Market update: July

- XRP shakes up U.S. Regulation

- Ripple achieves partial victory against the SEC

- Inflation continues to slow down

- BlackRock refiles Bitcoin spot ETF application

- Hodl Group - Ledger Enterprise Tradelink Network

- Hodl Group receives strategic investment from DutchYard

- Martijn Bakker appointed as CFO Hodl Group

XRP shakes up U.S. Regulation

The beginning of July was marked by the partial victory of the digital asset firm Ripple in their legal battle against the Security and Exchange Commission (SEC). During a preliminary hearing, the judge ruled that the sale of Ripple's XRP tokens on exchanges and through algorithms did not fall under investment contracts. This was celebrated as a victory among the entire cryptocurrency market, as more cryptocurrencies have been deemed securities by the SEC in the past.

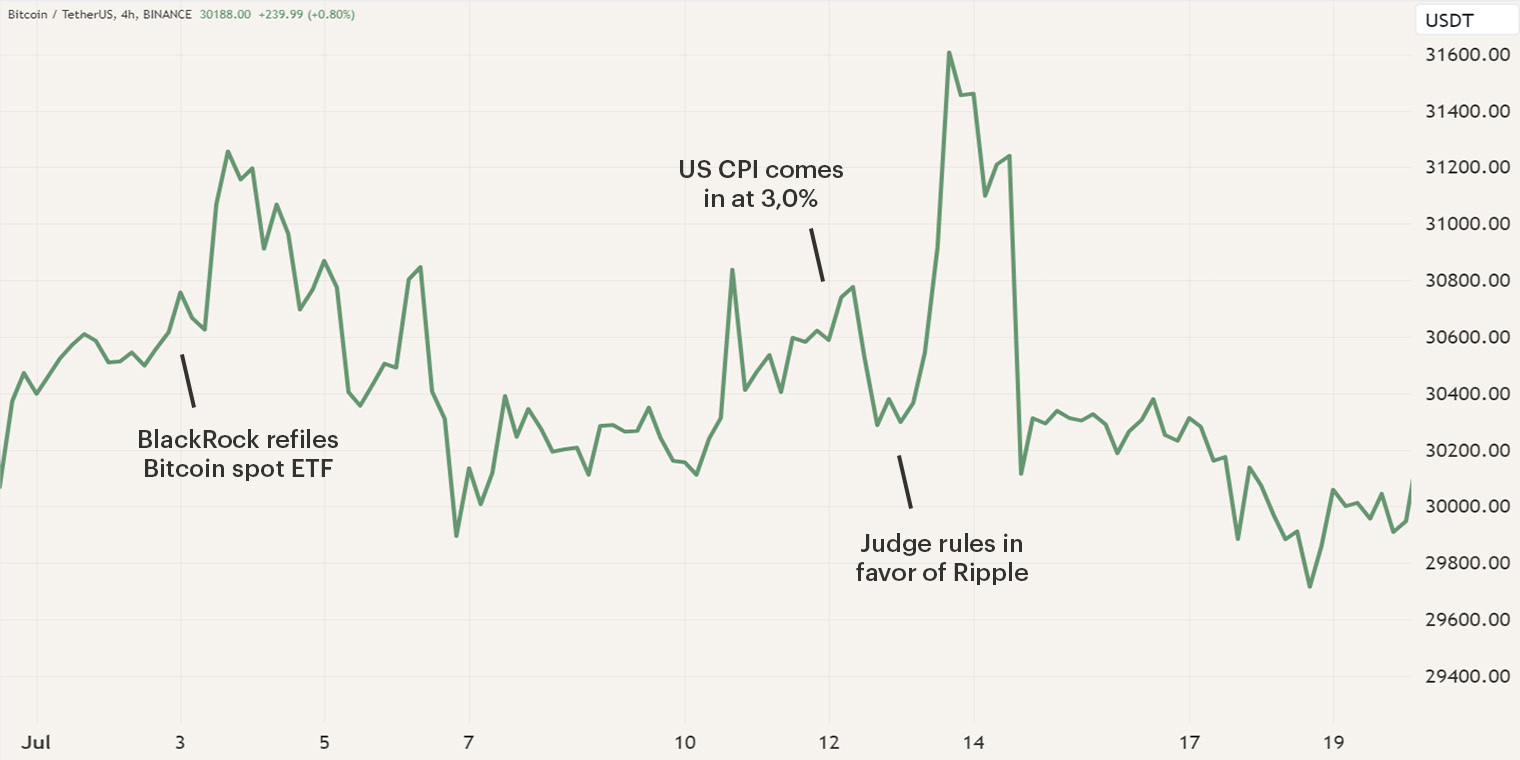

Amidst the ongoing events, the publication of the Consumer Price Index figures remained a significant catalyst, further amplifying volatility. As this event drew near, the fluctuations in the market intensified. Moreover, asset managers like BlackRock refiled their Bitcoin Exchange Traded Fund (ETF) after their initial filings were deemed inadequate. Notably, what stood out the most among these filings was the agreement reached between cryptocurrency exchange Coinbase and five of the Bitcoin ETF applicants to uphold surveillance-sharing. The combination of these events resulted in several short lived rallies and drops for Bitcoin, with its monthly low reaching approximately $29,600 and the monthly high surpassing $31,500.

Ripple achieves partial victory against the SEC

On the 13th of July, the U.S. District Court of the Southern District of New York made a significant ruling regarding the XRP-token. The court concluded that the sale of XRP tokens on exchanges and through algorithms did not qualify as investment contracts, thereby not violating federal securities laws.

However, a different outcome arose for the sale of XRP tokens to institutions. The court deemed this particular sale as an investment contract, and as a result, it was found to be in violation of federal securities laws. The organization had initially sold around $730 million worth of XRP tokens to institutional buyers such as hedge funds. The reason behind the classification of this sale was that buyers were found to have expected profiting from Ripple's operations, thereby passing the Howey test.

On the other hand, the court did not reach the same conclusion when it came to the sale of XRP tokens through exchanges and algorithms. The SEC can’t say or prove that speculative investors in these instances had "a reasonable expectation of profits to be derived from the entrepreneurial or managerial efforts of others." This is precisely why the sale of XRP tokens through exchanges and algorithms was not designated as securities.

Following the ruling, the XRP token experienced a substantial rally, with its price soaring from $0.47 to $0.94, resulting in a 100% increase. However, the digital asset later corrected to $0.67 and is currently consolidating at around $0.74.

This ruling holds great significance in the market representing a major milestone - the first juridical victory that cryptocurrencies are not to be classified as securities. Nevertheless, opinions among market participants differ. Some expect the SEC to appeal this ruling, expressing uncertainty about its long-term implications. Others also view the ruling as less of a victory since the same court previously stated that XRP is, in fact, a security.

The aftermath of this ruling is being closely watched by the cryptocurrency community and investors, as it holds the potential to significantly influence future regulatory decisions and shape the legal landscape for other digital assets. The digital asset industry has been closely following this case, considering it to be the first to offer some much-needed legal clarity.

Moreover, the ruling has had a notable impact on certain cryptocurrencies that were previously accused of being securities, as seen in the rally of coins like Avalanche and Solana. This outcome provides these cryptocurrencies with newfound legitimacy and confidence. Furthermore, the ruling also arms exchanges with legal ammunition, as it deems the offering of digital assets as non-securities, potentially safeguarding them from certain regulatory burdens.

Inflation continues to slow down

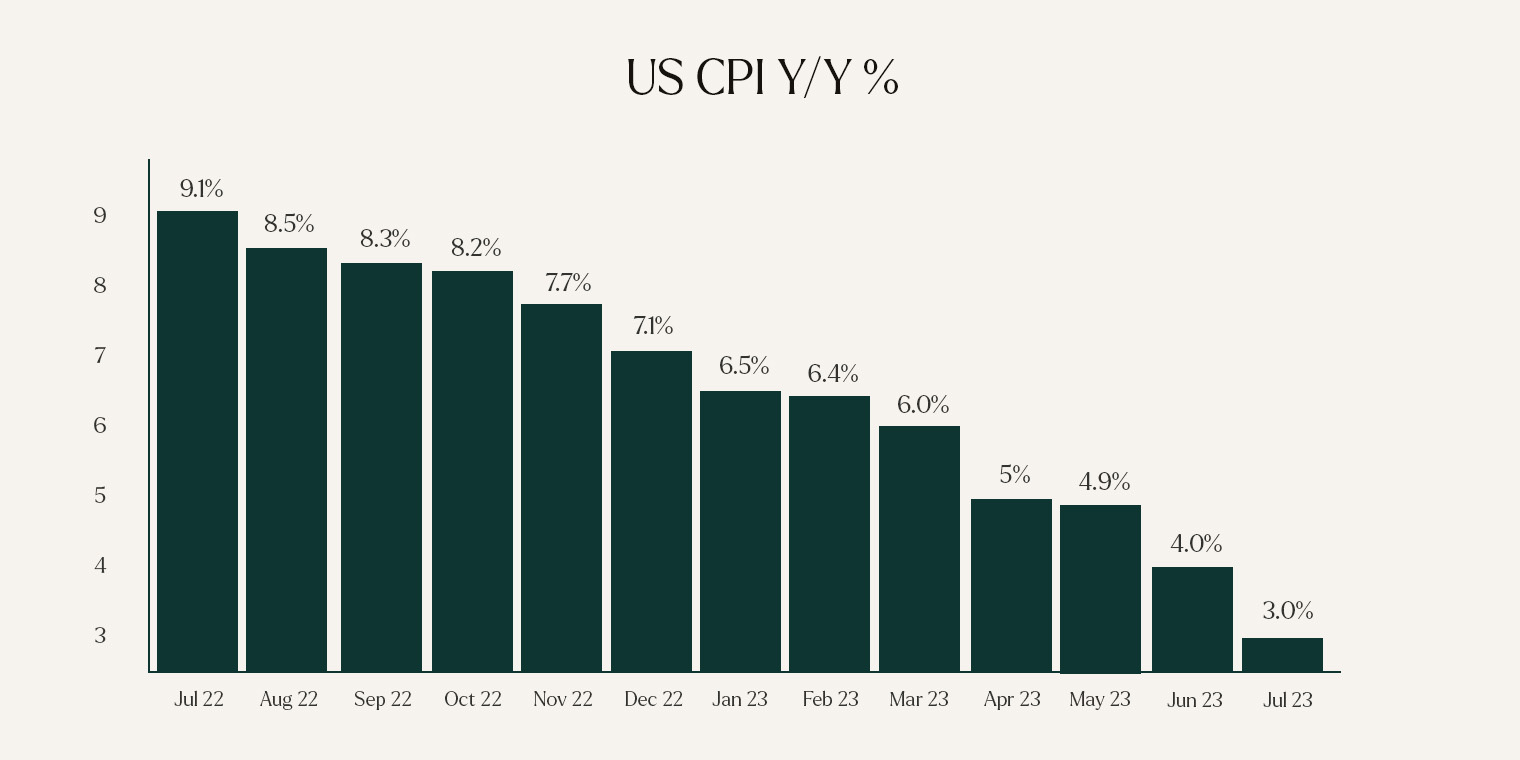

On the 12th of July, the latest CPI figures were published, and as experienced in prior months, volatility increased as the publication approached. Hours before the meeting, Bitcoin surged to almost $31,000 before correcting back to $30,000 after the publication. The figures seem promising as the month over month, year over year, and Core m/m CPI all came in lower than forecasted at 0.2%, 3%, and 0.2%, respectively.

Despite the high inflation rate of 3%, the overall year over year CPI has been declining for twelve consecutive months. The Core CPI, which excludes food and energy, dropped to 0.2% compared to last month and 4.8% to last year. However, this might not be enough for the Federal Reserve (Fed) to deter from raising rates later this month.

On the 26th of July, the Fed and the Federal Open Market Committee will convene to discuss the interest rate. At the time of writing, 96.1% of market participants expect the Fed to hike the interest rate to 5.50%, slightly above their forecasted end rate. In the future, inflation rates must continue their downward trend; otherwise, the Fed will have to maintain its hawkish approach. As of now, market participants aren't anticipating the Fed to lower the interest rates during 2023.

BlackRock refiles Bitcoin spot ETF application

On the last day of June, the SEC published a statement that the current filings of Bitcoin spot ETF of various asset managers, including BlackRock, were inadequate and not sufficiently clear. In response, BlackRock took action and submitted a more extensive filing that addressed the issues. In this revised filing, BlackRock disclosed that Coinbase would not only serve as a custodian but also as a surveillance-sharing partner.

This development is noteworthy because Coinbase entered into similar agreements with all five other ETF applications, namely Wise Origin, WisdomTree, VanEck, Invesco Galaxy, and ARK 21Shares. A surveillance-sharing agreement is a crucial component of ETF applications, intended to facilitate market surveillance and ensure compliance. Such surveillance is vital for detecting potential market manipulation, promoting fair and orderly markets, and upholding investor confidence.

On July 13th, the SEC officially added BlackRock's spot ETF application to its list of rulemaking files for the Nasdaq stock market, signaling that the SEC is treating the filing with seriousness and consideration. Consequently, news of Coinbase's surveillance-sharing agreement with multiple asset managers drove its stock price up by 16% to reach a high of $92.15.

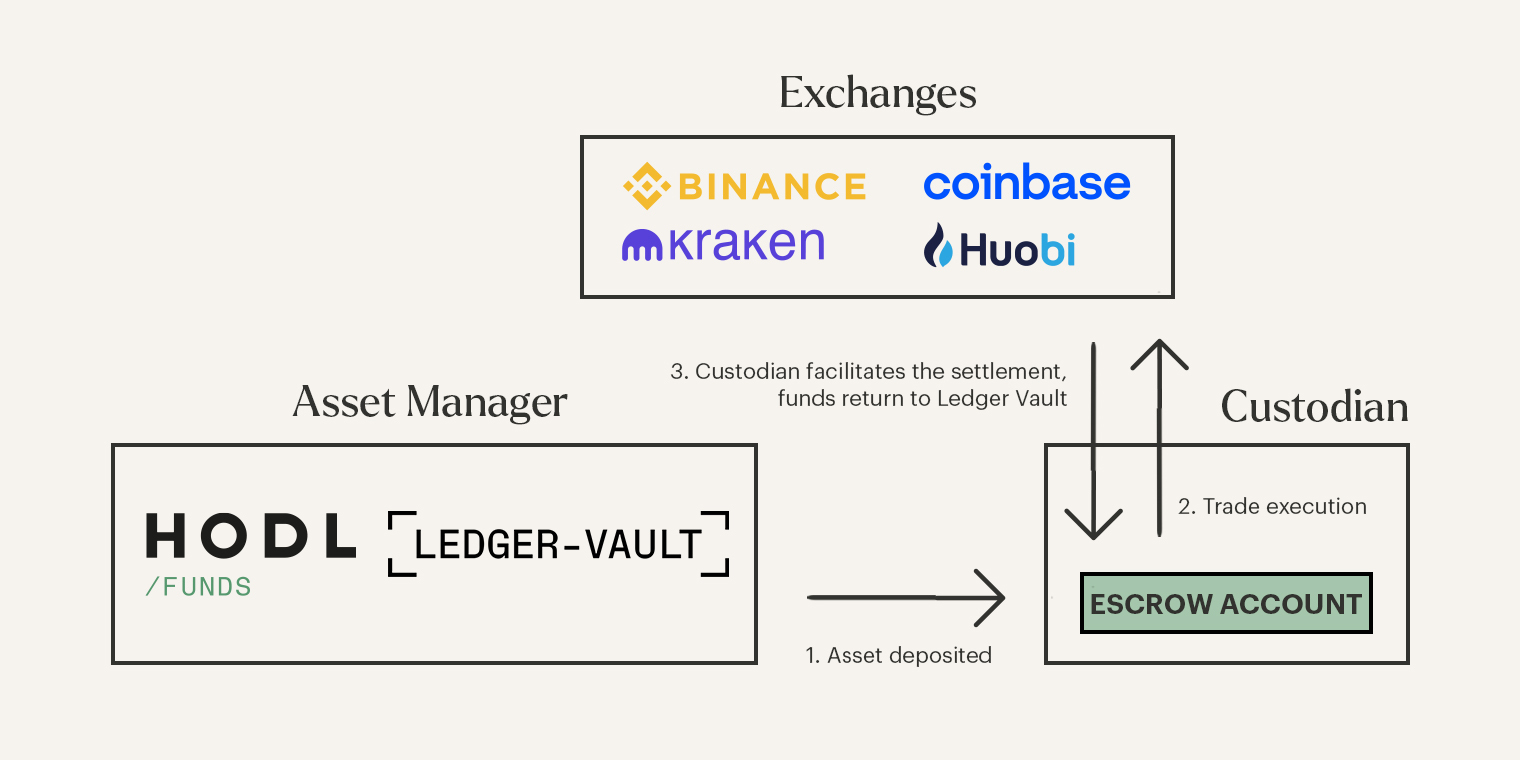

Hodl Group - Ledger Enterprise Tradelink Network

Ensuring the security of our clients' investments has always been our topmost priority, and we are continuously seeking ways to enhance this aspect. Since the inception of the first Hodl Funds, our clients’ assets have been secured by Ledger Vault, a leading cold storage security solution by Ledger Enterprise. In our pursuit of improved security measures, we are proud to announce to be a launching partner in their latest security solution, the Ledger Enterprise Tradelink Network.

This new technology enables institutions to custodial trading and exchange connectivity while maintaining self-custody over investors' funds. A primary concern for institutions has been to securely trade digital assets which mostly takes place on exchanges. However, these centralized exchanges have, regrettably, not always functioned as expected. To mitigate this counterparty risk, Ledger Enterprise has developed its revolutionizing Tradelink Network.. You can read more about this new security solution via the button below.

Read the Ledger Enterprise Tradelink Network article

Hodl Group receives strategic investment from DutchYard

In August 2020, Hodl established the first two Hodl Funds and since then, Hodl has grown exponentially. We stated frequently in our newsletter and blogs that we were looking at international expansion as more investors became interested in the Hodl Funds. This eventually led to the founding of various digital asset funds in Gibraltar, Spain, Luxembourg and an investment product in Switzerland. With this international expansion came the evolution of Hodl.nl into Hodl Group, which includes Hodl Funds, Research and Ventures.

To continue this growth and achieve our international ambitions, Hodl Group received a strategic investment from Dutchyard, the investment firm of Dutch entrepreneur Iwert Dijkema. Together with Dutchyard we embark on a new journey to provide professional and institutional investors exposure to the digital asset industry. To read more about the strategic investment in our organization, access the article through the button below.

Martijn Bakker appointed as CFO Hodl Group

On July 1st, Martijn Bakker assumed the role of Chief Financial Officer (CFO) at Hodl Group, marking his official entry into the company. Prior to this, Martijn had been associated with Hodl as an external Consultant since March. During the past consultancy period, he played a pivotal role in restructuring the accounting department, aligning the financial administration with Hodl's growth trajectory, and optimizing the fiscal structure. Martijn brings with him nearly 25 years of entrepreneurial experience in the tech industry, where he dedicated the last 8 years to developing his expertise in financial management for startups and scale-ups.

Martijn Bakker, reflecting on his new role, expressed his enthusiasm for the exciting new world of cryptocurrencies. He stated, "Joining Hodl Group presents an incredible opportunity to be at the forefront of the ever-evolving landscape of cryptocurrencies and investments. The potential for innovation and disruption in this space is immense, and I am eager to contribute to Hodl's growth and success in this dynamic industry."

We are delighted to have Martijn on board with Hodl Group as our CFO, and we are confident that his expertise and passion for the cryptocurrency sector will greatly benefit our organization's future endeavors.

Sign up for our newsletter to stay on top of the crypto market.