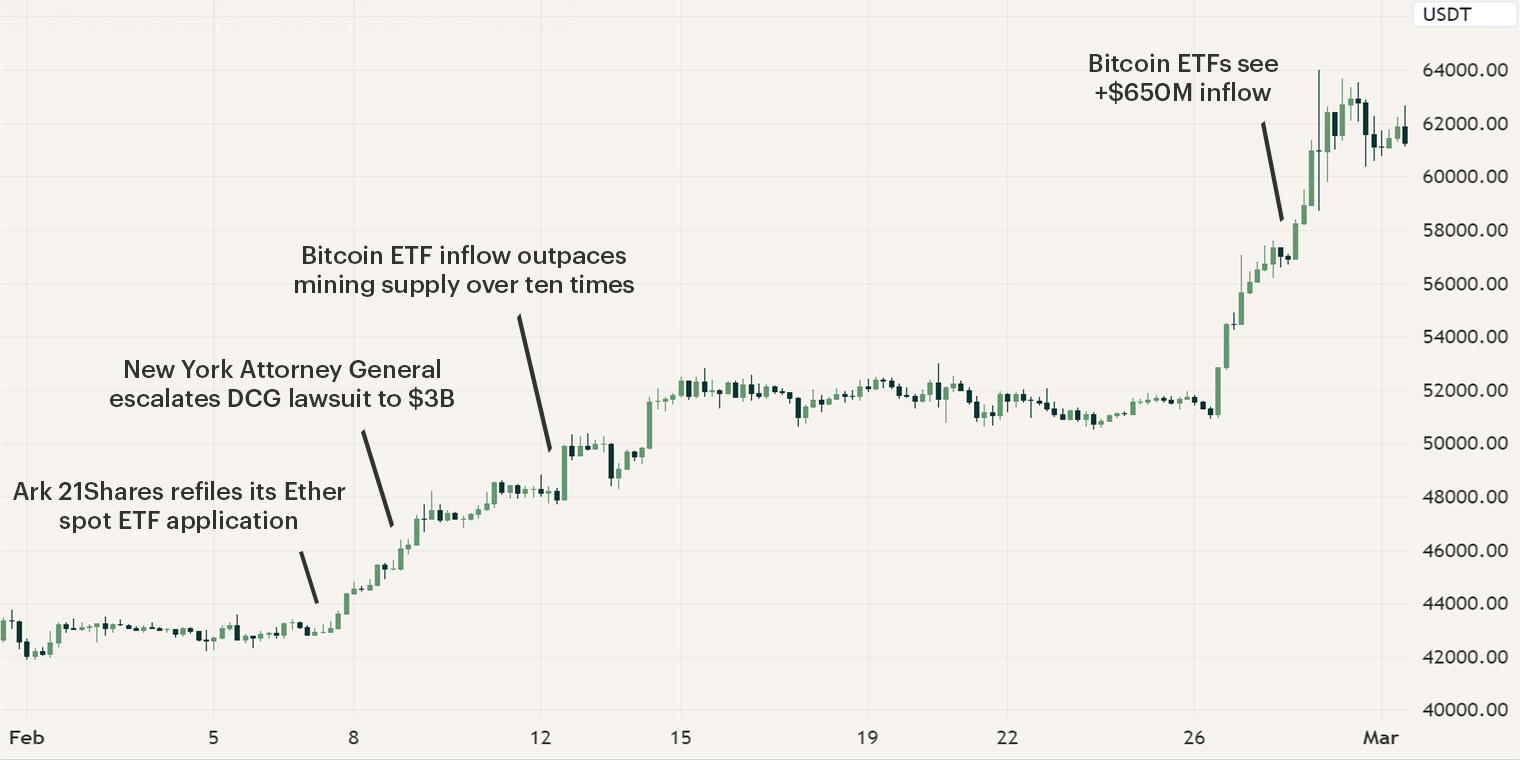

In February, Bitcoin experienced a strong upward trajectory as it increased by 43,57%, breaking through the $60,000 level, a price level not seen since November 2021. While positive sentiment flooded the market, in terms of noteworthy events, the month remained relatively quiet. In the first two weeks, the main focus of investors remained the Bitcoin spot ETF that continues to show strong inflows of capital, in some instances outpacing the mining supply over ten times. Furthermore, asset managers 21Shares refiled its Ether spot exchange-traded fund (ETF) and the New York Attorney General escalated its lawsuit against Digital Currency Group to $3 billion.

In the second half of February, the market experienced a shift in narrative as increasingly more investors positioned themselves towards Ether. Moreover, the overall altcoin market is gaining momentum as we see the majority of the altcoins recover lost ground.

Bitcoin’s all-time high in this cycle

As 2024 unfolds, Bitcoin has witnessed a strong upward trajectory, surging from $42,000 to a yearly high of ~$64,000 in February. However, five days into March, Bitcoin broke its all-time high of $69,045. In our view, it was not a matter of if we would surpass this level this year, but rather when. Bitcoin is about to enter uncharted price territory, with professional and institutional investors gaining access to the digital asset through traditional channels for the first time.

In the past month and a half, we've witnessed significant inflows into these ETFs, and with the Bitcoin Halving approaching in April, we believe we're on the brink of a perfect storm. While pinpointing Bitcoin's exact price remains uncertain, current market conditions present a unique opportunity for Bitcoin and the entire digital assets market. As Bitcoin maintains its upward trajectory, we're noticing a surge in momentum in the altcoin market, rapidly reclaiming lost ground.

As Bitcoin edges closer to uncharted territory and eventually enters it, it is expected to generate significant returns. However, altcoins are expected to yield even higher returns owing to their smaller market capitalizations and volatile nature. If you wish to read more about how we perceive current market conditions and where we, along with other market participants, think Bitcoin’s price will end during this cycle, read our latest article.

All eyes on Ether

Over the past year, the market has been primarily influenced by Bitcoin and the spot ETF narrative. With the approval of these ETFs, traders and investors are now eagerly seeking the next dominant narrative. Currently, opportunities are emerging for Ether and its vast ecosystem.

In 2023, American asset managers initiated the race for an Ether spot ETF, with the first definitive deadline set for May 2024. This milestone marks the potential entry of a second digital asset into traditional US markets. While the chances of approval vary, investment banking giant JPMorgan estimates a 50% chance of approval by May. In anticipation of this significant development, Ether has begun to reclaim lost ground, surpassing even the $3,000 mark, a price level not seen since April 2022.

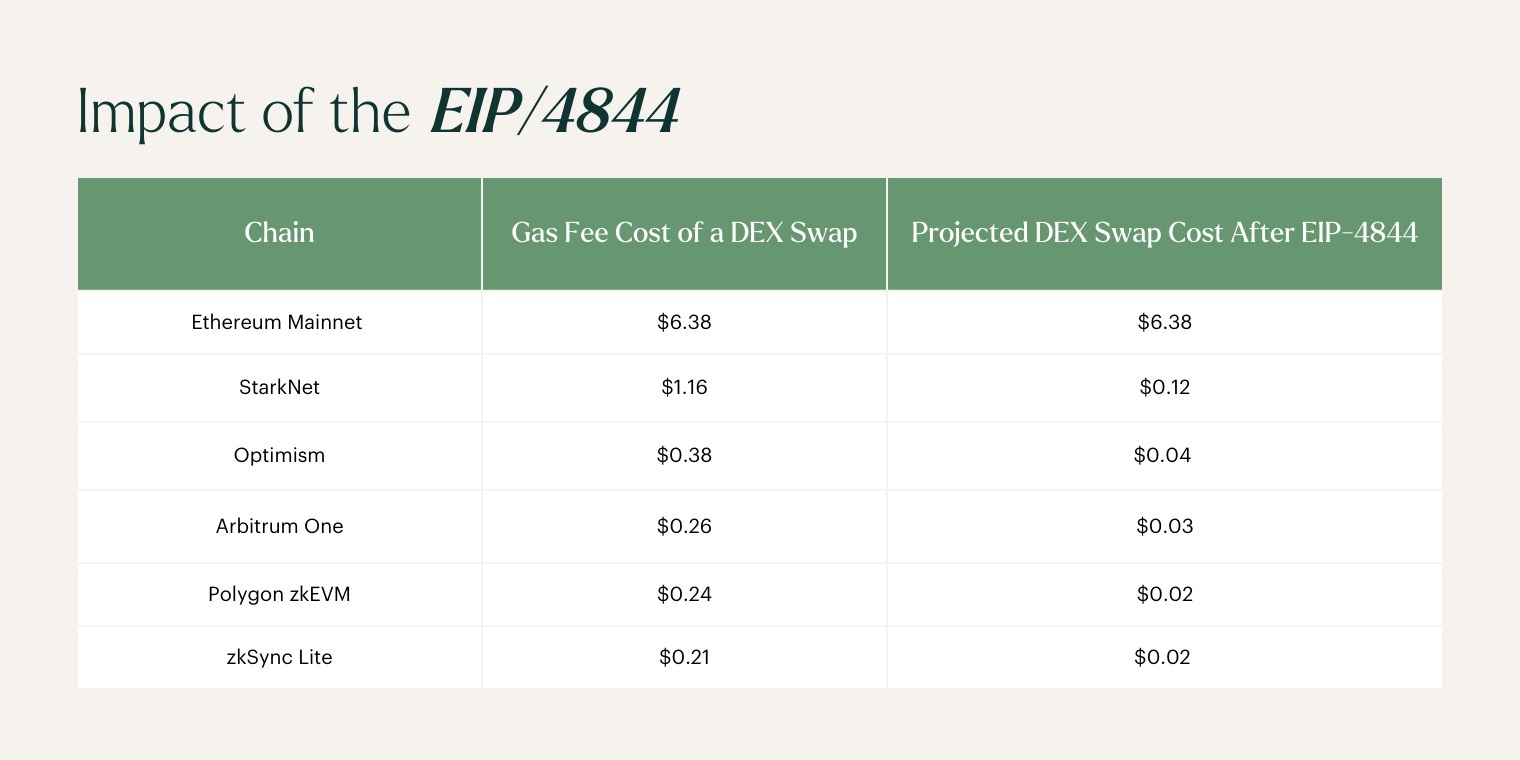

Additionally, planned for the 13th of March, the Ethereum network will undergo an update known as Dencun, promising several improvements, with the most notable being proto-danksharding. This crucial upgrade will allow Layer 2 networks like Optimism and Arbitrum to conduct transactions at significantly reduced costs while increasing transaction throughput, thereby tackling Ethereum's congestion issues.

With Ethereum edging closer to this upgrade and awaiting the crucial decision on its ETF, it is anticipated that in the upcoming months, Ethereum will emerge as a more dominant narrative and witness a surge in momentum. Given Ethereum's role as a smart contract layer, projects operating on the network are also poised to benefit from this positive trajectory

Nick Friedrich joins Hodl’s supervisory board

Since early February, Nick Friedrich, co-founder and chief operating officer, has joined Hodl’s supervisory board and stepped down from his operational activities. After seven years of active involvement in Hodl's operations, Nick has decided to shift his focus to the strategic side of the Hodl business and Growity, where he can actively implement his passion for trading and investing. As a result, he steps down as Hodl's Director but will join the Hodl supervisory board.

Dirk-Jan Schuld, the current chief performance officer of Hodl, will take over Nick’s role as Director while maintaining his current position in the organization. Read more about this change in leadership through the button below.

The Hodl Funds

The month of February led to an increase in the Hodl Funds. The Hodl Gib Fund, the Hodl Numeri, the Hodl Algo Fund, the Hodl.nl Genesis Fund, the Hodl.nl Consensus Fund and the Hodl.nl Oracle Fund ended at an NAV of €1,912.94, €50,773.12 €1,746.71, €5.90, €5,59 and €0.57, respectively.

Sign up for our newsletter to stay on top of the cryptocurrency market.